Market News and Charts for November 05, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

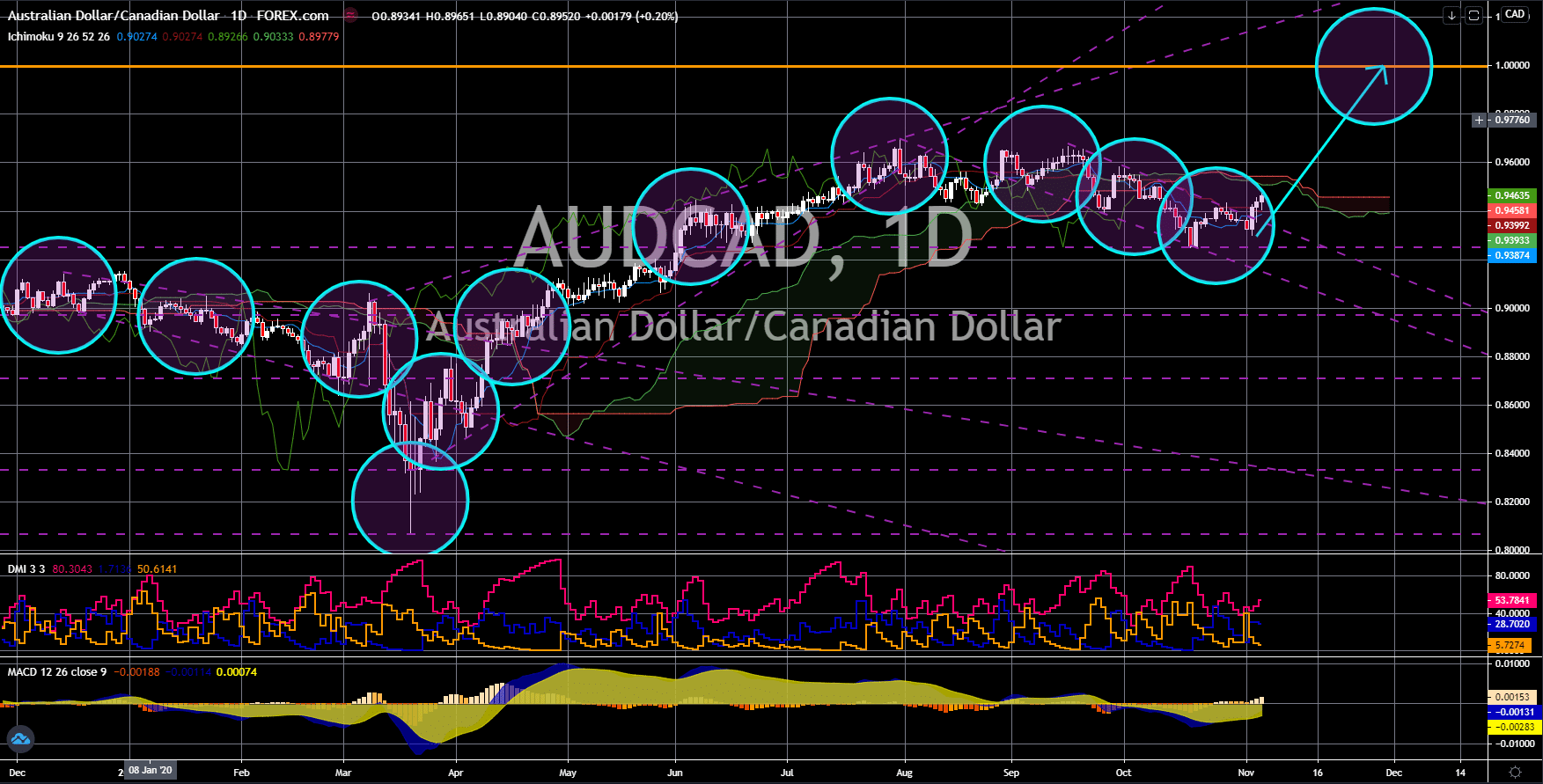

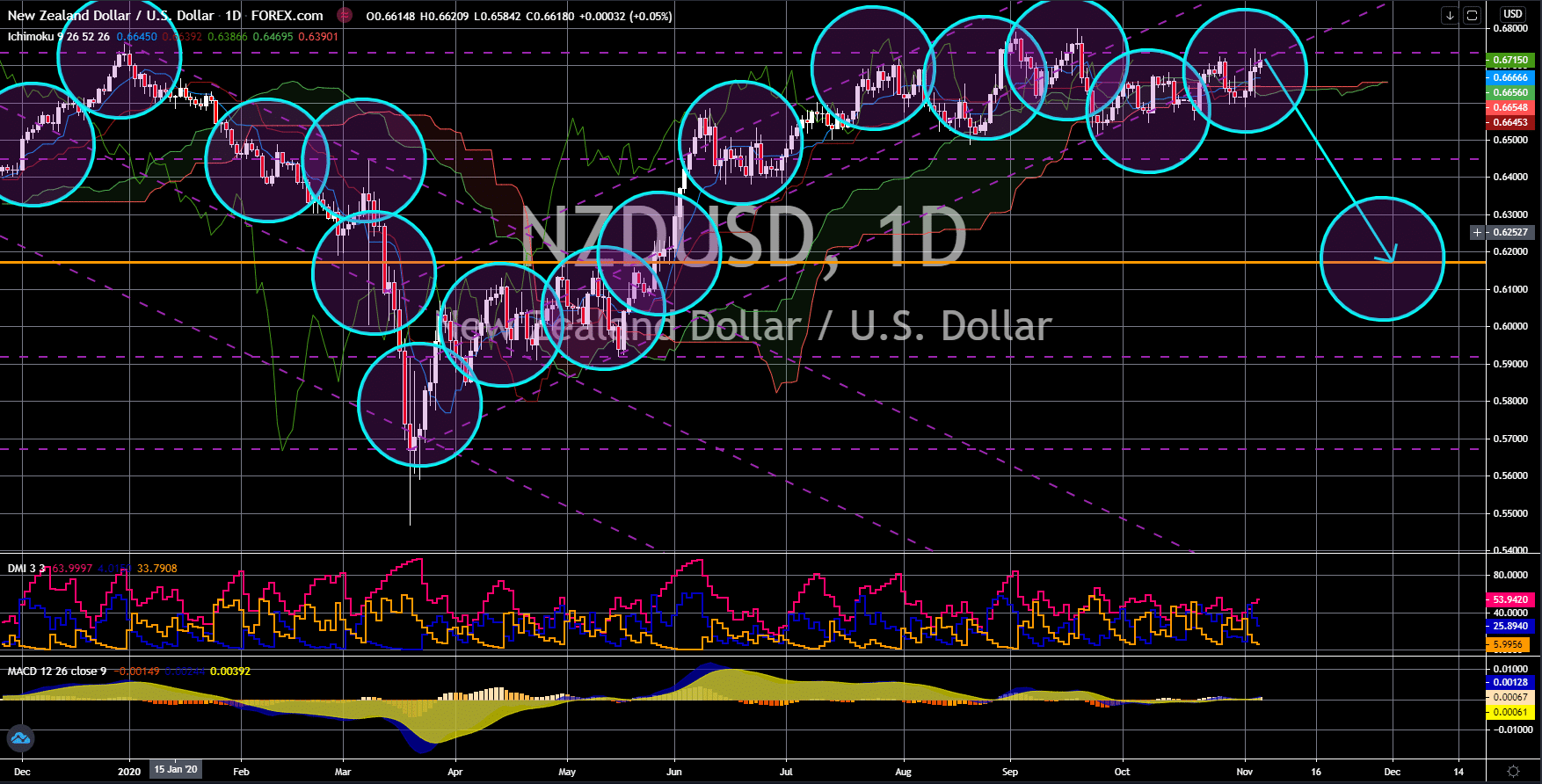

NZD/USD

The pair failed to break out from a major resistance line, sending the pair lower towards its May high. New Zealand’s labor market showed weakness on its most recent reports despite the country successfully containing the deadly virus. Unemployment rate for the third quarter went up to 5.3% from 4.0% in the previous quarter. Employment change for the reported quarter also narrowed to -0.8% from -0.4%. In contrast, labor cost increased by 0.4% from 0.2% in Q2. On the other hand, the US is expected to report its lowest number of unemployment claims since the pandemic hit the global economy in March. Expectations were at 732K, 19K lower from last week’s result. However, investors are anticipating a much lower figure after the estimates were beaten by the actual results for the past two (2) weeks. The ongoing 2020 US Presidential Election is also expected to drive the demand for the US dollar in the coming sessions.

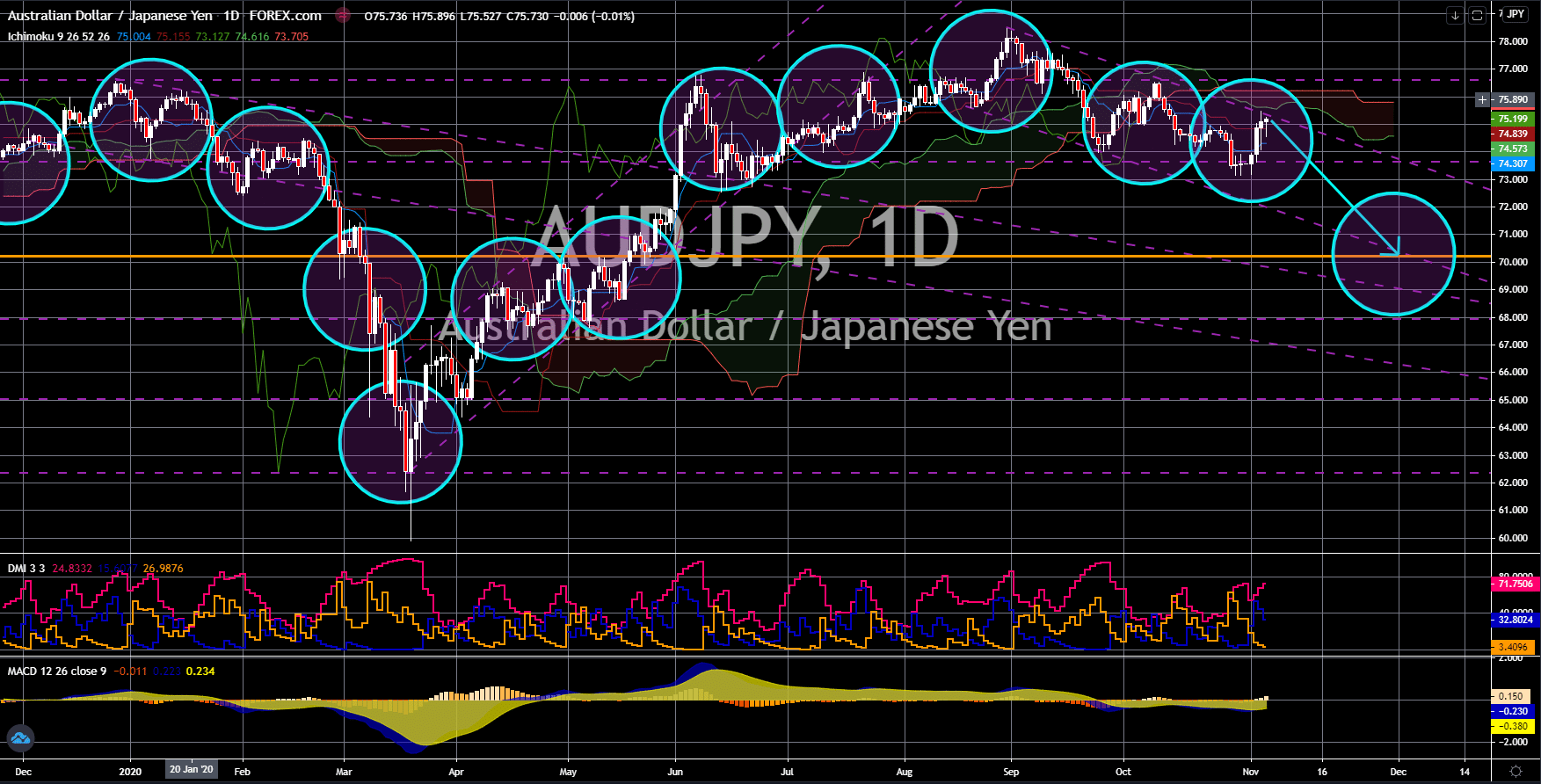

AUD/JPY

The pair will fail to break out from a downtrend channel resistance line, sending the pair lower. The Reserve Bank of Australia (RBA) cut its benchmark interest rate by 15 basis points to a historical 0.10%. This was despite the success of the country against COVID-19 and from its better-than-expected results. On Tuesday, November 03, Australia posted 53.7 points on its Services PMI, just a bit lower than the prior result of 53.8 points. Meanwhile, the AIG Construction Index was up by 52.7 points from 45.2 points. These suggest that the country’s manufacturing and services sector is expanding. In addition to this, retail sales reports were also up MoM and QoQ. The month-on-month result decreased by -1.1%, lower than the October’s result of -4.0%. QoQ, on the other hand, managed to beat the 6.0% expectations after it made a 6.5% increase in the said report. The previous record for Retail Sales QoQ was -3.4%.

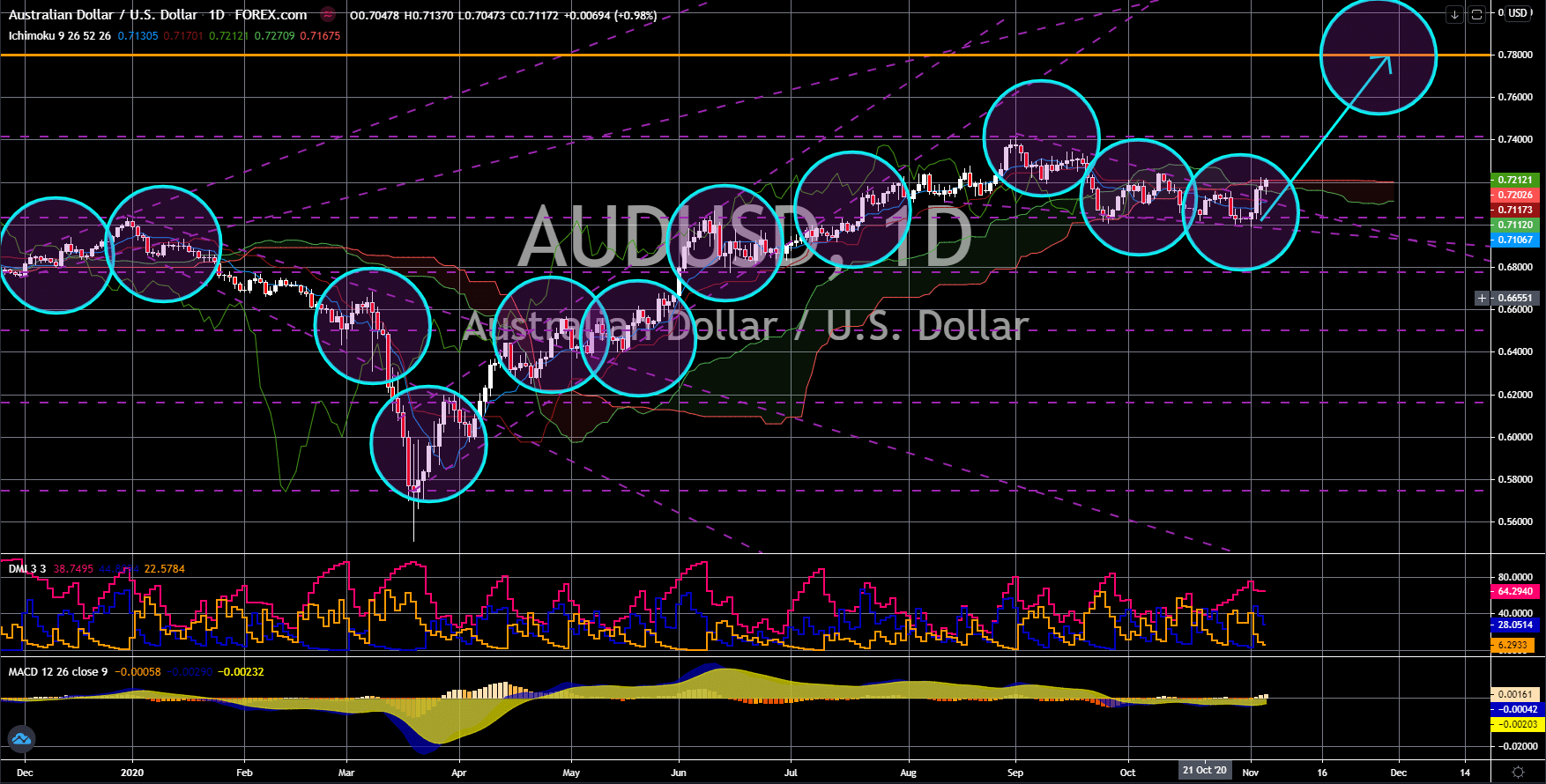

AUD/USD

The pair broke out from a downtrend resistance line, sending the pair lower towards its April 2018 high. A win for Joe Biden is expected to result in a softer approach to China. However, analysts are worried that this could result in China potentially overtaking the US as the world’s largest economy. More than that, this U-turn approach with China could hurt the US leadership and might force its allies to move forward without America. Australia was among the countries that have been put under pressure with the US-China trade war. Just like the US, China is a major trading partner for the country. However, it began decreasing its dependency on Asia’s giant following threats from President Trump. The change in leadership could potentially lead to Australia to look in Europe for allies. Another issue that Biden might face was his son’s business dealing with China. It was reported that Hunter Biden has ties with the Chinese Communist Party (CCP).

AUD/CAD

The pair broke out from a downtrend channel resistance line, sending the pair higher towards the 1.00000 price area. Canada posted an increase in imports and exports at $48.79 billion and $45.54 billion, respectively, in September. Both of which are higher than their previous record of $48.08 billion and $44.86 billion. However, its trade balance narrowed its losses at -$3.25 billion from -$3.21 billion. The drama in the US election is also expected to spill over Canada. As Biden gained a substantial number of votes against Trump, the incumbent US president is now seeking to challenge the result in the Supreme Court. As for Australia, the recent interest rate cut by 15 basis points is expected to be countered by the end of Victoria’s lockdown. Also, the recent report from AIG Construction Index and Services PMI is expected to continue in the coming reports. Figures came in at 52.7 points and 53.7 points, respectively.