Market News and Charts for October 16, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

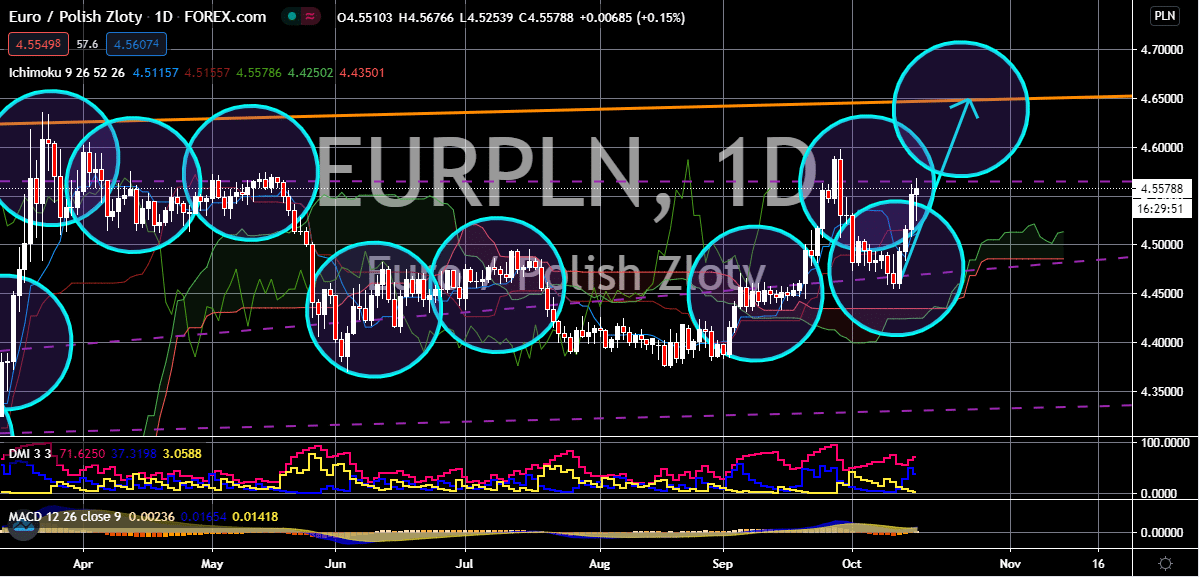

EUR/NOK

The euro gradually advances against the Norwegian krone and takes advantage of the uncertainties felt by investors from the unstable crude oil market. The euro to Norwegian krone trading pair is widely projected to eventually climb up to its resistance level, hitting ranges last seen in early March this year due to crude demand concerns. Also, it was just recently reported that Norway’s oil and gas infrastructure might be in serious trouble as the pandemic drags on longer. The response of major corporations to the pandemic may have contributed to the deteriorating safety of the country’s energy industry which has already taken major beatings this year. In fact, even the Norwegian government is greatly worried about the maintenance delays and changes to turnaround. These woes, unfortunately, have helped weaken the once outperforming Norwegian krone, allowing the euro to steal the attention and gain against it in the trading sessions.

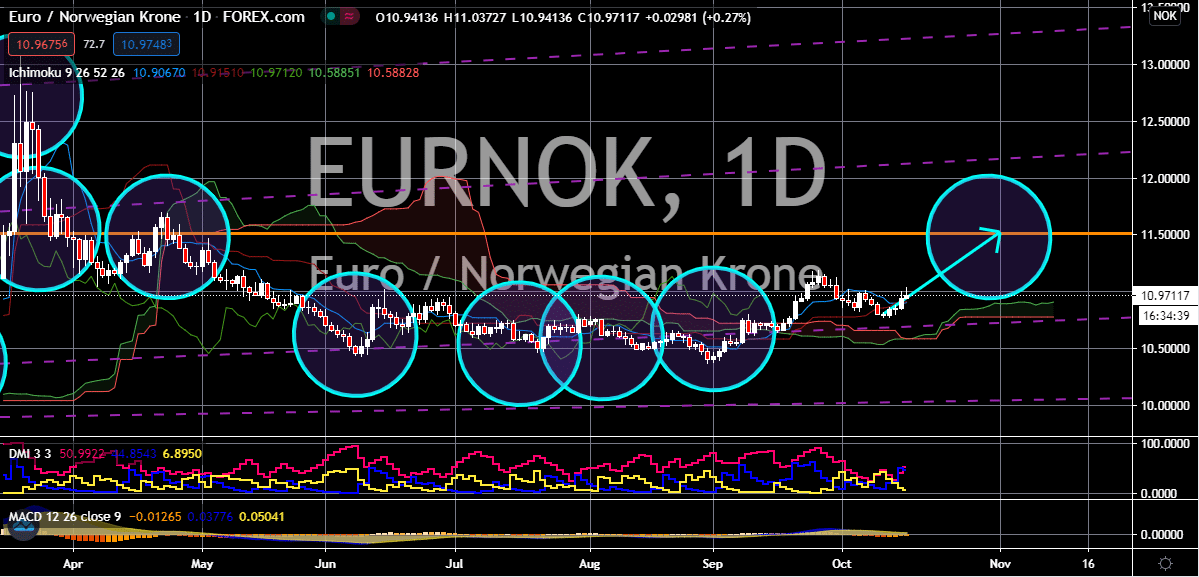

EUR/HUF

Currencies in the region are tumbling, and the Hungarian forint is feeling the intense pressure brought by the rising number of new coronavirus cases in the country. The uncertainties are allowing the bloc’s single currency to overpower the Hungarian forint and bring the prices of the EURHUF exchange rate higher. It is believed that the pair will eventually reach its resistance level by the end of the month. See, the political uncertainties and the rising number of coronavirus cases in Hungary have caused the Hungarian forint to dramatically weaken against the euro. The highly anticipated by-election on Sunday in Hungary, which in fact, could have stripped Fidesz of its two-thirds majority in the Hungarian parliament, turned out to be a fiasco for Fidesz candidates as they managed to snatch the constituency but only by a narrow margin. The election was massive and was important to both sides as it will determine the fate of the country amidst the pandemic.

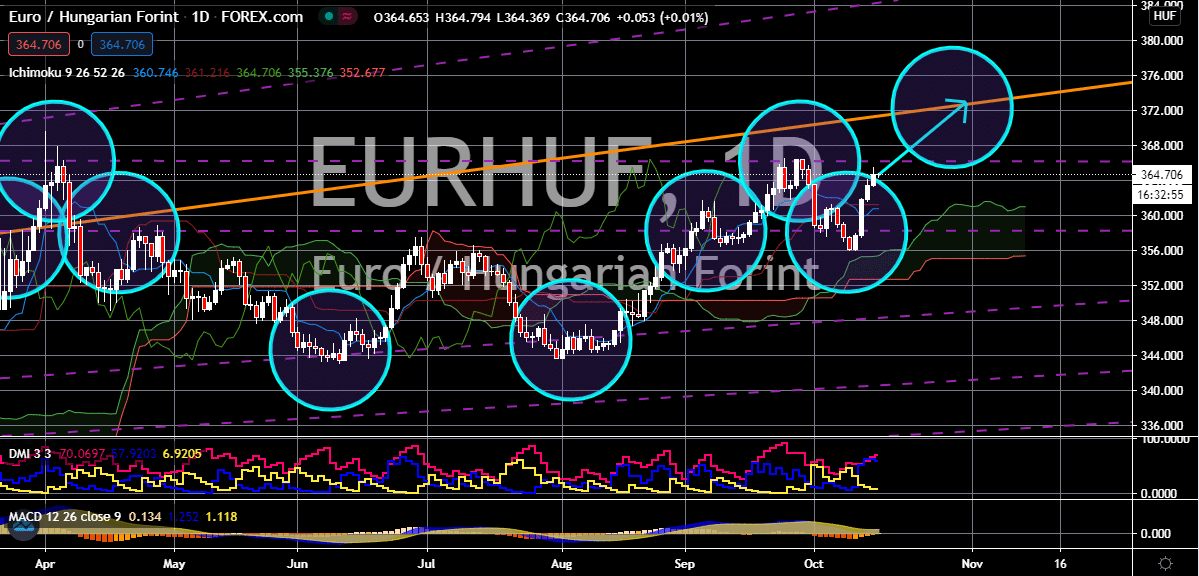

EUR/RUB

The Russian ruble continues to be hammered by intense geopolitical pressure but not everyone in Moscow is mourning about the currency’s weakness. The euro still has a clear advantage against the ruble and the sentiment for the pair is still strongly bullish. It is now believed that the trading pair will climb to its resistance level by the first few days of November. Just recently, it was reported that Russian Industry and Trade Minister Denis Manturov said that companies in the country that don’t rely heavily on imports are in a “sweet spot” right now as the Russian ruble stands weaker against most major currencies. The Kremlin has introduced measures to get firms to be less reliant on imports since the United States and European sanctions have curbed the country’s access to international markets since 2014. Economy Minister Maxim Reshetnikov said earlier yesterday that the Russian ruble is greatly undervalued, warning about the country’s inflation.

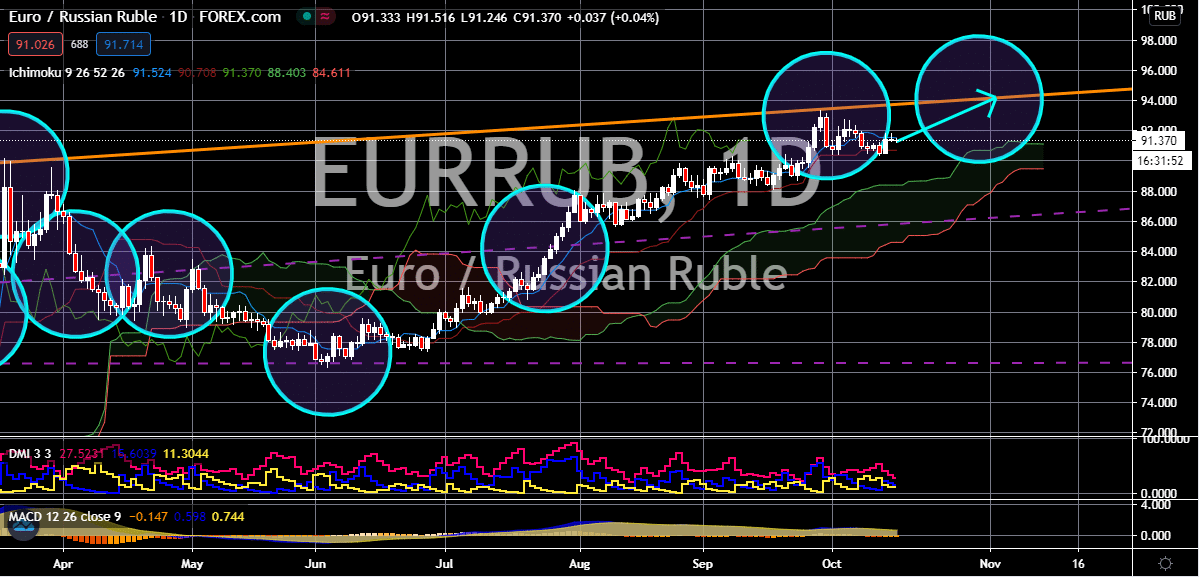

EUR/PLN

The Polish zloty is on its back foot against the bloc’s single currency and bullish investors are pushing the pair’s prices towards its higher resistance level. Looking at it, the pair has a potential for further gains if it manages to break past this initial resistance, climbing higher this month. The zloty is seeing a strong case of sell-off from investors as the tensions in the market continue to escalate. Since Poland’s net external is still notably massive, investors use foreign capital and the new coronavirus restrictions are unfavorable for the Polish zloty for numerous reasons. Just yesterday Poland’s prime minister called on the people to stay at home is possible as he announces new restrictions in major cities to contain the spread of the deadly virus in the country. Prime Minister Mateusz Morawiecki said that the country will return to the basic recommendations and restrictions as the country records more confirmed cases of the coronavirus.