Market News and Charts for October 16, 2019

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

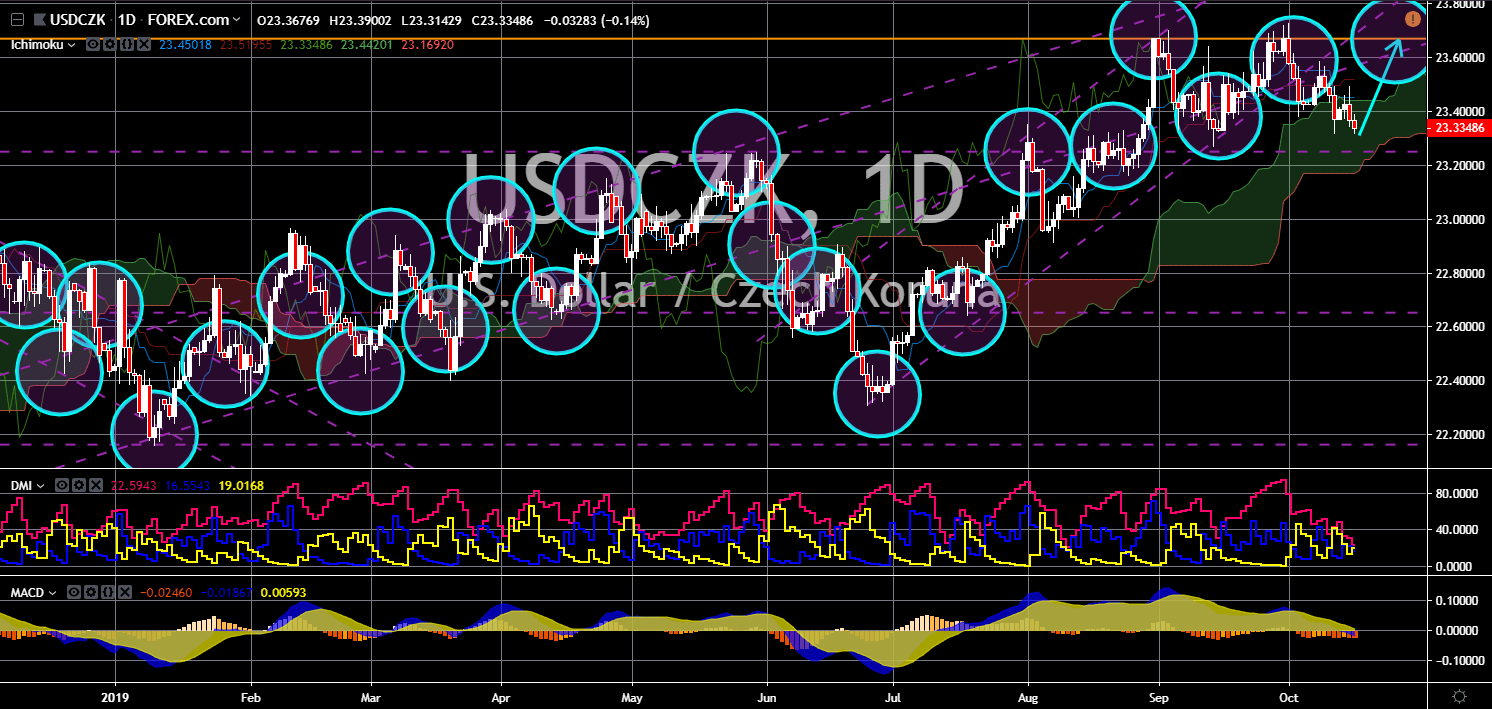

USD/CZK

The pair is expected to retest its previous high and to bounce back from a major support line. Czechia officially suspend its military equipment exports to Turkey. This is seen as a major move for the western allies as they seek to isolate Turkey. This was amid the country’s decision to buy Russian S-400 missile defense system. Russia’s defense system and U.S.’ F-35 fighter jets are designed to destroy each other, thus, incompatible for each system. America recently pulled Turkey out from its F-35 program due to the country’s Russia purchase. The United States is now seen increasing its efforts to build the eastern bloc’s military. The U.S. already installed THAAD (Terminal High Altitude Area Defense) in Romania and Poland. Czech Republic and Hungary, on the other hand, submitted official requests to buy F-35 fighter jets. The V4 nations were also turning to U.S. alliance, defying the European Union.

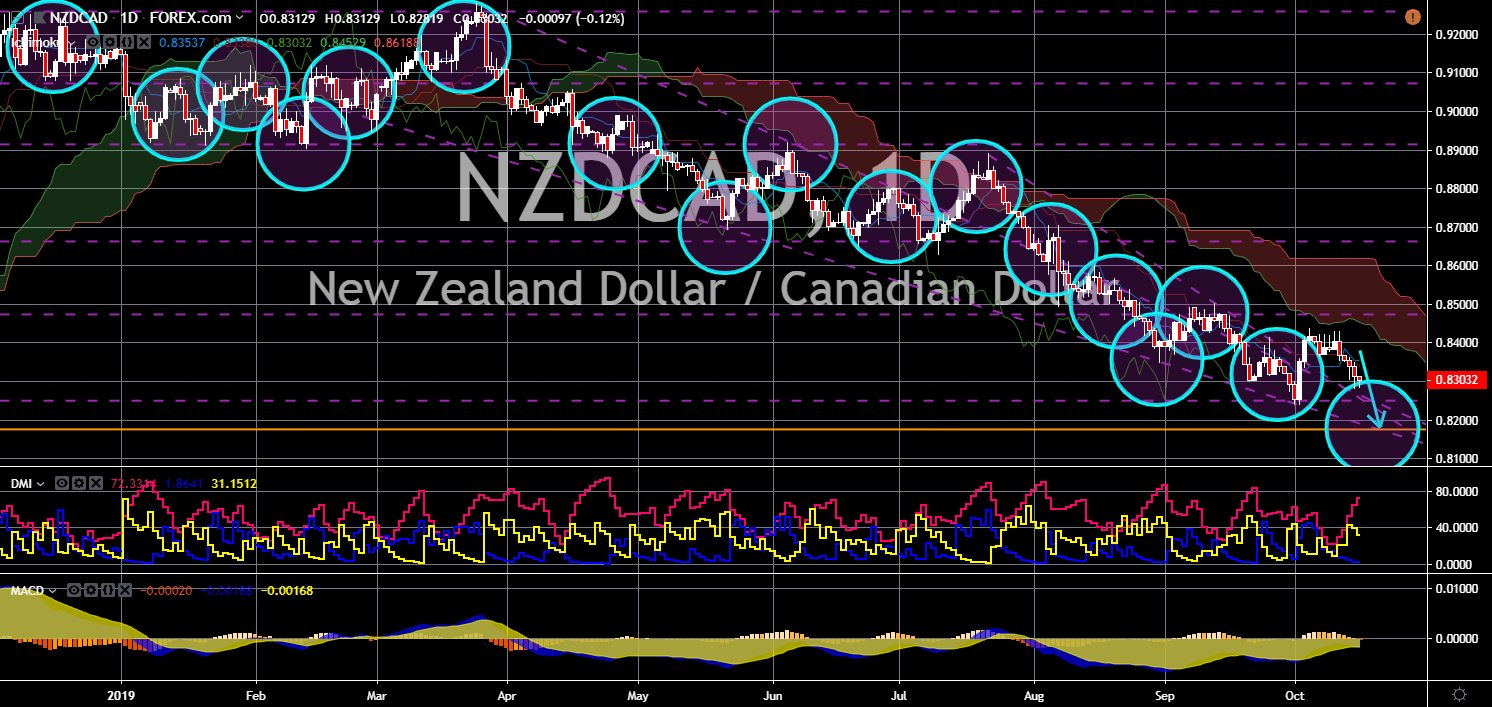

NZD/CAD

NZD/CAD

The pair is expected to continue to move lower in the following days and move toward its 74-month low. The Royal Bank of New Zealand (RBNZ) is pressured to further cut rates to accommodate economic and political uncertainty. Major economies, such as the United States, China, Germany, and the United Kingdom, are experiencing slowdown in growth. Analysts expect that this could be the end of the longest expansion in American history. The last global recession was during the 2008 Global Financial Crisis. New Zealand’s interest rate sits at 1.00%, while Canada was at 1.75%. New Zealand already cut interest rate twice, while Canada haven’t made cut since 2015. New Zealand and Canada were also middle players on the pacific-rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Canada said its economy was resilient, while New Zealand expressed its willingness to enter a negative rate.

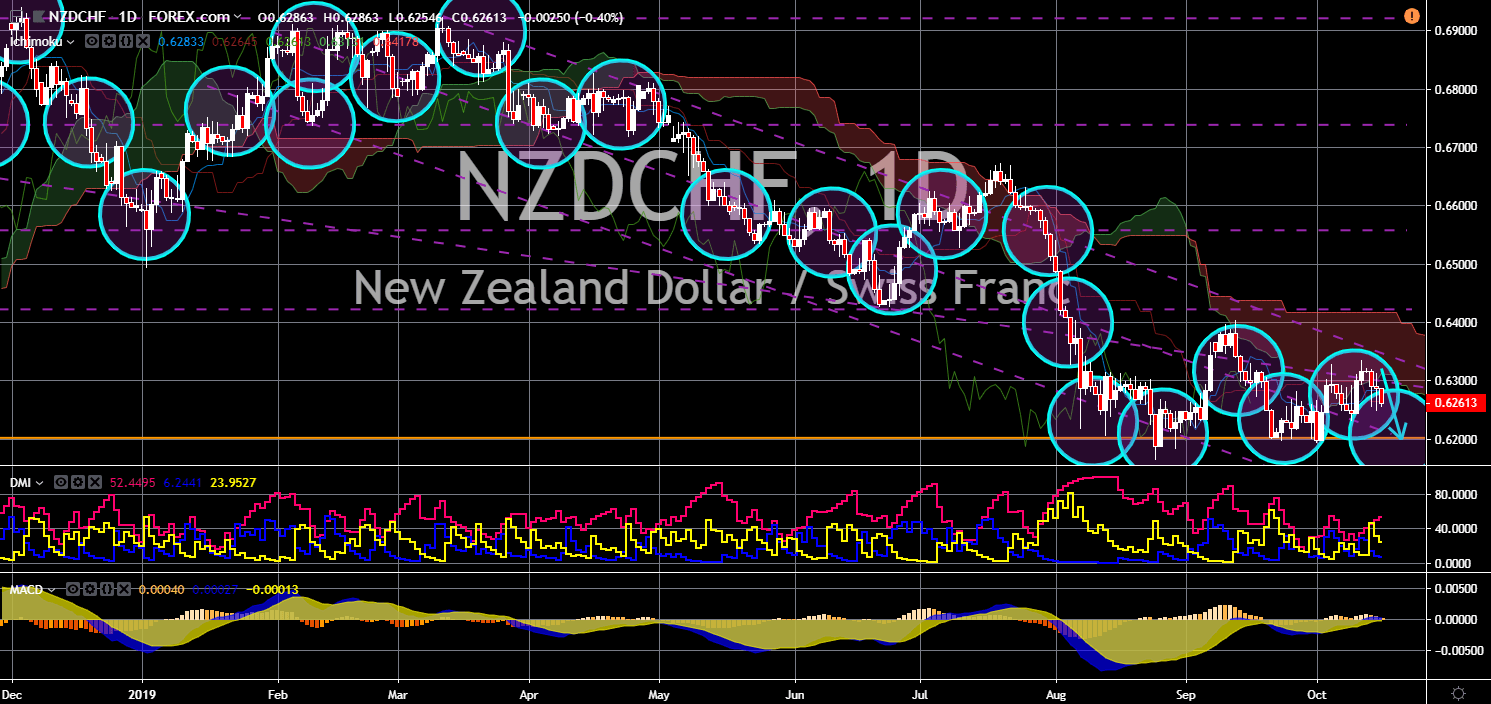

NZD/CHF

The pair failed to sustain its strength to retest a downtrend resistance line. The two (2) countries were looking forward to signing a post-Brexit trade agreement with the United Kingdom. The UK government said last month that New Zealand was its top priority for its trade deal. However, this might not come true for Switzerland. The Swiss economy is one of the most resilient in the world and it will be beneficial for Britain to prioritize Switzerland over New Zealand. This was following the possibility of the United Kingdom crashing out of the European Union without a deal. On October 17, Thursday, EU leaders are expected to discuss Brexit during the EU Summit. The UK is set to leave the bloc until October 31. Meanwhile, Switzerland’s interest rate was the lowest in the world, while New Zealand is poised towards a negative interest rates in the future.

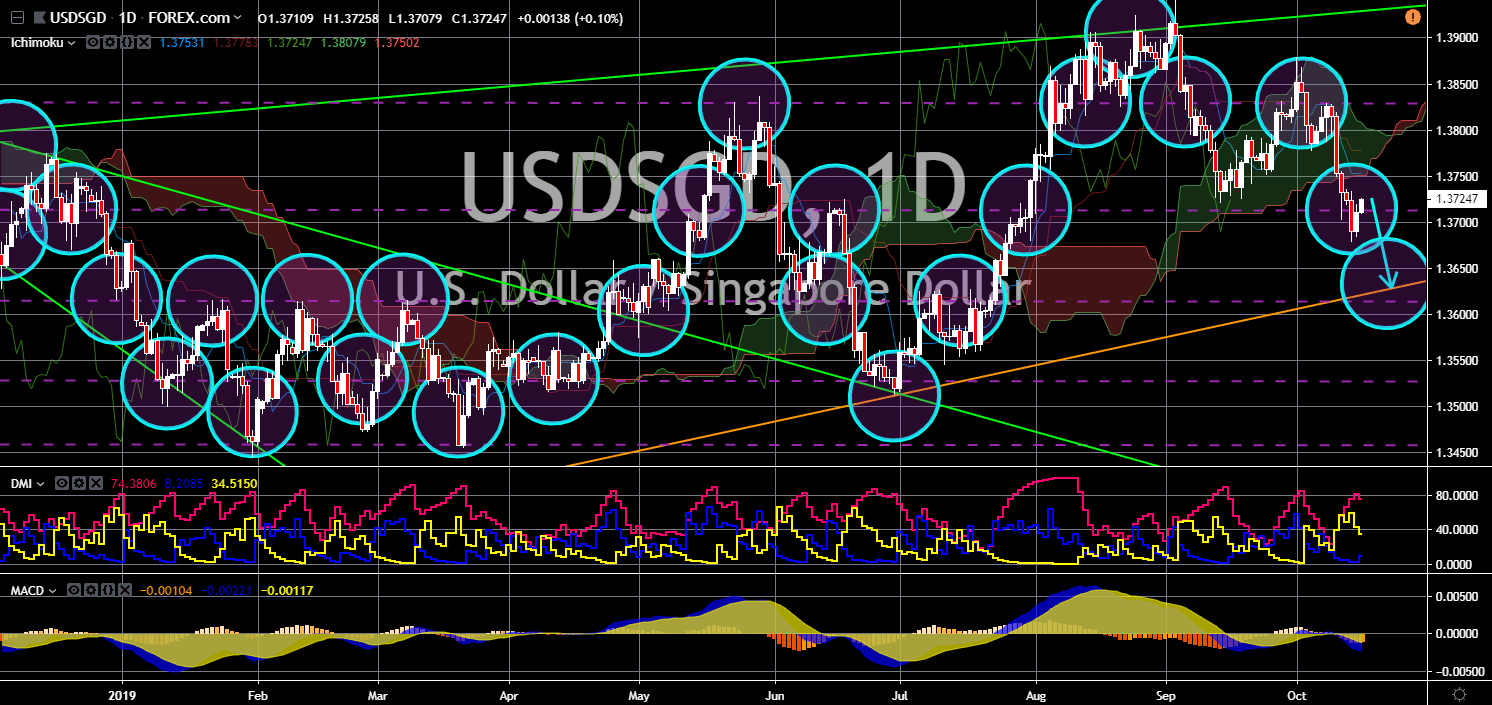

USD/SGD

The pair is expected to further move lower in the following days and to breakdown from a key support line. Singapore overtake the United States as the most competitive country in the world. The World Economic Forum’s Global Competitive Report measured the strength of 103 key indicators to predict the most competitive economy. Indicators include inflation, digital skills, and trade tariffs, across 141 countries. The U.S.’ slipped through rankings highlighted its ongoing trade war with China. The largest economies in the world strike a deal, which analysts hope would end the trade war between these countries. Singapore, on the other hand, has its influence increasing following China’s growing military presence in the South China Sea. The Singapore Strait host 1/3 of global trades, making Singapore a viable ally for any country who want to control the global order.

-

Support

-

Platform

-

Spread

-

Trading Instrument