Market News and Charts for November 18, 2019

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

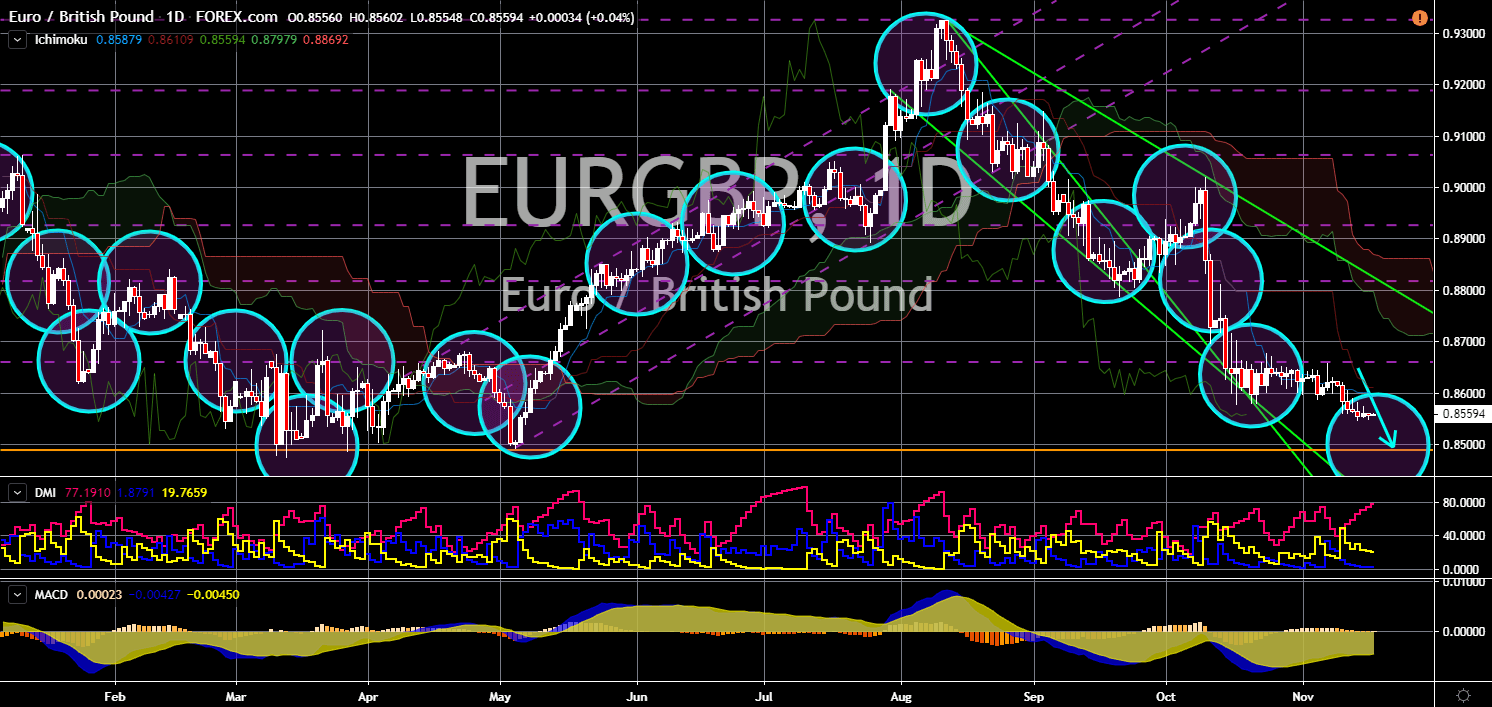

EUR/GBP

The pair will continue to move lower in the following days towards a major support line. UK Prime Minister Boris Johnson is continuing to defy the European Union. This was even after the British Parliament forces him to extend the Brexit until January 31. The European Commission give Britain an ultimatum to nominate its commissioner designate. This was amid the finalization of candidates by the EU Parliament. Technically, the United Kingdom is still part of the European Union and is bound by the EU law to follow its rules. Another major roadblock in the Brexit process was Gibraltar, a British Overseas Territory. Spain lost the territory more than 300 years ago from the United Kingdom. The border between mainland Spain and Gibraltar was open since 1985 as part of Spanish accession to Brussels. As the United Kingdom is preparing for its withdrawal, the Spanish government is also preparing to close is border with Gibraltar.

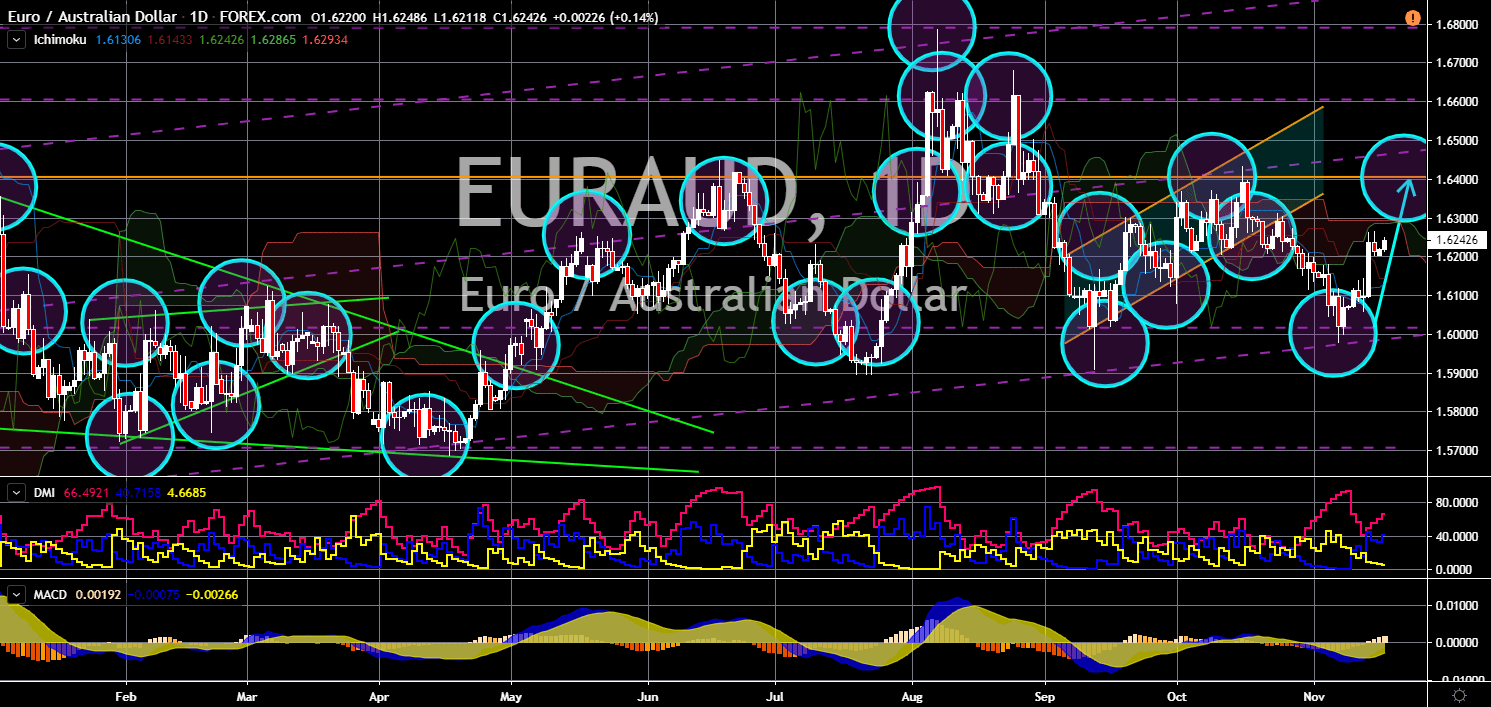

EUR/AUD

EUR/AUD

The pair will continue its upward movement towards a major resistance line. Tomorrow, November 19, the Reserve Bank of Australia (RBA) will have a meeting that could affect its interest rate decision by December. The central bank already slashed half of its interest rate this 2019 amid the global economic uncertainty and the U.S.-China trade war. Australia was heavily reliant on the two (2) largest economies in the world and was heavily affected during the height of the tit-for-tat war. Aside from this, the country was caught up between the European Union and the United Kingdom. Australia received a double whammy from the Brexit extension and from the EU banning several exports from the country. Australia was a post-Brexit signatory and currently have an ongoing trade with the European Union. Australia was now seeking trade compensation from the European Union and the United Kingdom.

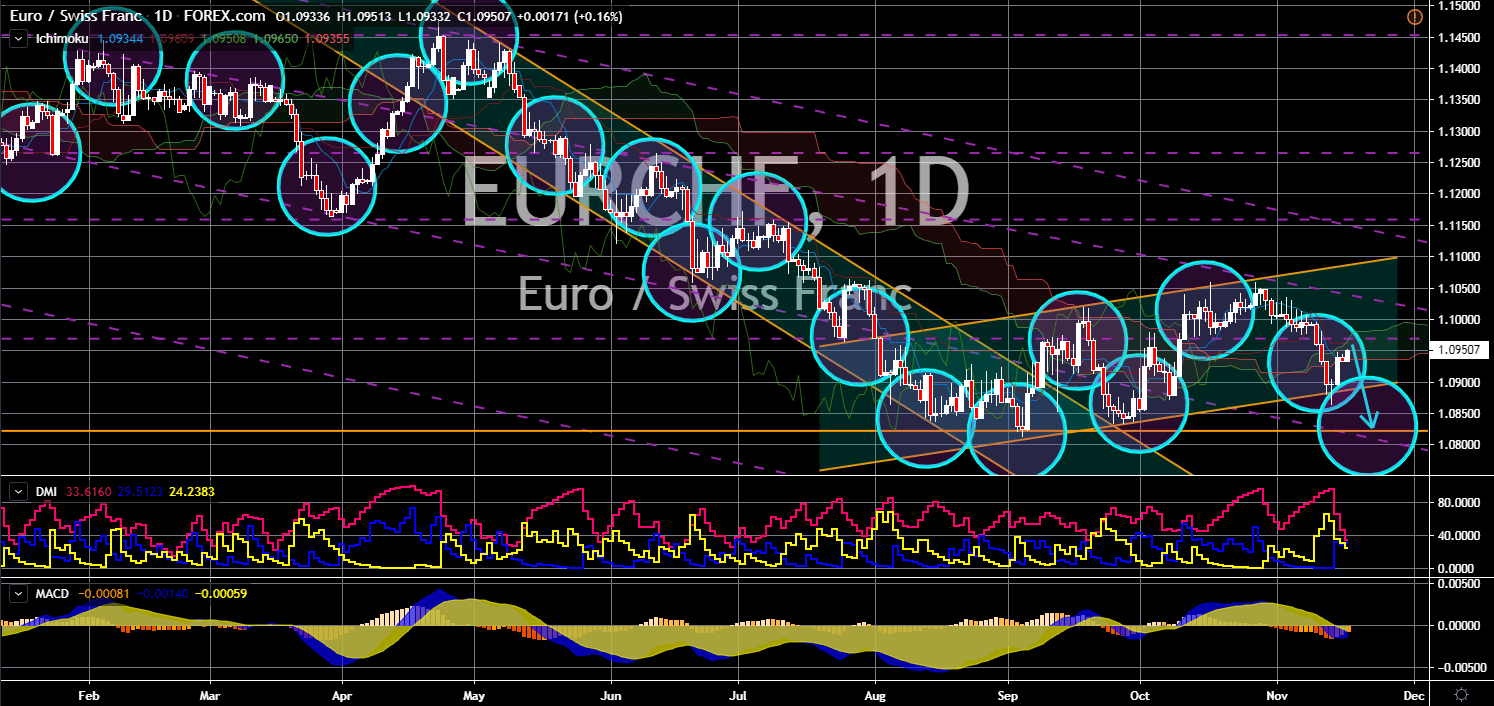

EUR/CHF

The pair is expected to continue its downward movement and to breakout from an uptrend channel support line. The United Kingdom and Switzerland has been increasing their cooperation since Britain voted for a referendum seeking to withdraw from the EU. As the British Parliament forces PM Boris Johnson to send an extension letter, Switzerland and the UK signed a transitional social security agreement. The deal will be triggered in a case of a “no deal” Brexit. Despite asking for a Brexit extension, PM Johnson plans on taking the UK out of the EU before January 31. This was after he received an approval from the MPs to have a general election in December. The prime minister is seeking to win the said election and form a majority government that will help him to crash out of the EU even without a deal. This is expected to affect Switzerland’s relationship with the European Union.

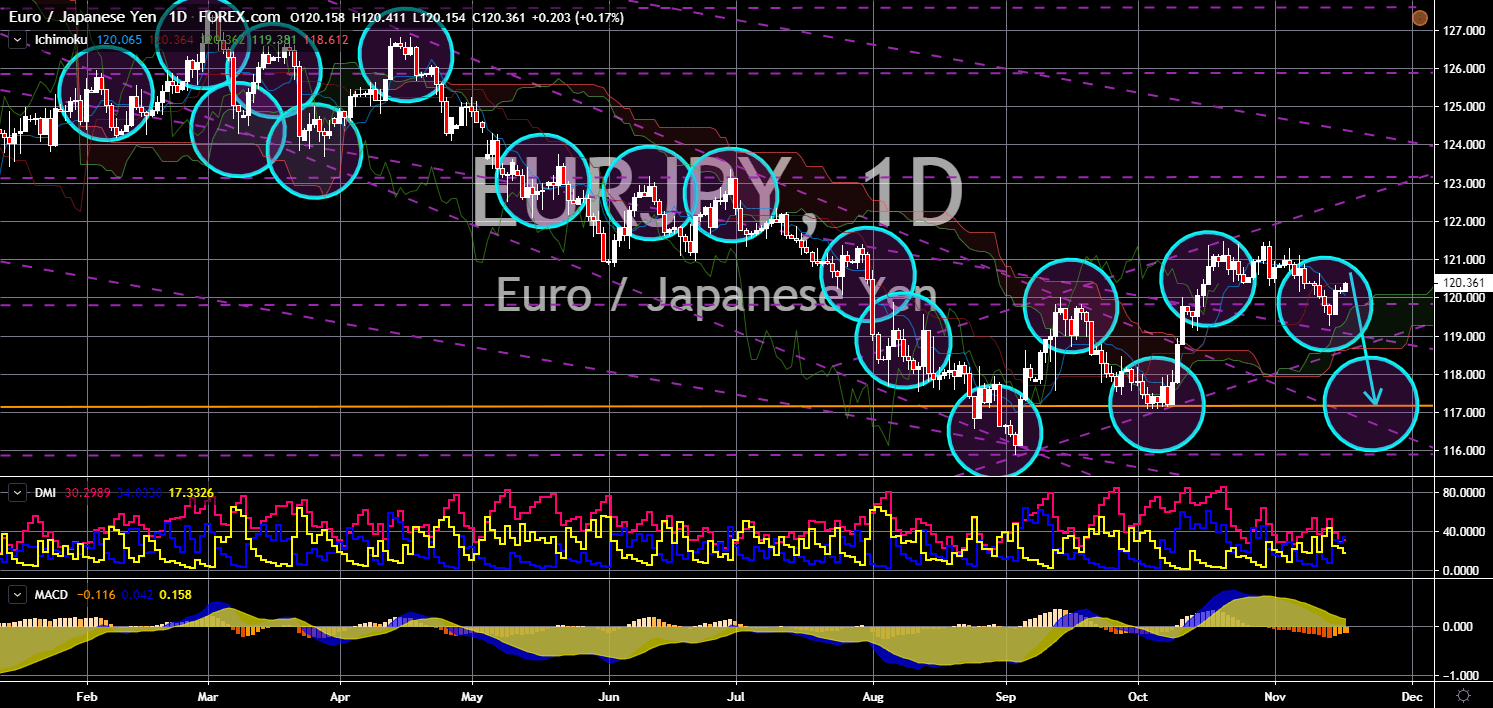

EUR/JPY

The pair will breakout from an uptrend support line, sending the pair lower towards a key support line. As the two (2) largest economies in the world battles for global economic leadership, the third (Japan), fourth (Germany), fifth (France), and sixth (United Kingdom), came up together to protect globalization. The EU-Japan free trade deal created the largest trading zone in the world. Japan, together with Australia, also led the effort to ratify the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Recently, Japan signed a bilateral trade agreement with the United States. Now, Japan is one of the members of the regional trading bloc RCEP (Regional Comprehensive Economic Partnership), together with China. The European Union, on the other hand, was distracted by the Brexit and by the Russia-led Eurasian Economic Union (EAEU).