Market News and Charts for October 11, 2019

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

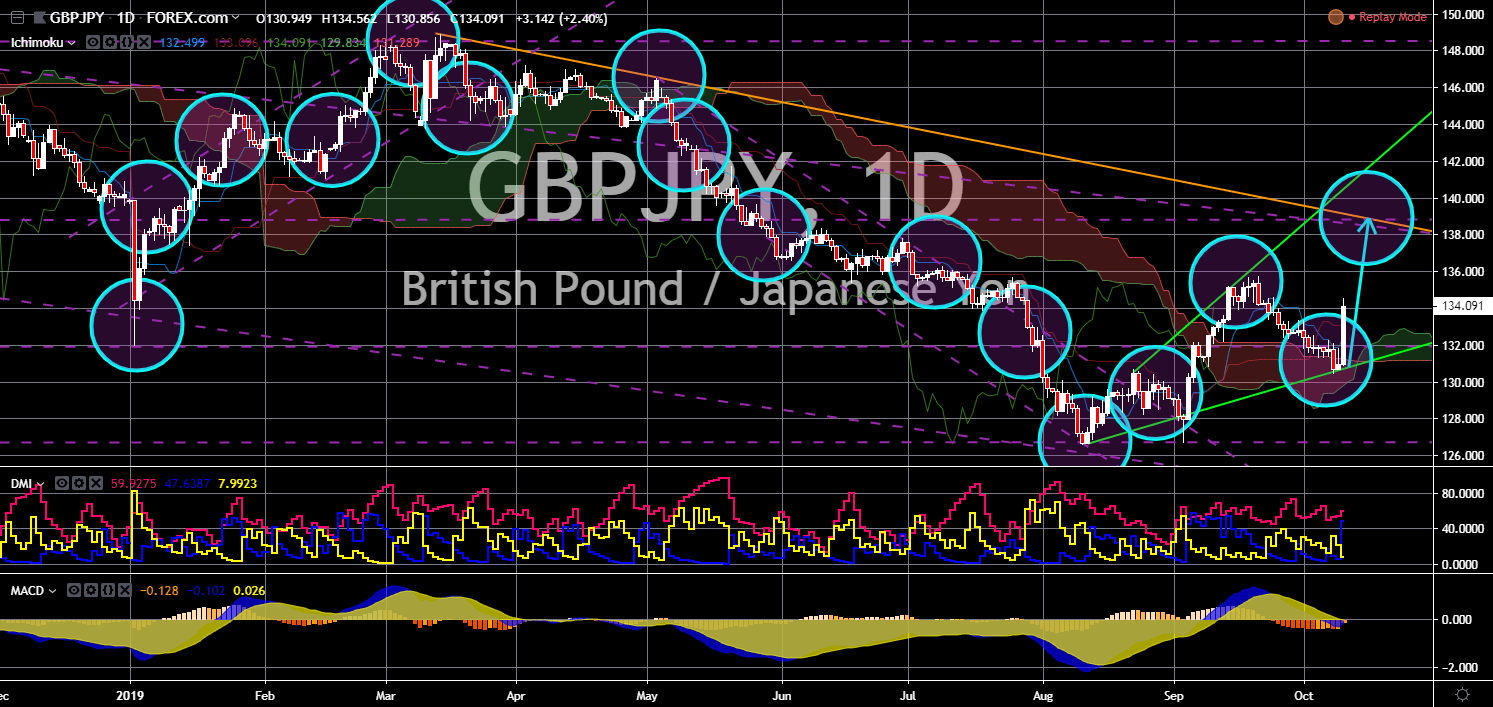

GBP/JPY

The pair is expected to continue moving higher in the following days after it found a strong support line. Japan is expected to encounter the country’s most devastating typhoon since 1958. This is expected to affect Japan’s economy, particularly the agricultural sector. On the other hand, Japanese firms are expected to pullout from the United Kingdom following uncertainties surrounding the Brexit. These companies are worried that the UK crashing from the EU without a deal might spell a recession. Japan has also been subject of UK’s tirade after the ratification of the EU-Japan Free Trade Agreement. The deal made the largest trading zone in the world, between the 3rd (Japan), 4th (Germany), and 6th (France) largest economies in the world. The United Kingdom, on the other hand, has been lobbying its former Commonwealth nations to integrate the CANZUK (Canada-Australia-New Zealand-United Kingdom).

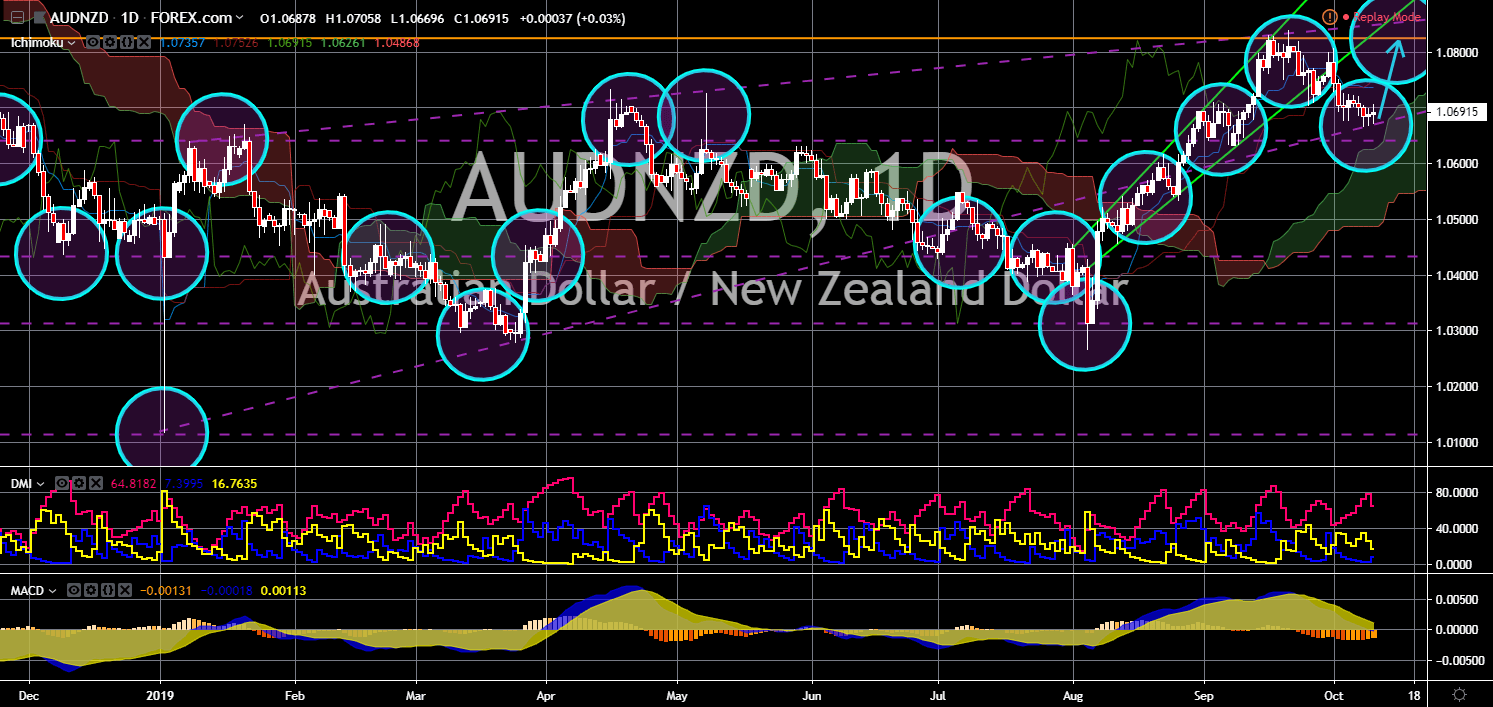

AUD/NZD

The pair will bounce back from a major uptrend support line, sending the pair higher toward its previous low. Australian Minister for Trade, Tourism, and Investment Simon Birmingham will meet Singapore’s Minister for Trade and Industry Chan Chung Sing. The meeting will cover negotiations on a digital economy pact to create an environment for online trade that protects personal data. The move is seen as Australia stepping out from its traditional alliance with New Zealand. Australia was the only member of the Five Eyes that was still at ban with the Chinese telecom giant Huawei. New Zealand said that the country’s decisions will never be influenced neither by the United States nor the United Kingdom. New Zealand also said that it is moving out from the unconventional method of measuring economic growth. The country said that it will measure growth through human index.

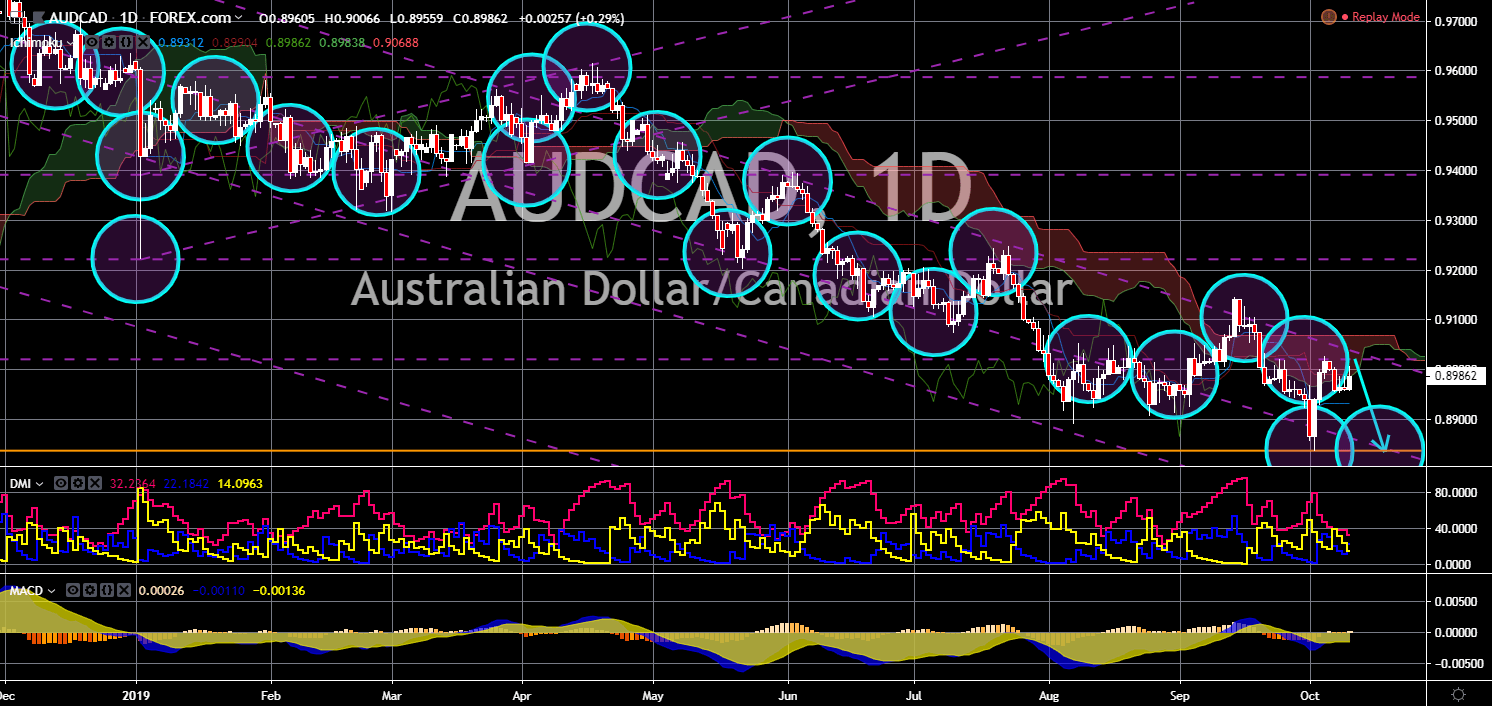

AUD/CAD

The pair failed to breakout from a key resistance line, sending the pair lower to its previous low. The Reserve Bank of Australia (RBA) reiterated that it was willing to entertain negative rates to accommodate economic and political uncertainties. Despite the positive impact of cutting interest rates, it might affect the value on the Australian Dollar. This in turn, will affect Australia’s economy in the end. Canada, on the other hand, had kept its benchmark interest rate. The Bank of Canada (BOC) said that there is no need for the central bank to cut rates. This was amid the strong performance of the country’s economy. Canada last cut its rate in 2018. Since then, the country increased its interest rate five (5) times starting mid-2017. Australia, on the other hand, has been cutting rates since 2011. These countries’ trading deal with the United Kingdom and the European Union will spell their currencies’ performance in the following months.

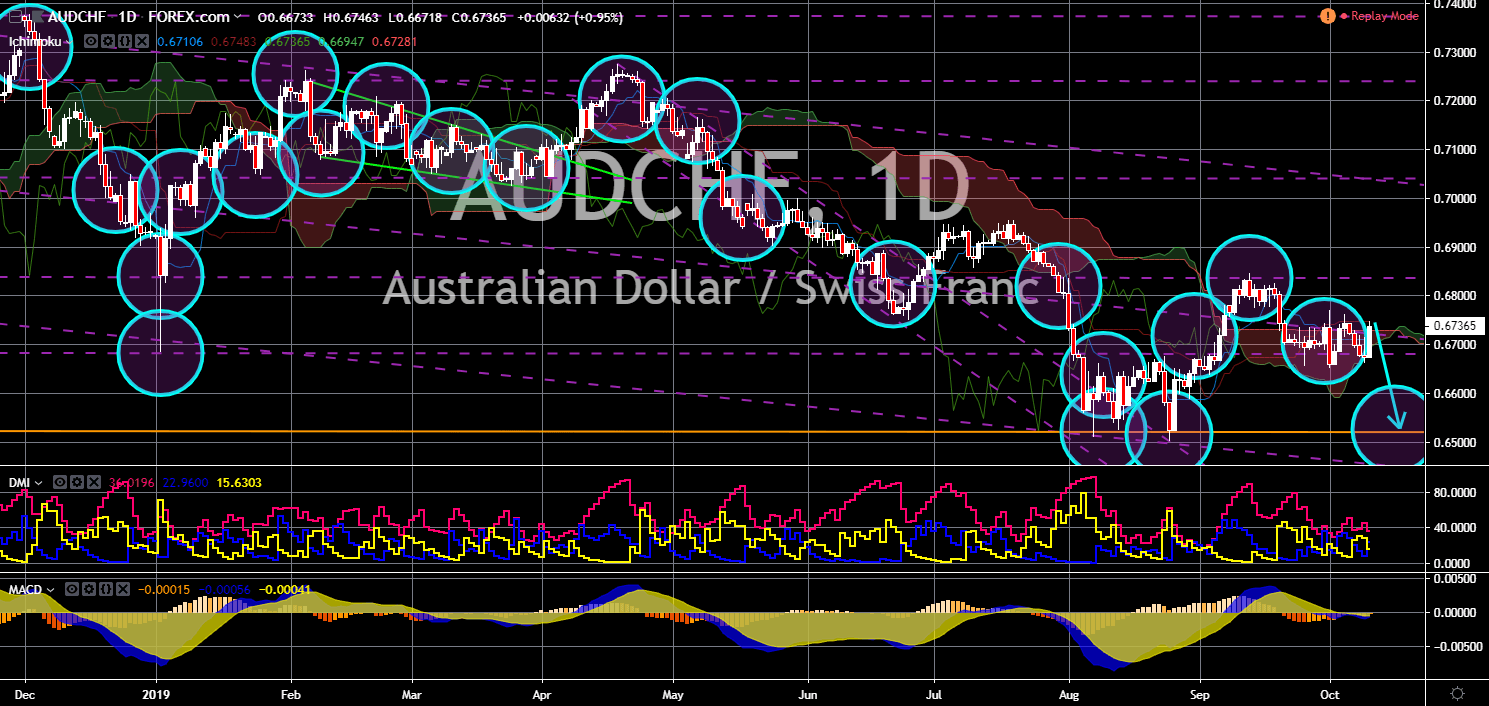

AUD/CHF

The pair will continue to move lower in the following days. This was following EU’s decision to remove Switzerland from its tax haven list. Australia, on the other hand, was still hot in the eyes of EU’s tax collectors. Countries on the list were deemed by the bloc as an instrument for companies and individuals to reduce their tax bills. Nations on the list faced reputational damage and stricter controls on financial transactions with the European Union. On May 19, Swiss voters decided to abolish tax privileges it offers to certain foreign companies, a system designed to attract businesses to the country. This is expected to somehow aid the narrowing relationship between Switzerland and the EU. Switzerland signed a post-Brexit trade agreement with the Britain which angered the bloc. This was after the country turned down the framework deal which will incorporate all the existing bilateral trade agreements between the two (2) economies.