Market News and Charts for October 22, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

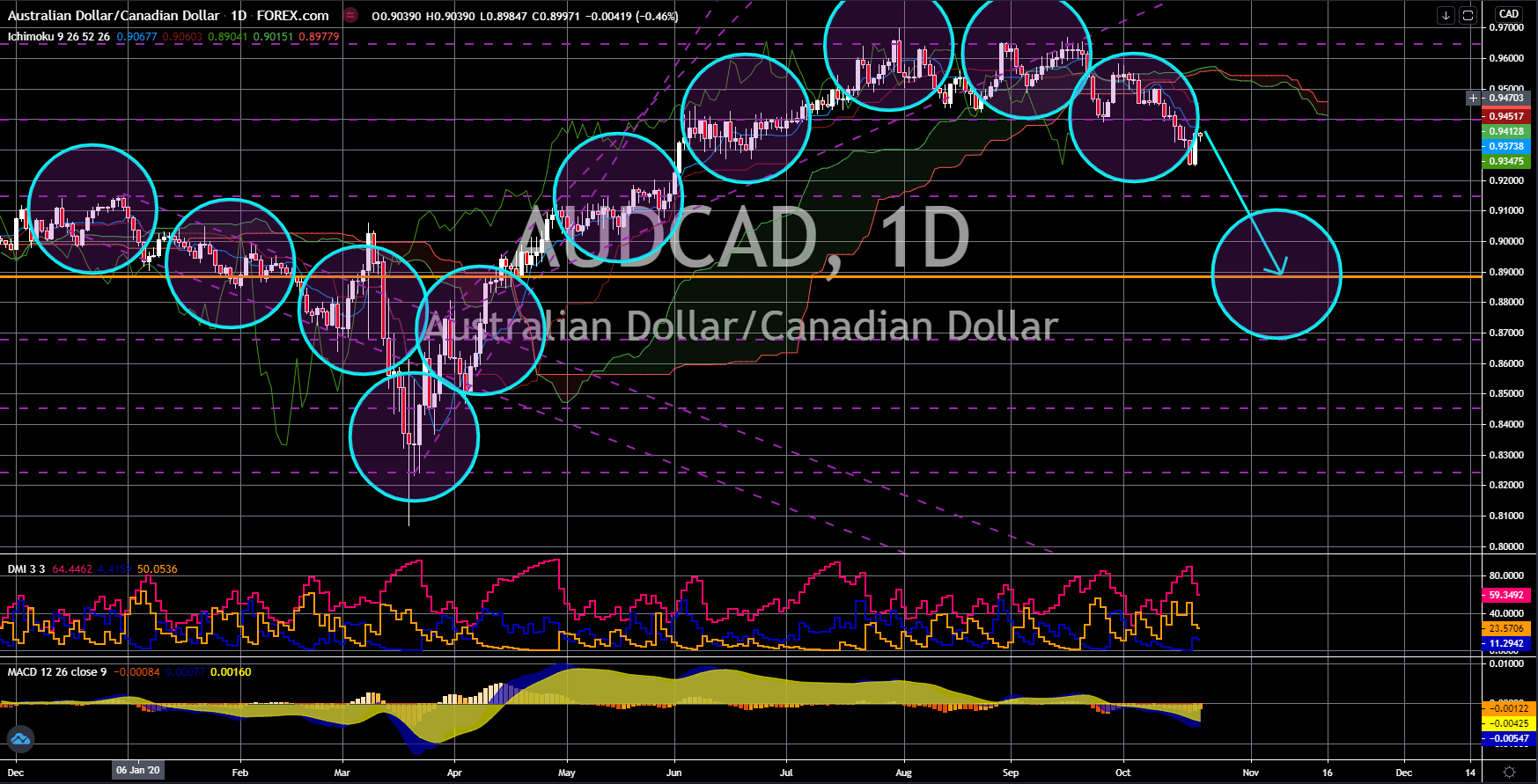

AUD/CAD

Tensions brewing between Australia and China have strained the strength of the Australian dollar, allowing the Canadian dollar to take over. It’s expected that the pair’s prices would continue trend downwards in the coming sessions, hitting their support level. The bad omen from the Reserve Bank of Australia also adds pressure to the downside, and bears are now waiting for further signs to push their gas pedals. Earlier this week, it was reported that Australia’s central bank discussed the possibilities of easing its interest rates further this October. The news caught the attention of bears, boosting their confidence, and raising concerns of lower interest rates for the antipodean country. On the other hand, the small draw reported by the Energy Information Administration on crude oil inventories has helped the Canadian dollar stand its ground against the Australian dollar. However, it seems that the loonie is still lagging behind its peers in the G10.

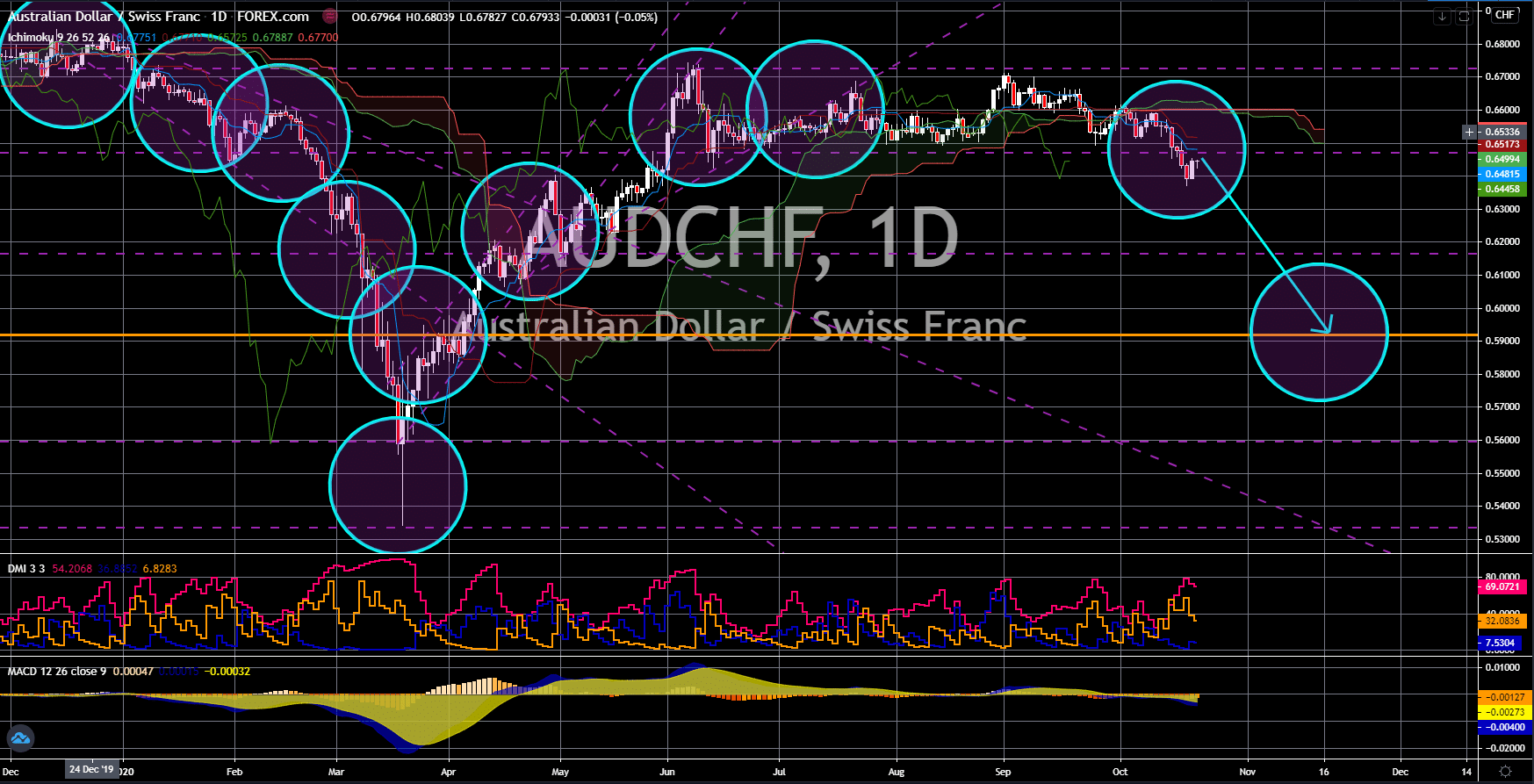

AUD/CHF

The Swiss franc has been trading softer in the past sessions against the Australian dollar, compared to other currencies. But the tides will soon shift to favor bearish investors as the Reserve Bank of Australia raises red flags, opening discussions and speculations as to whether it would ease its interest rates further this month. The exchange rate should climb down to its support level thanks to the statement of Australia’s central bank earlier this week. Moreover, the Swiss franc is highly regarded as one of the most overvalued currencies of the year, but its luck didn’t pan out as much as bears would like against the Aussie. However, the recent weakness of bulls should provide an opening for further downsides. Aside from that, the rising number of coronavirus cases around the world has been causing panic in the markets recently, and as major countries prepare for larger waves of cases, the Swiss franc should remain very attractive in the forex sessions.

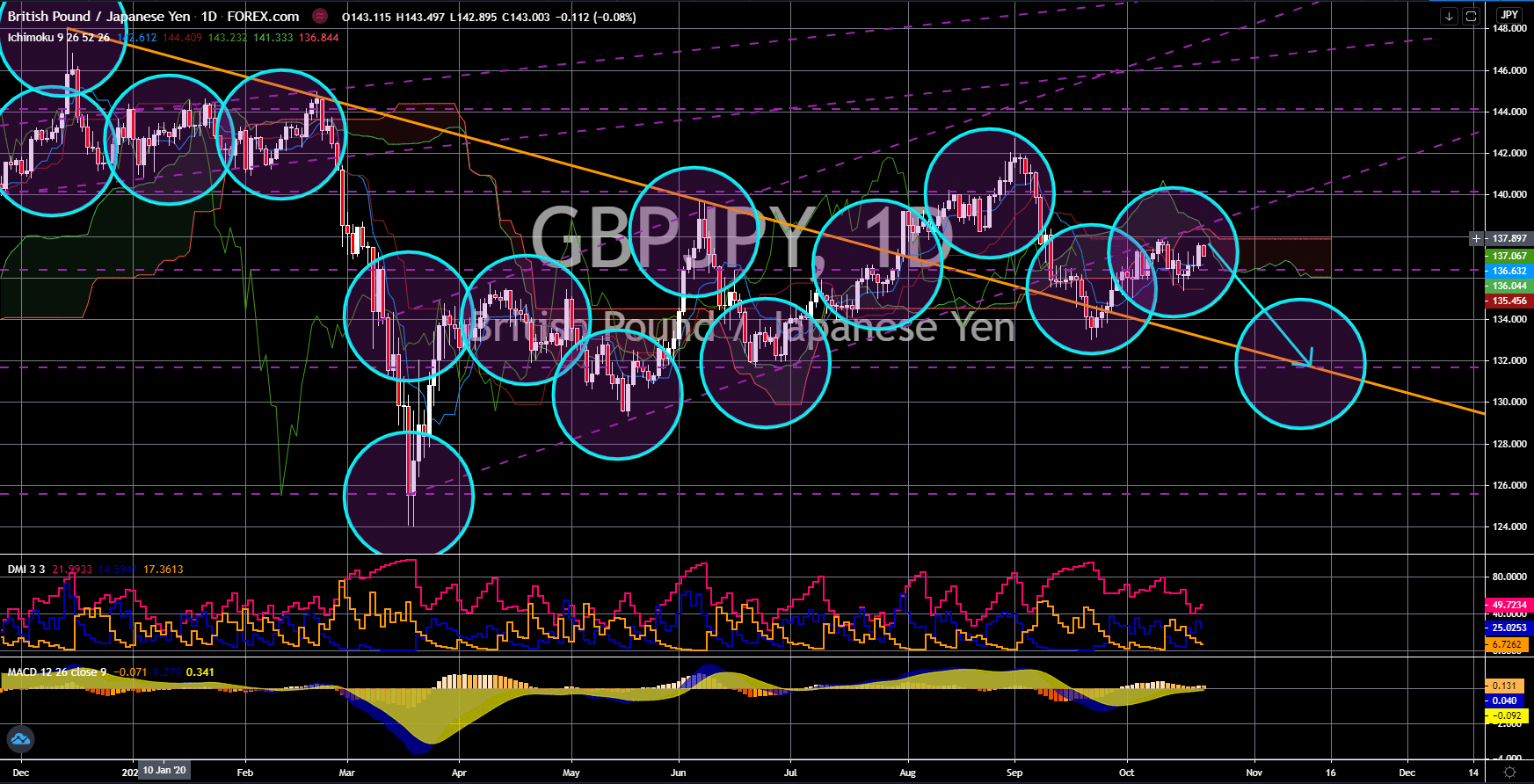

GBP/JPY

The British pound will most likely face a reversal lower in its matchup against the Japanese yen. Bears are expected to hold on to the reins, forcing prices down in the coming sessions as they take advantage of the fundamentals around the pair. Looking at it, yesterday was a great day for bulls as the sterling jumps thanks to the recent reports regarding the EU’s top Brexit negotiator which boosts the optimism for the market. Michel Barnier commented that despite the disagreements and hindrances faced by the two sides, a much-needed trade deal between the United Kingdom and the European Union is already within reach. However, this was not supported by any other further details, causing the sterling to dramatically fall in the sessions against the Japanese yen. With that said, the Japanese yen’s security appeal continues to attract investors as more uncertainties continue to rise along with the number of new coronavirus cases around the world.

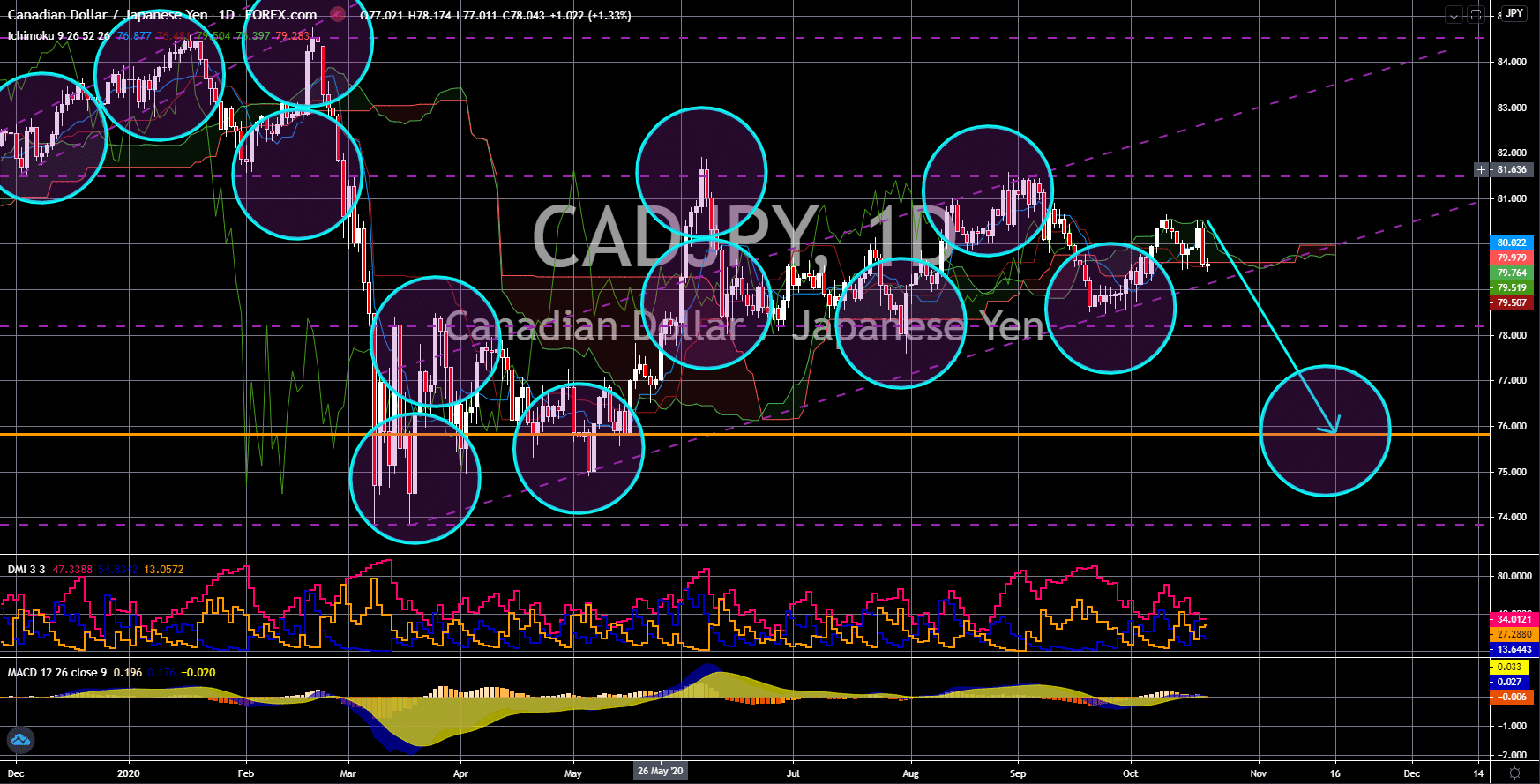

CAD/JPY

The stable conditions of crude oil in the commodity market today fail to support the Canadian dollar against the safe-haven appeal of the Japanese yen. The loonie is still significantly lagging behind its G10 peers, suggesting that it does not have enough fundamentals to back its run in the trading sessions. The rising number of new coronavirus cases in Canada is adding further pressure to the downside, helping the cause of bearish investors. Just yesterday, Canada reported more than 2,600 confirmed cases of the deadly virus, setting a new daily record for the country. The recent statement from an official from British Columbia failed to support the loonie as it does not have near-term merits for investors. On the other hand, the Japanese yen slightly slipped today thanks to the fresh stimulus hopes in the United States. However, in contrast to the coronavirus’ detrimental impact on the loonie, the Japanese yen’s safe-haven appeal should work well in its favor in the coming sessions as investors get more and more frightened for what is to come.