Market News and Charts for October 14, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

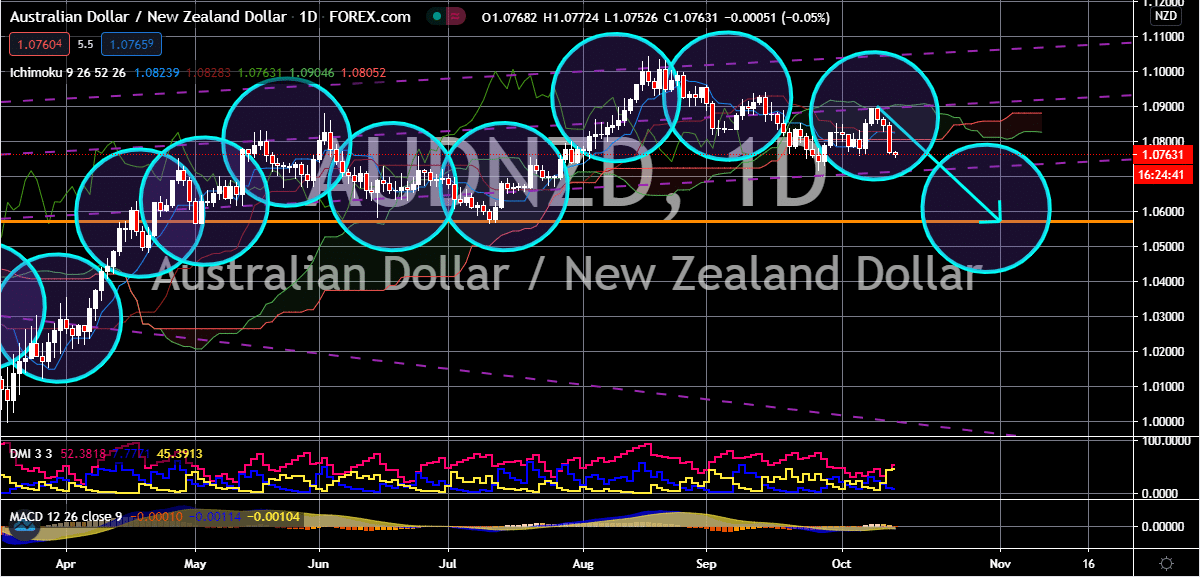

USD/CNH

The Chinese yuan continues to drag the US dollar in the trading sessions as investors brace themselves for the upcoming US presidential elections due next month. In less than 3 weeks, the United States will elect a president and as of today, national polls found that Democratic candidate Joe Biden is leading against the incumbent president, Donald Trump. The political uncertainties, mixed with economic concerns, have bombarded the US dollar, allowing the Chinese yuan to take advantage of it in the foreign exchange markets. Looking at it, the Chinese yuan faced major headwinds following the decision of the People’s Bank of China. But fortunately for bears, it seems that the US dollar is significantly weaker. Just recently, PBOC-run magazine, China Finance, reported that under extreme circumstances regarding the trade war, the financial network and information system of the country could be affected, inflicting long-term damages to the yuan.

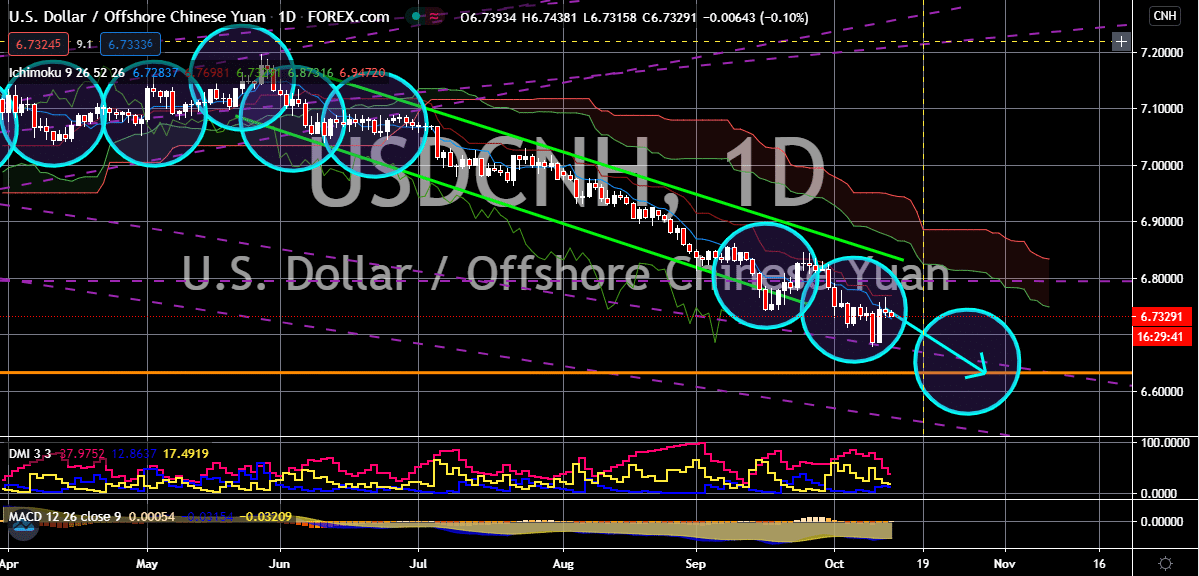

USD/TRY

The Turkish lira is pinned on its lowest point against the US dollar. Looking at the chart, it appears that the bullish sentiment for the exchange rate won’t die down anytime soon. Hence, the prices should continue to gradually appreciate in the coming trading sessions. The Turkish lira has led the losses in the emerging market currencies in the past weeks and the efforts of the nation’s central bank aren’t helping the struggling currency. Earlier this week, it was reported that the Central Bank of the Republic of Turkey raised the renumeration rates on the required lira reserves by about 200 basis points on all banks. The decision comes as a further backdoor tightening step that rolls back measures that it has initially adopted to ease the impact of the coronavirus on the country. Thanks to the report, the lira further weakened against the safe-haven appeal of the US dollar. The exchange rate is at its all-time high and it’s still expected to climb to 8.20000 soon.

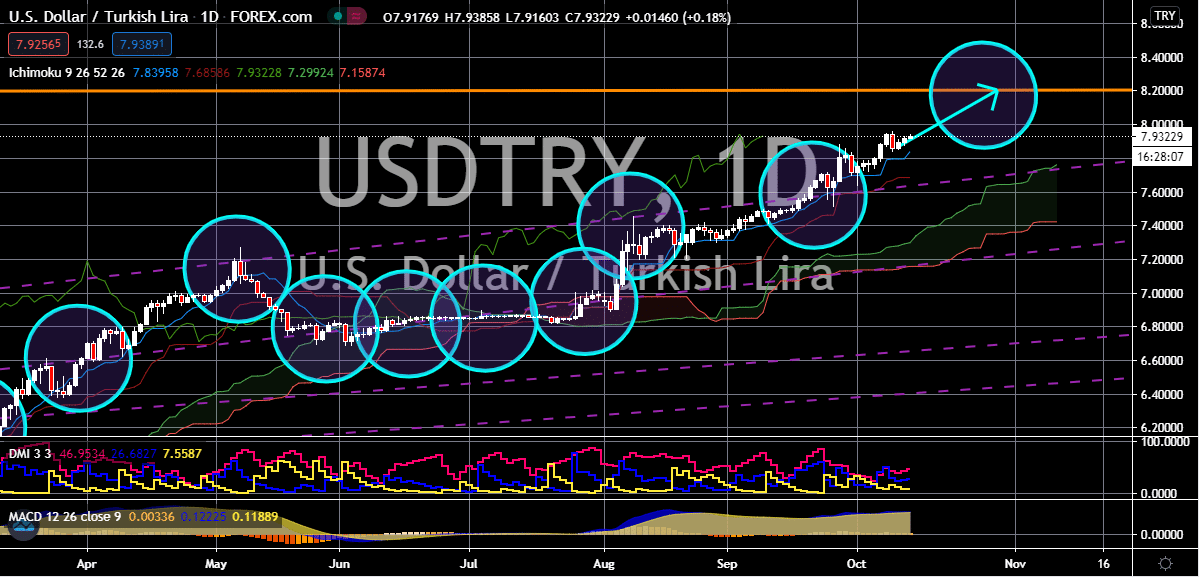

EUR/NZD

As the number of coronavirus cases in Europe rises, the euro would most likely remain vulnerable against the New Zealand dollar. It is believed that the Brexit concerns, rising number of cases, and economies woes in the eurozone would cause the single currency to plummet against major currencies in the foreign exchange market. The euro to New Zealand dollar exchange rate should fall to its resistance level by the latter part of the month. Just recently, the European Union agreed to pay more than 1 billion euros to biopharmaceutical company, Gilead for six months-worth of supply for its antiviral drug remdesivir. Obviously, leaders in the bloc are getting more and more alarmed about the rising number of cases in the region and are exerting more effort to finally contain it without shutting down its economies. The news about the EU’s agreement comes shortly before Gilead published the final results of its biggest trial vaccine for the coronavirus.

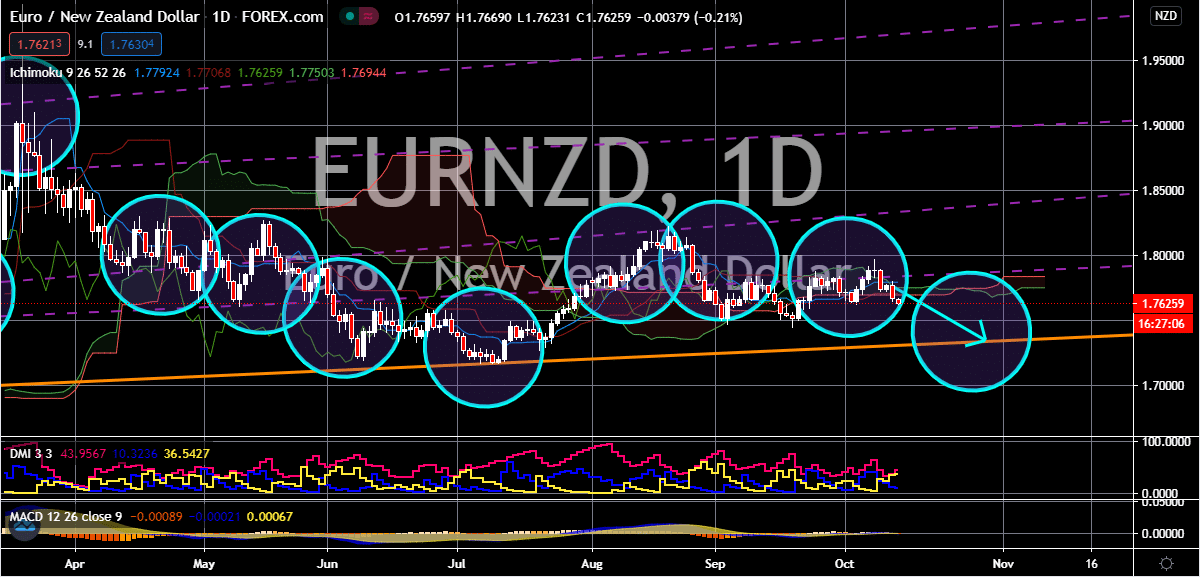

AUD/NZD

The Australian dollar dips again against its neighbor, the New Zealand dollar this Wednesday’s trading sessions. However, compared to its decline in the past few days. The recent reports regarding Australia and China have weakened the Aussie in the trading sessions, allowing the kiwi to advance. Australia is currently trying to confirm the reports of China’s ban on its coal imports. According to sources close to the matter, Beijing is telling energy providers and steel companies to stop purchasing coal from Australia. The news came as a surprise to the market as trade tensions between Asia-Pacific countries have already deteriorated in recent years. See, coal is one of the major experts of Australia to China and the antipodean country has been raising a lot from its exports to the country. However, if this is true, it would further dent the economic recovery of the country, allowing other currencies like the New Zealand dollar to overpower the Australian dollar.