Market News and Charts for November 27, 2019

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

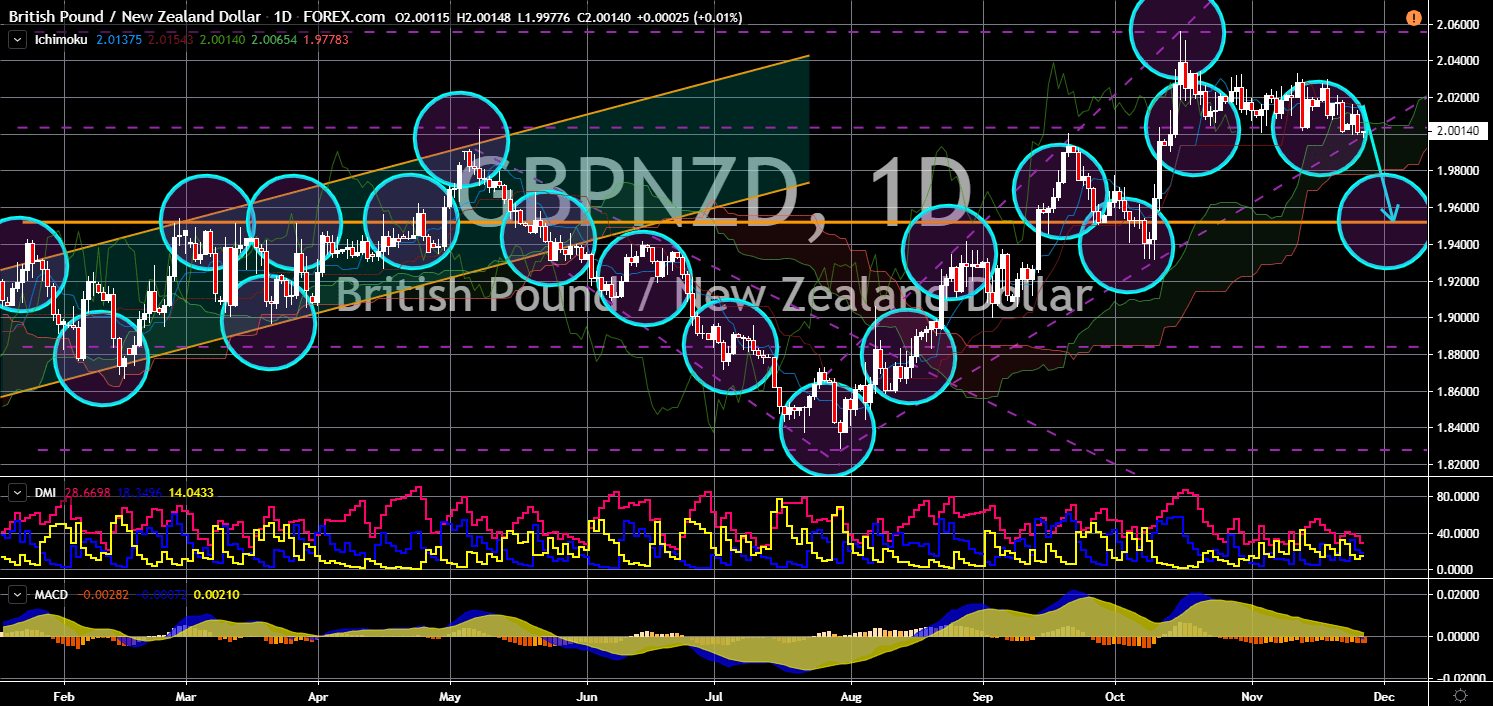

GBP/NZD

The pair is expected to breakdown from a major support line, sending the pair lower towards another major support line. Kiwi traders are expecting the New Zealand government to continue its positive result for the month of October. Last month, the Australia and New Zealand (ANZ) Banking Group Limited reported that business confidence for the month of October were better-than-expected. Data showed -42.4 result compared to the -54.1 forecast and -53.5 result from the previous month. On the other hand, pound traders are waiting for any news regarding today’s meeting by the Bank of England and Monetary Policy Committee wit the UK parliament’s Treasury Committee. Analysts are anticipating the meeting to revolve around the post-Brexit United Kingdom. The country is set to leave the European Union on January 31 but might leave earlier depending on the December 12 general election.

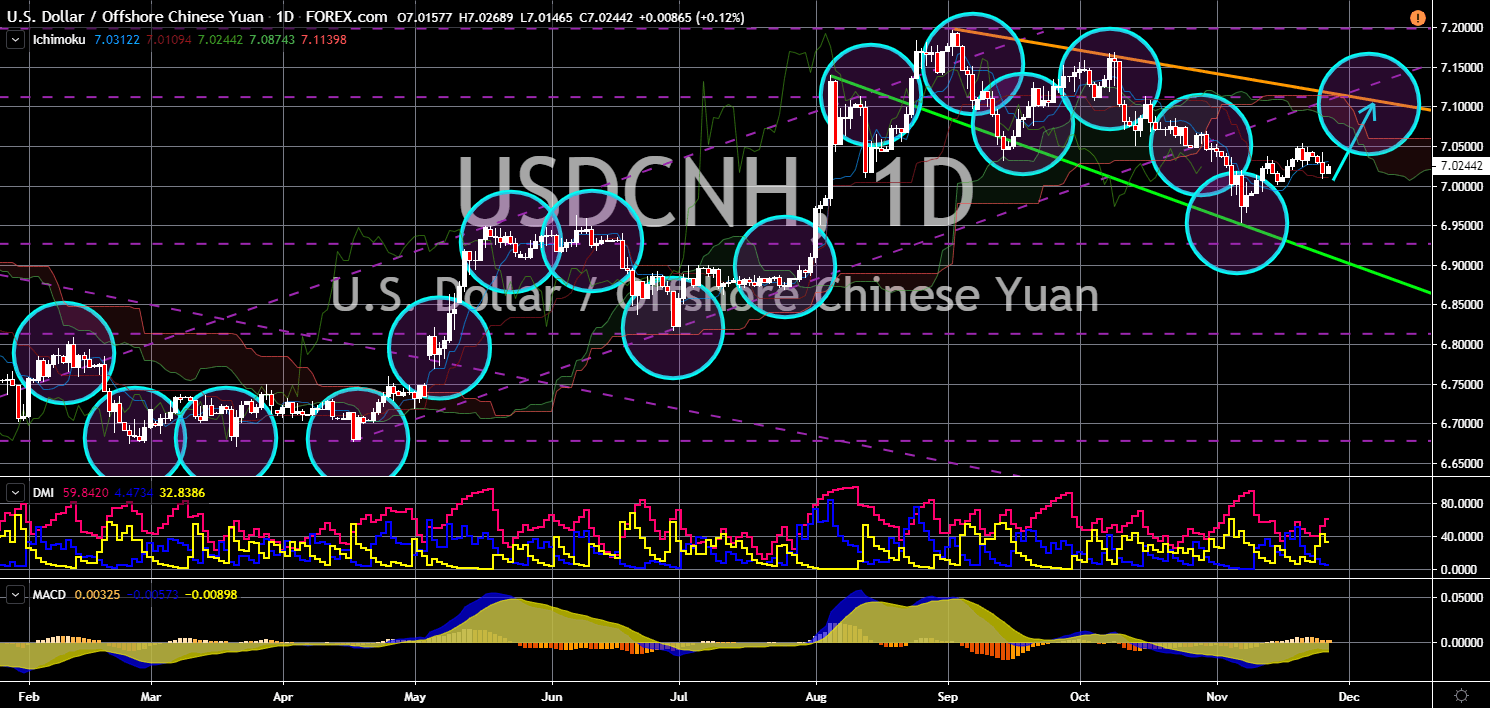

USD/CNH

USD/CNH

The pair will continue moving higher in the following days towards a “Rising Widening Wedge” pattern resistance line. The current status of the U.S.-China relations was still mixed. This was amid several factors affecting the current negotiations between the two (2) largest economies in the world. On Monday, U.S. Trade Representative Robert Lighthizer, Treasury Secretary Steve Mnuchin and Chinese Vice Premier Liu He discussed the progress on the phase one trade deal in a phone call. This was followed by the confirmation from the two (2) sides that the U.S. and China are near reaching a deal. However, negotiations might be affected with the ongoing Hong Kong elections wherein pro-democracy candidates are winning against pro-China candidates. The U.S. House of Representative also passed a bill supporting Hong Kong protesters. China, on the other hand, is accusing the United States of orchestrating the month-long rally in the city.

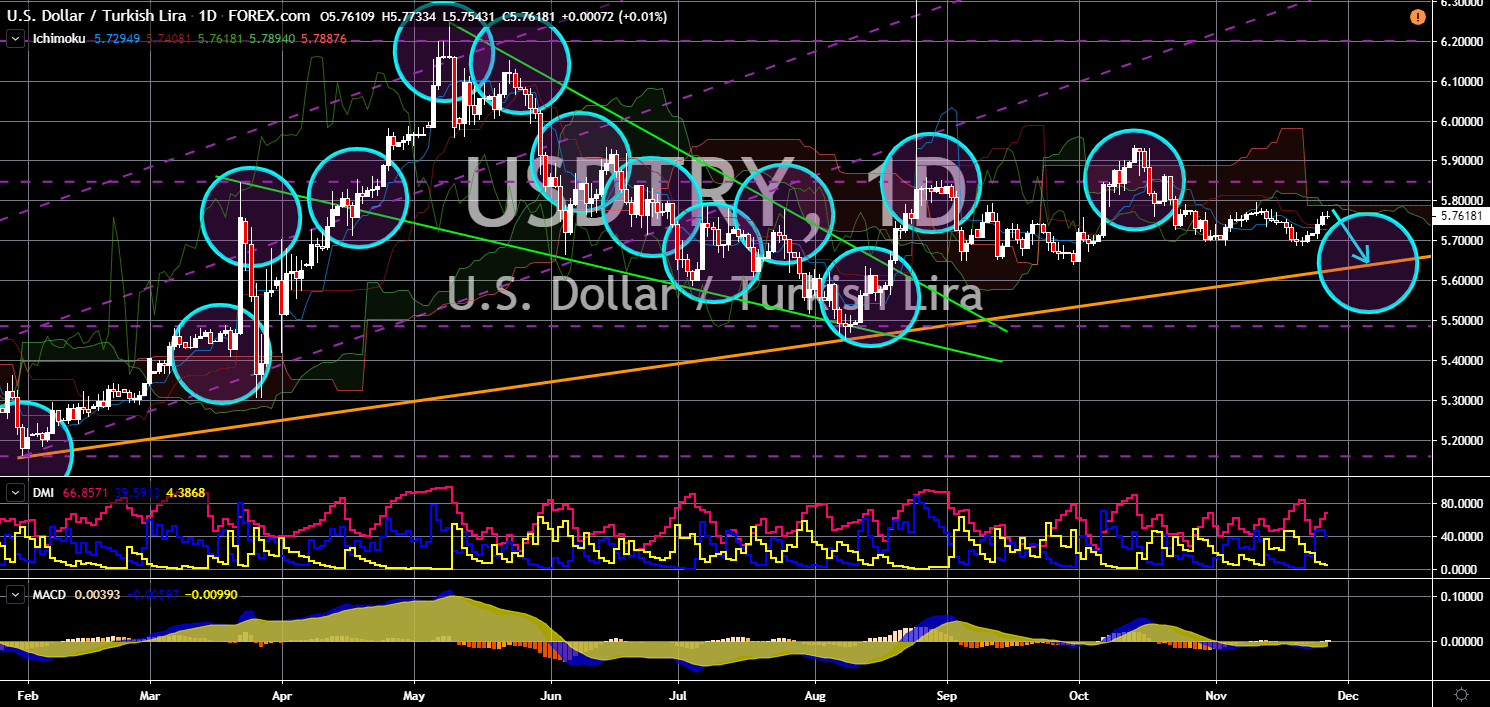

USD/TRY

The pair is expected to continue its sideways movement and to move lower towards an uptrend support line. The relationship between the United States and Turkey entered a new low. President Recep Tayyip Erdogan said Turkey is planning to have its own fighter jet in five (5) to six (6) years. This was following the suspension of Turkey from the F-35 fighter jet program. Its suspension was caused by its purchase of Russia’s S-400 missile defense system despite being a member of the U.S.-led NATO (North Atlantic Treaty Organization) Alliance. A U.S. senator further added that Turkey’s testing of the defense system is a direct mocking of the United States. Turkey is also refusing to back NATO’s defense plan for the Baltic and Poland until the alliance offered their political support for Turkey in Syria. In addition to this, President Erdogan asked the Turks to convert their foreign currency and leave the U.S. dollar for Turkish Lira.

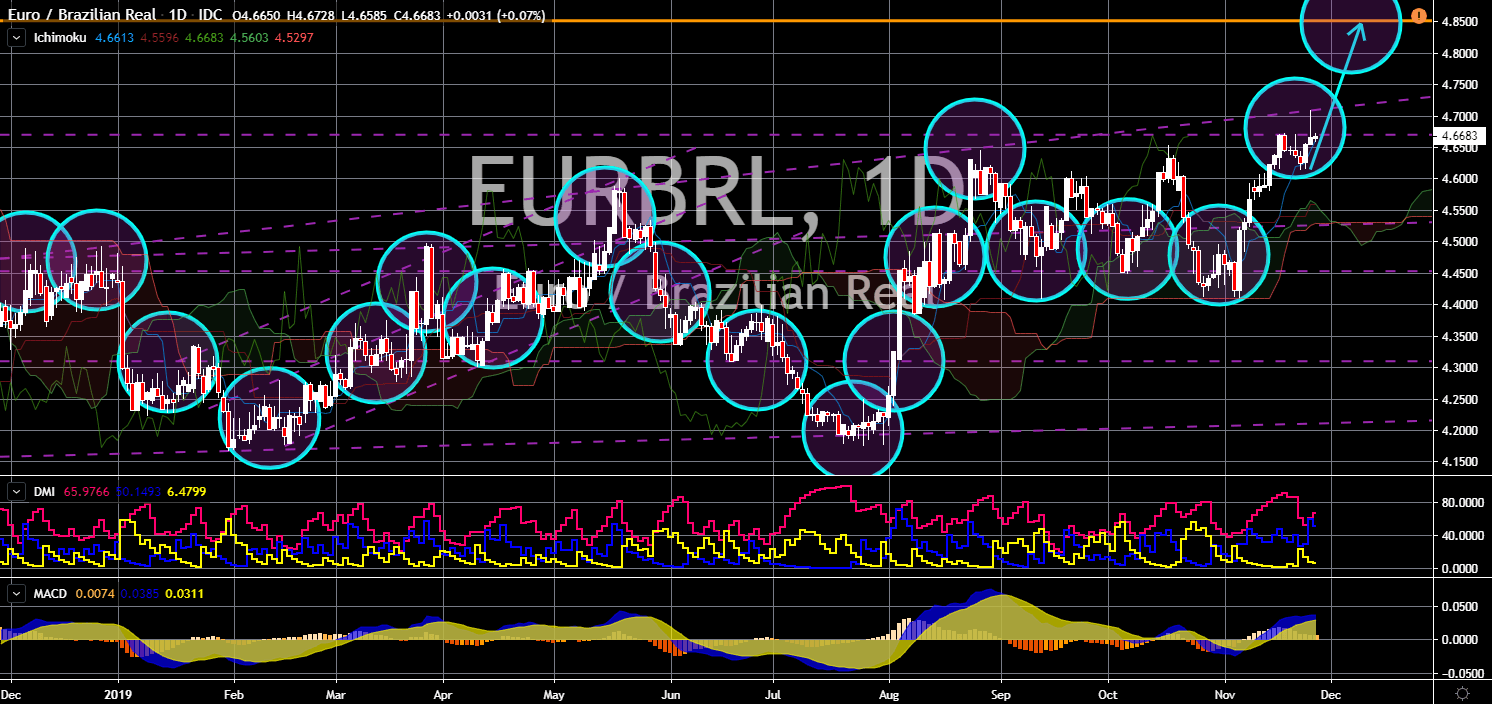

EUR/BRL

The pair will breakout from a major support line, sending the pair higher toward its 14-month high. Foreign exchange outflow in Brazil is increasing. For the past four (4) months, the government was only able to record 2 weekly increase in its foreign exchange. This further support its data from the Brazil Bank Lending month-over-month (MoM) report. Meanwhile, business confidence in France is surging to its highest since July 2017. This is expected to support the single currency. Italy’s Consumer and Business Confidence report, on the other hand, was stable. With regards to the relationship between the European Union and Brazil, investors and traders should expect a sluggish process towards finalizing the EU-Mercosur deal. This was amid the recent burning of the Amazon rainforest and the commercialization of Amazon’s land. This puts Brazilian President Jair Bolsonaro at odds with the rising green parties across Europe.