Market News and Charts for November 04, 2019

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

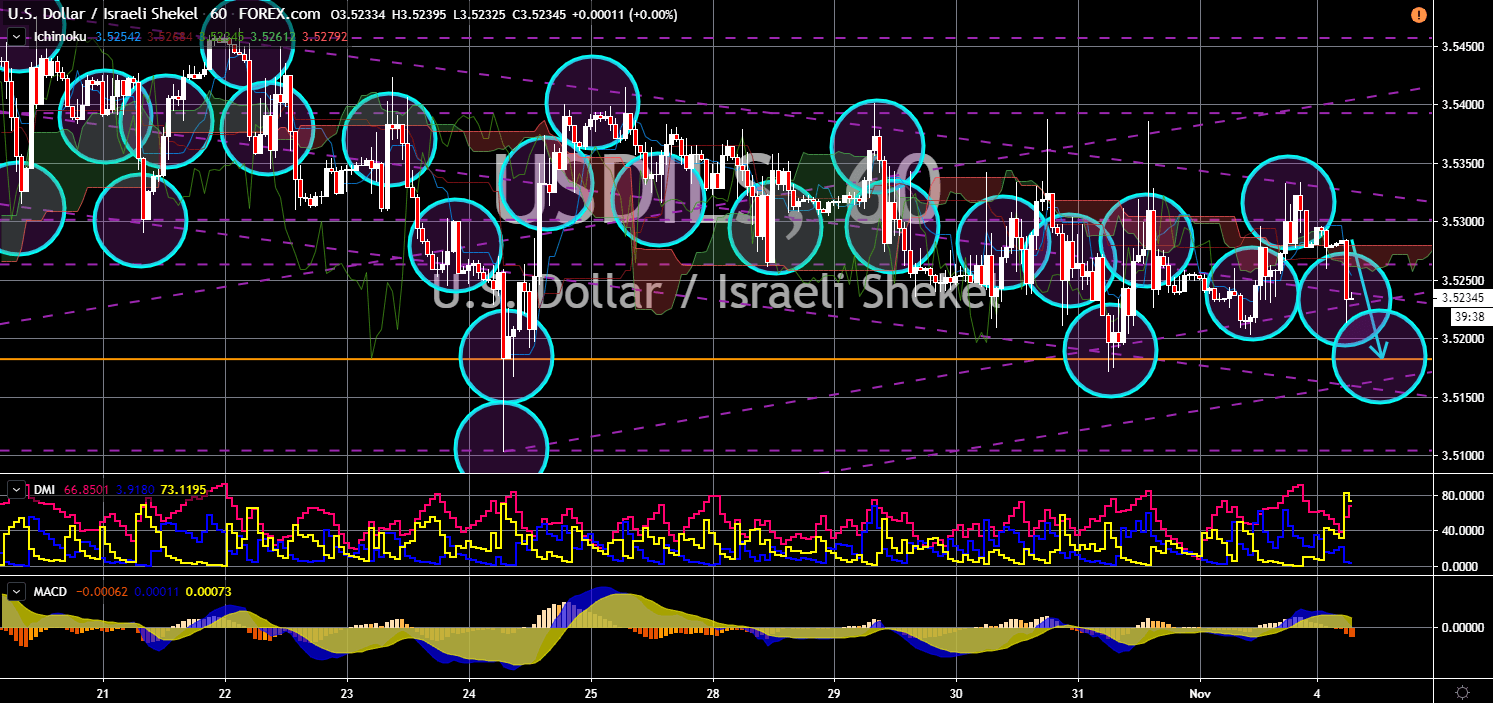

USD/ILS

The pair is expected to continue moving lower in the following days towards a major support line. Israel, Russia, and America are in a diplomatic standoff with the jailed Israeli woman and a jailed Russian man. Russia jailed an Israeli-American woman after being caught smuggling 9 and a half grams of marijuana to Moscow. Israel President Reuven Rivlin asked his Russian counterpart, President Vladimir Putin, to release the Israeli citizen. In return, the country will ease its arms sales to Russian enemies, including Ukraine. However, this was further complicated after the United States asked Israel to extradite a jailed Russian hacker to America. But Israel declined, citing the on-going swap with Russia on the jailed Israeli-American woman. This is expected to put spat on the U.S.-Israel relationship. The U.S. had supported Prime Minister Benjamin Netanya during the recent election.

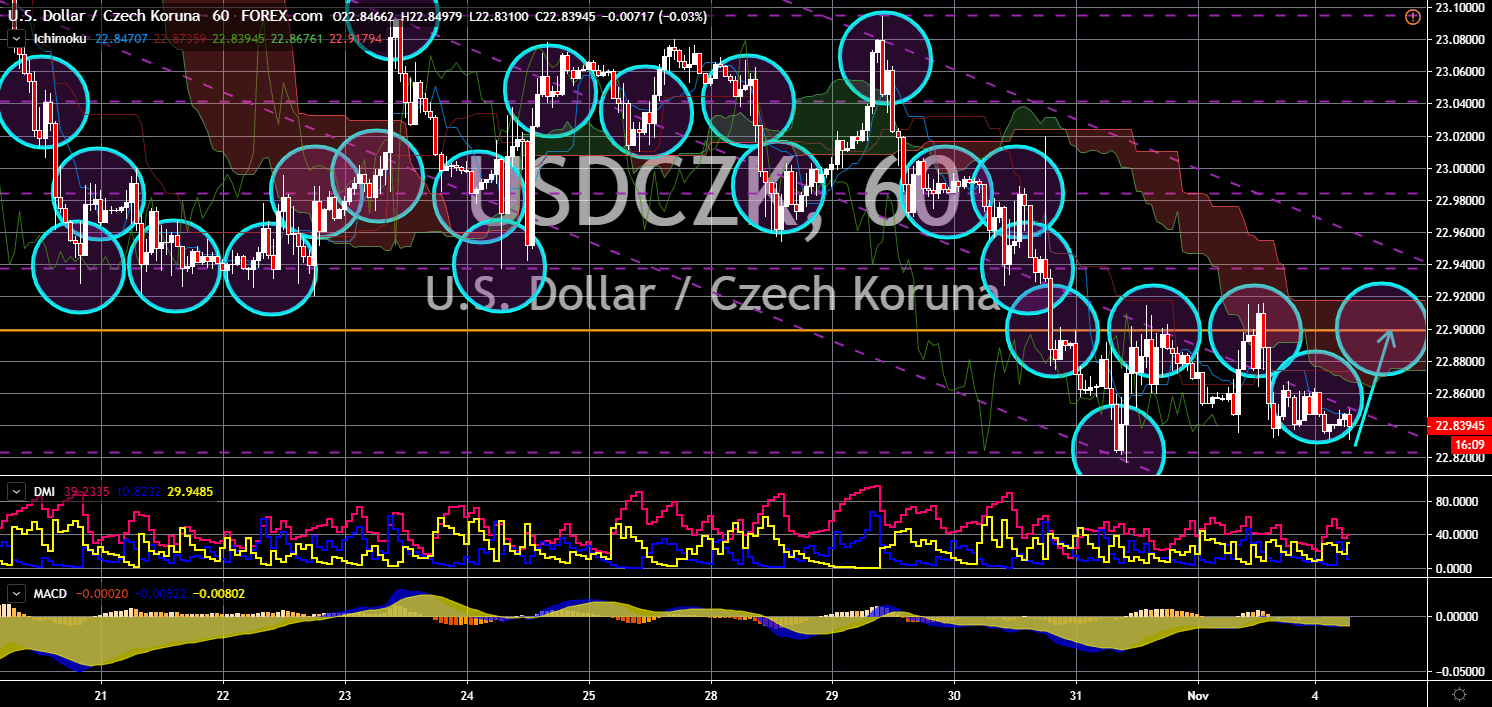

USD/CZK

USD/CZK

The pair will bounce back from its current low and breakout from a downtrend channel’s middle resistance line. The Czech Republic recently celebrated the independence of Czechoslovakia from the Astro-Hungarian Empire. This was despite the peaceful separation of Czechia and Slovakia in 1993 after 75 years of being together. It also celebrated its 15th year of being an EU-member state in May. However, its view of global issues could lead the country to breakaway again, now from the EU. The United States successfully lobbied Czech politicians to ban Chinese telecom giant, Huawei, amid spying allegations. It was the only European country to do so despite being the closest to the Chinese government. Germany is pushing for deeper cooperation between the world’s largest trading bloc and the world’s second largest economy. This was following the successful ratification of the EU-Japan free trade agreement (FTA).

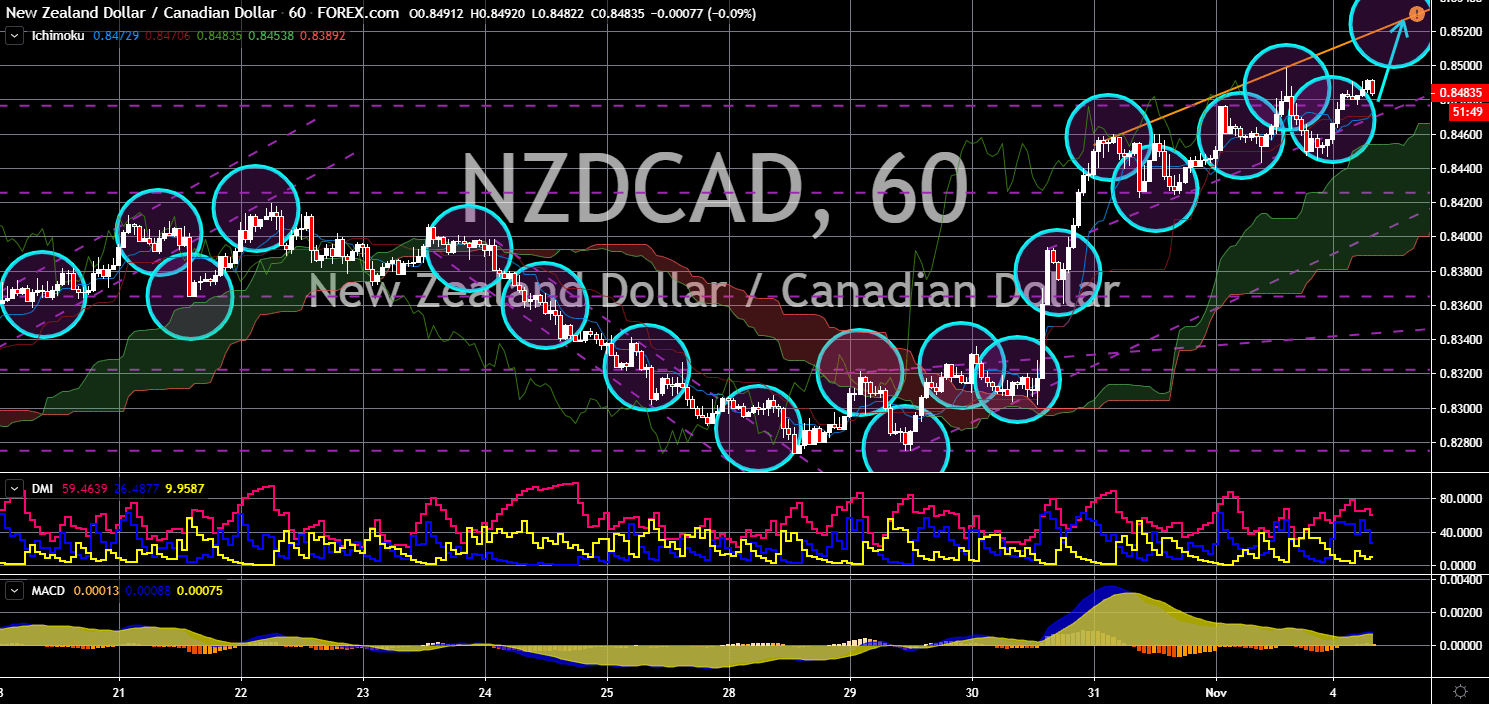

NZD/CAD

The pair is expected to bounce back from the support line, sending the pair higher toward its all-time high. New Zealand is leading the new trend for countries around the world. In 2018, New Zealand, together with Scotland and Iceland, formed the Wellbeing Economy Governments group. These countries agreed that economic growth should not be pursued. Instead, they should focus and be accountable for the quality of life outcomes of its citizens. This triggered a major shift in the recent Canadian election wherein PM Justin Trudeau was reelected for his second term. On his speech, Trudeau mentioned that his Canada Child Benefit program lifted 287,000 families above the poverty level. This weighs more than his common arguments that his government was able to add millions of jobs or that Canada has the fastest gross domestic product (GDP) among the G7 nations.

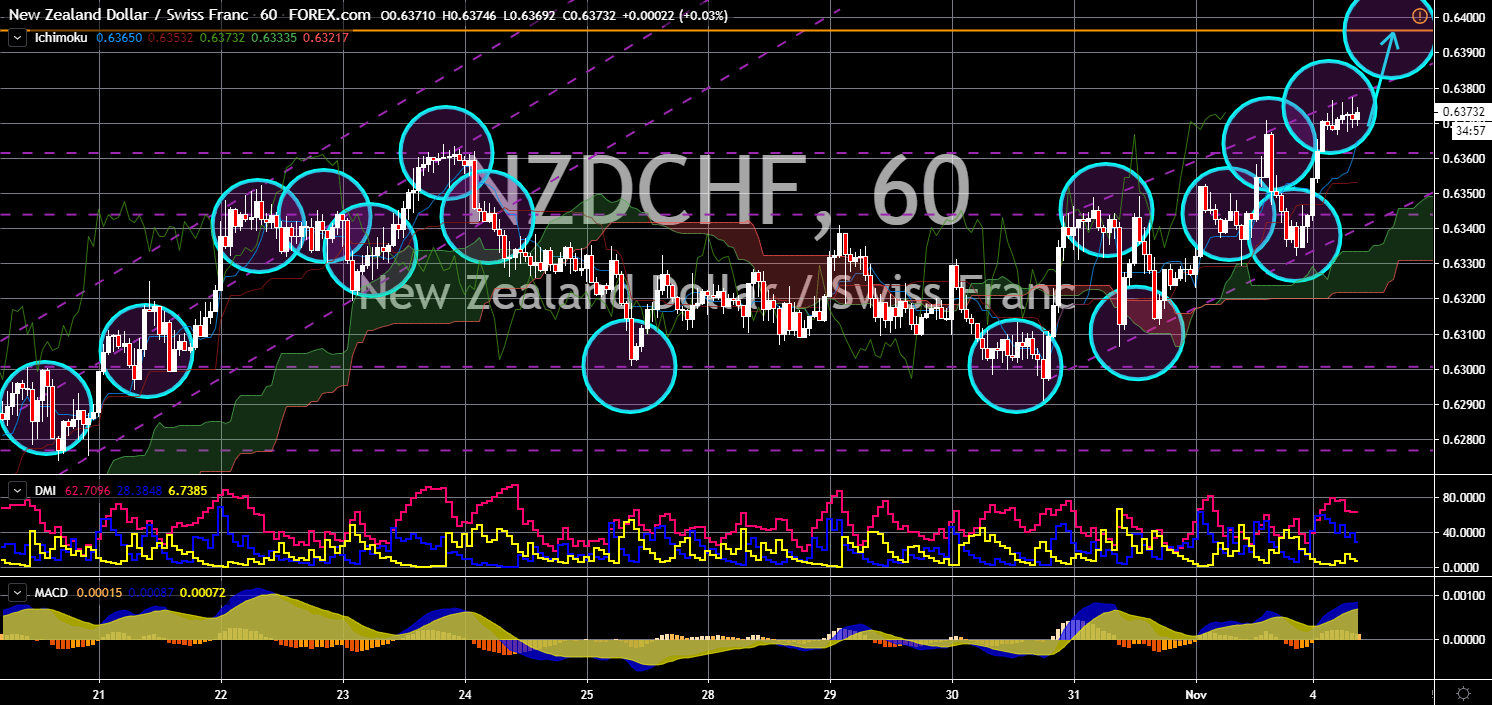

NZD/CHF

The pair will continue to move higher in the following days, sending the pair higher towards its 2-month high. Recent reports suggest that New Zealand was the fifth-richest country on a per-adult basis. The Global Wealth Report showed that global wealth rose by $9.1 Trillion or 2.6%. New Zealand’s growth, on the other hand, surpassed the global growth after recording 4.2% growth in the past 12 months. Its per-adult wealth was recorded at $304,120. This is the first time that the country was included on the list. The report was in line with New Zealand Prime Minister Jacinda Ardern’s move to measure growth through life quality. New Zealand, Scotland and Iceland, came up together to form the Wellbeing Economy Governments group. New Zealand is also rebranding its international policy to neutral. New Zealand abstained from choosing between the Maduro government and the Venezuelan opposition leader, Juan Guiado.

-

Support

-

Platform

-

Spread

-

Trading Instrument