Market News and Charts for October 08, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

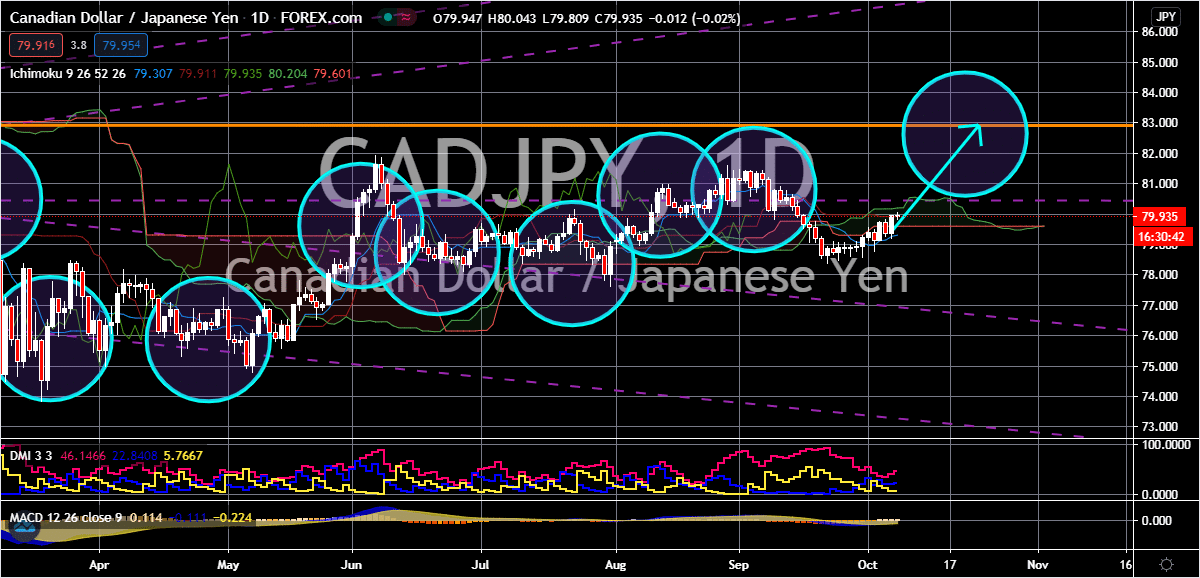

CAD/JPY

The Canadian dollar holds its ground against the Japanese yen despite the uncertainties looming over the global financial market. It is believed that the exchange rate’s prices will eventually climb to its resistance level as bullish investors gather enough strength and momentum from the commodity market and the equity market. The safe-haven appeal of the Japanese yen fails to help it defend itself against the loonie as Wall Street finally calms down ahead of the highly anticipated third-quarter earnings season. Looking at the charts, the Canadian dollar has lost its footing in the previous sessions as Wall Street gets spooked by the fading hopes for a stimulus aid from the US government. However, as of today, the Japanese yen is seen nursing its losses as the market once again feels hopeful for a stimulus program from the US authorities. See, the fluctuating risk sentiment in the market is preventing bulls from gaining a powerful momentum.

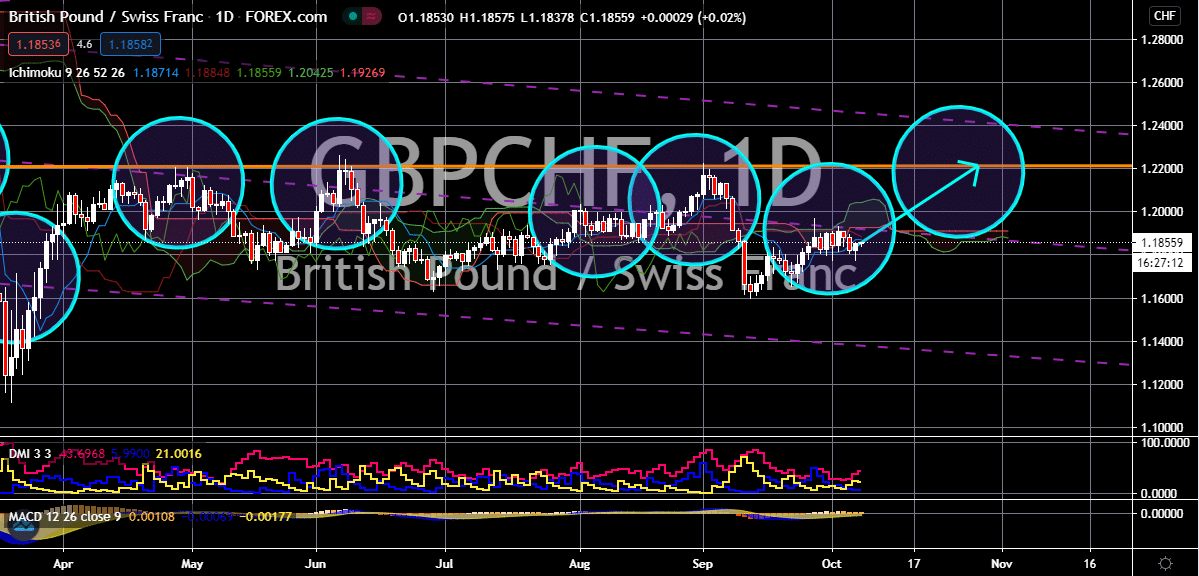

GBP/CHF

The reports about significant progress from the ongoing Brexit negotiations between the European Union and the United Kingdom have boosted the confidence for the pound sterling. The British pound to Swiss franc exchange rate is on track to gradually climb up to its resistance level this October as bullish investors hope for the best. A source from the EU commented that serious progress has been made between the two feuding sides on reciprocal social security rights for the two parties’ citizens. Another source said that this progress is one of the most positive outcomes form the two parties so far. Thanks to those pieces of news, the safe-haven appeal of the Swiss franc won’t obviously stand a chance and, of course, the Swiss National Bank will be okay with the exchange rate’s appreciation. See, a stronger franc will threaten the economic recovery of Switzerland’s economy and the SNB is avoiding it from appreciating against major currencies.

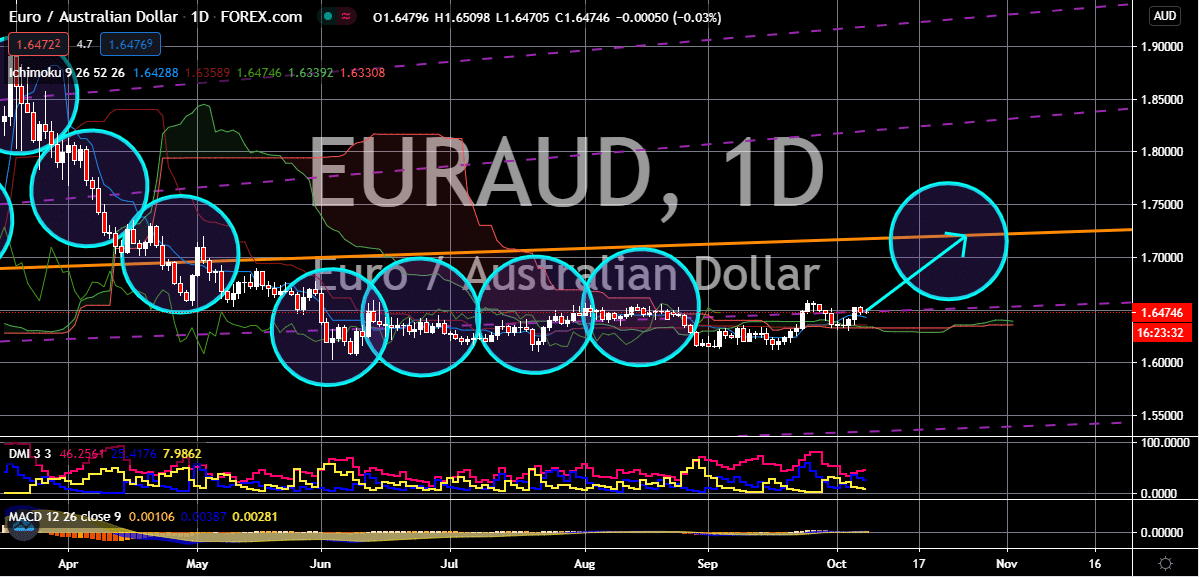

EUR/AUD

As of today, the euro to Australian dollar exchange rate is seen ricocheting from the pair’s initial resistance level as the single currency lacks the adequate strength to force prices higher. However, it is widely believed that the month of October will be good for bullish investors, hence, it is expected that the prices would climb to their higher resistance level soon. Looking at it, the Australian dollar could be constrained in the coming trading sessions due to the fears for the monetary policy outlook of the Reserve Bank of Australia. Just recently, it was reported that the RBA left its rates unchanged and according to RBA Governor Philip Lowe, the decision was based on the uneven recovery of major economies around the world. Governor Lowe then clarified that the global economy is indeed recovering but it’s not even among countries, adding that the containment of the coronavirus will be the key for an even comeback.

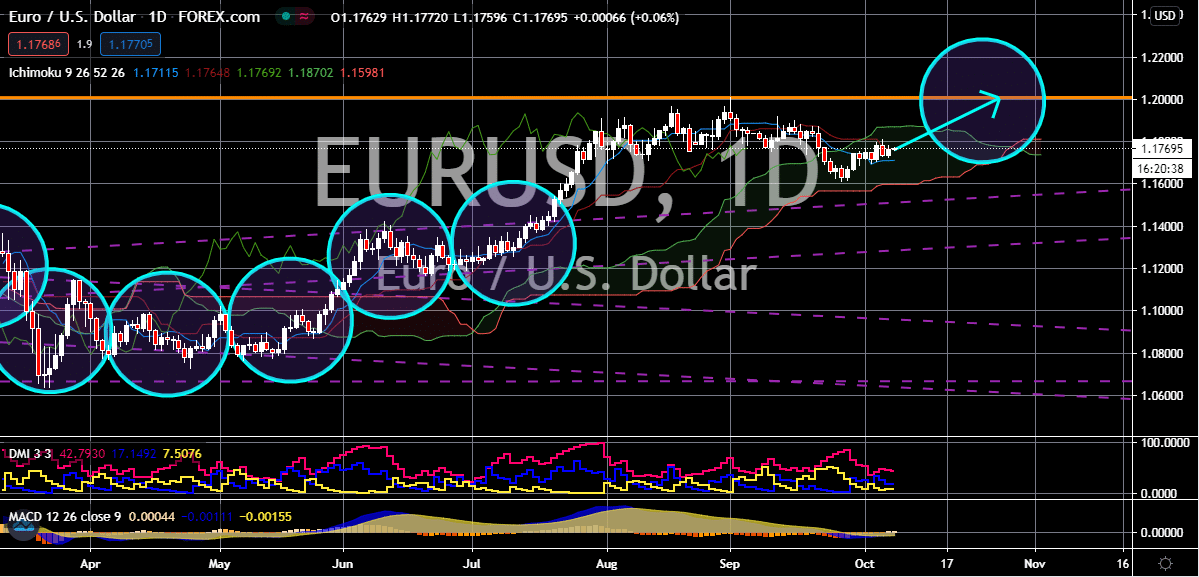

EUR/USD

The euro to US dollar trading pair remains on bullish territories in the foreign exchange market and it is believed that prices would eventually head back up to its resistance level as the greenback lacks the fundamentals to push prices higher in the short-term trading sessions. However, some experts also believe that the latter weeks of the year could be very bearish for the exchange rate but that is still far from now so it should be an initial concern for investors. Looking at it, the US dollar is held by the recent reports regarding the comments of Federal Reserve officials. According to the news, the officials of the bank are concerned about the lack of further fiscal stimulus and its chances of jeopardizing the economic recovery of the United States. Just yesterday, the Federal Open Market Committee released the meeting minutes from its September meeting where the bank held its interest rates unmoved. Bears failed to gain some support from the news about the Fed.