Market News and Charts for November 25, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

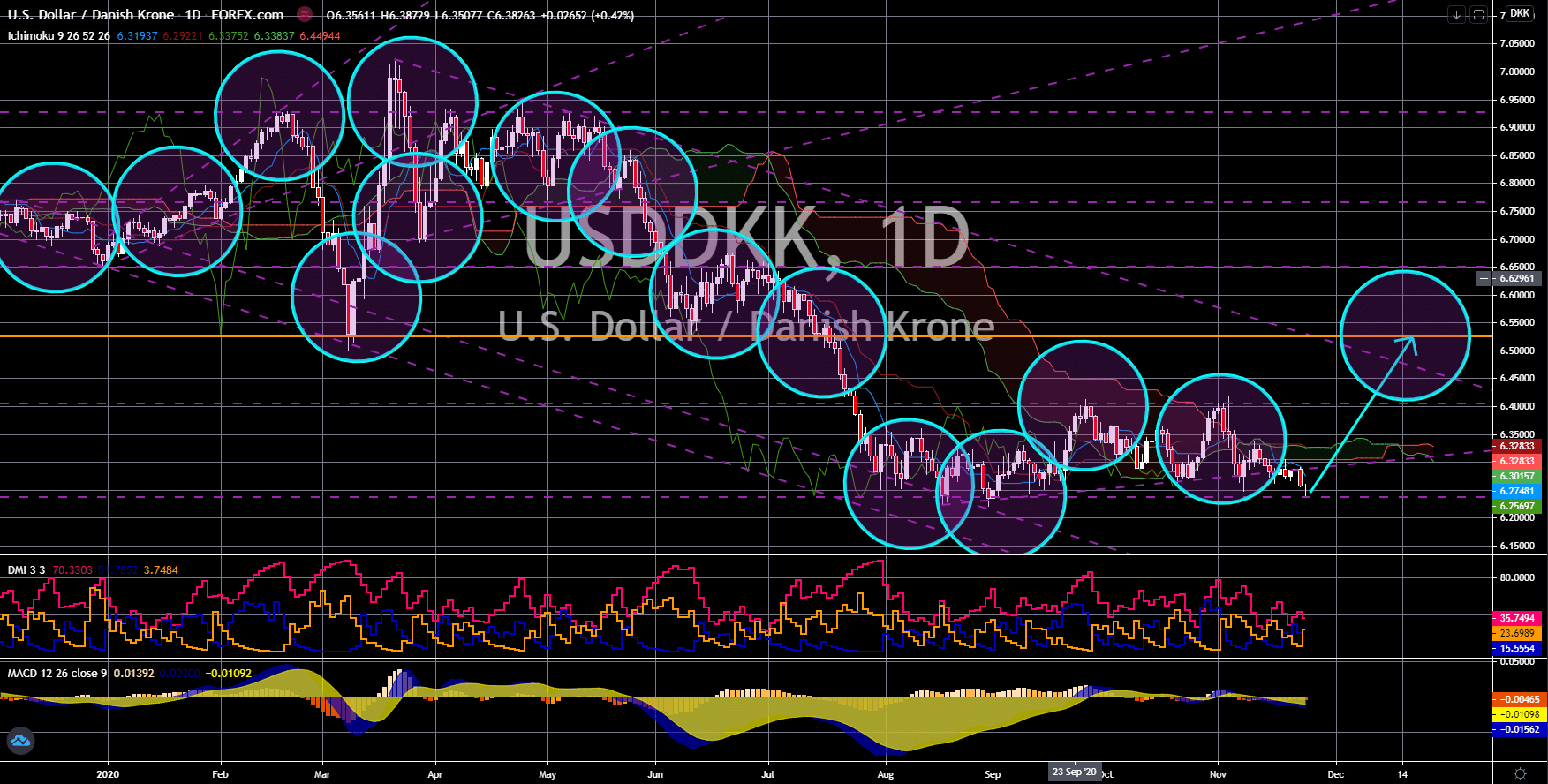

EUR/TRY

The pair will continue to move higher in the following days towards the 11.00000 price area. The rising cases of coronavirus in Europe is already taking a toll on several reports from the EU and its member states despite most of these countries not putting their country in a lockdown. France, who’s cases was now at 2.15 million, ranks fourth in the global list of countries with the cases. As a result, its manufacturing and services sector suffered in the month of November with 49.1 points and 38.0 points results for the PMI reports. However, the chart shows a decline in cases since its November 07 high of 86,852. On Tuesday, November 24, the number of reported cases was only 9,155. On the other hand, Turkey, which boycotted French products, has now mounting debts. National government debt was now at $1.93 trillion for the month of October, an increase of $70 billion in just a month. The prior month’s figure was $1.86 trillion.

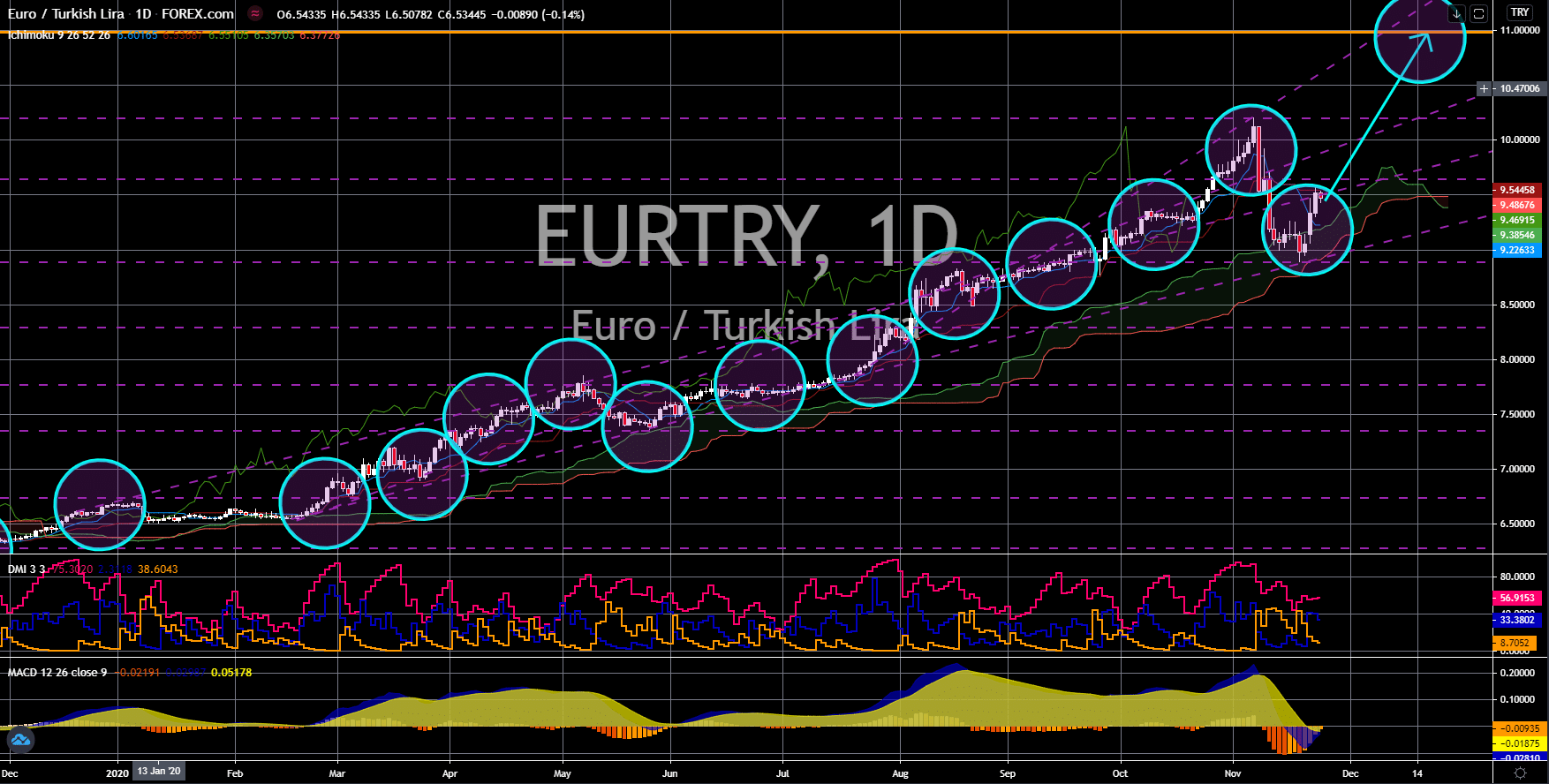

GBP/AUD

The pair will continue to move lower towards the 1.7000 support area. Both the UK and Australia published their Manufacturing and Services PMI reports this week. Australia kickstarted the report on Sunday, November 22. The figures for these reports were 56.1 points and 54.9 points, respectively. Meanwhile, despite beating the EU average, Britain’s figures on Monday, November 23, were still lower compared to Australia. Figures came in at 55.2 points and 45.8 points. The decline in UK reports were supported by the drop in retail sales report. Consumption in Britain has slowed down to 1.2% for the month of October from 1.4%. This was due to the concerns by consumers of the possible economic implications by COVID-19. Also, despite recording its lowest number of daily cases on Tuesday at 11,299 since October 02, the possibility of a no-deal Brexit could blow the country’s economy as well and could cost the UK of about $25 billion by 2021.

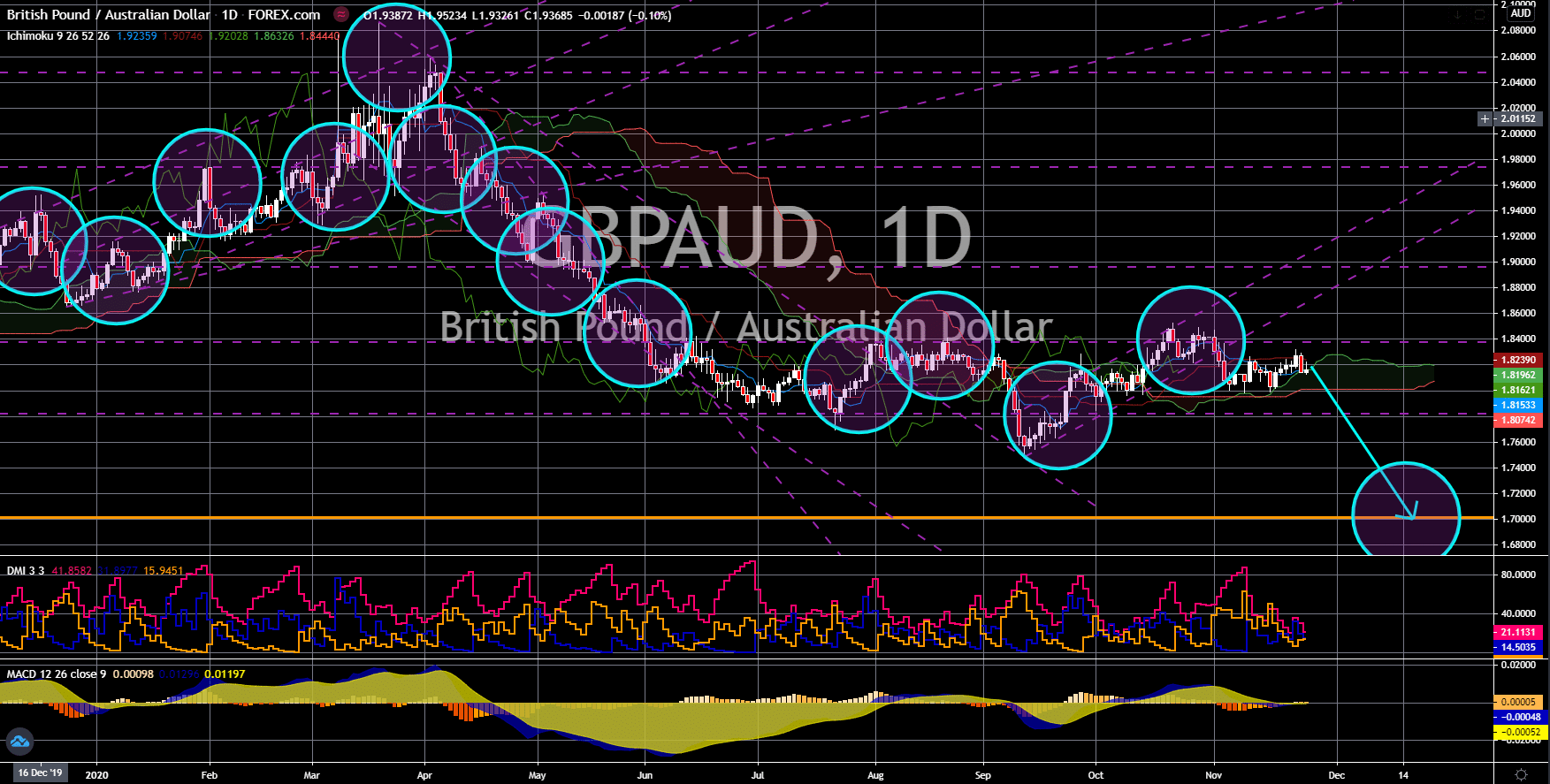

GBP/CAD

The pair failed to break out from an uptrend channel resistance line, sending the pair lower towards a major support line. Canada recorded its lowest job loss over the course of the pandemic at -79,500 while its previous figure was -564,400. At the height of the pandemic in May 2020 the government saw more than 2.3 million individuals become unemployed. Analysts applauded the efforts made by the government to trim unemployment despite the rising cases of COVID-19 in the country. On Monday, November 23, the country saw its highest single day increase of 7,052. Despite this, the figure is still low when compared to the US. America leads the list of countries with the highest number of cases at 12.7 million. On the other hand, the UK and the EU haven’t reached a final agreement for the post-Brexit relationship between the two (2) parties. Only 35 days remaining before the United Kingdom will officially leave the bloc on January 01, 2021.

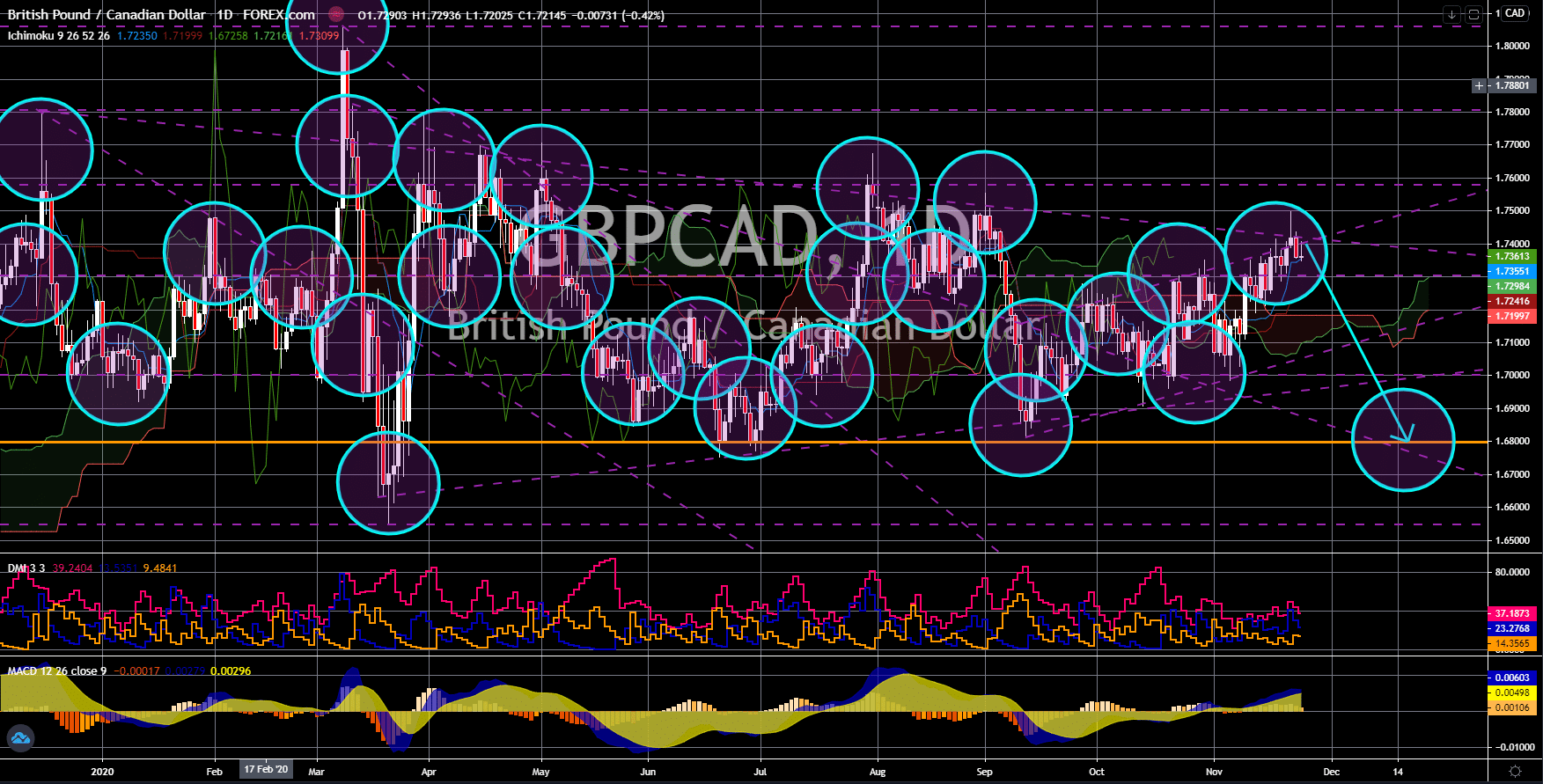

USD/DKK

The pair will bounce back from a major support line, sending the pair higher towards a key resistance line. Investors are hopeful that the United States will continue its winning streaks on its reports. This was following the better-than-expected results for Manufacturing and Services PMI reports. The figures for these reports were 56.6 points and 57.7 points, respectively. Also, the House Price Index increased by 1.7% MoM and 9.1% YoY. The pessimism from investor’s outlook on the world’s largest economy started after the disappointing initial jobless claims report on Thursday, November 19. The number of claimants for unemployment benefits rose by 742,000 against the prior month’s 711,000 result. For this week, the weekly Thursday report will be published earlier. On Wednesday, November 25, analysts are expecting an improvement on the report with 730,000 expectations. Investors should also keep an eye on the stimulus bill.