Market News and Charts for October 04, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

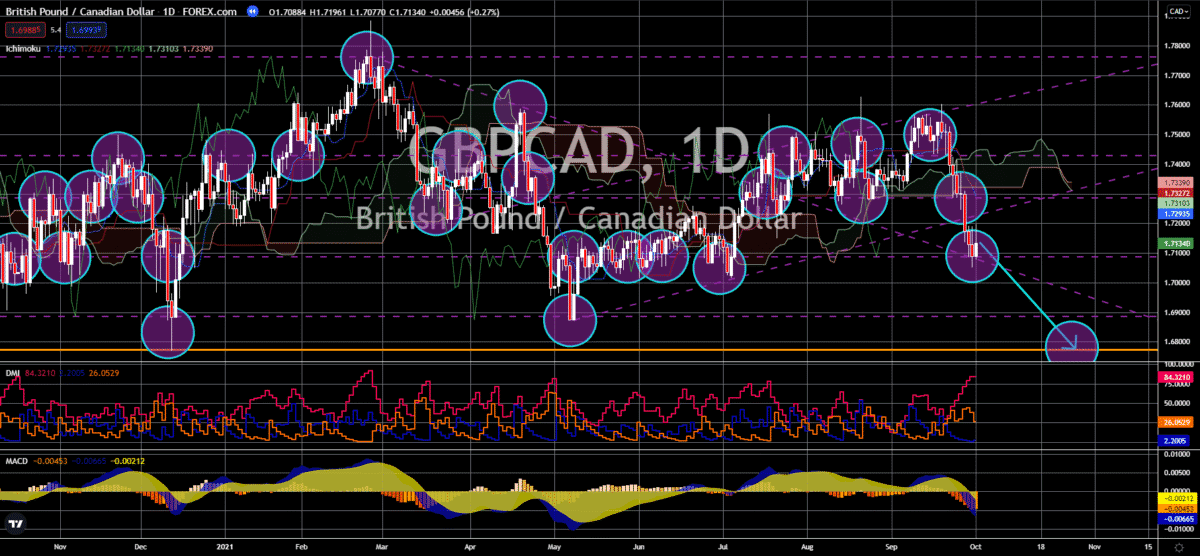

EUR/DKK

Germany’s Consumer Price Index (CPI) in September expanded 4.1% year-over-year, lower than the analysts’ expectations of 4.2%. However, the result is higher than the previous record of 3.9%, making it the highest level since 1993. Also, it is up from 4.0% in July and August this year. In total, the price of consumer goods hiked by 6.1% on an annual basis, which is above average. This increase was driven mainly by soaring costs of heating oil, motor fuel, natural gas, and electricity, which were up by 76.5%, 28.4%, 5.7%, and 2.0%, respectively. Other factors are the coronavirus pandemic-related impacts, such as the abiding global supply chain bottlenecks. This crisis made some industries suffer. Hence, most of them had passed the higher costs to the consumers for the recuperation of their losses and damages. Meanwhile, the MoM inflation result in September came in at 0.0%, missing economists’ 0.1% projection. This latest figure is below August’s 0.9% record.

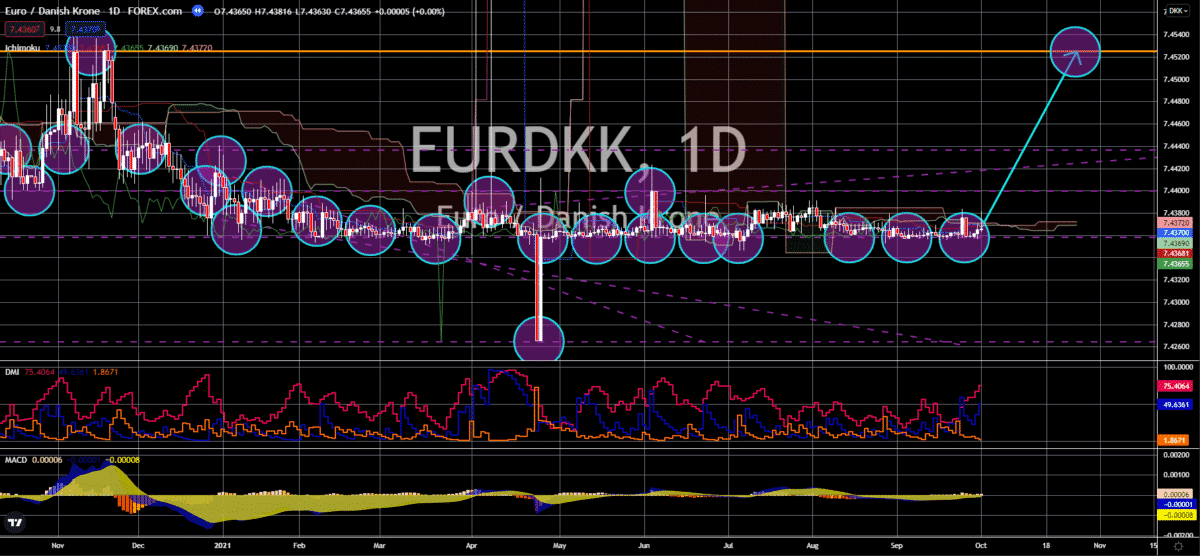

EUR/TRY

Turkey’s trade balance in August increased to -4.26 billion from the previous month’s -4.28 billion result. On the other hand, exports in September climbed to 20.80 billion from the prior 18.90 billion data. Around 76.4% of the data were accounted for industrial exports, which hiked by 29.8% year-over-year. This sectors’ highest contribution came from the steel division, wherein its foreign sales were worth $2.61 billion. It left behind the automotive section, whose exports were worth $2.47 billion. In addition, agricultural and mining exports escalated by 13.2% to $2.74 billion and 39.1% to $584.37 million, respectively. Meanwhile, the country’s September Manufacturing Purchasing Managers’ Index (PMI) plummeted to 52.50 points from August’s 54.10 points. In line with higher output requirements, manufacturers had raised their purchasing activity. There are some signs that the supply chain delays were moderated but input costs climbed, pushing output prices up further.

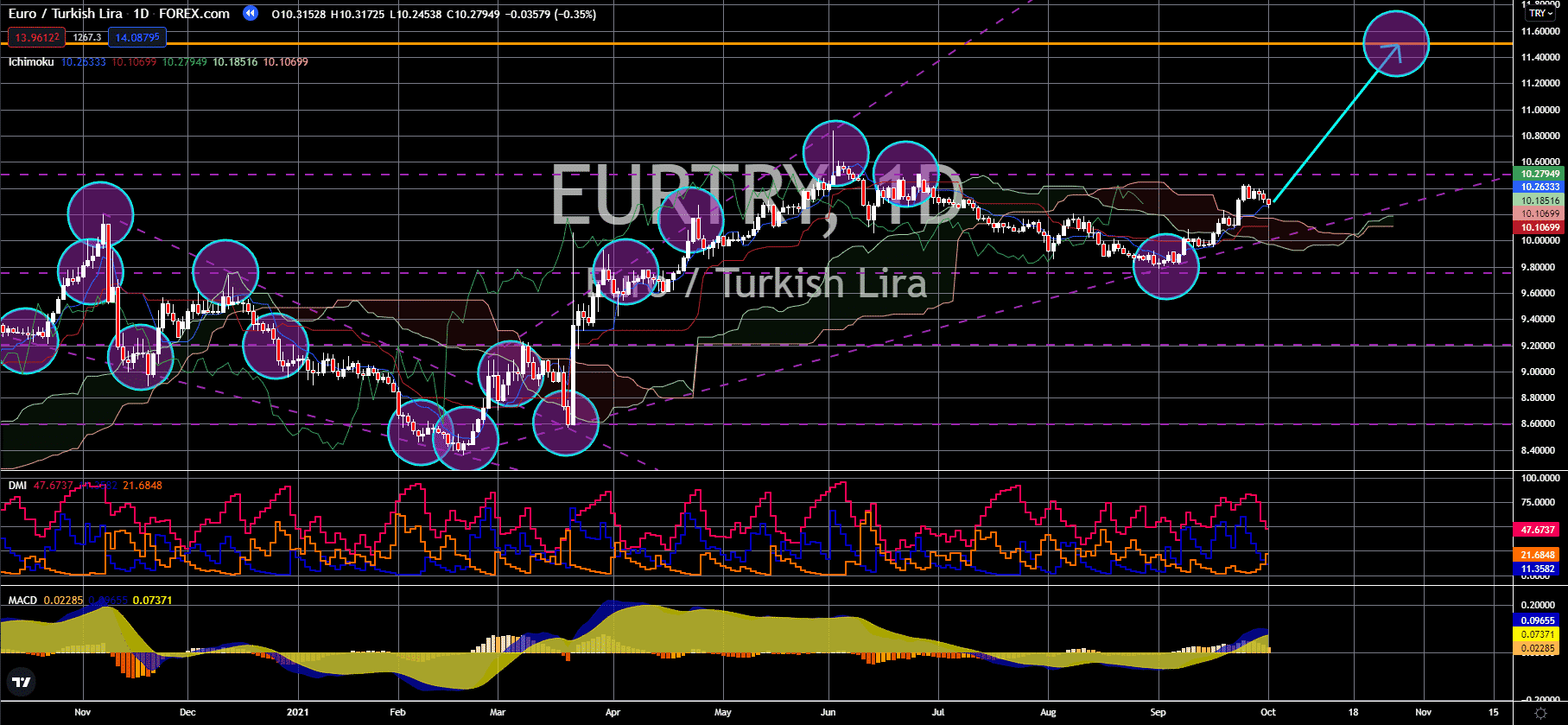

GBP/AUD

Australia’s commodity prices plunged by 37.4% year-on-year from the precursory data of 49.3%. The global pricing pressure has pushed traders’ concerns regarding the risk of higher inflation. In turn, this has led to the growing anticipation for a tighter monetary policy. Additionally, it pushed bond yield sharply higher. The 10-year Australian government bonds were trading up at 1.7%, the highest since May 20 fiscal year 2021. It jumped by 2.1% or 44 basis points in the past six weeks. Next week, the country’s most populous state is set to ease its nearly four-month coronavirus curb. Therefore, brightening the outlook as authorities are shifting focus to rejuvenating the economy. Meanwhile, Kiwi’s manufacturing Purchasing Managers’ Index (PMI) accumulated 56.8 points from 52.0 points. On the other hand, the Australian Industry Group’s (AIG) manufacturing index rates in September plummeted to 51.2 points. This latest figure is lower than August’s 51.6 results.

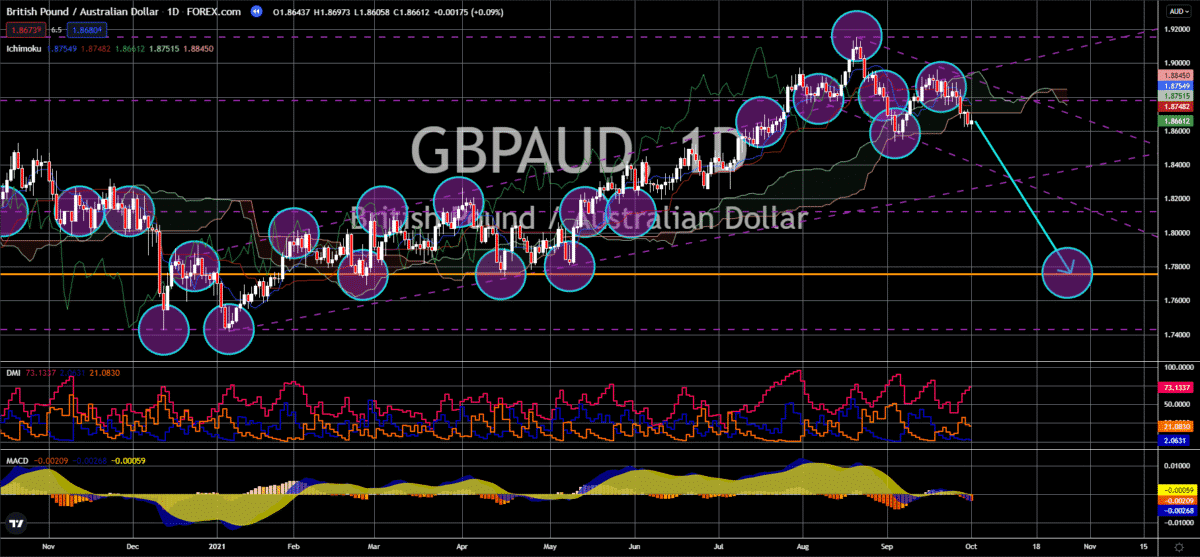

GBP/CAD

The United Kingdom’s gross domestic product increased by 23.6% year-over-year in the second quarter, surpassing the 22.2% analysts’ consensus. It sharply rose from the previous quarter’s data of -5.8%. Likewise, the QoQ GDP result incremented by 5.5% in Q2, higher than the 4.8% estimate and the precursory record of -1.6%. However, the country’s economy is still 3.3% smaller than its pre-pandemic outlook. Thereby putting the UK’s Covid-19 recovery behind other G-7 economies which include France, Japan, and the U.S. For the past weeks, some events underscore the kingdom in a rocky road ahead as it struggles from an impending shortage of roughly 100,000 truck drivers. According to the analysis, this crisis is a result of both pandemic disruptions and scarcity of skilled foreign workers, caused by Brexit immigration restrictions. Meanwhile, the manufacturing PMI in September 2021 grew 57.1 points, topping the 56.2 estimate. Yet, lower than the prior 60.3 figure.