Market News and Charts for November 05, 2019

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

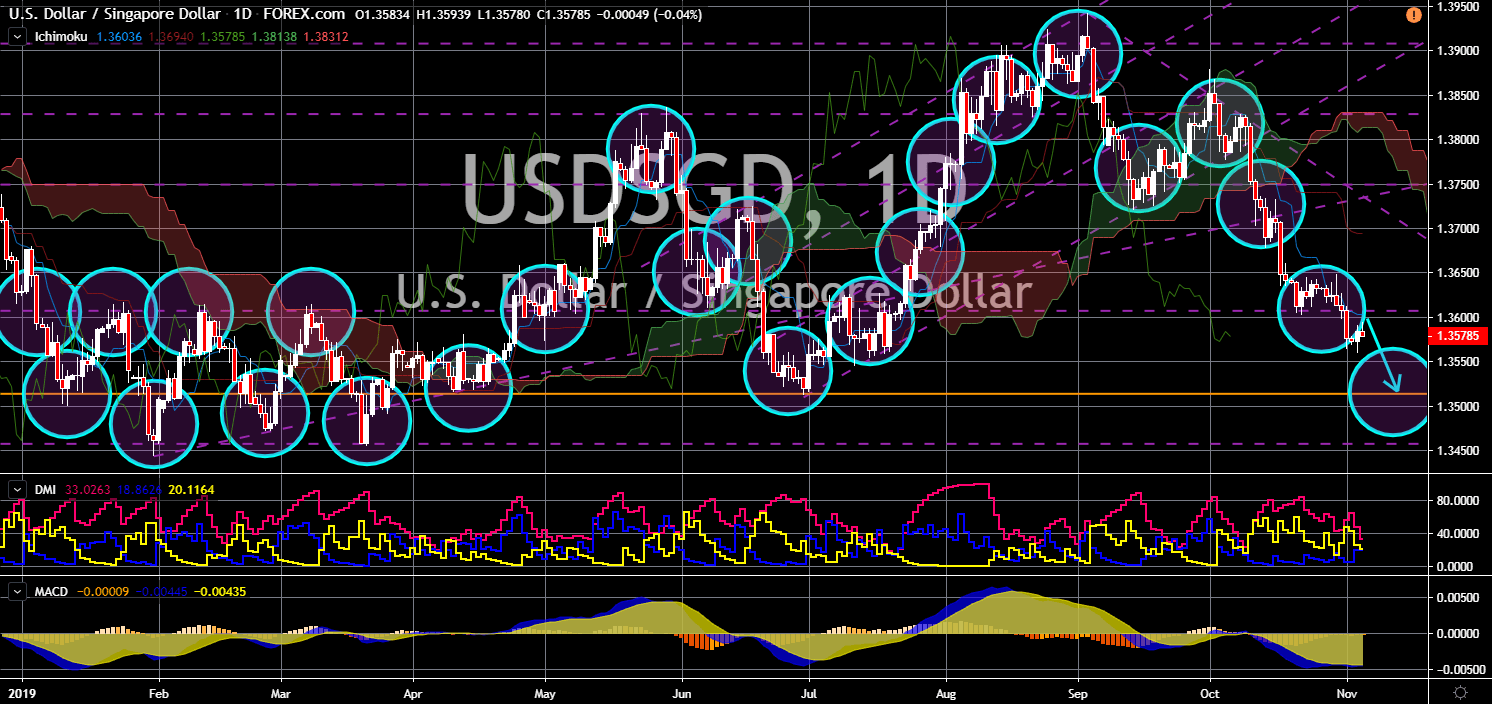

USD/SGD

The pair will continue to move lower in the following days to complete the “Rising Widening Wedge” pattern. Singapore beats the United States in a ranking of the most competitive country this 2019. This increases the leverage of the country against America as the largest economy seeks to expand its military influence in Southeast Asia. Aside from this, Singapore is considering to tapped Chinese telecom giant, Huawei, for its 5G network. Singapore is set to rollout the commercialization of 5G in 2020. Singapore’s Purchasing Manager’s Index also went up slightly by .01 to 49.6. A reading over 50 indicates expansion from the previous month, while one under 50 indicates contraction. The United States and China is trying to lobby Singapore to its side. The Singapore strait connects the Indian Ocean to the South China Sea. It accommodates 30% of global shipping trades, making it a strategic location for both the U.S. and China.

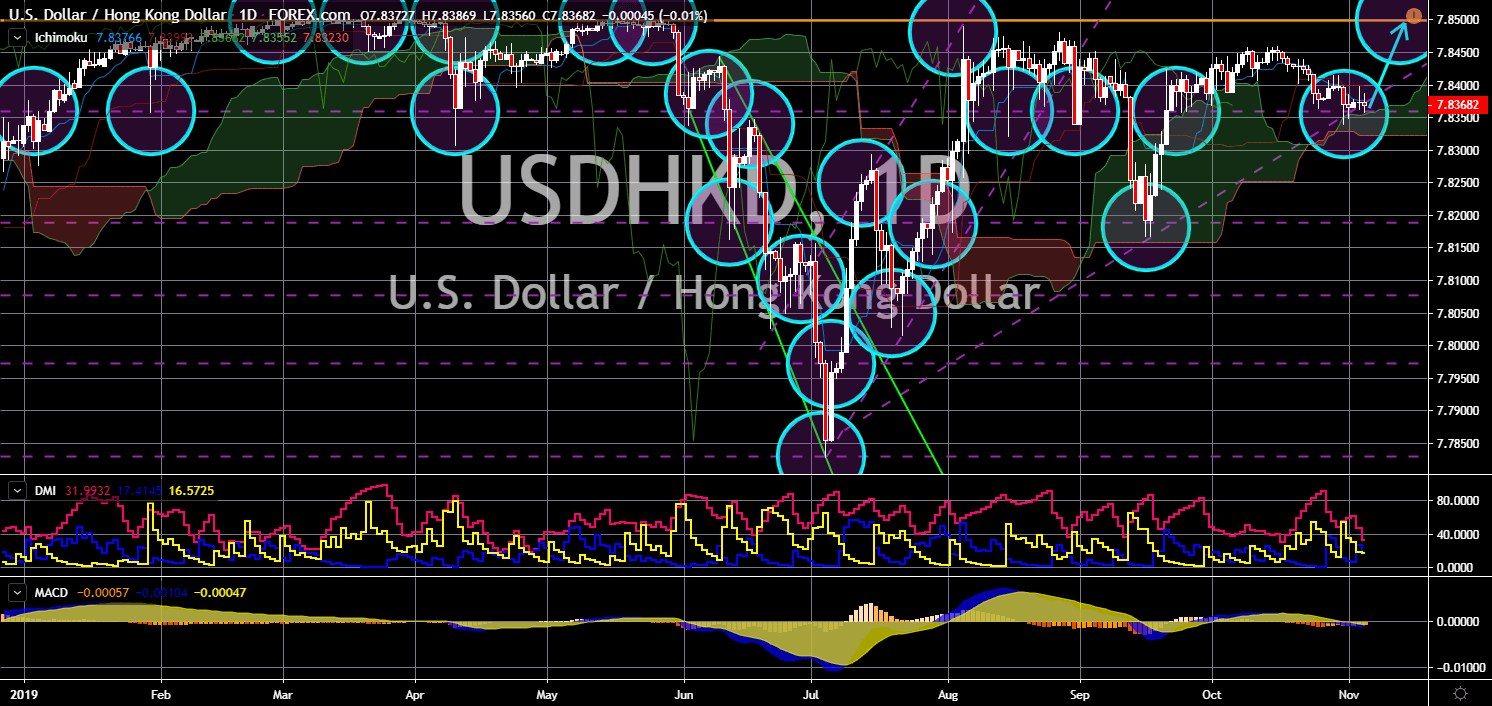

USD/HKD

USD/HKD

The pair is expected to bounce back from a major support line and an uptrend support line. Hong Kong falls into recession for the first time in a decade and a further slump in the administrative region’s economy is expected. Months of civil unrest in Hong Kong had forced several businesses to shut down. Aside from this, Hong Kong might lose its city-state status if protests will not end in the near future. The United States lawmakers are also forging a way to increase its support to Hong Kong protestors. The U.S. Congress drafted a bill that will review its trading relations with the administrative region if Hong Kong fails to certain criteria. Hong Kong has been an economic and political pawn China to defy U.S. sanctions. The arrest of Chinese telecom giant Huawei’s Chief Finance Officer roots from Huawei’s supplying of telecommunication equipment to Iran. Iran is currently under the U.S. sanctions.

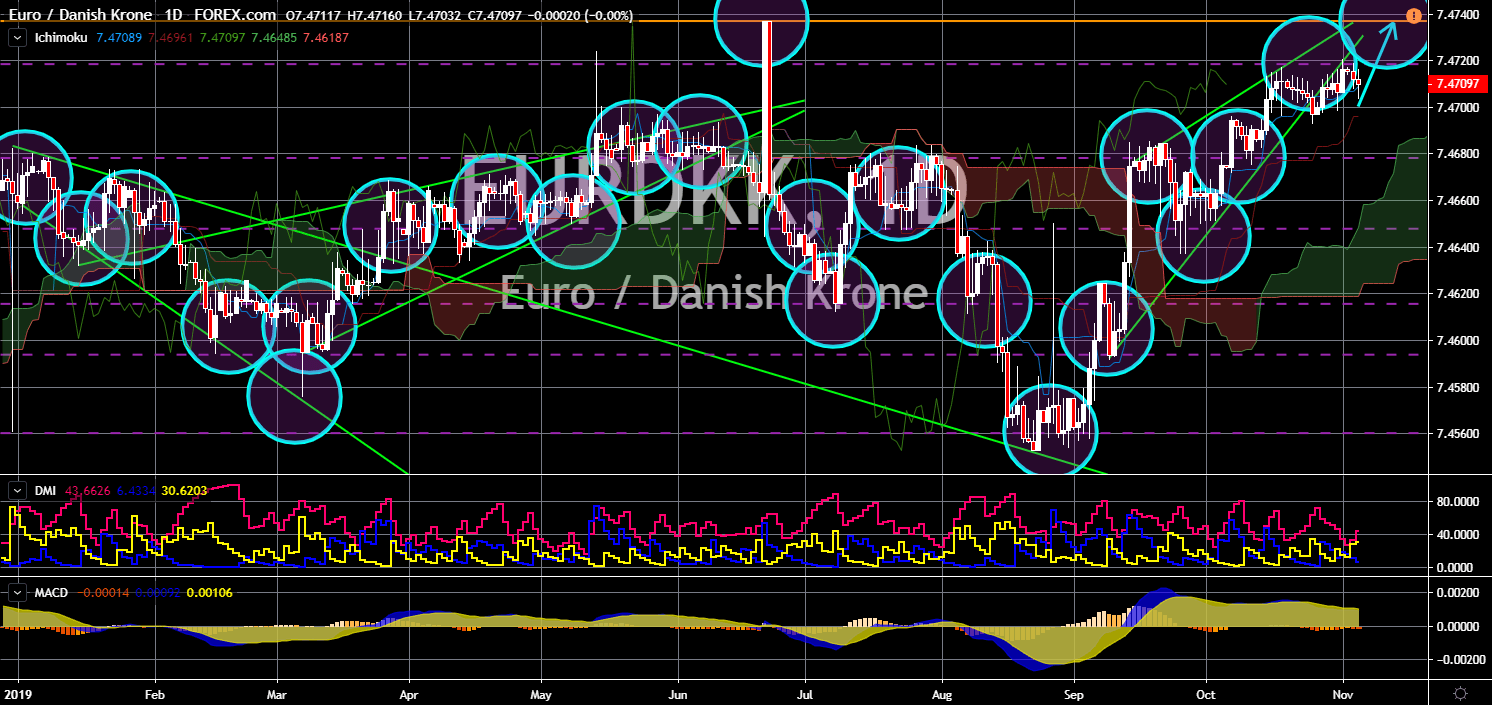

EUR/DKK

The pair will continue moving higher in the following days to retest its previous high. Denmark’s approval of the Nord Stream 2 pipeline will put the country at odds with the United States. Germany is heavily dependent on Russia’s liquified natural gas. As the country enters recession, Denmark is trying to save the largest economy in the European Union by adding lifeline to its car manufacturing industry. However, this could add anger to U.S. President Donald Trump who skipped his meeting with Danish Prime Minister Mette Frederiksen. This was amid the PM’s refusal to discuss the sale of Greenland which is part of the Kingdom of Denmark. In another news, Margrethe Vestager was reappointed as EU’s commissioner for technology. She led the digital taxation of U.S. technology giants like Apple and Alphabet (Google). Despite this, Germany and France still hold major positions in the European Commission.

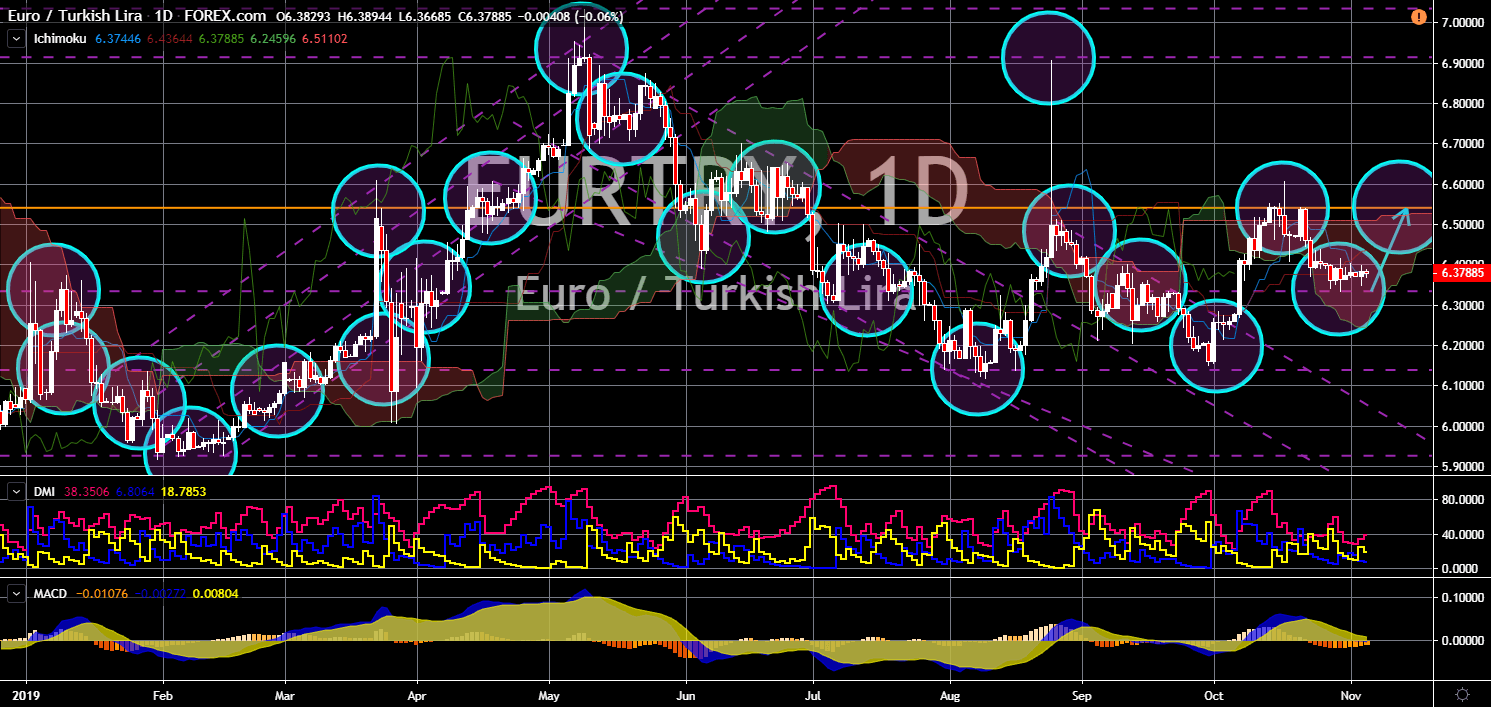

EUR/TRY

The pair is expected to bounce back from a key support line, which will send the pair higher towards a major resistance line. The EU-Turkey relationship is in trouble following the recent moves by Turkey. Turkey has been in accession talks since 2005. However, progress was slow with only 16 out of 35 chapters for accession was completed. Aside from this, Turkey’s lack of progress in reforms and fundamental rights and freedom has been dragging the accession talks. In line with this, the European Union cuts over €1 billion in funds for Turkey over two (2) years. Further, the EU-member states commit to arms export ban against Turkey following its offensive move in Northern Syria. Turkey retaliated by suggesting opening its borders to the EU to allow mass migration. This could potentially drag the relationship among EU nations in the future. The largest trading bloc has been divided on issues on immigration.