Market News and Charts for November 17, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

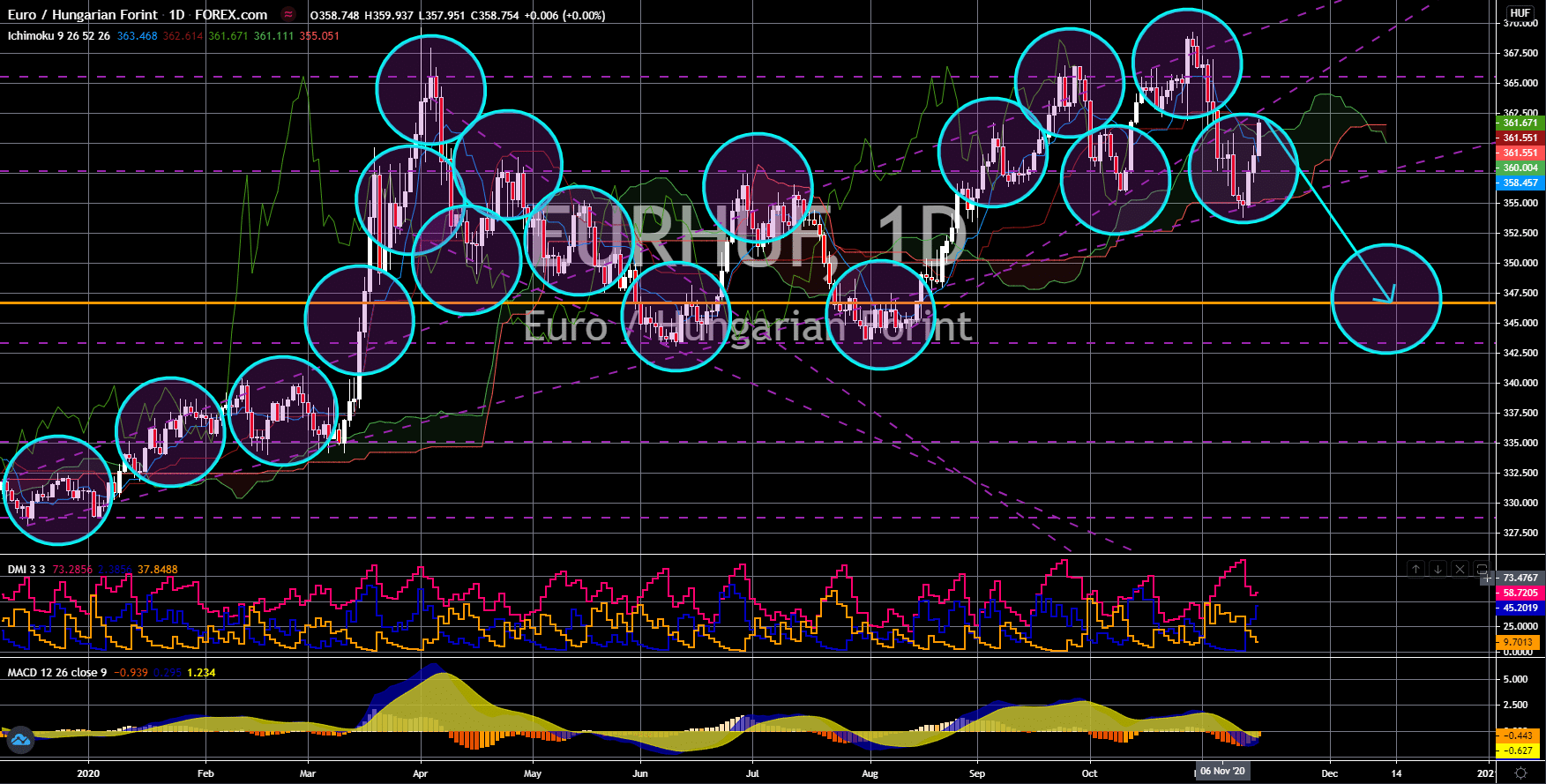

EUR/HUF

The pair will fail to break out from an uptrend resistance line, sending the pair lower towards its previous low. Hungary is playing fire with the European Union after the country along with Poland vetoed the EU budget of $2.14 trillion over the next seven (7) years. This was following the EU’s stance that the budget allocation can be altered for countries that it found were violating the EU rule of law. This move could delay the much-needed funds from the block towards the EU member states that are hardly hit by the pandemic. On their most recent reports, some EU member states already showed some weakness amidst the second wave of the pandemic. France’s consumer price index (CPI) MoM and YoY reports both posted zero percent growth. Meanwhile, Italy recorded 0.2% and -0.3%, respectively, on the same reports, showing no signs of improvement from their prior report. The delay in the budget will negatively impact the upcoming reports.

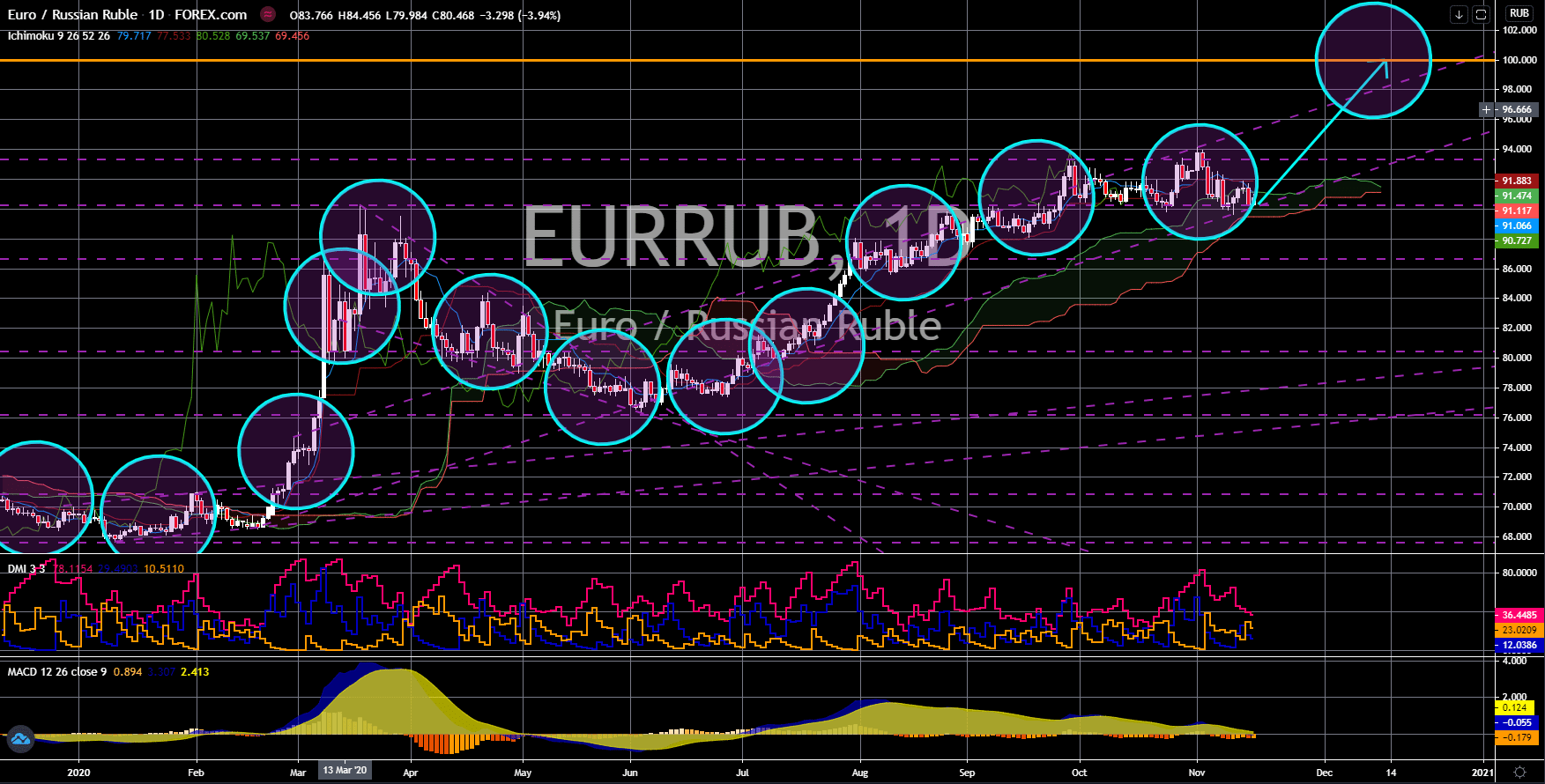

EUR/RUB

The pair will continue to move higher in the following days towards the 100.000 price area. Despite the stagnant growth in the European Union, investors of the EURRUB pair will go long amid the worries that Joe Biden’s presidency will be disastrous for the Russian economy. During the 2016 US Presidential Elections, Russia was accused of meddling which eventually led to the election of Donald Trump. Over the next four (4) years since the 2016 election, the US pulled out from major accords including the Paris Agreement and the TPP (Trans-Pacific Partnership). However, president-elect Biden promised to rejoin the Paris Accord on his first day in the office. This gesture is expected to reconnect the US with its allies in Europe. As for the current situation in Russia’s economy, the outlook was still bleak. Industrial Production report for the month of October declined by -6.1%, steeper than the -5.0% slump recorded in the prior month.

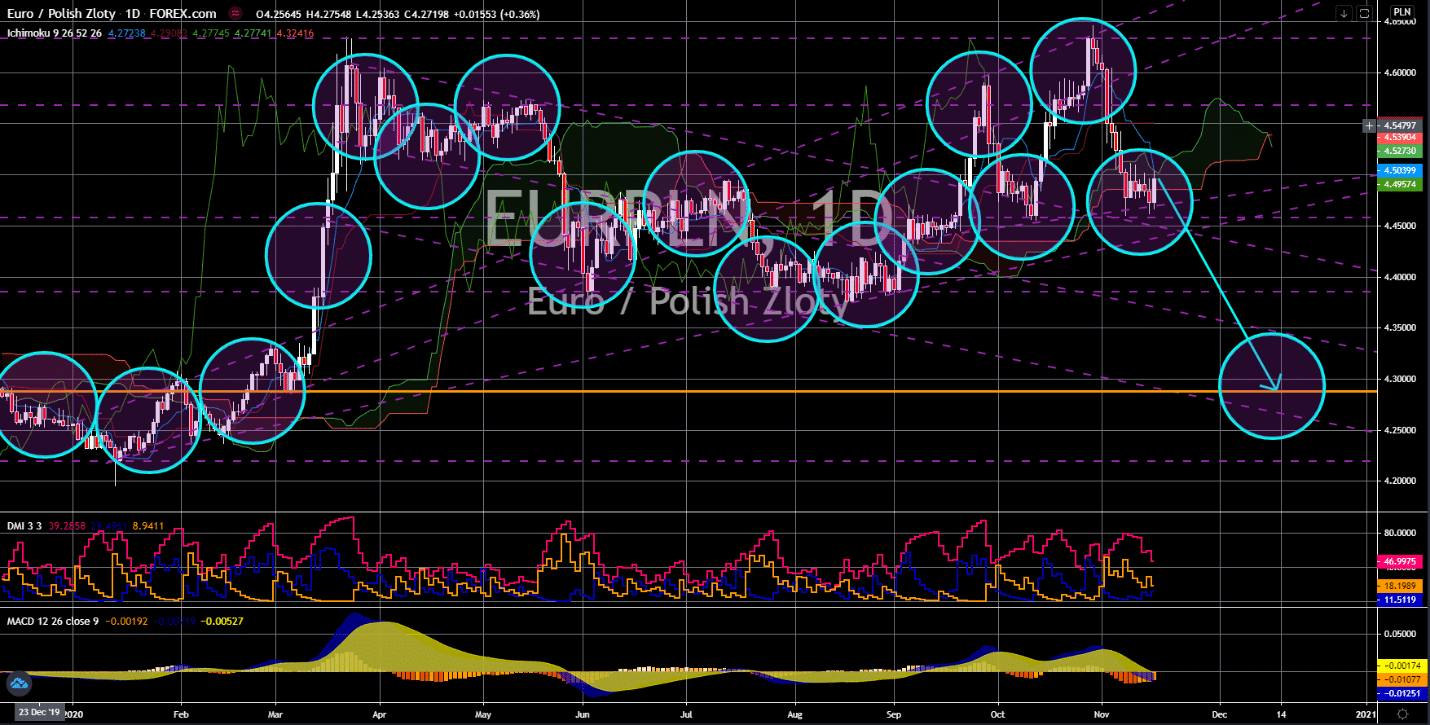

EUR/PLN

The pair will break down from a major support line, sending the pair lower towards its March 05 low. The strong GDP figures from Poland will help the Polish zloty to recover back its losses from the euro currency. The figure for the country’s gross domestic product QoQ report for the third quarter of the fiscal year jumped by 7.7%, close to -8.9% contraction in Q2. Also, the ratio of Poland’s economic recovery in Q3 against the second quarter was among the highest in the bloc. Meanwhile, the country’s GDP recorded -1.6% decline on an annual basis which was better than the -1.7% expectations and against its previous result of -8.2%. In addition to this, Poland’s current account in euro denomination was up to 1,072 million in September compared to August’s 947 million figure. This can support the country near-term as it vetoed the proposed $2.14 trillion budget for the EU member states over the next seven (7) years.

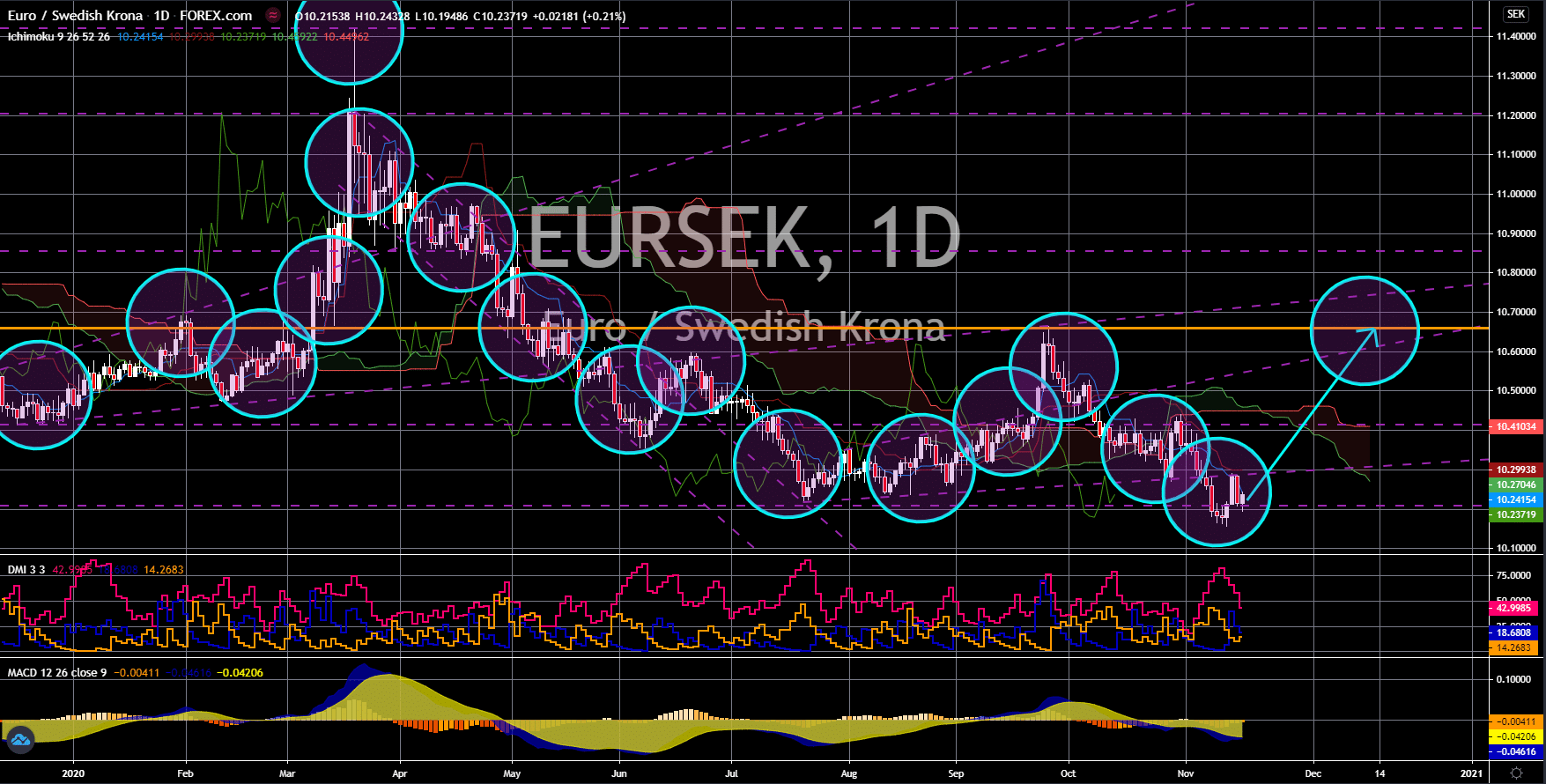

EUR/SEK

The pair will bounce back from a major support line, sending the pair higher to retest its previous high. Sweden, who’s no lockdown approach during the onset of the pandemic in the region has raised many concerns from investors, has now taken a step to contain the virus. Swedish Prime Minister Stefan Löfven has passed a law that will limit public gatherings up to 8 people. On the first wave of COVID-19, the country’s economy was not spared from the slump in economic activity throughout the region. Analysts are now expecting that the stricter measures by the Swedish government will show more disappointing figures for the country’s economy. Meanwhile, Germany has imposed a more modest form of lockdown dubbed by Chancellor Angela Merkel as “light lockdown”. The softer approach was introduced to prevent Germany’s economy from suffering the same fate it had in the second quarter of 2020.