Market News and Charts for November 24, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

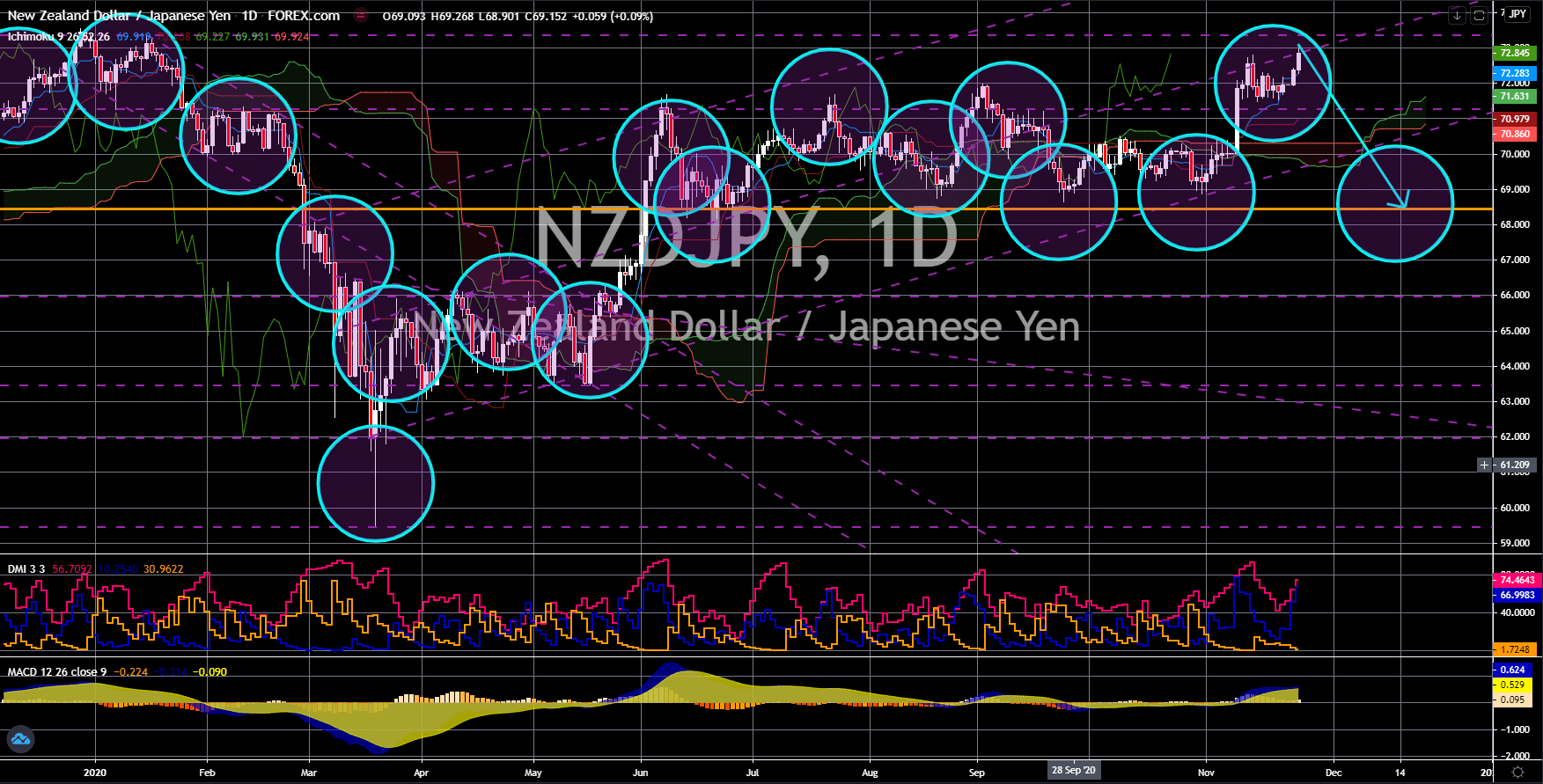

NZD/JPY

The pair failed to break out from a major resistance line, sending the pair lower towards a key support line. New Zealand’s economy has taken a toll from its refusal to open its borders due to fears that COVID-19 cases might increase. On Monday, November 23, the country recorded only two (2) new cases of the deadly virus. Japan, on the other hand, has made opposite decisions. Prime Minister Yoshihide Suga was in talks with Chinese leaders on the possibility of resuming flights between the two (2) countries. On Sunday, November 22, Japan broke records with its 2,514 single day increase. With its most recent reports, NZ has shown a slowdown in consumer consumption. Retail Sales for the third quarter (July-September) increased by 28.0%. On Q2, the figure was -14.6% for the same result. However, analysts noted that a quick recovery from a recent slump was common. Credit Card Spending on Thursday, November 19, declined by -6.3%.

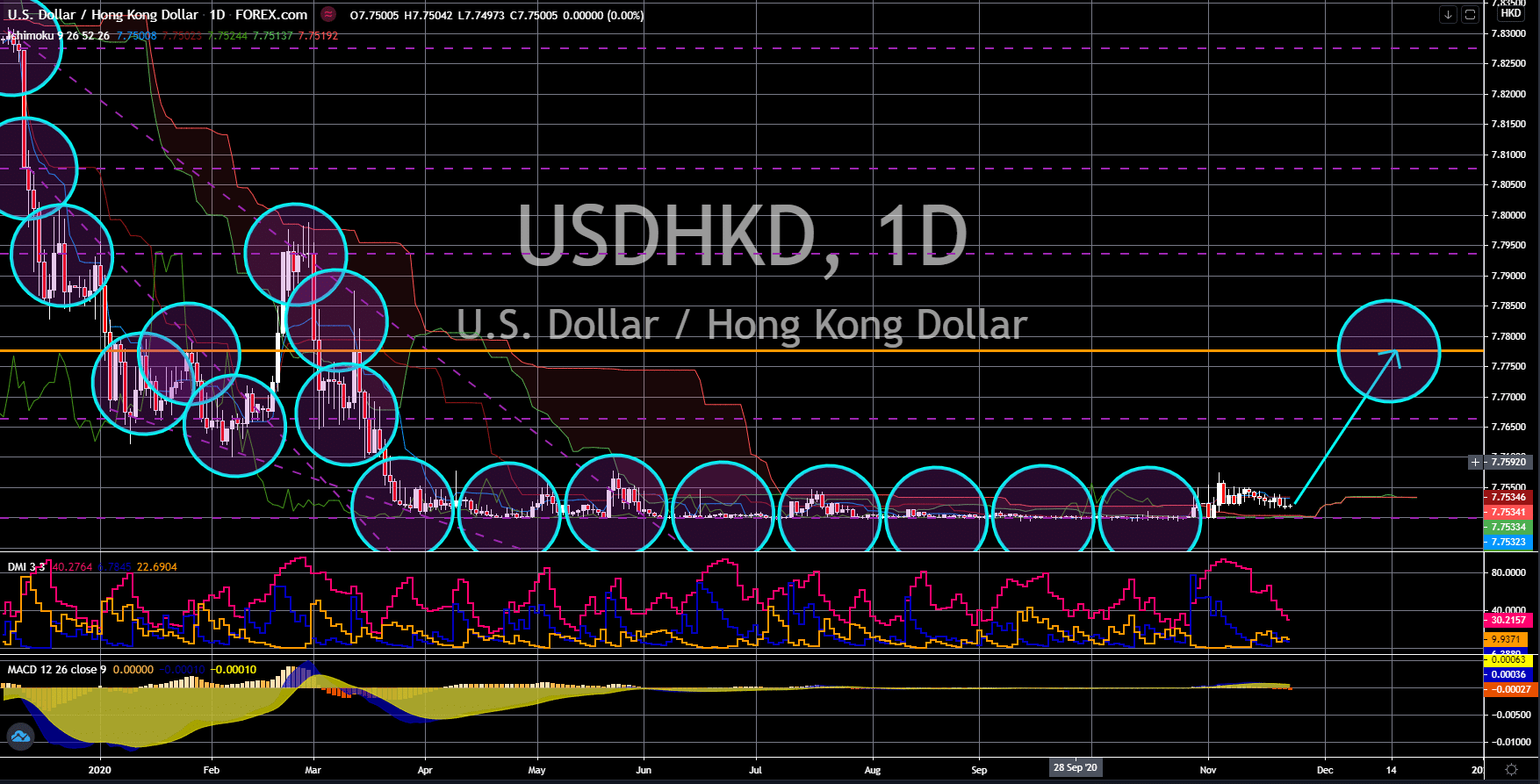

USD/HKD

The pair will continue to move higher in the following days following the end of the accumulation phase. The upbeat US reports on Monday, November 23, will signal a bullish trend for the greenback against the Hong Kong dollar. Figures for the US Composite, Manufacturing, and Services PMI were 57.9 points, 56.7 points, and 57.7 points, respectively. All these figures were above their previous records. The better-than-expected results are expected to make investors shrug off the rising number of claimants for unemployment benefits. On Thursday, November 19, the number of individuals who filed for their unemployment insurance rose by 742K, higher than the previous week’s 711K result. Investors are now expecting a lower figure this Thursday, November 26, at 730K. On the other hand, the increasing dependency of Hong Kong to China is a double-edged sword. With closer China-HK relations, investors might prefer investing to China.

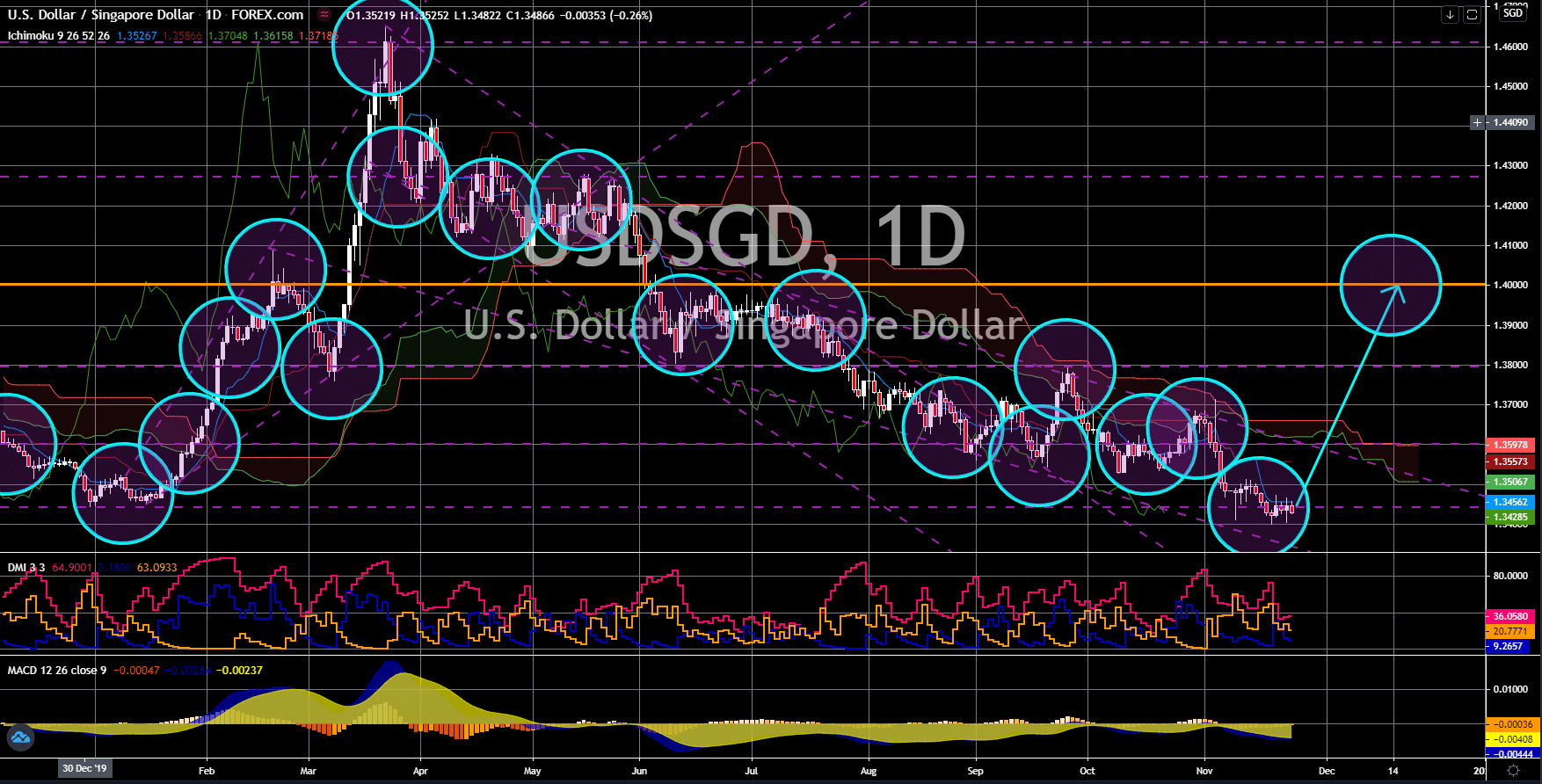

USD/SGD

The pair will bounce back from a major support line, sending the pair higher towards a key resistance line. Singapore posted a disappointing Q3 GDP data on Sunday, November 22. The country contracted by -5.8%, which was lower than analysts’ estimate of -5.4%. At the same time, Singapore remains on the negative territory despite other economies recording a positive growth for the third quarter. The slowdown in Singapore’s economy might also continue for some time. Despite Asia Pacific region recording a small increase in COVID-19 cases compared to Europe and the Americas, the country’s status as a financial hub is on the line with the slowdown in the western economies. Furthermore, the positive figures in US reports will only make the Singaporean dollar weaker against its US counterpart. However, analysts gave a positive outlook for Singapore in 2021 with the formation of RCEP, the world’s largest trading bloc.

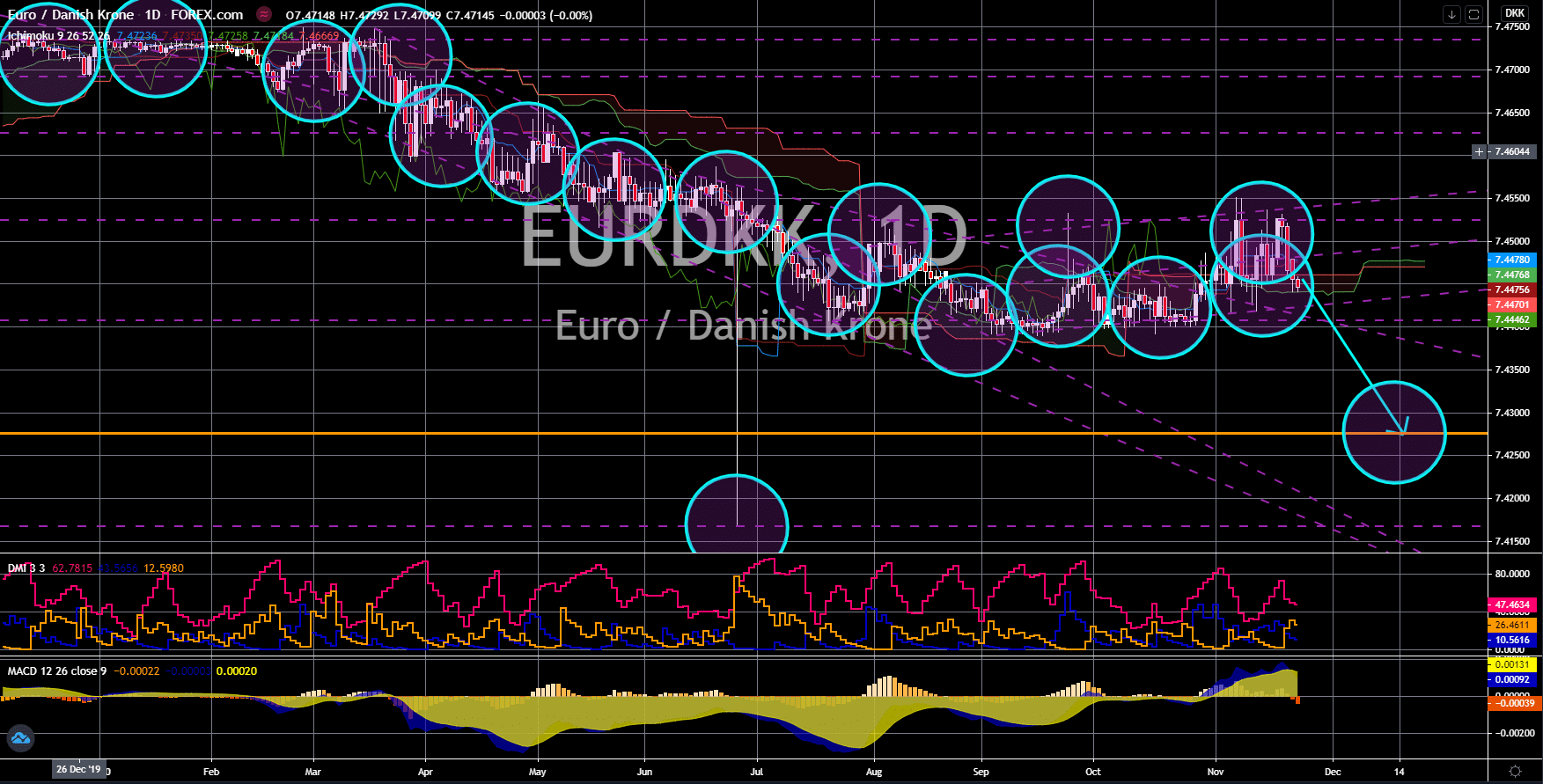

EUR/DKK

The pair will break down from a major support line, which will send the pair lower towards the 4.42759 price area. Hopes for a robust recovery in the European Union had vanished following the disappointing results in the bloc and its member states in the previous days. The Manufacturing and Services PMI reports, which measures the economic activity in their respective sectors, showed a below 50 points figures. This means that the sectors were contracting due to the resurgence of COVID-19 in the region. The figures for these reports were 49.1 points and 38.0 points, respectively, for France while Germany recorded 57.9 points and 46.2 points. Meanwhile, the EU bloc had the figures of 53.6 points for Manufacturing PMI and 41.3 points for Services PMI. On Tuesday’s report, November 24, Germany is expected to grow by 8.2% in the third quarter of fiscal 2020 following Q2’s contraction of -9.7%.