Market News and Charts for October 04, 2019

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

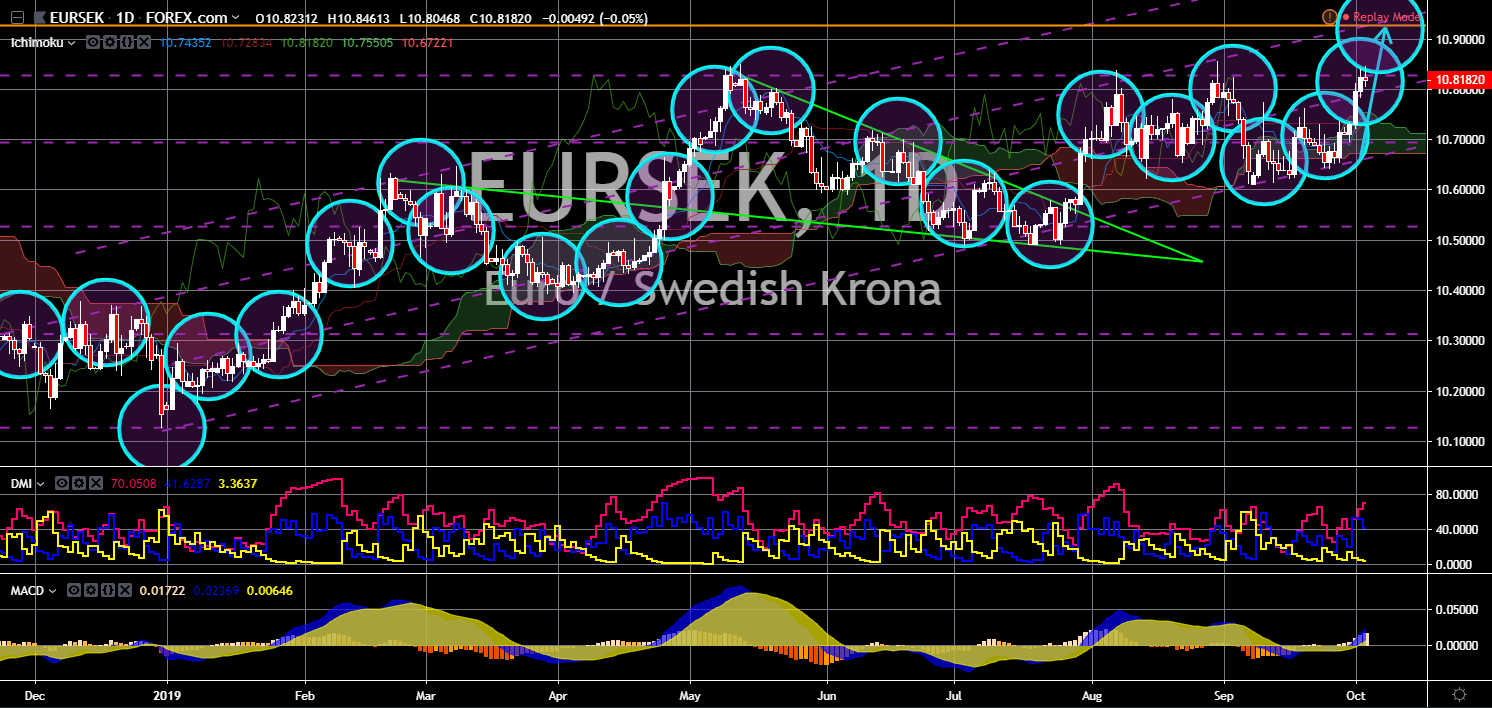

EUR/SEK

The pair is expected to continue its rally and to breakout from a major resistance line. Ylva Johansson was appointed by the European Commission president-elect Ursula von der Leyen. She will be the new minister for home affairs portfolio, on migration and asylum, security and the future of Schengen. The issue on migration and asylum was critical for the bloc following incidents involving migrants from the Middle East. In 2015, German Chancellor Angela Merkel opened the EU borders to Syrian refugees. It was embraced by people at first, until an incident happened at Cologne. This caused her chancellorship and she was due to step down as the country’s chancellor by 2021. Her Conservative Party was also moving away from her policies. Political analysts see this move as an advantage for Von der Leyen. This will allow her to maintain control over the decisions by the minister as Sweden was far from the Middle East.

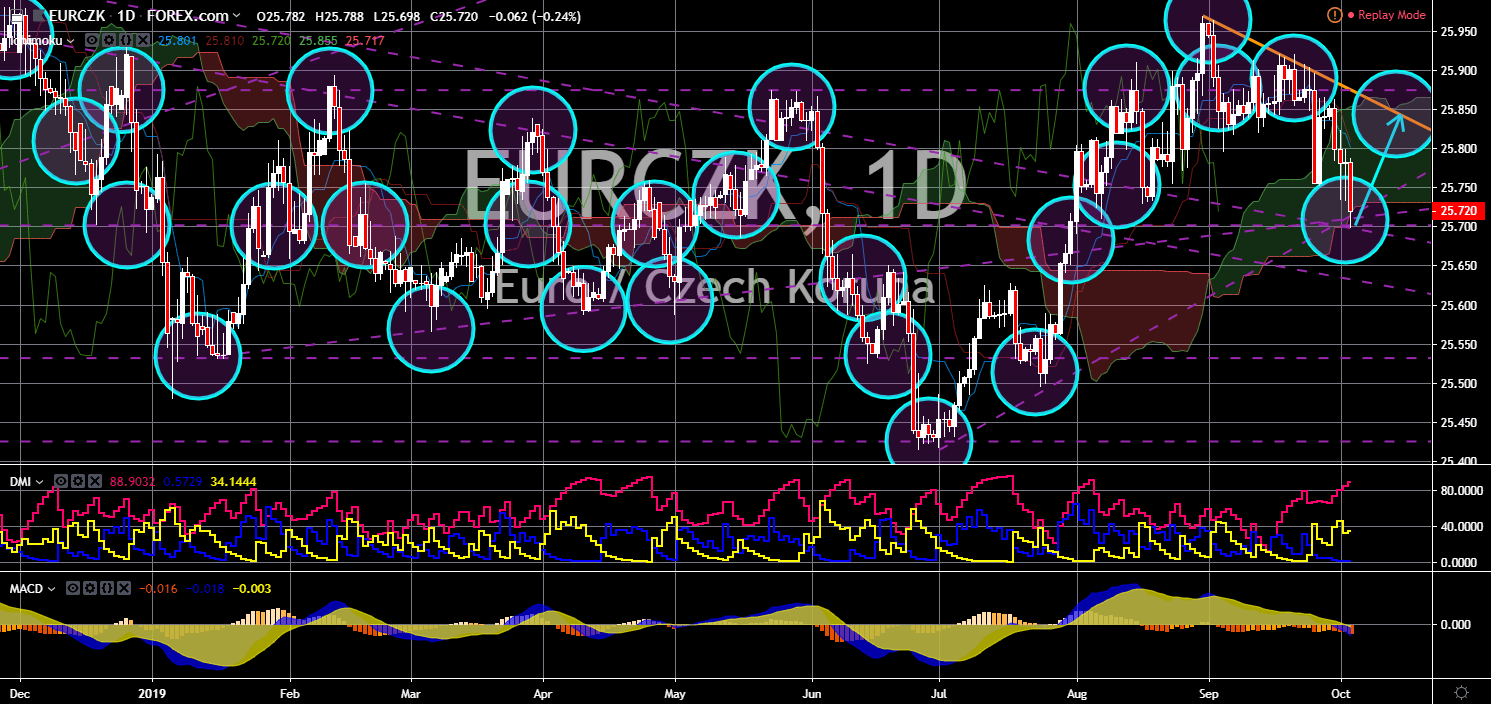

EUR/CZK

EUR/CZK

The pair is seen to bounce back from a major support line after a recent sell off. The new European Commission president-elect Ursula von der Leyen visited the V4 nations weeks before taking her oath. This was in her bid to reintegrate the eastern bloc back to the Germano-Franco leadership. Recent movements and protest to oust Czech Prime Minister Andrej Babis failed. The same thing is true for other Visegrad countries, like Hungary, Poland, and Slovakia. Following her visit was the comment by PM Babis that the country will not leave the European Union. This gave political analysts hope that the largest trading bloc will not be divided anytime sooner. This was amid the looming withdrawal of the United Kingdom from the EU. However, uncertainties are still present with the strengthening presence of the United States in the region. American turned to the eastern bloc to strengthen its military presence on the EU-Russia border.

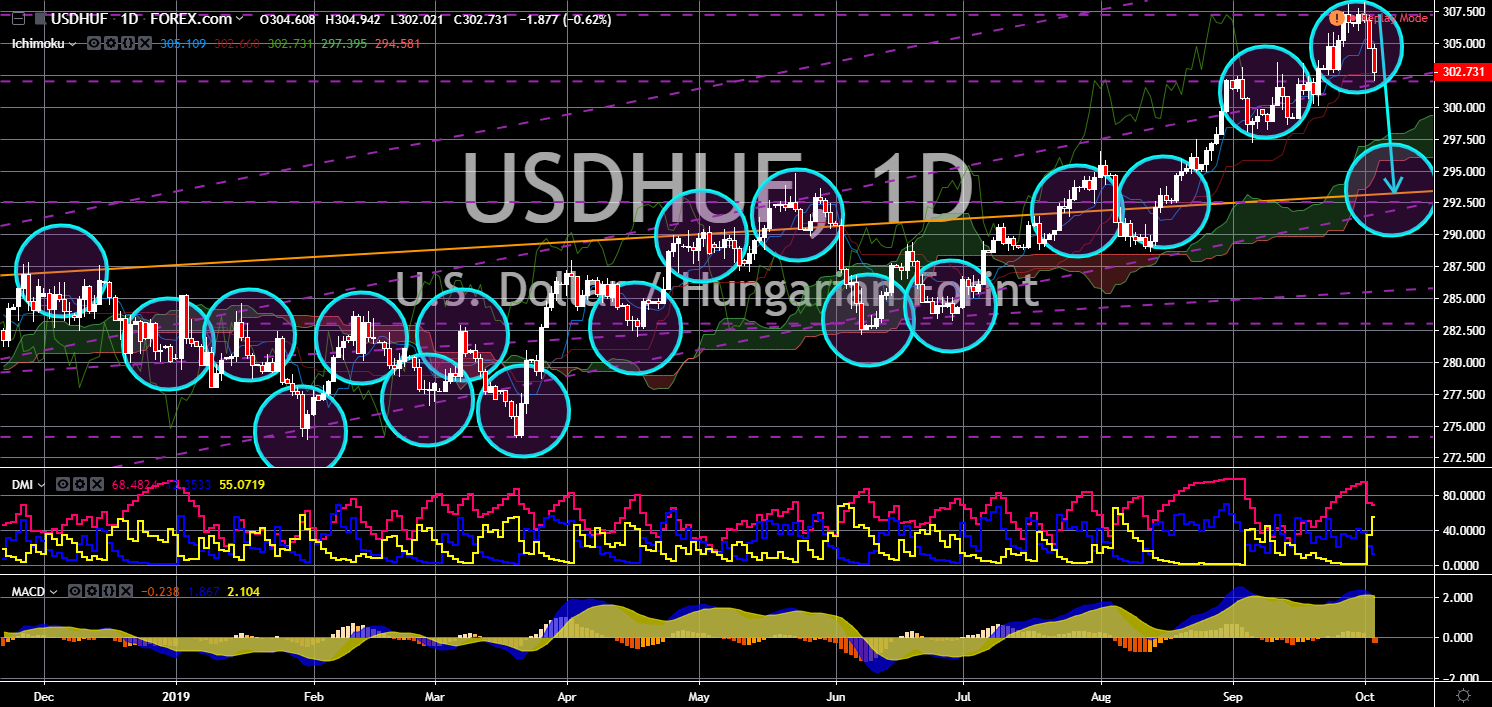

USD/HUF

The pair is expected to break down from a key support line, which will send the pair lower. Hungary is ramping up its partnership with the United States. This was after its relationship with Germany and France falters. The U.S.-Hungary relationship is also pivotal for America as it tries to contain Russia’s rising military aggression. This was following the withdrawal of the U.S. and Russia from the INF (Intermediate-range Nuclear Forces) Treaty. The INF prevents the two (2) nuclear-armed countries to develop the next generation of nuclear weapons. Europe suffers from the Cold War between the United States and Russia. The withdrawal of these two (2) countries from the pact threatens a new era of the Cold War. In line with this, the U.S. signed a defense cooperation agreement with Hungary on its bid to militarize the country. The U.S. plan to deploy more troops in the country and to sell more F-35 fighter jets in the region.

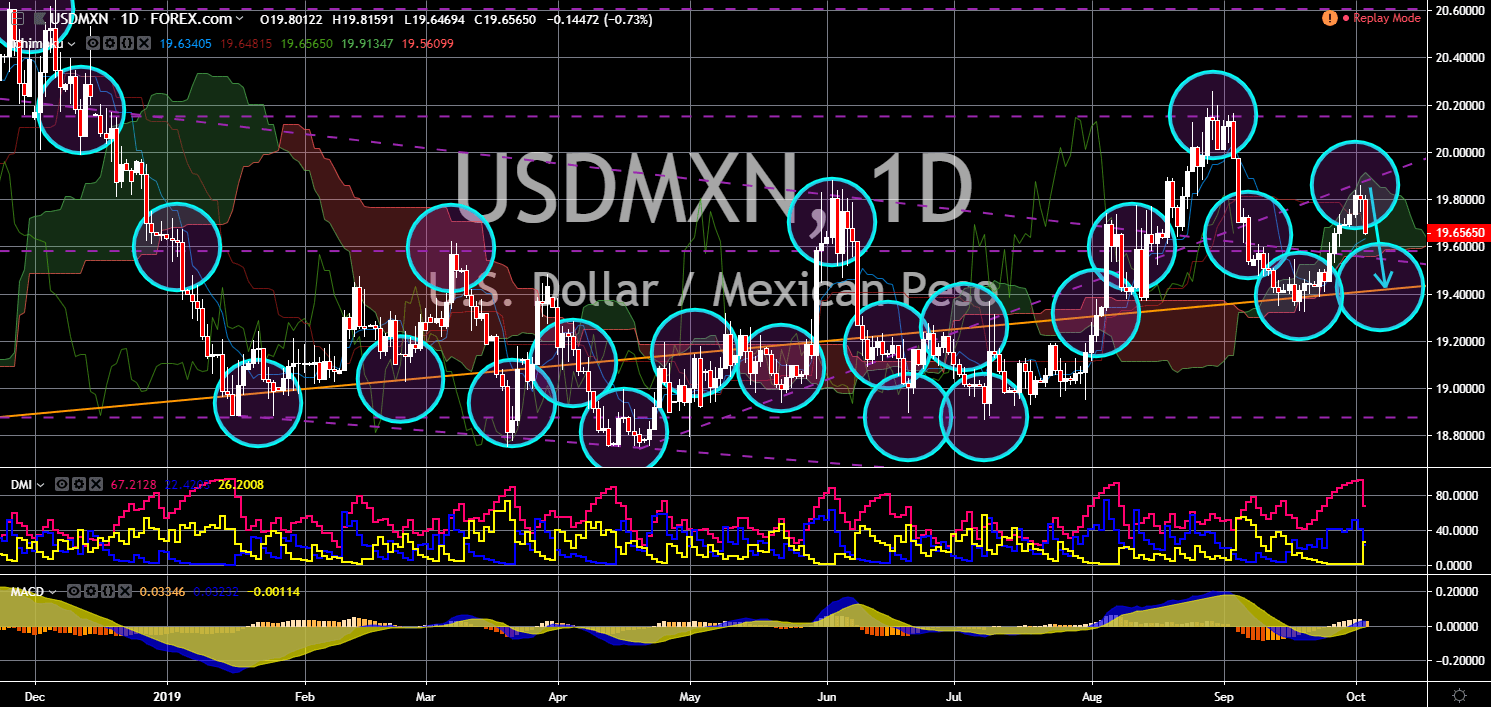

USD/MXN

The pair failed to breakout from key resistance line, sending the pair lower towards a major support line. Mexico’s exports to the United States are booming. This was amid the ongoing trade war between the United States and China. China previously hold the title as the U.S. largest exporter. However, since the election of U.S. President Donald Trump, he tried to lower the trade gap between the countries. This led to America levying $550 billion worth of Chinese goods from 25%-30%. Since declaring a trade war, Mexico ramp up its exports to America to prepare for the looming ratification of the NAFTA. The North American Free Trade Agreement was a trading pact between neighboring countries – the United States, Canada and Mexico. Data showed that Mexico’s exports to the United States were $361 billion, up by 2.7% from last year. Despite this, investors were still skeptical that the U.S. might impose tariff to Mexican goods.