Market News and Charts for October 20, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

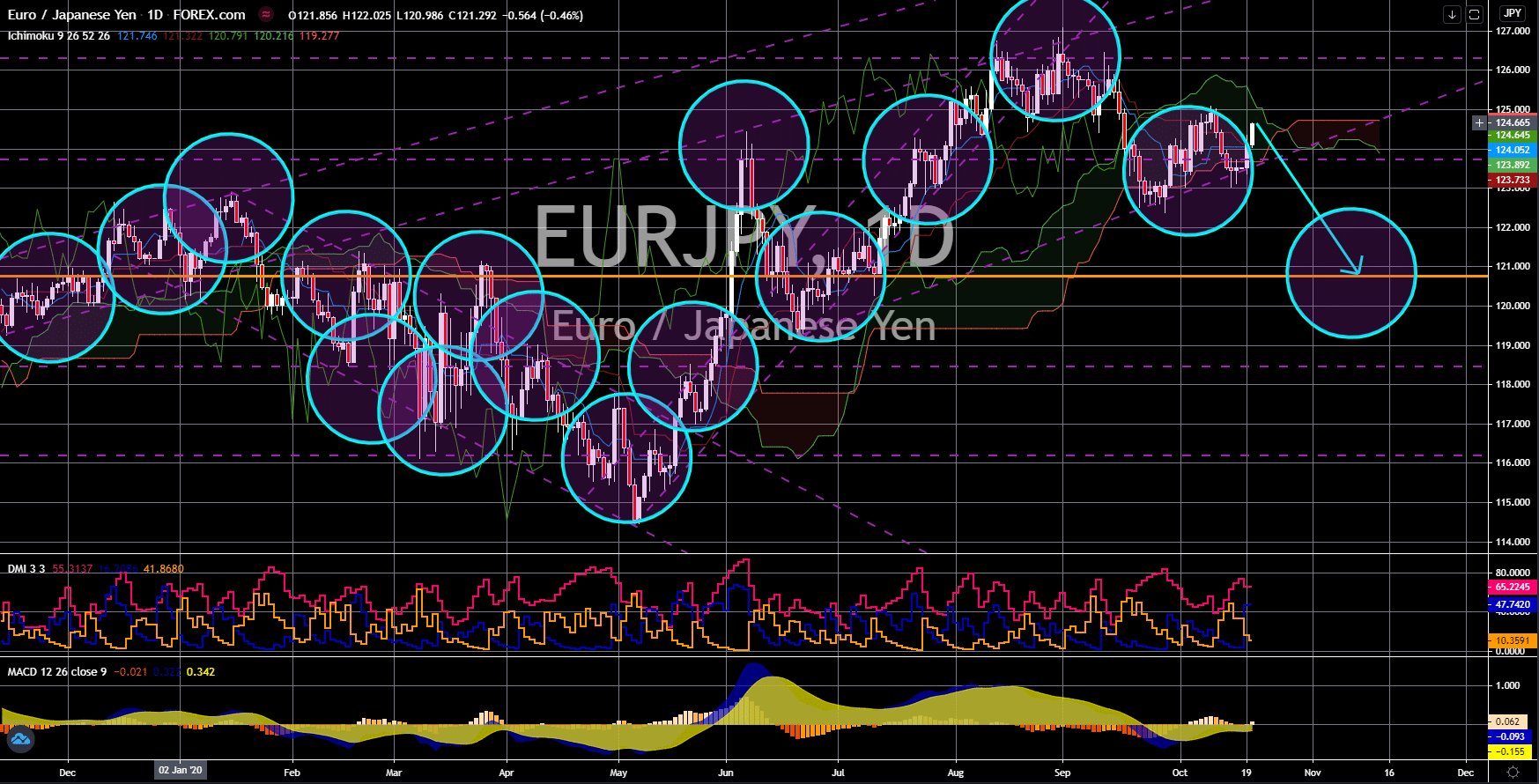

USD/CZK

The pair will fail to break out from a major downtrend resistance line, which will send the pair lower towards its previous low. While western Europe is struggling to revive its economy, its eastern counterpart led by the V4 nations are helping the region to go back to its feet. Czech Republic posted its Consumer Price Index reports on Friday, October 16. The CPI MoM report managed to pull itself after it grew by 0.2% from the decline of -0.3% for the month of August. Meanwhile, the country’s year-over-year figure for CPI made a slight improvement from -0.5% to -0.4% for September. Another report that support’s Czechia’s recovery was its inflation rate report. Poland, Hungary, and Czech Republic posted 3.8%, 3.4%, and 3.3% inflation, respectively. All of whom managed to reach their inflation target of +-3.05. Investors are expected to push the Czech Koruna higher against the US dollar due to the uncertainty brought by the US elections.

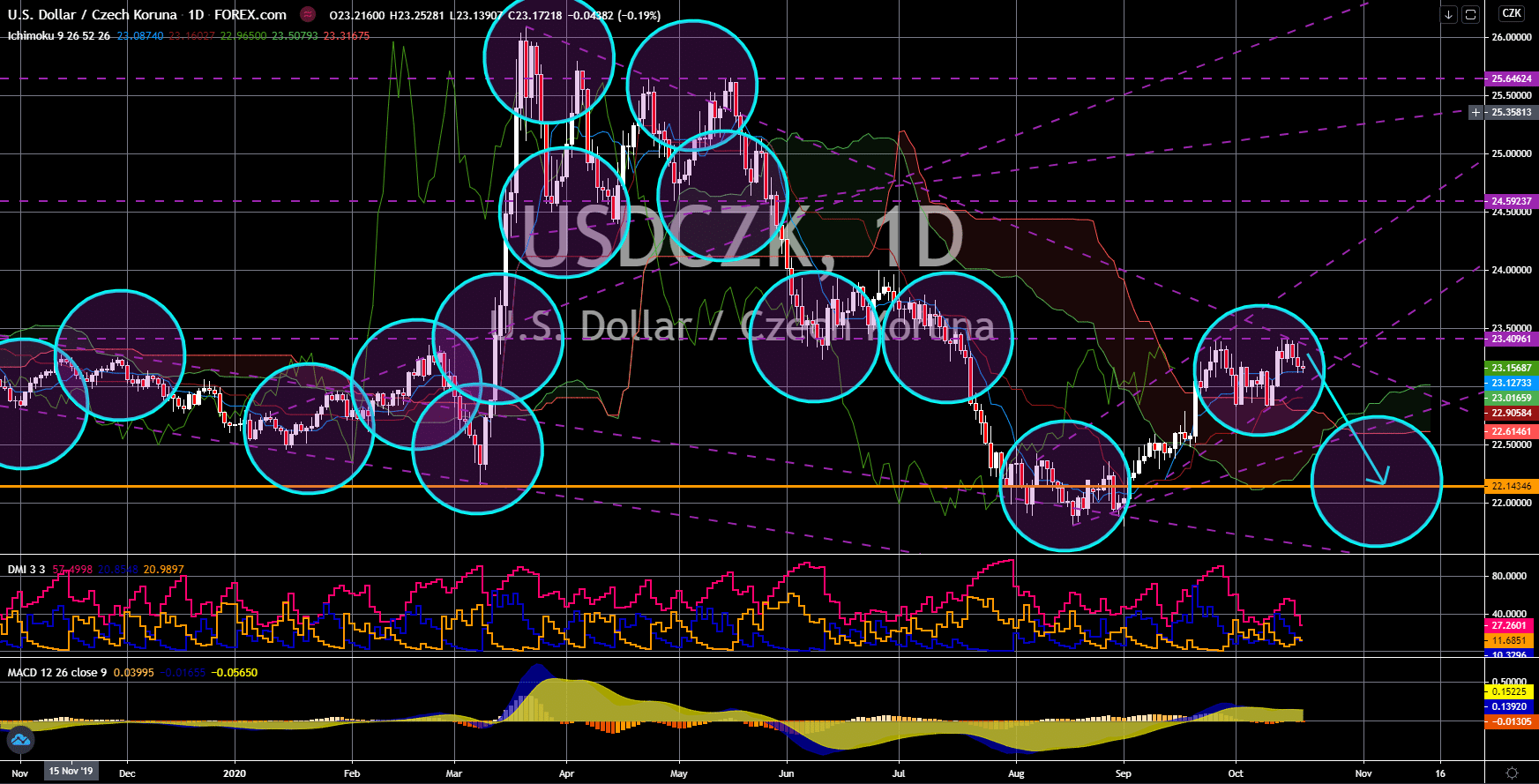

EUR/CHF

The pair will bounce back from its current support line, sending the pair higher towards a major resistance line. Swiss franc’s safe-haven status might be stripped again after Switzerland posted the highest average daily increase in new local cases of 146.0% over the past week. The Swiss government already took some precautionary measures by requiring its citizens to wear masks in indoor public places. Germany, France, the United Kingdom, Italy, Spain, and the Netherlands are also expected to announce their own restrictions to contain the virus. Analysts feared that a new lockdown in Europe could send the countries in the region in a double recession. Currently, reports have shown that the European region is struggling to recover from the pandemic. Switzerland posted a decreased surplus for its trade balance report. The result was a $3.279 billion surplus, down from $3.543 billion in August and much lower than the $4.320 billion expectations.

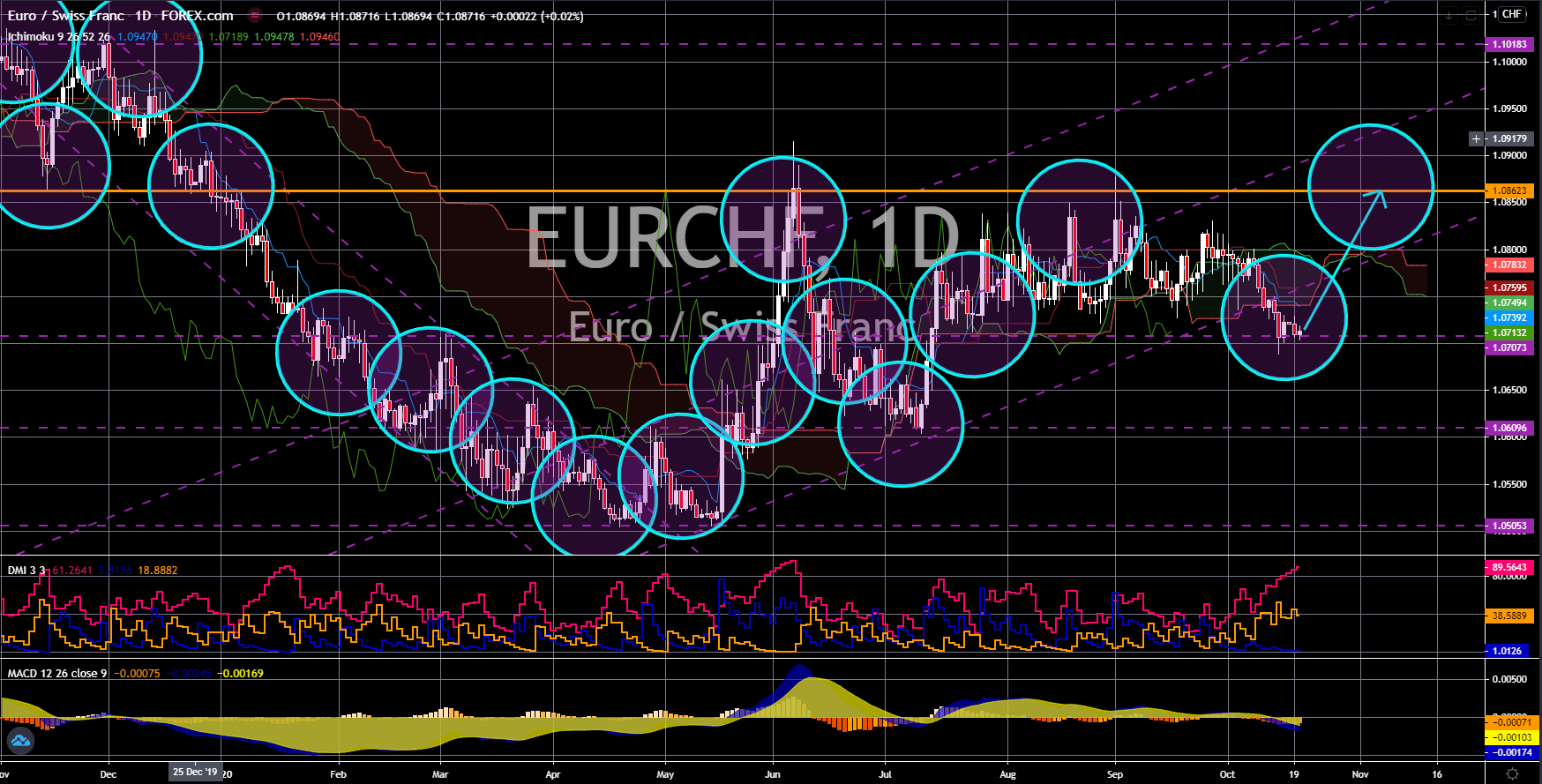

EUR/GBP

The pair will break down from an uptrend channel support line, sending the pair lower towards its May 2020 low. The European Union came under pressure after UK Prime Minister Boris Johnson said that Britons should be ready for a no-deal Brexit. Initially, a hard Brexit could cost the British economy of around $25 billion by 2021. However, it is already contributing $17 billion to the EU budget in 2019. This means that it has lower downside from its withdrawal. Meanwhile, the EU will lose its third-largest member and second-highest paying member. The European Union has two (2) choices. On one hand, the EU should benefit from the UK’s departure. However, this is unlikely as Britain is expecting to also benefit from its withdrawal rather than to lose something from it. On the other hand, the trading bloc must compromise to ensure a smooth Brexit transition. However, this will also trigger more EU member states to withdraw from the bloc.

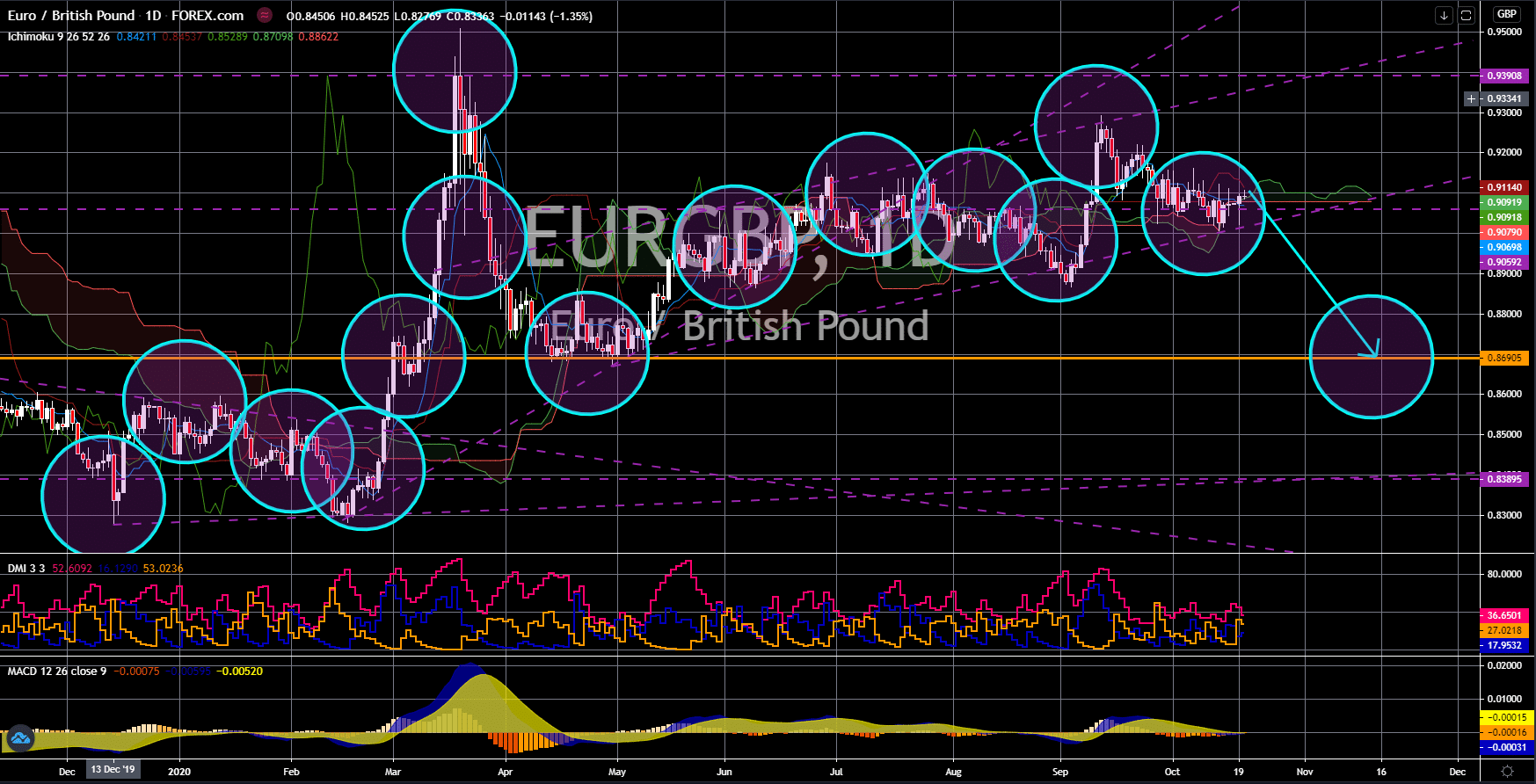

EUR/JPY

The pair will continue its short-term downtrend movement in the coming sessions. Investors are optimistic for Japan’s Q3 data following its strong import, export, and trade balance reports. Imports were still down by -17.2% year-over-year but was an improvement from August’s decline of -20.8%. Meanwhile, exports made a huge jump from -14.8% in last month’s report to -4.9% on Sunday’s report, October 18. This resulted in a trade surplus of $675.0 billion. The figure for the trade balance report in the previous month was $248.6 billion. A report also suggests that the third-largest economy in the world ended its economic contraction in August. On the other hand, the European Union is struggling to recover from the pandemic. Recent reports from Germany and France showed their economies contracting rather than expanding. In last week’s report, October 13, Germany posted a disappointing CPI MoM and YoY figures of -0.2% and another -0.2%.