Market News and Charts for November 10, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

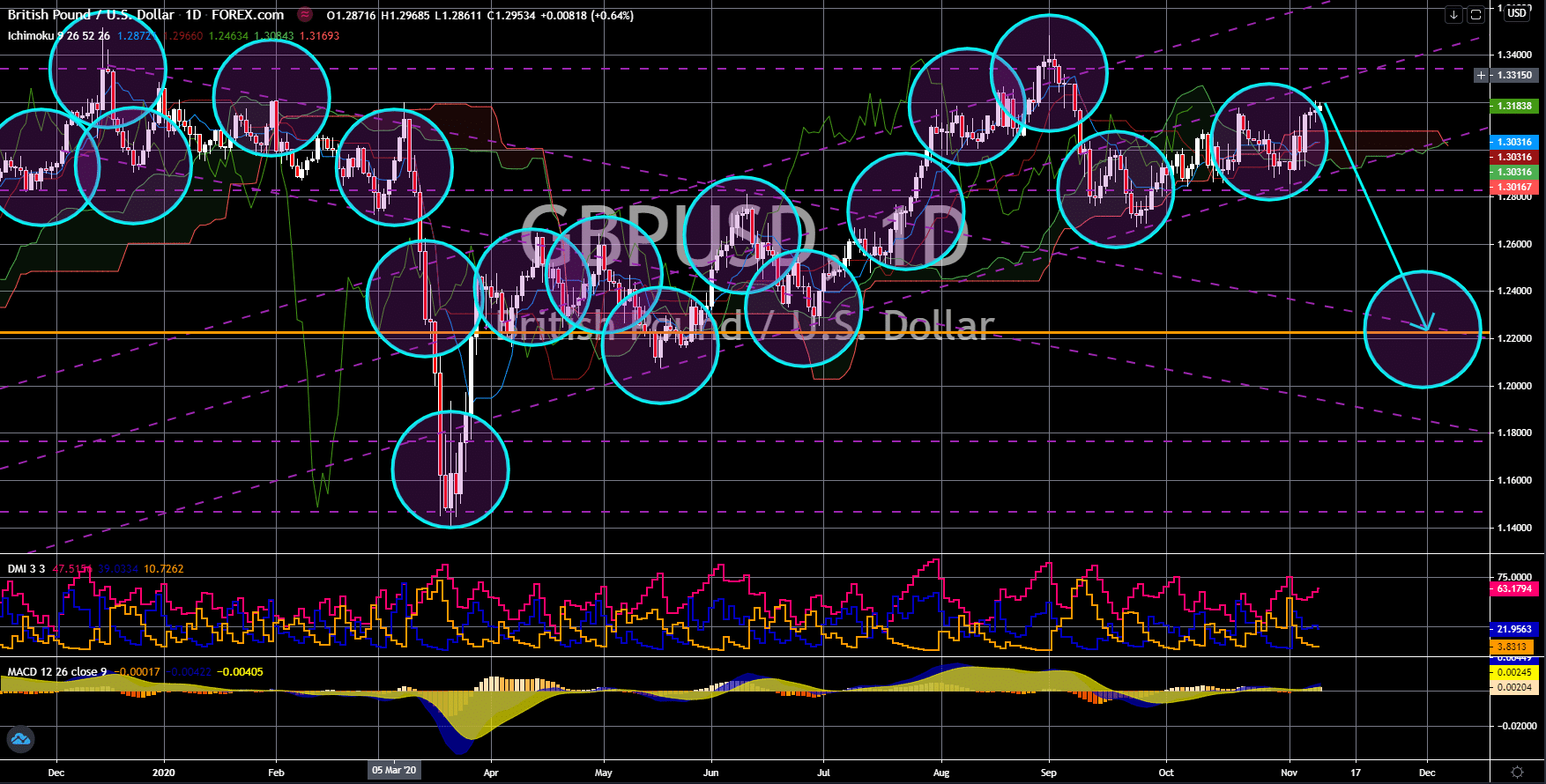

GBP/USD

The pair will break down from an uptrend channel support line, sending the pair lower towards its May 26 low. The United Kingdom is expected to post disappointing figures in today’s reports, November 10. The number of people claiming to be unemployed is expected to increase by another 50,000 for the month of October, almost twice than the 28,000 recorded in the previous month. On the other hand, the most recent initial jobless claims from the United States posted lower figures from the prior week. The number came in at 751,000 compared to the previous week’s 758,000 result. Moreover, the win of Joe Biden spells more stimulus for the local economy. Cumulatively, the US government and the central bank injected around $6.6 trillion in the US economy. However, House Speaker Nancy Pelosi is seeking another $2.2 trillion in the new stimulus bill. The announcement from Pfizer yesterday could send employment results to record high.

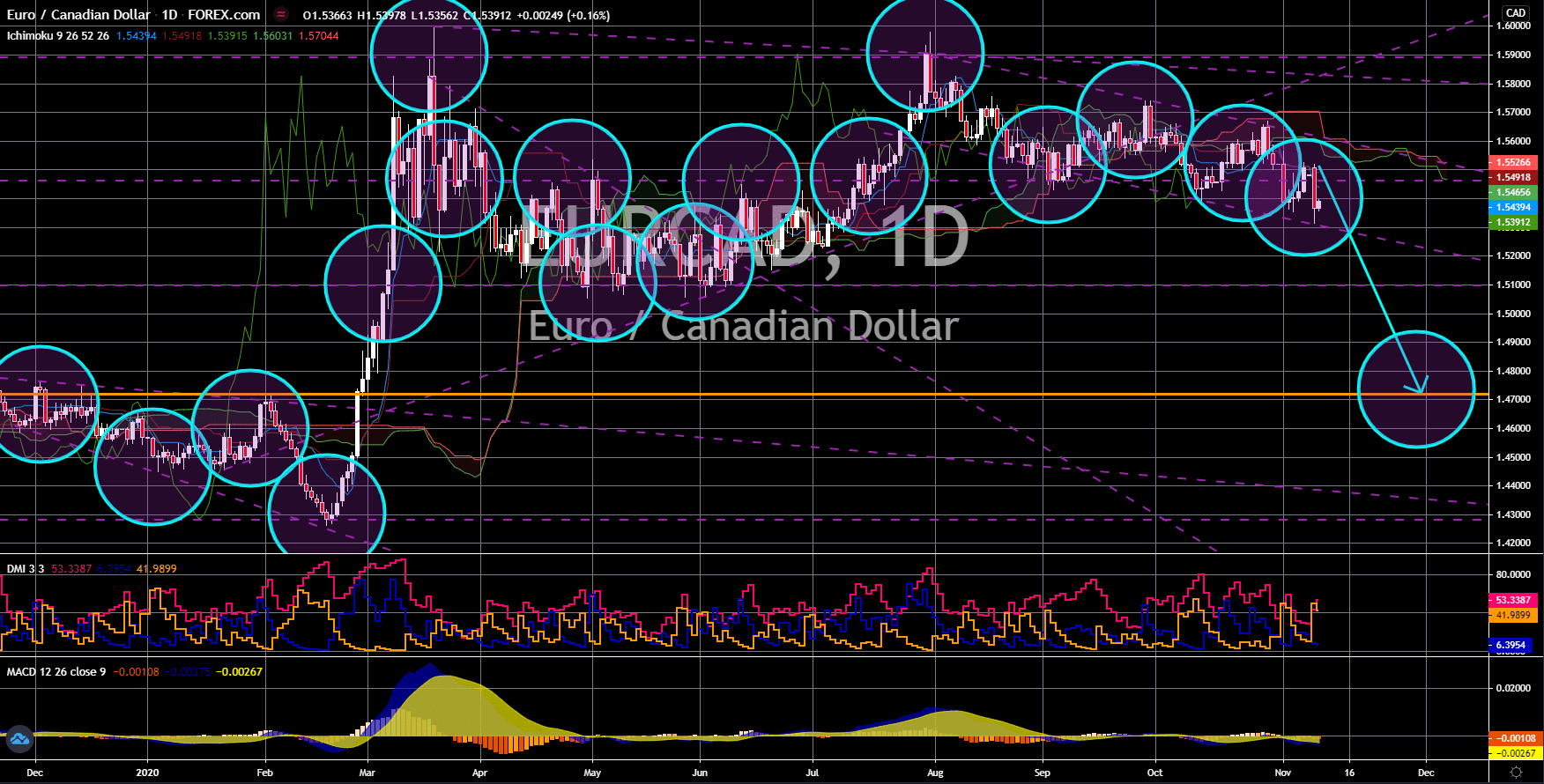

EUR/CAD

The pair will break down from a downtrend channel support line to retest its 1.47196 support line. Canada’s labor market is showing signs of plateau following the recent surge in employment. On Friday, the country added 83.6K on its employment change report. This was the lowest reported figure for the past six (6) months. Meanwhile, unemployment rate was almost unchanged from 9.0% to 8.9% in October. However, the record-breaking daily COVID-19 infections in Europe is making the Canadian dollar a better investment than the single currency. Germany, the EU’s largest economy, recorded 23,399 cases on Saturday, November 06. Currently, this was the country’s highest daily tally. On November 02, the country already entered a second lockdown dubbed by German Chancellor Angela Merkel as the “light lockdown”. Prior to the lockdown, expectations for the country in the coming days were already bleak.

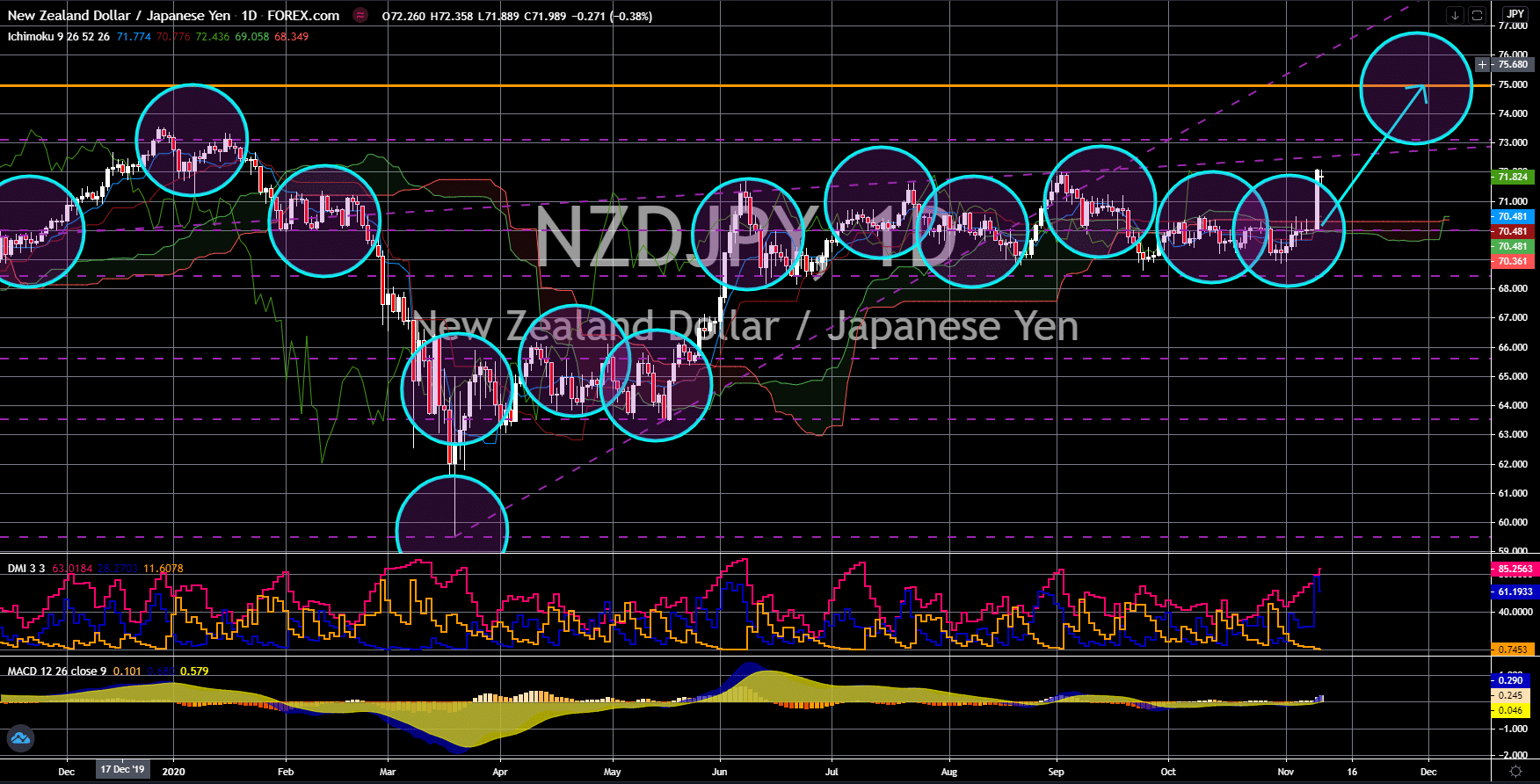

NZD/JPY

The pair will continue its rally towards the 75.000 price level. Consumer’s confidence in the NZ economy will drive the price of NZDJPY pair higher. On Monday’s report, November 09, for electronic retail card sales, the numbers jumped by 8.8% for the month-on-month (MoM) report while an 8.2% increase was recorded on an annual basis. The economic plan for the remaining days of 2020 by Prime Minister Jacinda Ardern could further send these figures higher. The NZ government allotted $311 billion as subsidy to businesses who will employ individuals during the pandemic. This amount is expected to employ around 40,000 unemployed individuals. Furthermore, the country will continue to support SMEs (Small-Medium Enterprise) with a three (3) year no interest loan scheme. On Japan, the pro-China stance by president-elect Joe Biden against China could isolate the world’s third largest economy.

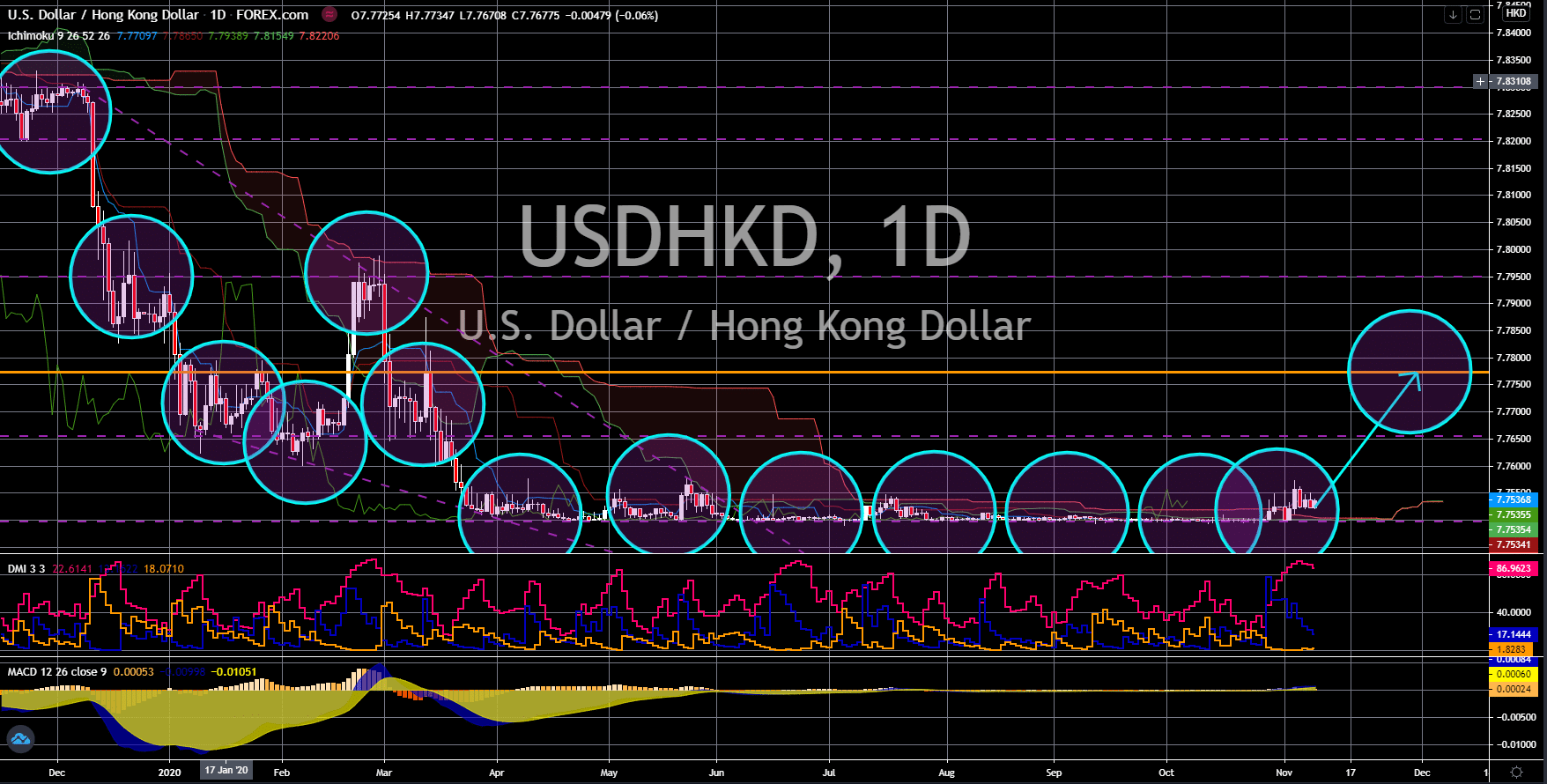

USD/HKD

The pair will continue to move higher in the following days towards its May 13 high. President-elect Joe Biden is expected to be softer when it comes to China. This, in turn, might bring back the old trading relations between the United States and China’s administrative region, Hong Kong. For the SAR (Special Administrative Region), however, its increasing dependence to Chinese economy might push the investors out of Asia’s financial hub. In addition to this, the US economy might attract investors back to the world’s largest economy following the development by Pfizer of a vaccine that is considered as 90% effective on its Phase 3 trial. The US also reported better-than-expected figures on its most recent reports, which will help the US dollar to recover its losses in the past few months. The NFP report on Friday, November 06, added 638,000 jobs, which is higher than the 600,000 expectations by analysts.