Market News and Charts for November 15, 2019

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

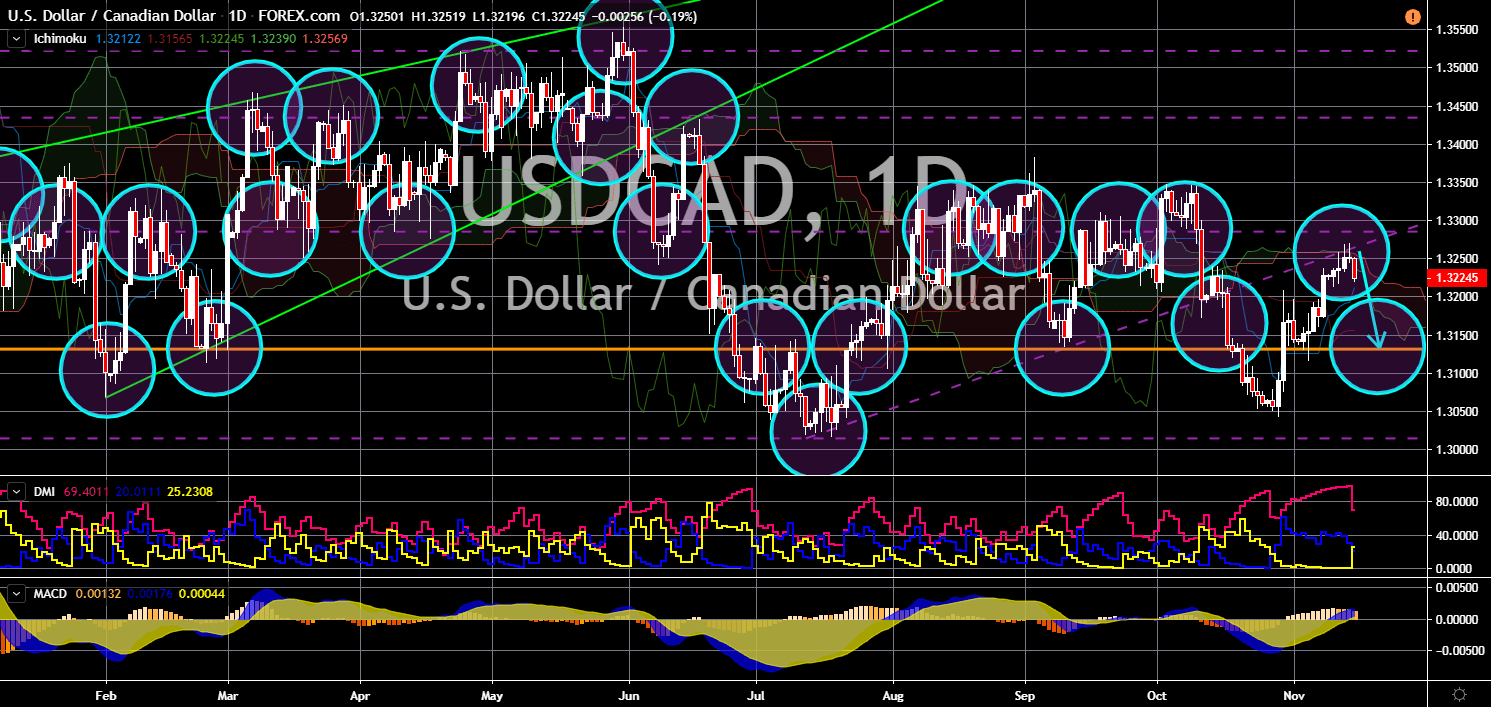

USD/CAD

The pair failed to breakout from a key resistance line, sending the pair lower towards the nearest support line. U.S. House Speaker Nancy Pelosi is aiming to pass a key trade agreement by the Trump administration this year. The USMCA (United State-Mexico-Canada) free trade agreement (FTA) is currently the second largest trade pact in the world. The European Union is currently the largest trading bloc, but the RCEP (Regional Comprehensive Economic Partnership) is trying to replace the EU by 2020. Trump is seeking to be reelected in the 2020 election and a major catalyst for his reelection roots from his key policies in the 2016 campaign. However, analysts doubt that passing one of his key policies will be enough. One of his main policies was the border wall between the United States and Mexico which haven’t been realized yet. The USMCA is expected to benefit the U.S. agricultural sector.

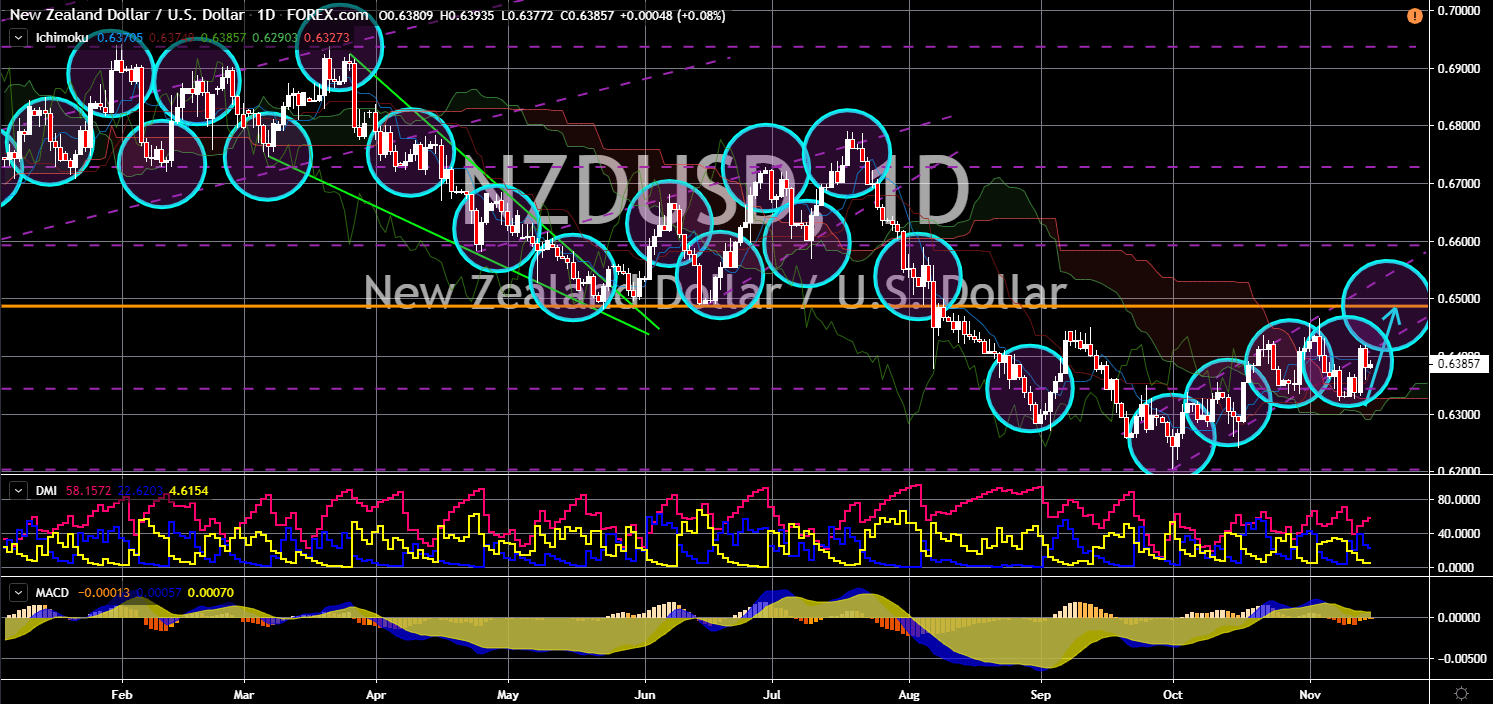

NZD/USD

NZD/USD

The pair is expected to regain its strength and retest a major resistance line. U.S. Ambassador to New Zealand Scott Brown will be leaving his role after his first term. He said the reason for his exit is because he has been admitted as the new president and dean of the New England Law school in Boston. However, analysts speculated that his leave was due to the changing foreign policy of New Zealand. New Zealand PM Jacinda Ardern boldly announced that New Zealand’s decision on Huawei will not be influenced neither by the United Kingdom nor the United States. Aside from this, New Zealand was one (1) of the few countries that abstained from choosing sides between the Maduro government and self-proclaimed president of Venezuela Juan Guiado. In other news, New Zealand Foreign Minister Winston Peters is set to visit Washington to negotiate trading deals and to discussed anti-terrorism as part of the Five Eyes.

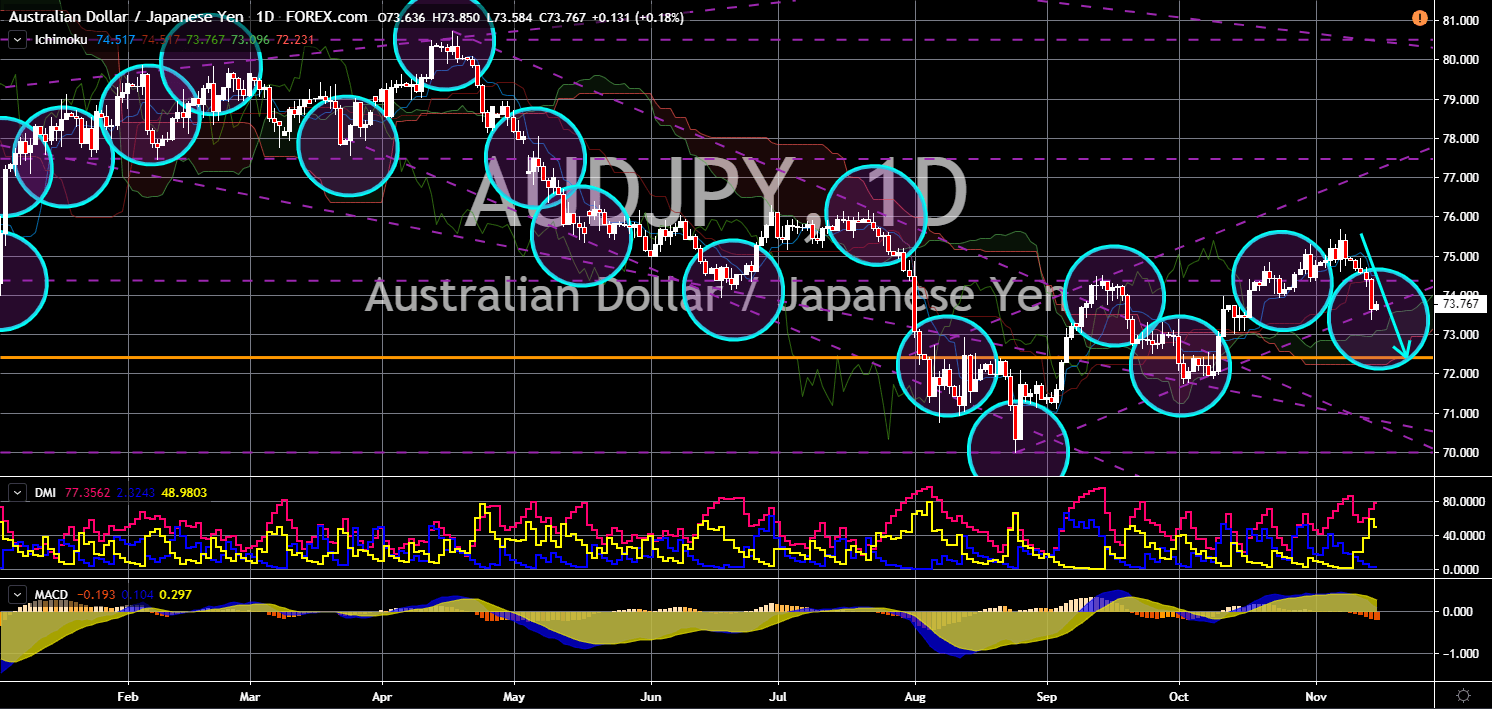

AUD/JPY

The pair will continue to move lower in the following days towards a key support line. Australia’s east coast wildfires renewed tension in the Australian government. The conservative government are pressured to make solutions on the unprecedented wildfire. The same scenario happened in Brazil in the second half of the year. The lack of action by Brazilian President Jair Bolsonaro prompted the EU leaders to take action. Finalizing the EU-Mercosur trade deal was once again crippling after the draft deal ended the 20 years of negotiations. This could also be the same scenario for Australia who has been drawing some irked from the European Union. The EU has recently banned Australian exports with names originating from any European locations. Japan, on the other hand, was able to ratify the EU-Japan free trade deal (FTA), which became the largest trading zone in the world.

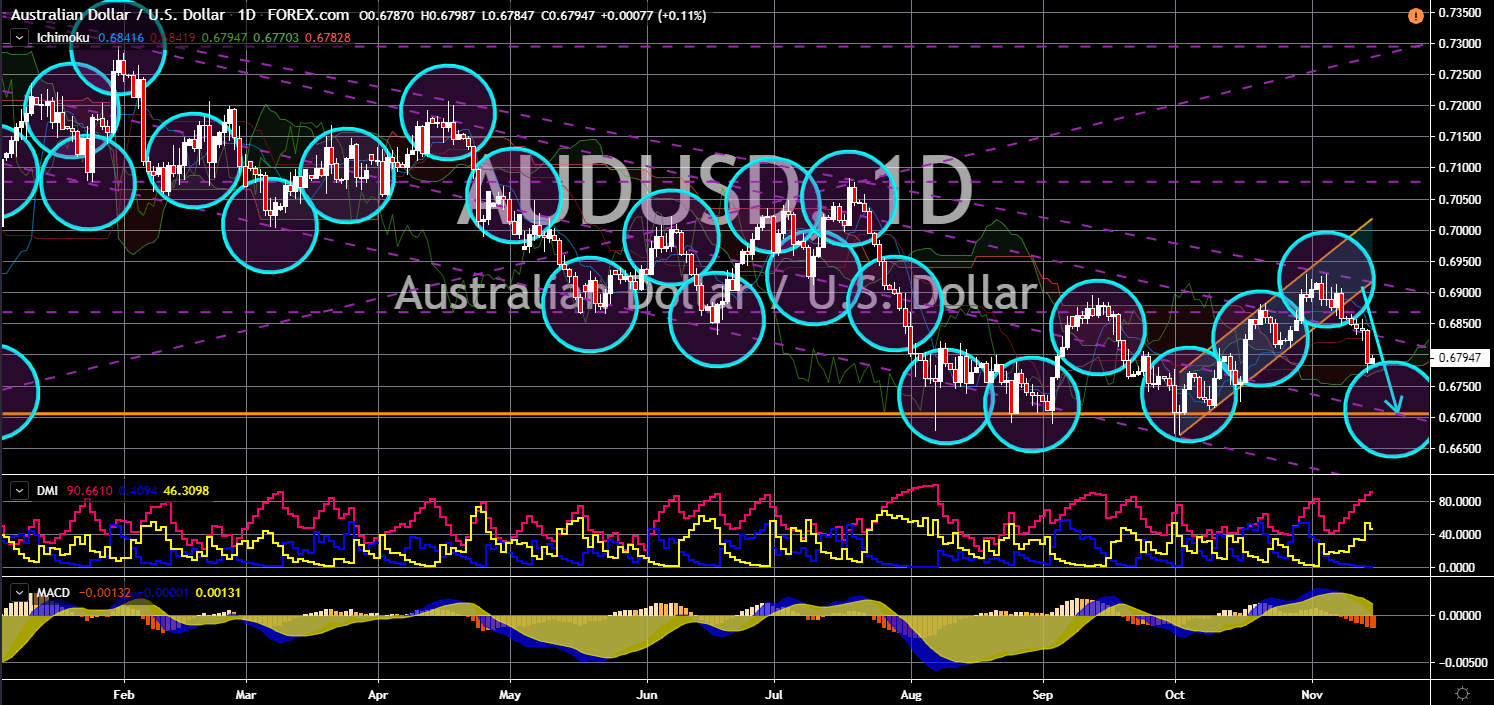

AUD/USD

The pair failed to breakout from a downtrend resistance line, sending the pair lower towards a major support line. Australia reaffirmed its support to the U.S. deterrence in the Indo-Pacific. This was the summary of speech by Australian Defense Minister Linda Reynolds. Australia is an important political ally of the United States in the Indo-Pacific region. However, analysts are worried that the dependency of Australia to the U.S. defense might put the country at risk. This was also the same concern that the Germano-Franco alliance viewed on falling U.S. military presence and influence around the world. This pushed the European Union to consider creating its own military army. The EU leaders have been criticizing the Australian government on its inability to decide for itself. Australia was the only country, aside from the United States, committed to banning the Chinese telecom giant Huawei.

-

Support

-

Platform

-

Spread

-

Trading Instrument