Market News and Charts for October 22, 2019

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

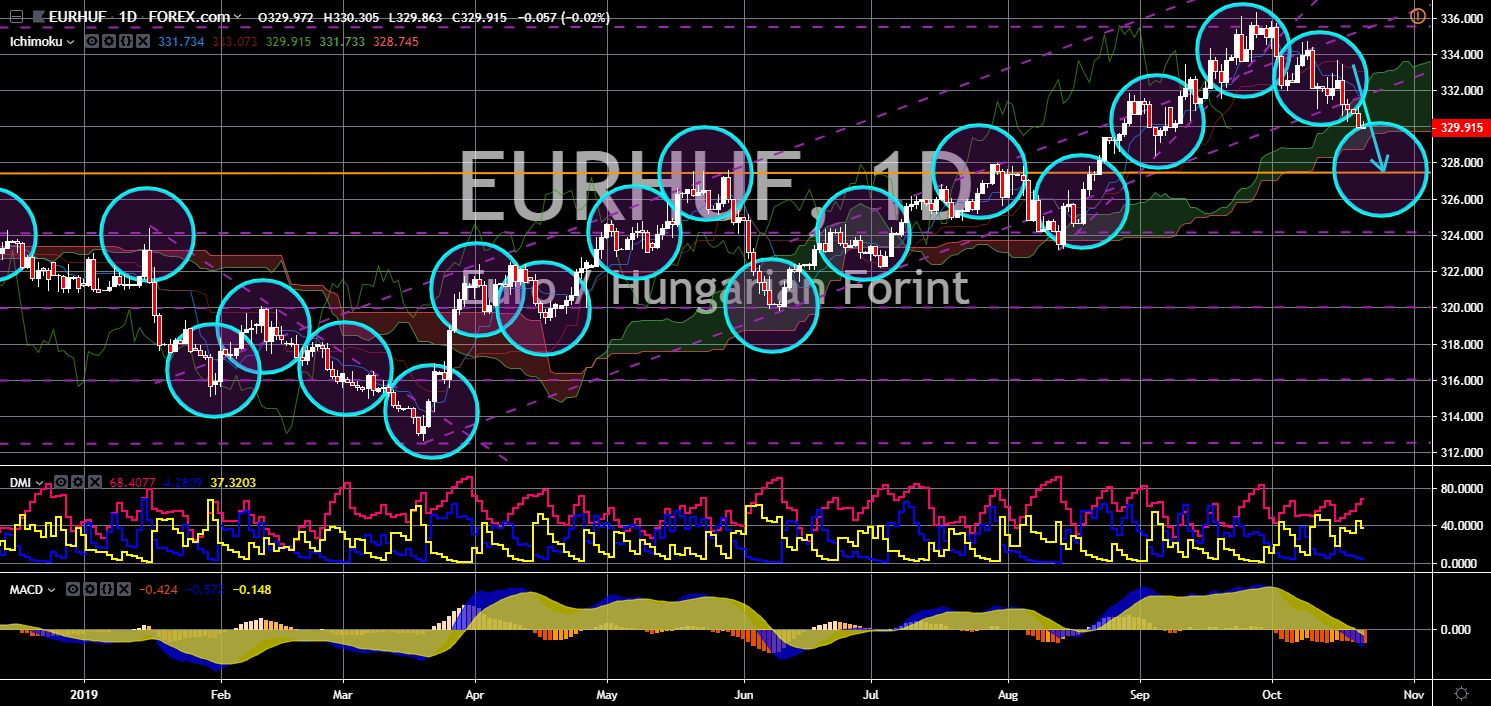

EUR/NOK

The pair is expected to experience a pullback after hitting its all-time high last week. Norway is losing its influence in Europe after the election of Ursula von der Leyen. She was named as the first female president of the European Commission. Just weeks before taking her oath, Von der Leyen visited the Visegrad nation. This was her attempt to put EU-member states together amid the looming withdrawal of the United Kingdom from the bloc. The withdrawal of the UK is expected to bring the country back to the EFTA (European Free Trade Agreement). The EFTA has a bilateral trade agreement with the EU that allow its members to access the single market. The EU reiterated that only EU-member states have the privilege to benefit from the single market. Thus, the European Union is planning to impose stricter rules among non-EU European countries. This is expected to hit Norway, Switzerland, Iceland and Liechtenstein.

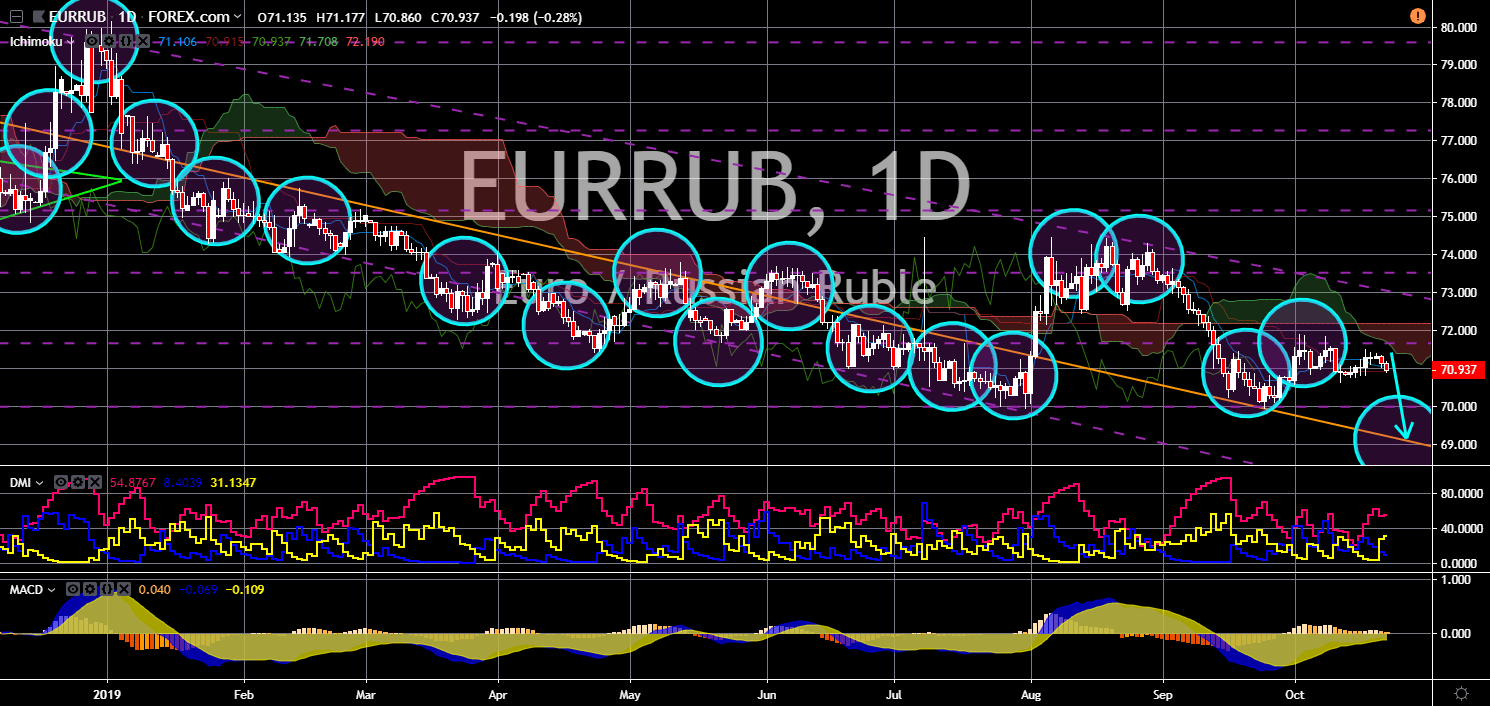

EUR/HUF

EUR/HUF

The pair is expected to further move lower after it broke down from an uptrend channel support line. The U.S. withdrawal on Syria caused geopolitical instability in the Middle East and in Europe. Not only did it cause tensions between the United States and Turkey, but also between the European Union and Hungary. Hungary threatened that it was ready to use force to protect its borders against migrants. This was following the advancement of Turkish military in Northern Syria. This had forced Syrian to flee away from the war zone and enter the EU borders as migrants. This stance by Hungary made the European Union to retaliate. Johann Wadephul, deputy faction leader of Germany’s governing party, the Christian Democratic Union (CDU), said Hungary should make up its mind whether to stay in the EU or not. The CDU was the party behind Angela Merkel’s de facto leadership in the European Union.

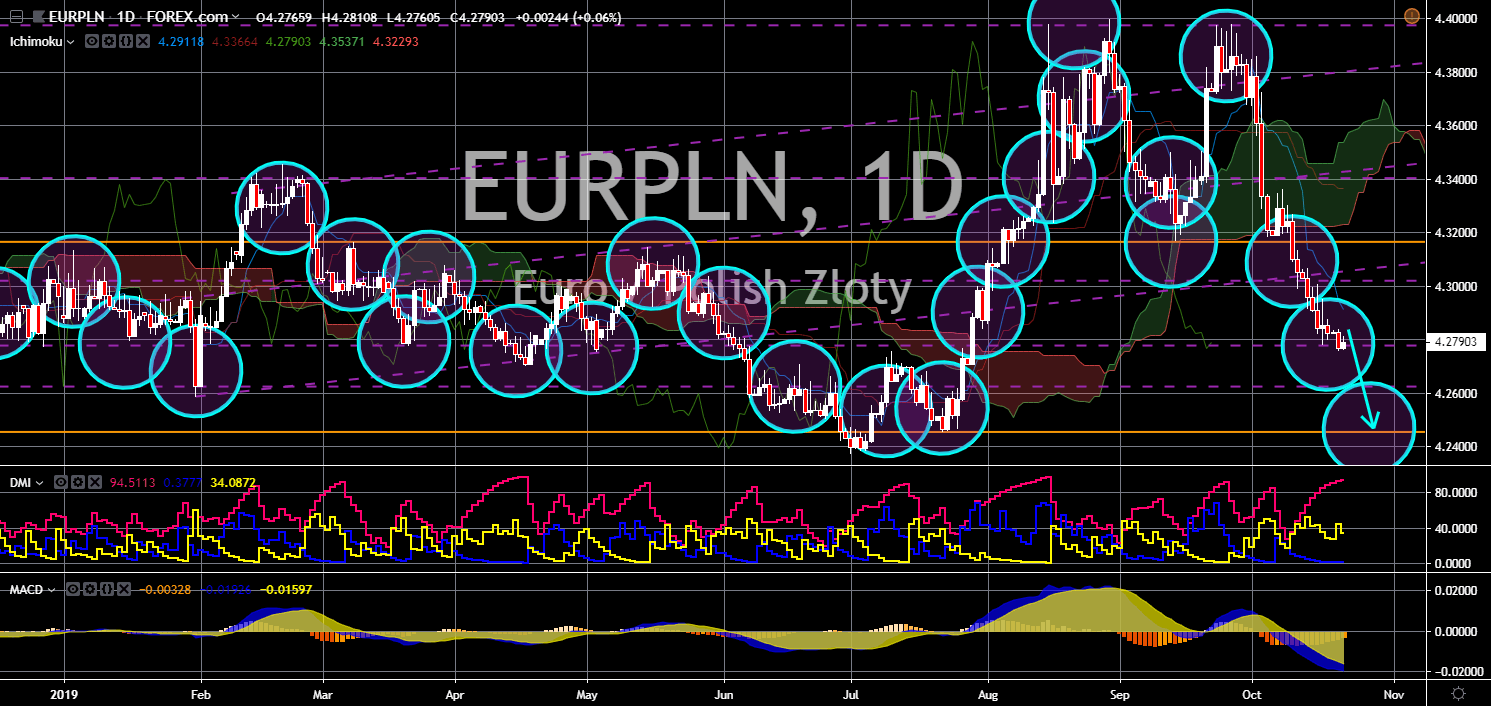

EUR/RUB

The pair will fail to breakout from a key resistance line, sending the pair lower to its 20-month low. The European Union is divided over the bloc’s move to ease relations with Russia. Germany and France, the EU’s two (2) de facto leaders, will have a meeting with President Vladimir Putin and President Volodymyr Zelensky. Together, they will discuss easing tensions in Ukraine after Russia annexed Crimea in 2014. However, EU-member states are worried that the Germano-Franco alliance might compromise too much. This will be a key meeting for the European Union as Ukraine was both and EU and NATO applicant. Aside from this, French President Emmanuel Macron was trying to set the bloc’s relationship with Russia clear. The move is seen as similar to Richard Nixon’s strategy of opening up China to the rest of the world. Russia, on the other hand, is building its own trading bloc, the Eurasian Economic Union (EEU).

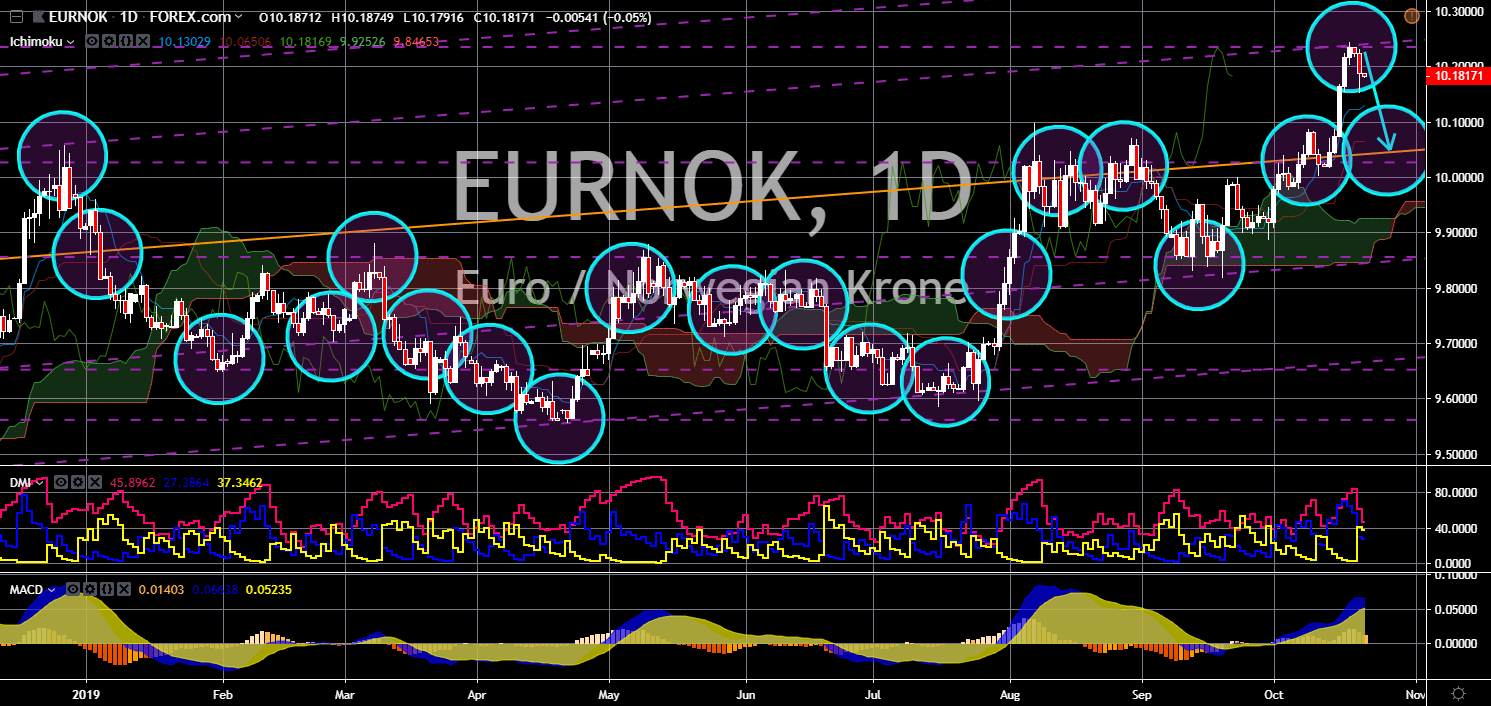

EUR/PLN

The pair is expected to breakdown from a major support line, sending the pair lower to another major support line. The European Union launched another infringement case against Poland. The bloc accused the country of undermining its judicial independence. Poland has recently passed a law that will force some of its judges to a forced retirement. The move is seen by the EU as an effort from the right-wing Law and Justice party (PiS) to elect official loyal to the party. This move was made by the European Union days before Poland’s parliamentary election. However, result from the election showed a landslide victory for the PiS party. Political analysts warned that the election’s result has disastrous implications between Poland and the EU-member states. Aside from Poland, other V4 nations – Hungary, Czechia and Slovakia, were on the rise against the Germano-Franco leadership in the European Union.