Market News and Charts for November 20, 2019

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

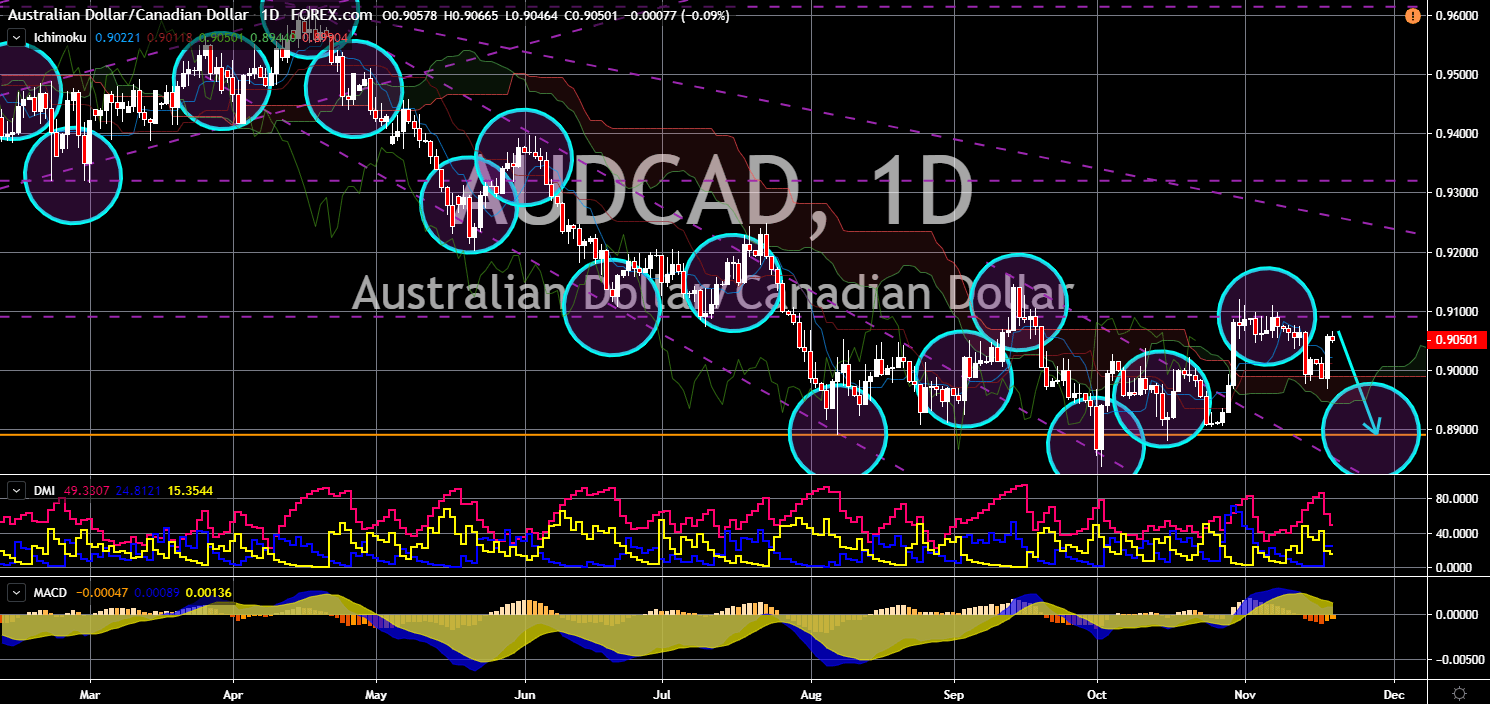

AUD/CAD

The pair will fail to break out from a major resistance line, sending the pair lower. Sweden’s central bank announced that it will be selling some of its Australian and Canadian bonds holdings over carbon footprint. This was amid the rising green movement in Europe. In the recent election in Switzerland, green parties accounted for 20% of the total seats in the parliament. The news will add to investors’ pessimism with the Australian economy. One expert further noted that Australian house prices are one of the biggest risks to the global economy. Meanwhile, Canada is expecting to increase its citizenship among immigrants to 40% by 2024. These immigrants are mostly in Canada for work. This means that the Australian labor market is expected to further strengthen in the coming years, so as their economy. As Canada focuses on economy, Australia was prioritizing the threats of Chinese military activity in the region.

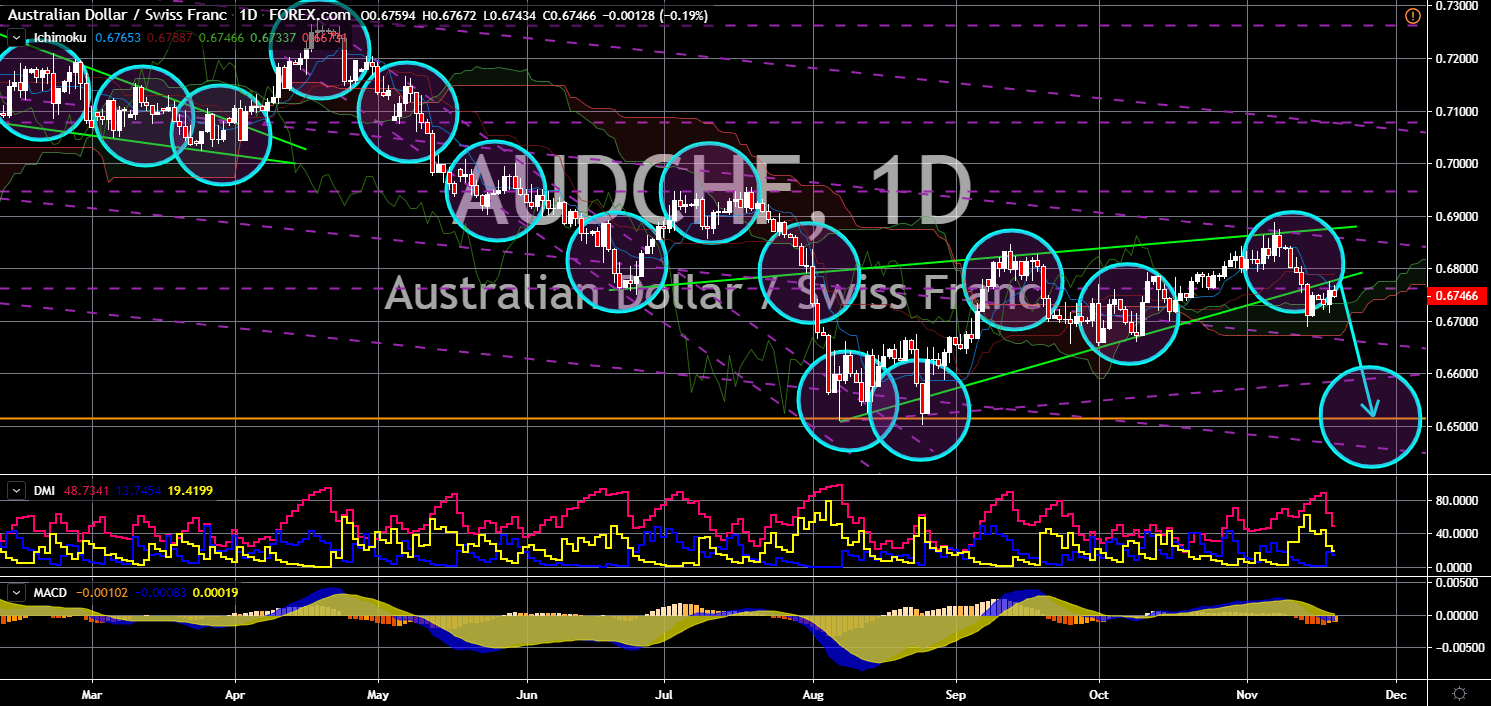

AUD/CHF

AUD/CHF

The pair broke down from a “Rising Wedge” pattern support line, sending the pair lower toward its previous low. Australia is still flirting with recession as the economy has been dragged from the escalating trade war between the United States and China. The country was heavily exposed with the two (2) economies. China was the country’s largest economic trading partner while the U.S. was its largest military partner. The opposite is true for Switzerland. The Swiss Franc is considered as one (1) of the most stable currencies in the world. Aside from this, Switzerland maintains trading deals across continents. It has a trading deal with the European Union and is a signatory of a post-Brexit trade agreement. It was also the first country to sign with China’s Belt and Road Initiative (BRI). However, the two (2) economies can both be affected in a global recession. Australia’s house prices and Switzerland’s household debt are at their record highs.

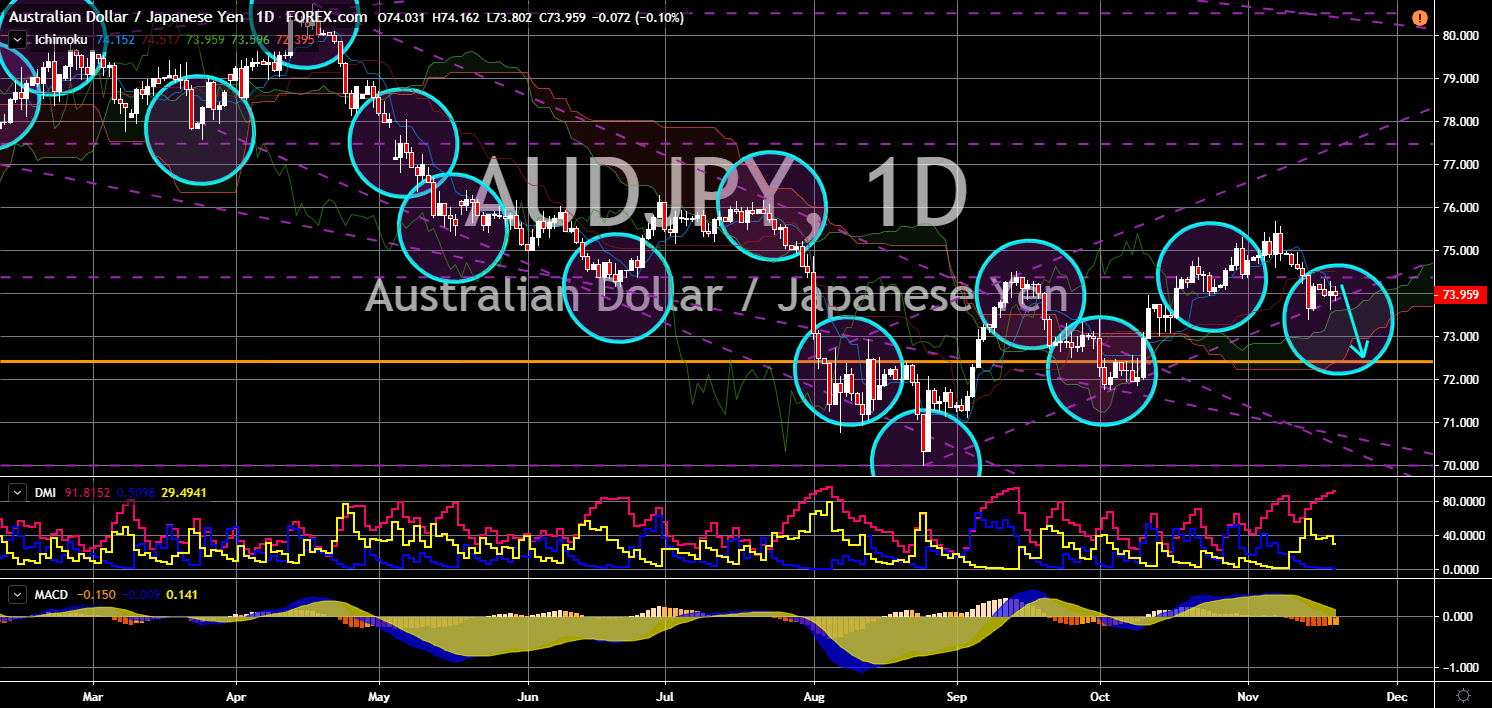

AUD/JPY

The pair is expected to breakdown from an uptrend channel support line. Australia and Japan were both regional powers in the Asia Pacific. Together, they ratified the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). They were also members of the ASEAN (Association of Southeast Asian Nation) and a future trading bloc, the RCEP (Regional Comprehensive Economic Partnership). The two (2) economies were experiencing economic slowdown bought by the U.S.-China trade war. Several reports and events were pointing to a weaker Japanese Yen. The country’s All Industries Index for the month of October were flat at zero (0) percent. This was better-than-expected from analysts’ estimate of -0.1% but were lower from 0.2% for the month of September. Aside from this, Japan’s export was at its lowest in three (3) years. However, Australia is more likely to experience recession in the following months.

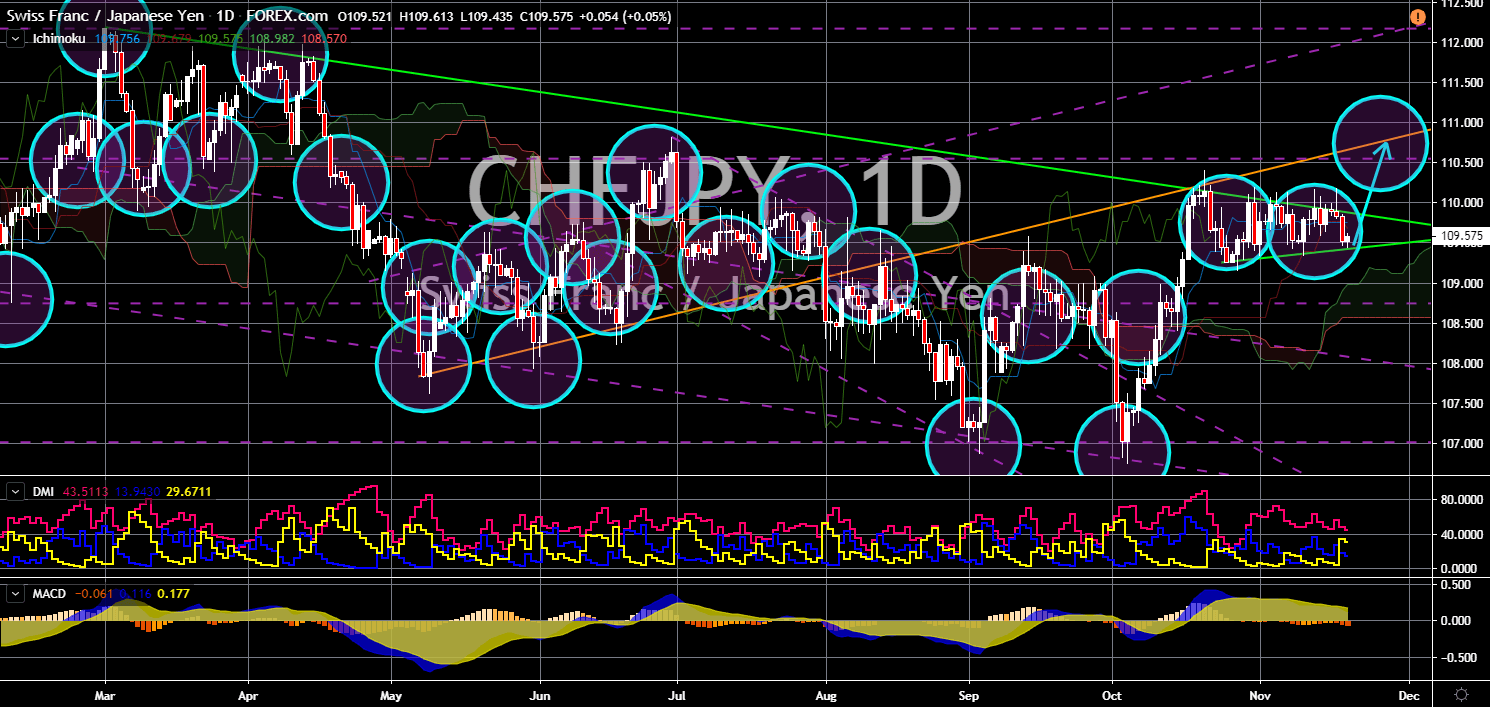

CHF/JPY

The pair is expected to breakout from an “Ascending Triangle” pattern resistance line. Sveriges Riksbank, Switzerland’s central bank, said it sees a modest climate change risk to the country’s economy. This was after Japan was hit by Typhoon Hagibis, which was considered as the most devastating typhoon in the country since 1958. The Japanese government said the typhoon costs Japanese economy $10 billion. This is expected to affect the already sluggish economy of Japan. Meanwhile, as politics in Europe turns green, Switzerland made the first move to tie its political move with climate change. The Swiss Central Bank said it is reducing its bonds holdings from Australia and Canada. In other news, recent reports were pointing to a continued slow growth in Japan. The country’s exports plunged to three (3) years low and is expected to continue in the following quarters. Japan’s All Industries Activity Index were also flat.