Market News and Charts for October 19, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

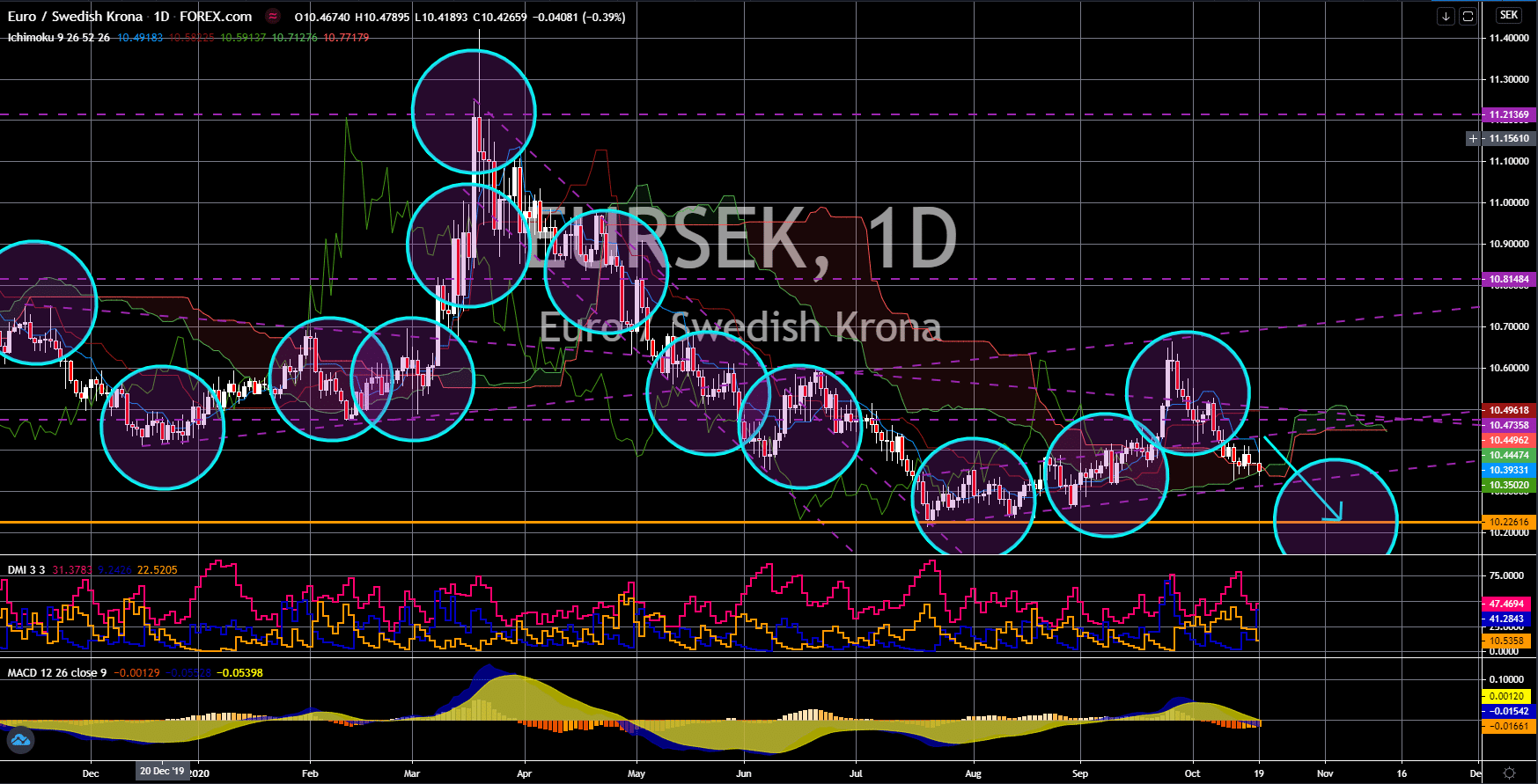

EUR/SEK

The pair will continue to move lower in the following days towards a major support line. Investors of the single currency were whipsawed following the disappointing results from the EU member states which ended the EURSEK rally. A month after the coronavirus became pandemic, analysts gave an outlook to economies who suffered from the “Global Lockdown”. The outlook for Germany was a decline of 4.2% for fiscal 2020. Meanwhile, a recovery is expected in 2021 wherein the EU’s largest economy is expected to expand by 5.8%. However, six (6) months after these projections, analysts have now revised their initial forecast and downgraded Germany’s recovery. The economic contraction for 2020 is now expected to reach -5.4%. Meanwhile, recovery by 2021 was slower at 4.7%. This means that it will take another year for Germany to recover from the financial turmoil brough by COVID-19.

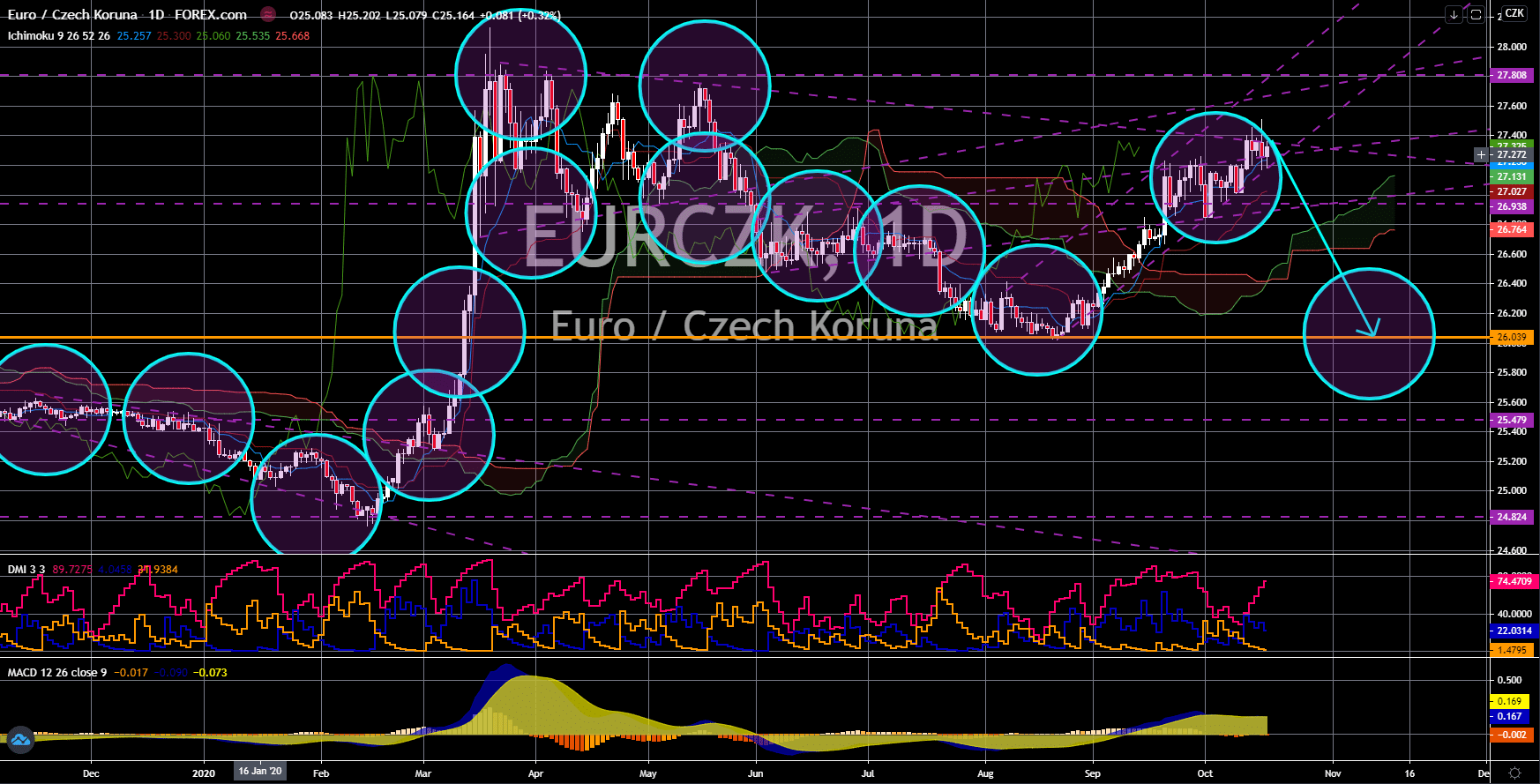

EUR/CZK

The pair will break down from an uptrend channel towards its previous low. A small recovery is better than no recovery at all. This is the scenario for the EURCZK pair. On Friday, October 16, Czech Republic published its Producer Price Index (PPI) reports. The month-over month report posted a 0.2% growth for the month of September against a decline of -0.3% in August. Meanwhile, the YoY report was still in the negative territory at -0.4% but slightly higher than August’s result of -0.5%. The result also beat analysts’ estimates of -0.7%. Looking at France’s Thursday report for Consumer Price Index (CPI) reports, however, Czechia’s figures were better. The second-largest economy in Europe posted a -0.5% decline on its CPI MoM. This figure was the steepest decline in the said report since January 2019. On the other hand, the zero percent growth of the YoY report for CPI was the lowest result CPI YoY since March 2018.

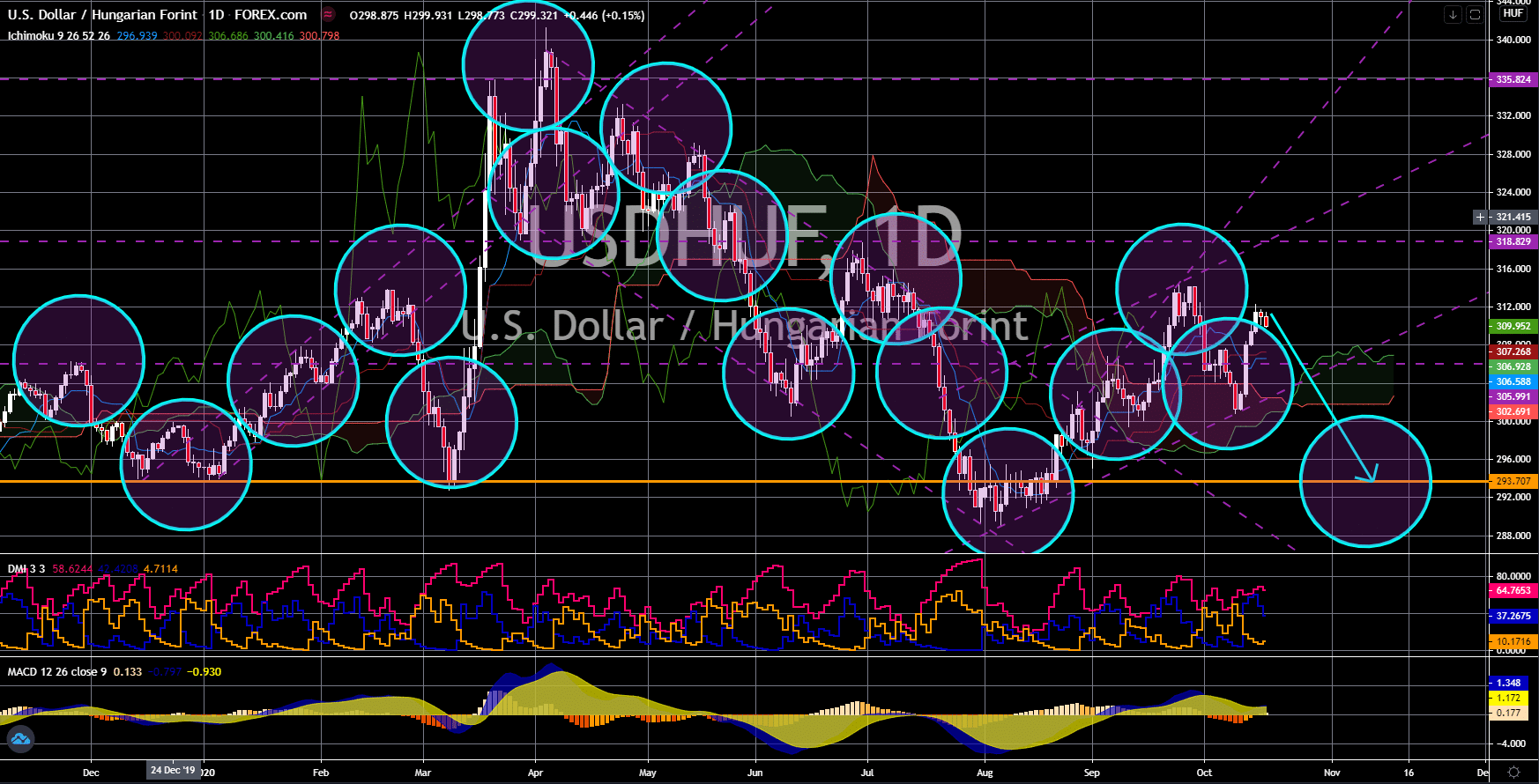

USD/HUF

The pair will revisit its previous low in the coming sessions. The main catalyst for the expected decline in the USDHUF pair was the $2.2 trillion stimulus bill that is still pending. Cumulatively, the US government and the Federal Reserve injected $6.6 trillion in the local economy to keep businesses afloat and help employees who lost their job during the pandemic to keep up with their finances. A major beneficiary of the stimulus was people who are filing for unemployment claims. However, the uncertainty over when the vaccine will become available to the general public added uncertainty in business operations. This, in turn, resulted in companies continuing to retrench their employees. This resulted in 898K additional claimants last week for unemployment benefits. President Donald Trump reiterated that the government will only continue the negotiations for the pending stimulus bill once the election is over on November 03.

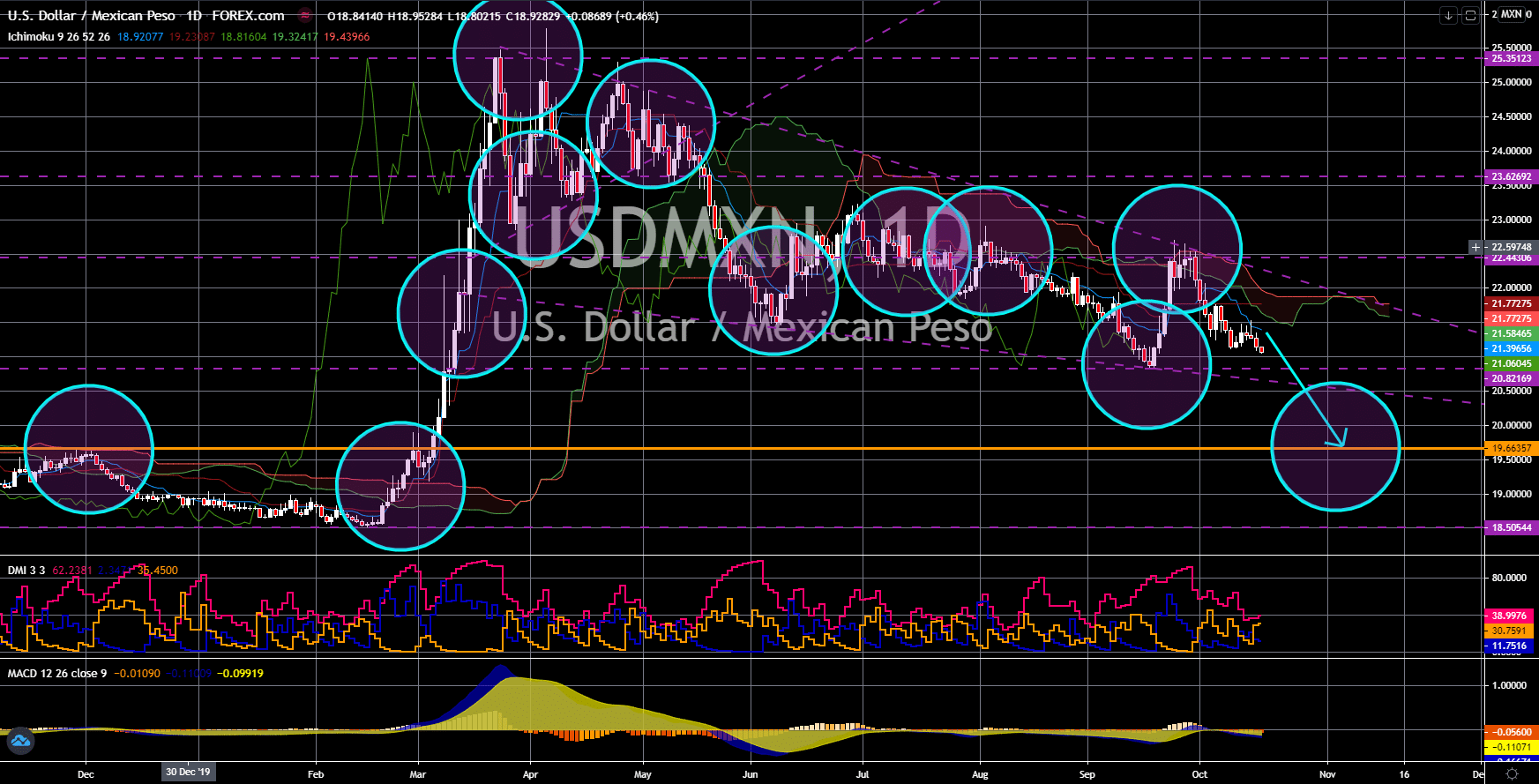

USD/MXN

The pair will continue to move lower after it failed to break out from a major downtrend resistance line. The uncertainty of the US elections on November 03 is pulling away investors from the greenback towards other safer and more stable currencies. Aside from this, the inability of the US government to release the much-needed stimulus to help businesses and individuals is affecting the performance of the US dollar. Since April 2020’s high of 25.78360, the value of the US dollar against the Mexican peso declined by almost 20.0%. Analysts are expecting this trend to continue until the election day. As for Mexico’s economy, it recently revealed a $14.0 billion package program. The money from the private sector will be used for 39 infrastructure projects that they partnered along with the government to add jobs and stir economic activity in the country. The government is expecting the program to create around 185,000 to 190,000 new jobs.