Market News and Charts for November 11, 2019

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

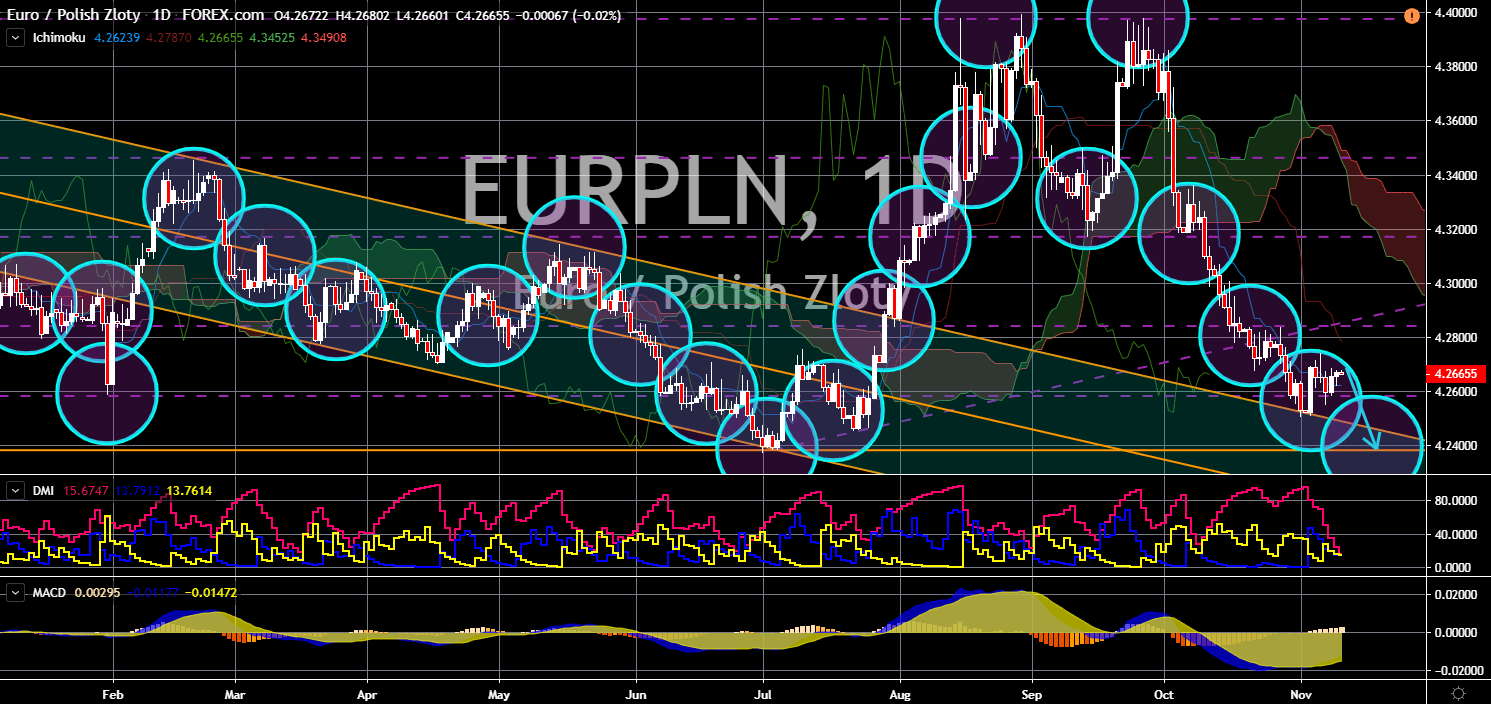

EUR/PLN

The pair is expected to continue moving lower in the following days to retest its 5-month low. Poland is under pressure from the European Union. Recently, the country, together with fellow V4 nations – Hungary and Czech Republic, were accused of breaking the EU law. This was amid their refusal to take in refugees during the summer of 2015. This was due to the Cologne attack in Germany. Now, the European Union’s top court ruled out that Poland again broke another European Union law. Brussels said that Poland’s passage of a law that will lower the retirement age for judges was illegal. At the same time, its introduction of a different retirement age for men and women was against Brussel’s law. Despite the accusations from the bloc, Polish still have a strong support towards the ruling party. The Law and Justice Party (PiS) took 45% of the vote during the recent election.

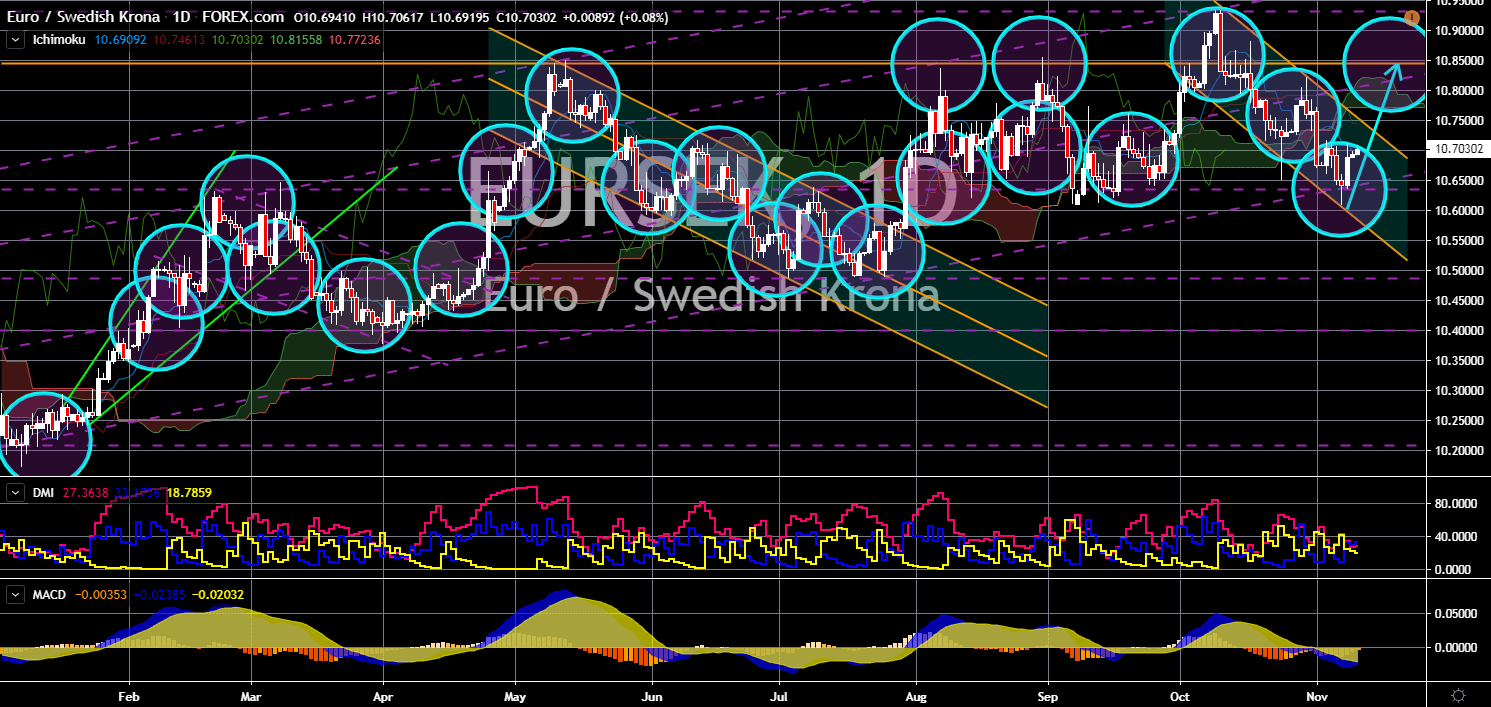

EUR/SEK

EUR/SEK

The pair is expected to break out from a downtrend channel resistance line. The European Union warned Sweden that the country’s economy is facing a slowdown, faster than the average EU slowdown. The slowing growth of the European region can be attributed to several factors. This includes the ongoing U.S.-China trade war, which has been dragging economies all over the world. Aside from that, the Brexit delay has put the EU-member states on the brink of uncertainty. The bloc’s future relationship towards the sixth-largest economy in the world, the United Kingdom, depends on the Brexit deal. However, this is further complicated with the looming general election in the United Kingdom. On December, PM Johnson plans to win a majority government to take the UK out of the EU. Labour Party’s Jeremy Corbyn is expected to be Boris Johnson’s opponent in the upcoming election.

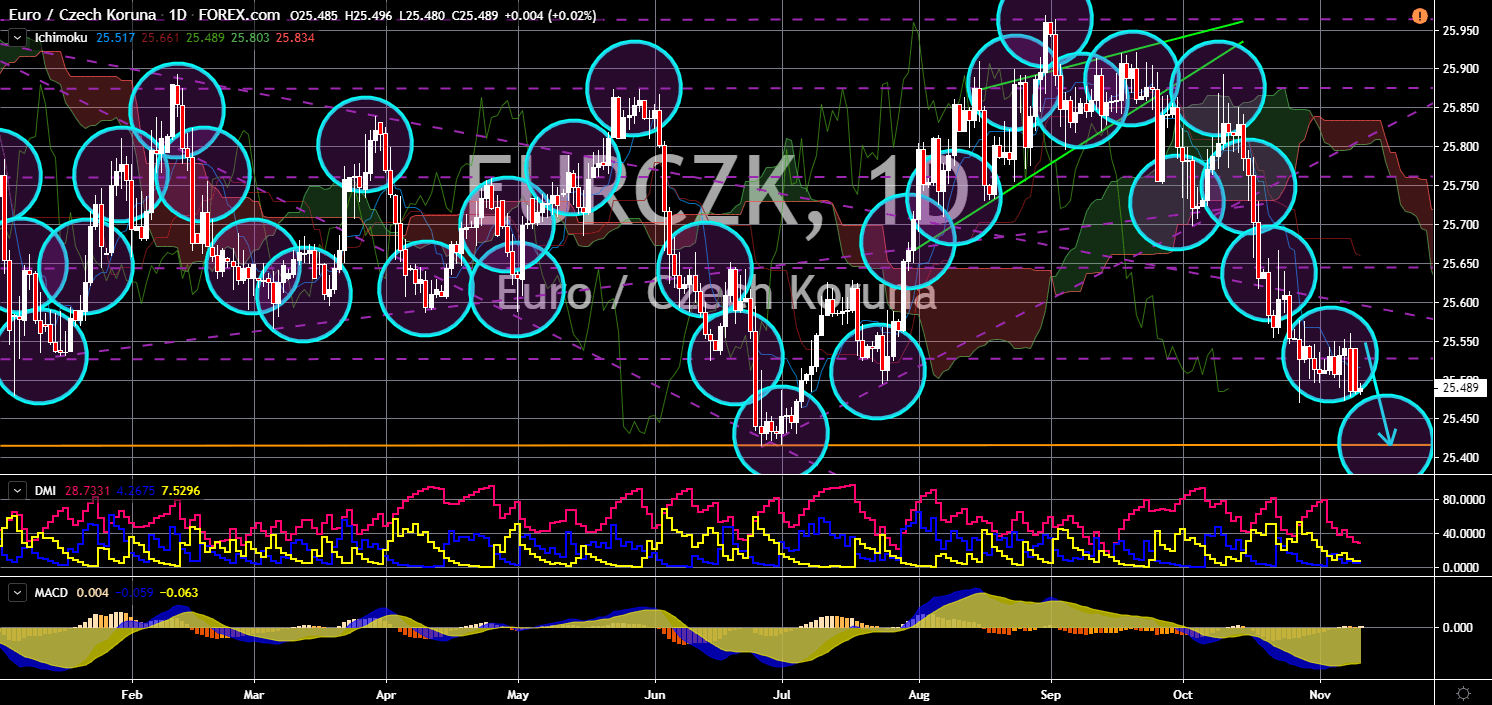

EUR/CZK

The pair is expected to continue moving lower in the following days toward its 6-month low. The European Commission announced that Hungary, a member of the V4 nations, is set to become the EU’s fastest growing economy. This was despite the allegations by the Brussels that the V4 nations broke the EU’s rule of law. This was amid the region’s economic slowdown and the possibility that the EU’s largest economy, Germany, will enter a recession. This will give prime minister Andrej Babis more leverage to negotiate with the European Union. Recently, the Czech PM said that the country should build a nuclear plant even if it violates the bloc’s law. Aside from that, the bloc accused the billionaire prime minister of making personal gains from the EU subsidy funds. This was aside from the accusations that the country did not fulfill its duty as an EU-member state to accept immigrants. This further puts the EU at odds with Czechia.

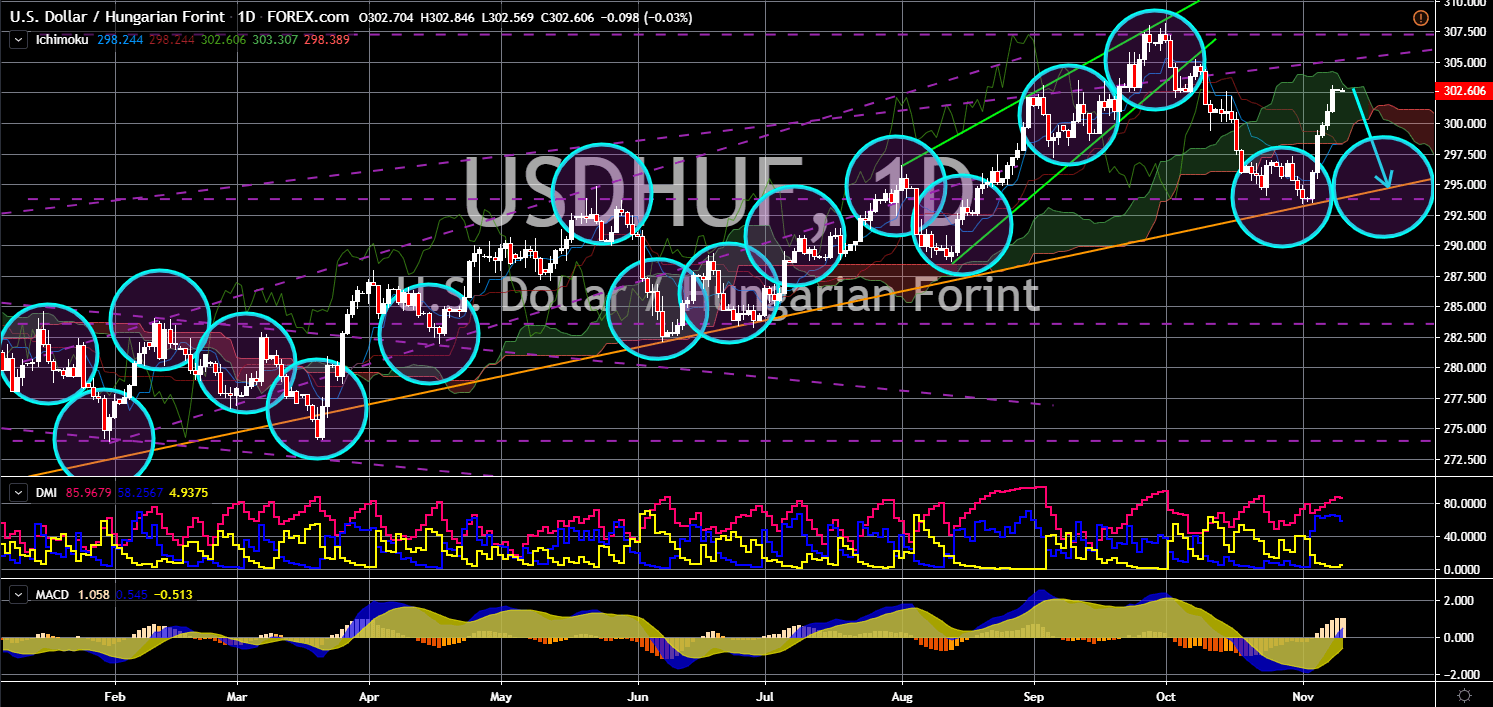

USD/HUF

The pair is expected to reverse back after its recent rally. Hungary is playing fire with the United States and Turkey. In the recent months, the United States and Hungary seemed inseparable. The two (2) countries were strengthening their alliance amid the threats from Russia and an out of touch Germany-France leadership. However, the comments made by President Recep Tayyip Erdogan reversed this progress during his meeting with Prime Minister Viktor Orban. Hungary is a rare ally of Turkey in the European Union. Turkey warned that it will open its gates to the 4 million immigrants from Syria following the narrowing EU-Turkey relationship. Aside from this, the phone call by President Donald Trump to President Volodymyr Zelensky could further destroy their relationship. On Tuesday, Hungary opened the way for Chinese telecom giant Huawei to enter the establishment of the country’s 5G network.