Market News and Charts for October 09, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

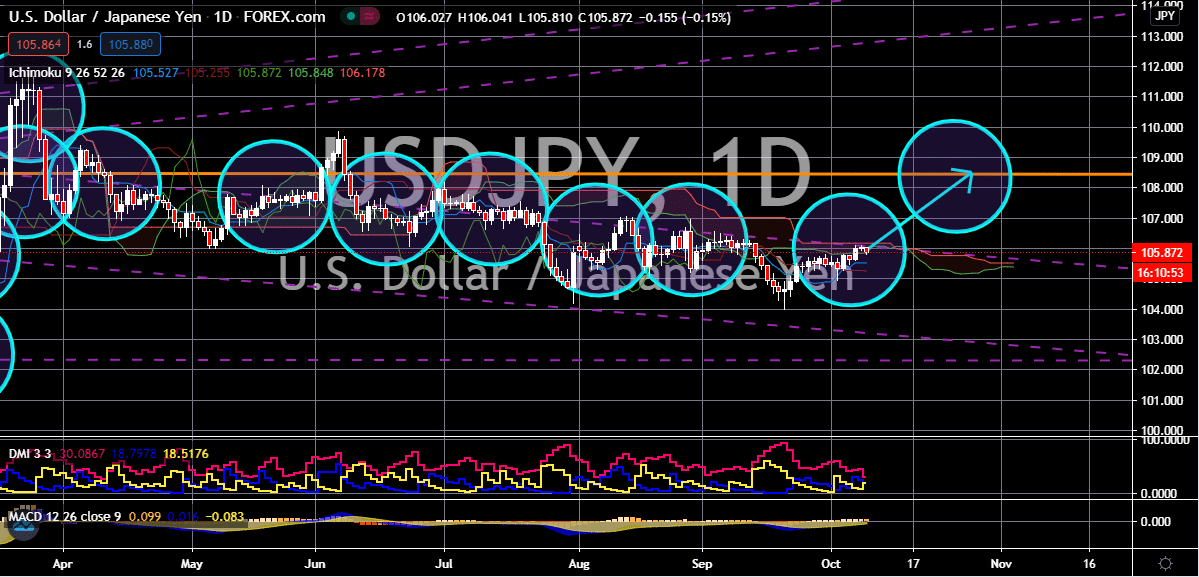

USD/JPY

Despite the downside faced by the US dollar to Japanese yen exchange rates in some sessions, the sentiment remains significantly bullish. It is believed that the trading pair will gradually advance to its resistance level as the US dollar receives help from the fresh hopes for a stimulus program. Just recently, it was reported that US House Speaker Nancy Pelosi, concerned about the health and behavior of President Donald Trump, is putting her foot down and is determined to push the incumbent leader out of the office because he is incapable of doing his job. Also, it appears that both leaders are seemingly open to agreeing on a package for the struggling airline industry. Some investors are hoping for a stimulus package from the government if Pelosi’s plan comes through. On the other hand, the hopes for a stimulus package has strained the strength of the Japanese yen, zapping its safe-haven appeal and allowing the US dollar to finally regain its footing.

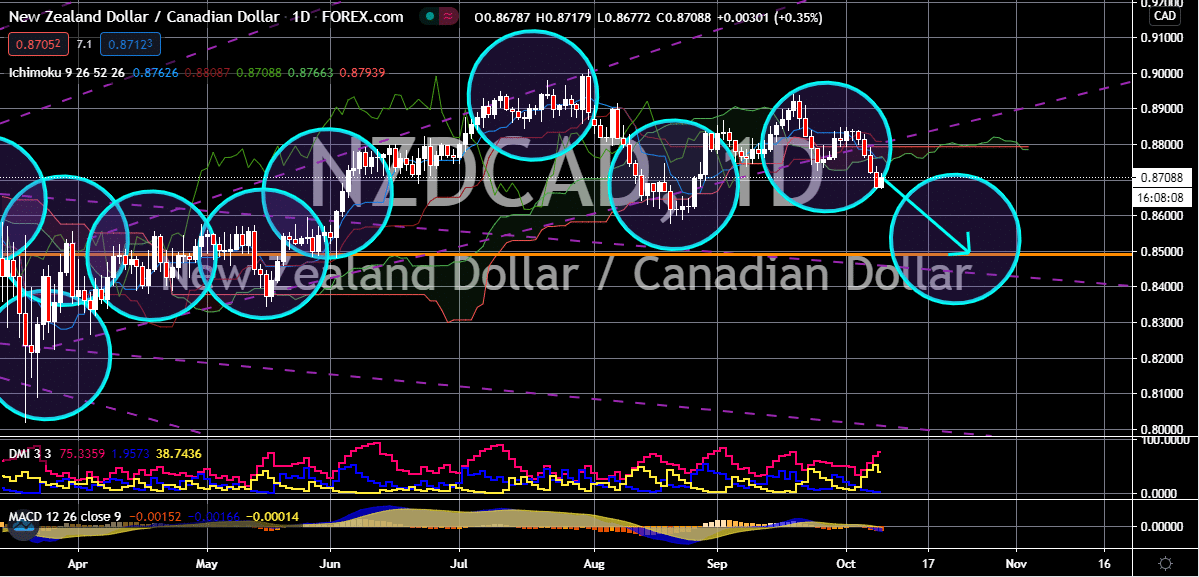

NZD/CAD

The New Zealand dollar appears to be brushing off the talks about the possibility of negative interest rates in trading sessions this Friday and pushes the Canadian dollar. It seems that the kiwi is looking to redeem some of its major losses from this week’s trading and is trying to end the week in a positive light. Unfortunately for bullish investors, the exchange rate is widely projected to turn bearish in the coming days, and that prices would ultimately crash to their support level. Once again, the Reserve Bank of New Zealand gives its straight guidance to the public, which is a rare occurrence in the foreign exchange market compared to other central banks around the world. It was reported that the chief economist of the RBNZ said that that the bank should do too much too soon rather than too little too late. The comment raised speculations regarding the chances of cutting rates to negative territories to support the antipodean country’s economic recovery.

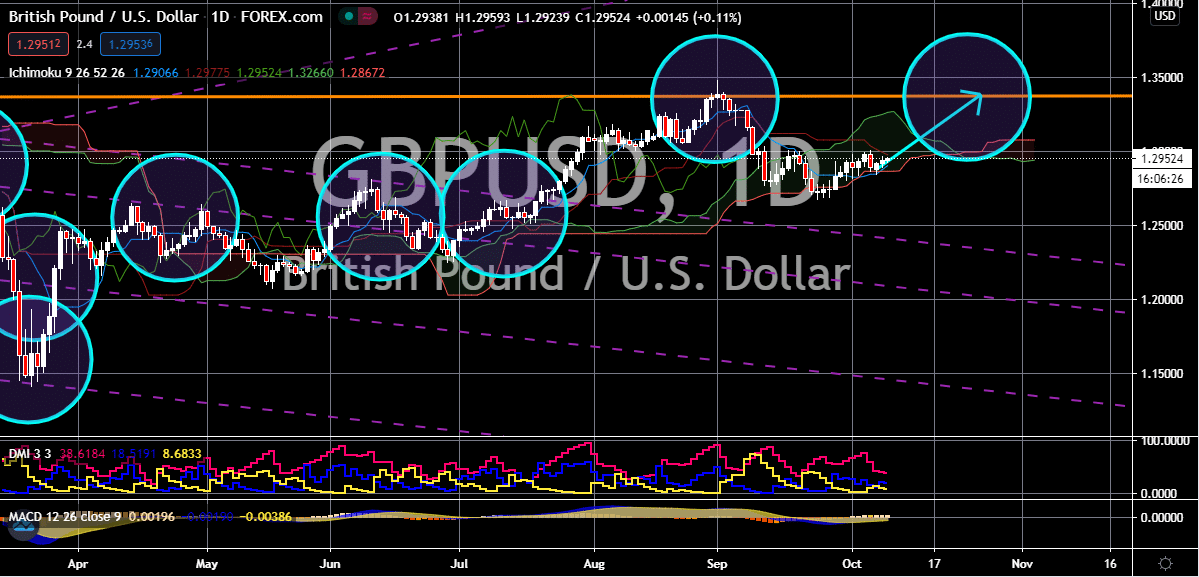

GBP/USD

The British pound to US dollar trading pair continues to see bullish territories and the price is expected to soar its resistance level. Brexit related news and fresh stimulus package hopes are keeping the exchange rate afloat in the sessions this Friday. The United Kingdom needs to step up its game in the coming days to snatch a trade deal with the European Union according to the president of the European Council. Charles Michel said that the trade talks are approaching their “moment of truth” ahead of the highly important EU summit next week. This puts pressure on the two sides to finally settle their differences and make some compromises to agree on a deal. Meanwhile, US President Donald Trump and House Speaker Nancy Pelosi appear to be open to pursue a stimulus plan for the airline industry despite Trump shutting down the talks with Democrats regarding a bigger stimulus plan for the whole US economy.

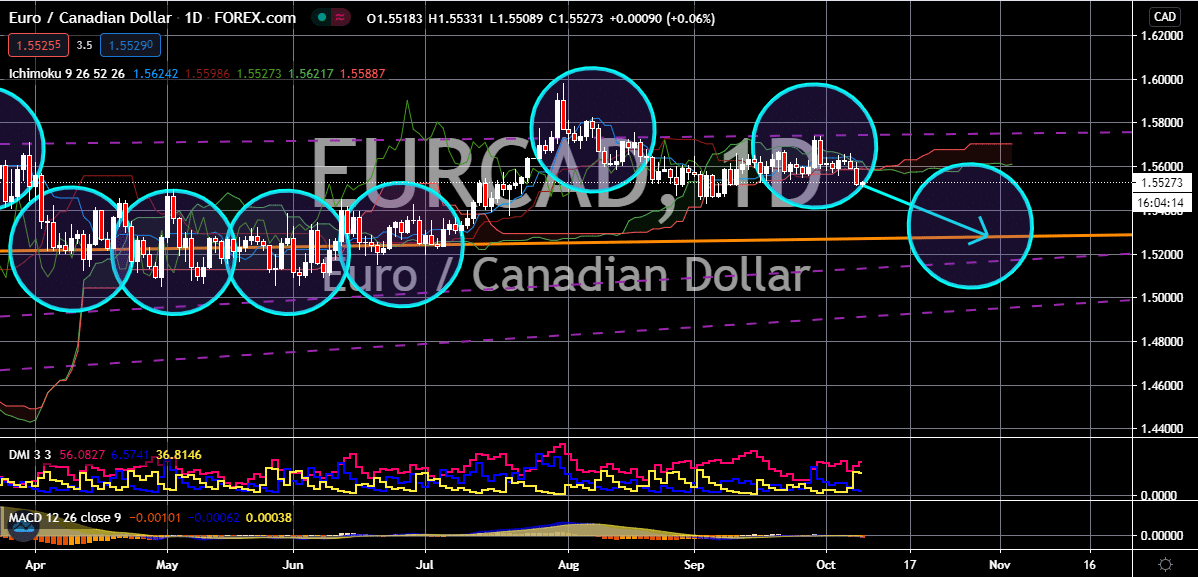

EUR/CAD

The European Central Bank’s subtle moves following the footsteps of the US Federal Reserve weakens the euro, allowing the Canadian dollar to take advantage of the EURCAD’s momentum. It is not believed that the trading pair’s prices will go down to its support level in the coming trading sessions, hitting ranges last seen back in July. The ECB has launched an in-depth review of its monetary policy strategy. On the other hand, the Canadian dollar has strengthened in the trading sessions thanks to the higher crude oil prices in the commodity market. The revived hopes for a fresh stimulus plan for the United States economy also help the Canadian dollar and the global stock market. The positive sentiment brought by those pieces of news has helped investors brush off the negative sentiment from the recent comments of the Bank of Canada governor Tiff Macklem, suggesting the possibility of negative interest rates in the near future.