Market News and Charts for November 21, 2019

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

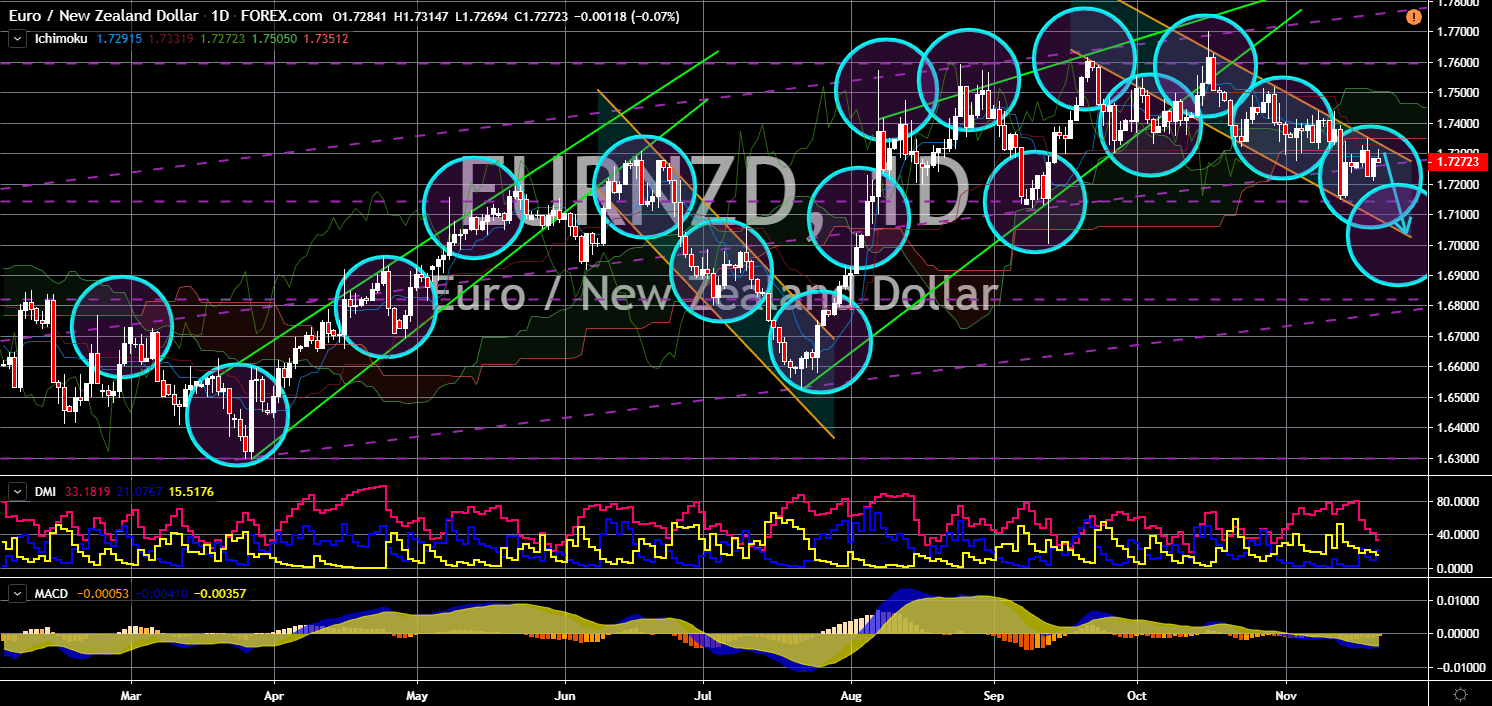

EUR/NZD

The pair will fail to breakout from a downtrend channel resistance line, sending the pair lower. New Zealand Foreign Affairs Minister Winston Peters today, November 21, announced the appointment of the country’s new Ambassador to the European Union. Carl Reaich recently served as the Ministry of Foreign Affairs and Trade’s manager of consular division. Under his leadership, he dealt with the ministry’s 234 cases regarding its citizens breaking the law of other countries. This appointment is seen by political analysts as a move towards increasing New Zealand’s cooperation with the largest trading bloc. This appointment came after Johnson said New Zealand was at the top of its priority for a post-Brexit trade agreement. For the past few months, New Zealand has been building a new foreign policy independent from Australia. This allowed the country to sign trading agreements without tensions from competing economies.

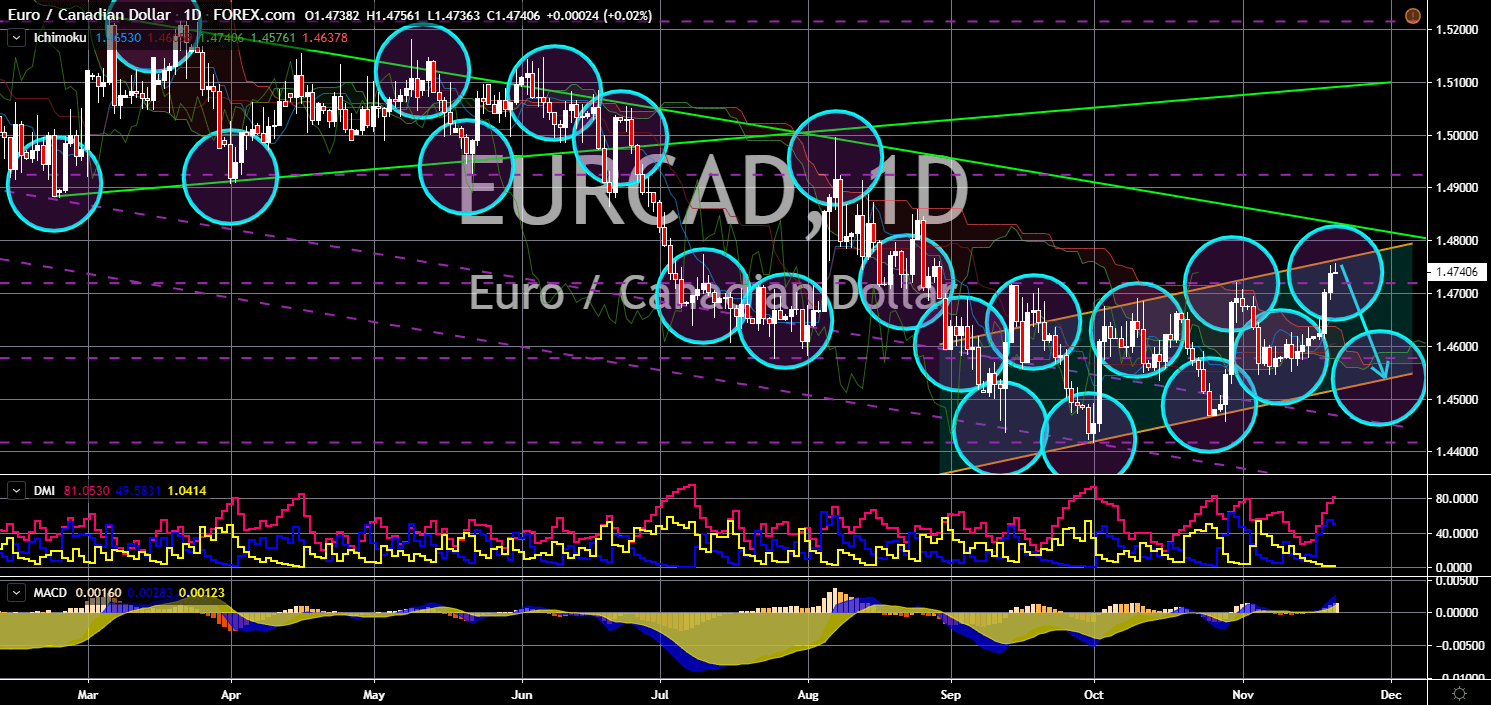

EUR/CAD

EUR/CAD

The pair failed to breakout from an uptrend channel, sending the pair lower in the following days. On October 21. Canadian Prime Minister Justin Trudeau was able to secure his position for the next four (4) years. However, his Liberal Party suffered a defeat, giving him the ability to form only a minority government. Despite this, his new government is blazing with hope. The wait-and-see strategy of Canada in signing trade agreements between the European Union and the United Kingdom is paying off. UK Prime Minister Boris Johnson promised the Canadian government of a “Super Canada Plus” deal in 2020 if he won on the December election. On the other hand, Canada please the European Union with the continuity of the Canadian climate change policy. This was as the largest trading bloc turns to a greener economy. In addition, Canada’s new trade minister in talks with China for a free trade agreement (FTA).

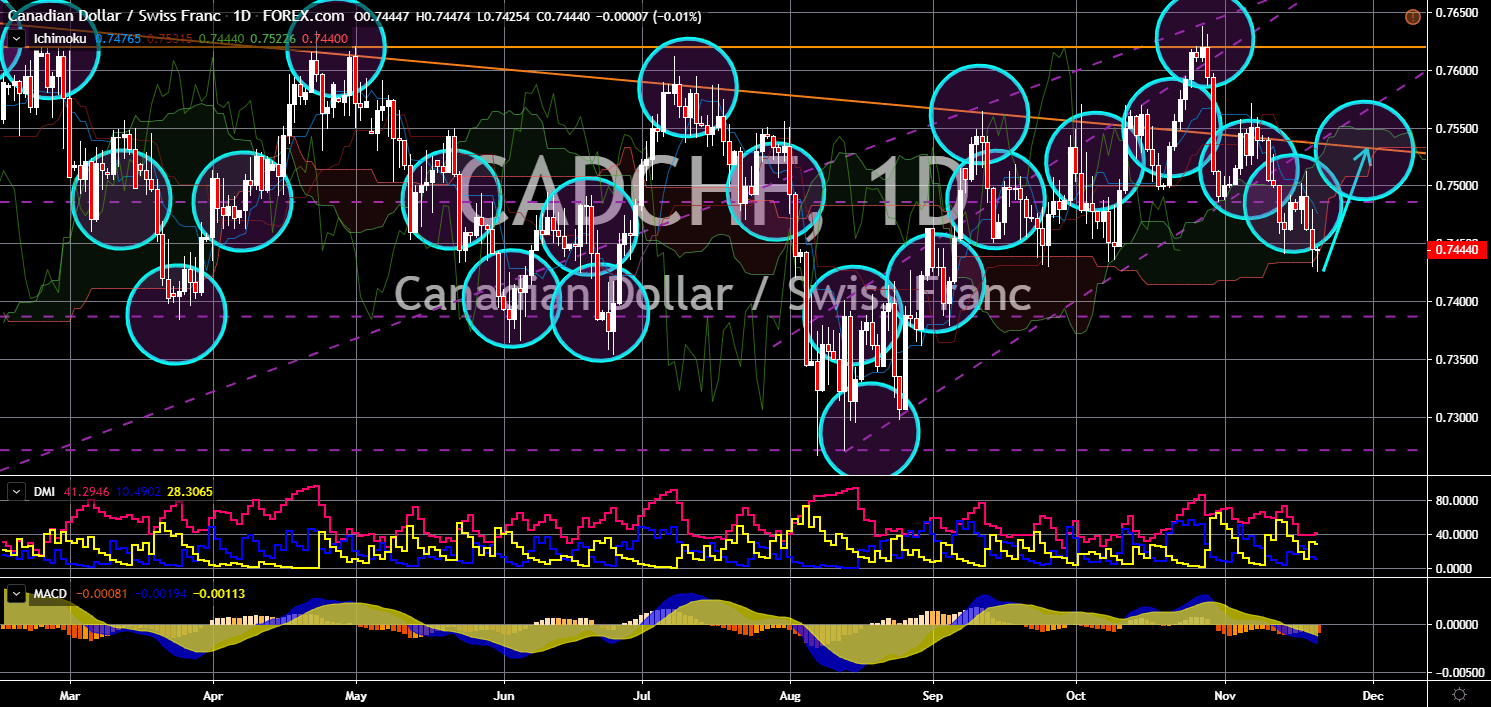

CAD/CHF

The pair is expected to reverse back and continue its upward movement. Riksbank’s Andrea Maechler reiterate that the country’s negative rate policy is absolutely necessary for the Swiss economy. This was despite pressure to the Swiss National Bank to change its ultra-expansive monetary policy. Switzerland has the lowest interest rate in the world at -0.75%. On the other hand, Canada’s picking up inflation result is expected to give the Canadian dollar some boost. The country’s inflation was up by more than 2% in October, which could spell for the Canadian central bank to hold onto its current interest rate. Meanwhile, the country’s job creation slowed to 28,200 in October from the 49,300 in September. This is also lower from the 56,500 that analysts were expecting. Despite this, Canada still ranked as the best country for developing talents. This was in line with Canada’s decision to accept skilled workers in the country.

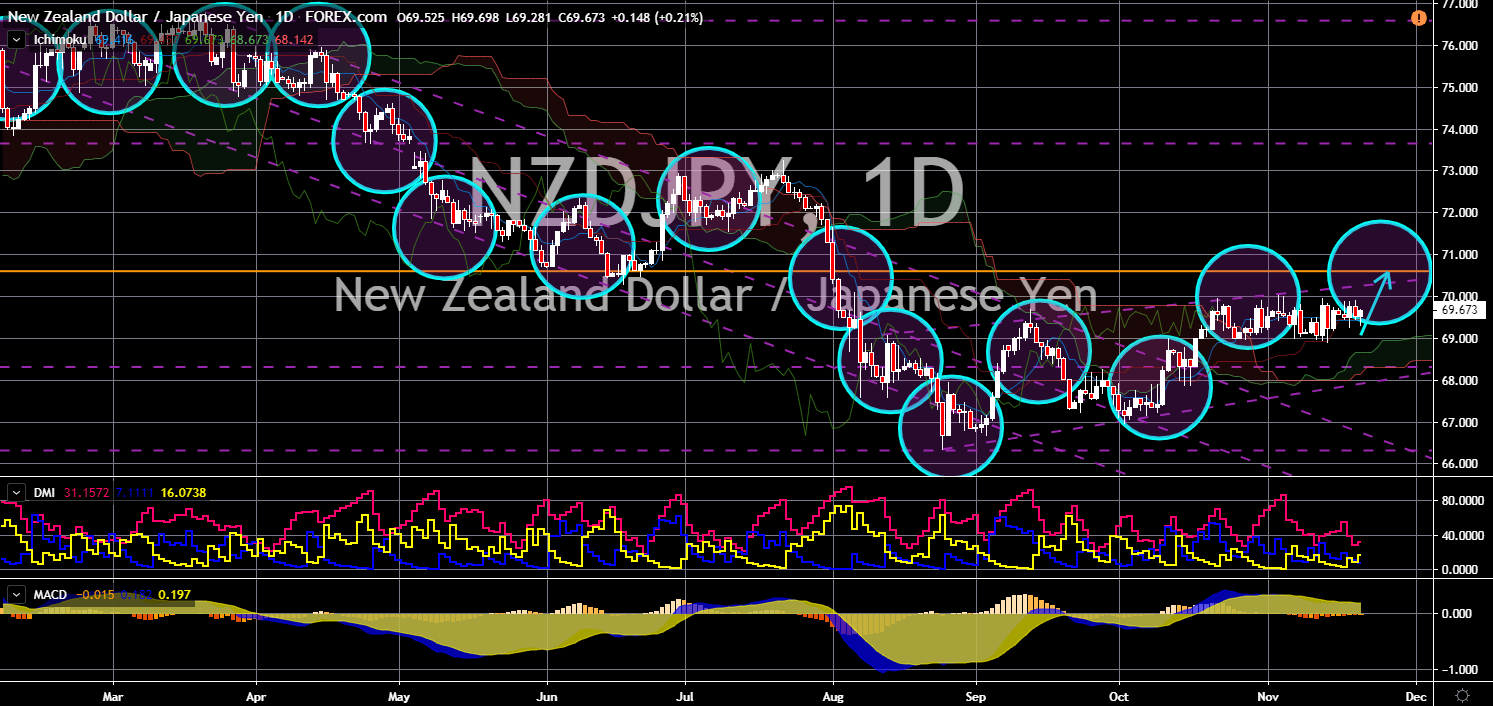

NZD/JPY

The pair will continue moving higher in the following days to retest a key resistance line. All economic reports of Japan today, November 21, were all sitting in negative. Japan’s National Core Consumer Price Index (CPI) slowed to its 30-month low year-over-year (YoY). The same thing is happening with its National Core CPI on a monthly basis where its slow down to its record low for the year 2019. The country’s Manufacturing Purchasing Managers Index (PMI) is still in contraction. Since the beginning of the year, there are only two (2) months (January and May) where Japan’s manufacturing sector expanded. Meanwhile, its service sector was also in contraction following months of consecutive expansion. This is expected to drag the Japanese Yen and pressure the Japanese central bank to further ease its monetary policy. Japan became the fourth country to be in negative interest rate territory in 2016.