Market News and Charts for November 01, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

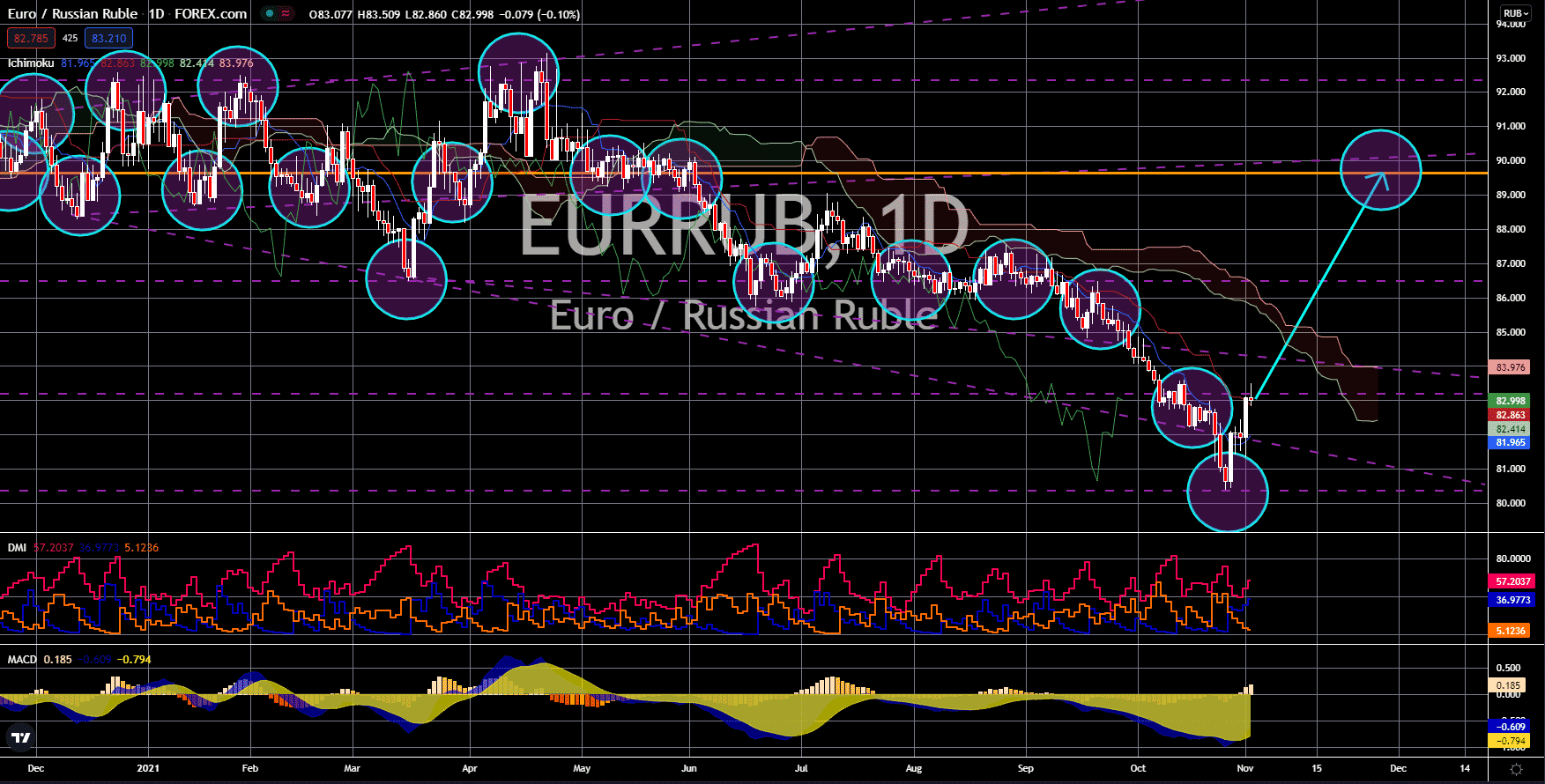

USD/RON

The United States’ Manufacturing Purchasing Managers’ Index will be up for release on the first day of November. Analysts expect a result of 59.2 points for the previous month which is slightly lower than September’s 60.7 points. Nevertheless, the consensus remains far above the 50-point threshold which separates expansion from contraction. In a separate financial data to be released by the Institute of Supply Management or ISM, October’s Manufacturing PMI is expected to keep resting above 60 points. The agency forecasts a 60.5-point settlement for the month, narrowing from the previous period’s 61.1-point hit. For the record, the world’s biggest economy encountered a trough during the third quarter as the emergency of the Delta variant took a hit on its economic activities. With this, the country’s Q3 GDP recorded a 2.2% hike, dismaying economists’ expected 2.7% growth. This is also a sharp downgrade from the second quarter’s 6.7% quarterly expansion.

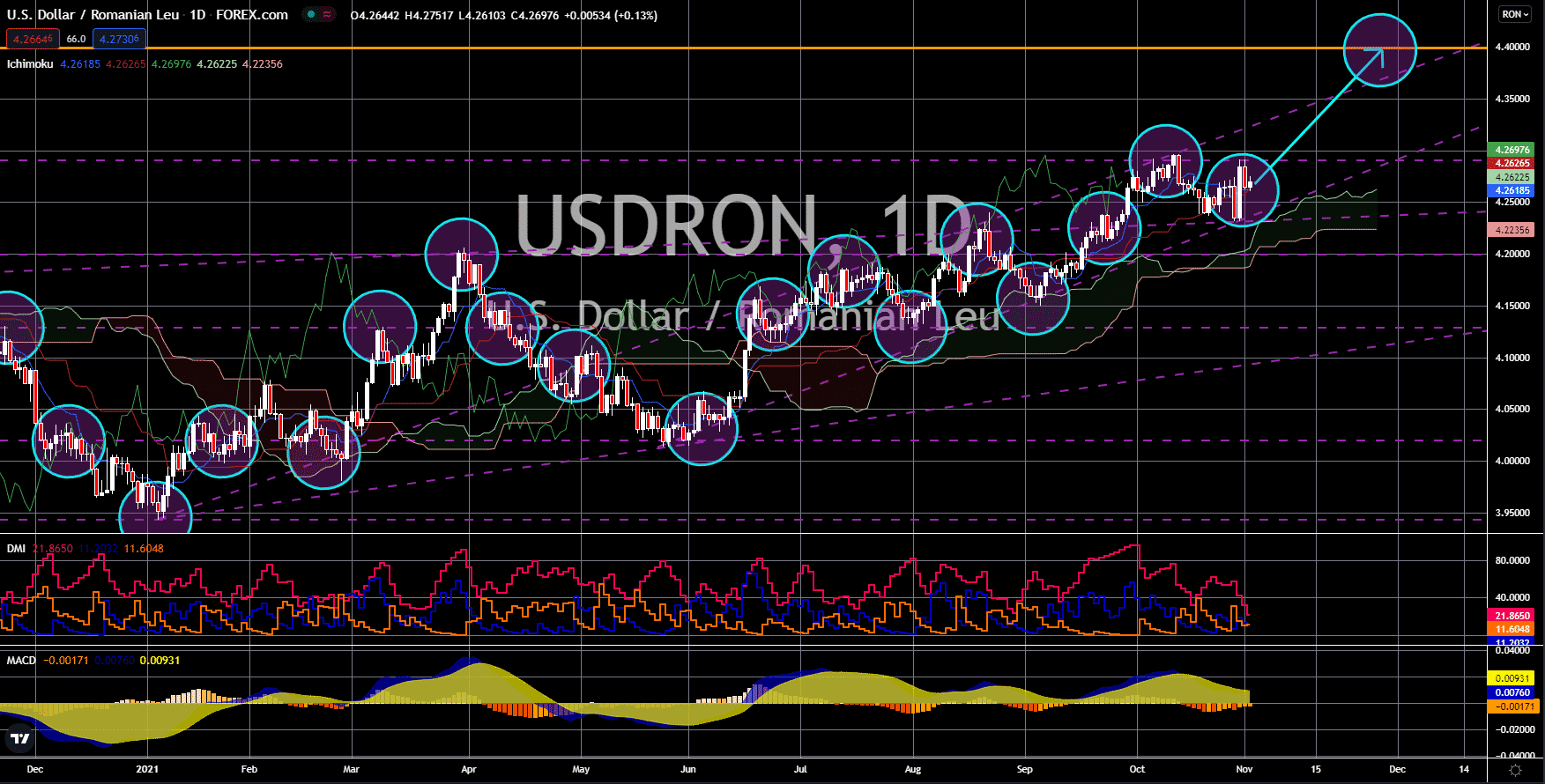

EUR/NOK

In September’s data, Norway’s Core Retail Sales hops back to the positive territory. The important indicator, which provides a valuable insight about the health of consumer spending, hikes 0.5% MoM. This is better than the forecasted -0.1% decline for the period. It is also significantly higher than the previous month’s -3.9% month-on-month stall. Likewise, the nation’s unemployment rate showed a 4.0% result in August. Such an update came to the delight of analysts which have given a 4.7% projection. It is also a sharp drop compared to July’s revised 4.3% result. For the record, the Norges Bank resorted to hiking rates to 0.25% in September after resting at 0% since May 2020. The move came amid inflation woes along with its improving economic performance. It is the first high-income nation to make such an advance during the cycle. In an estimate, analysts expect the central bank to lift rates by 25 basis points on its upcoming November 04 deliberation.

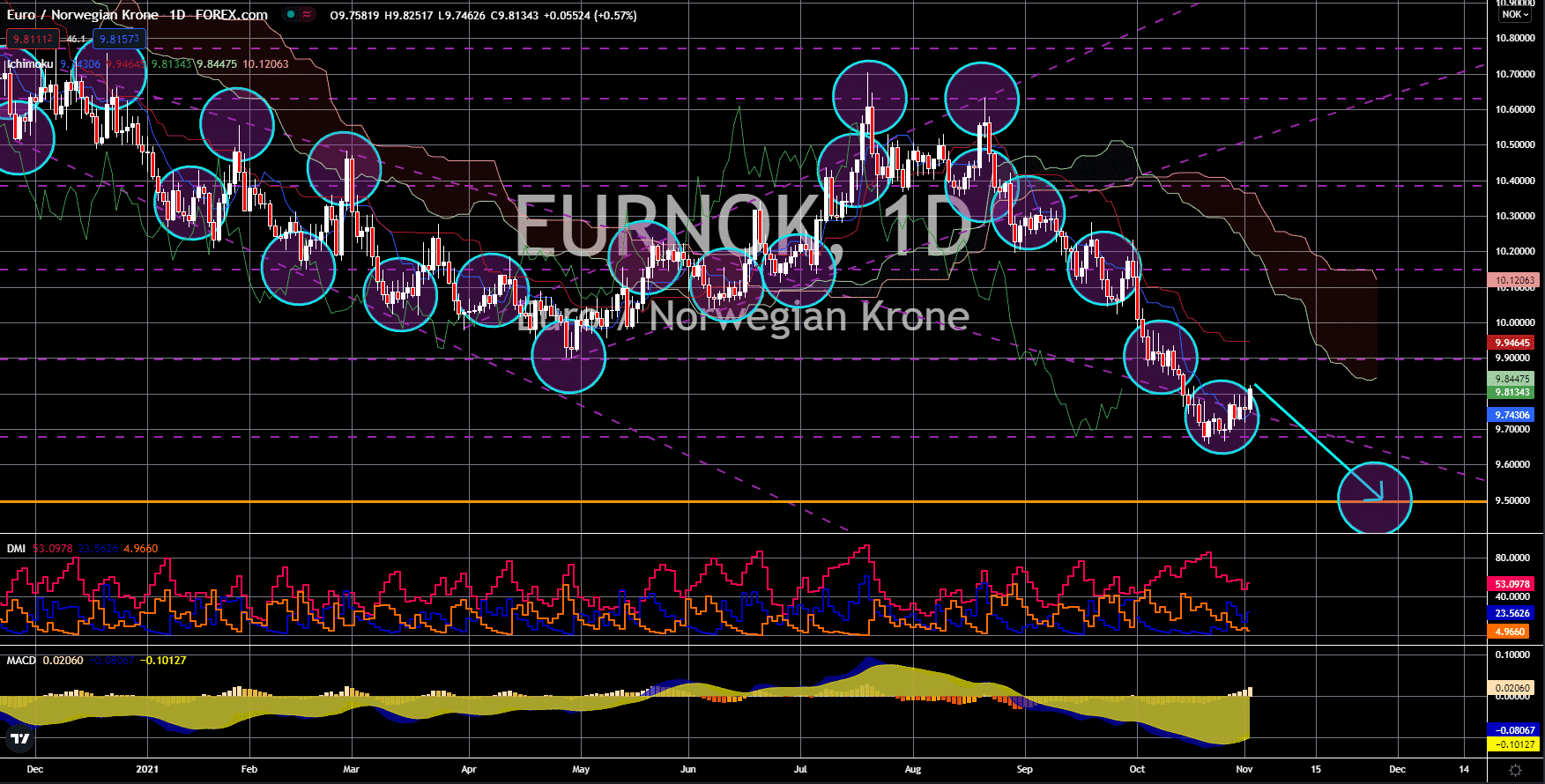

EUR/HUF

The Eurozone reports an impressive economic recovery for the third-quarter of 2021. The bloc updated a GDP growth of 2.2% quarter-on-quarter, beating Q2’s revised 2.1% pace. Analysts point at the bettering macroeconomic conditions for staging a solid footing for the EU’s recovery. On the other hand, the good news came with a source of worry. In October, the 19 member states collectively notched a 4.1% surge in Consumer Price Index which is more than twice as much as the ECB’s original 2.0% target. The result is also the highest recorded so far in more than a decade. This raises concerns on whether inflation is really just transitory as what the European Central Bank has long claimed it to be. During its latest deliberation last October 28, the monetary regulator kept its benchmark rate unchanged at 0.0%, also highlighting that hike may not come even in 2022. ECB’s Christine Lagarde claims that the Eurozone is not yet ready for a rate hike.

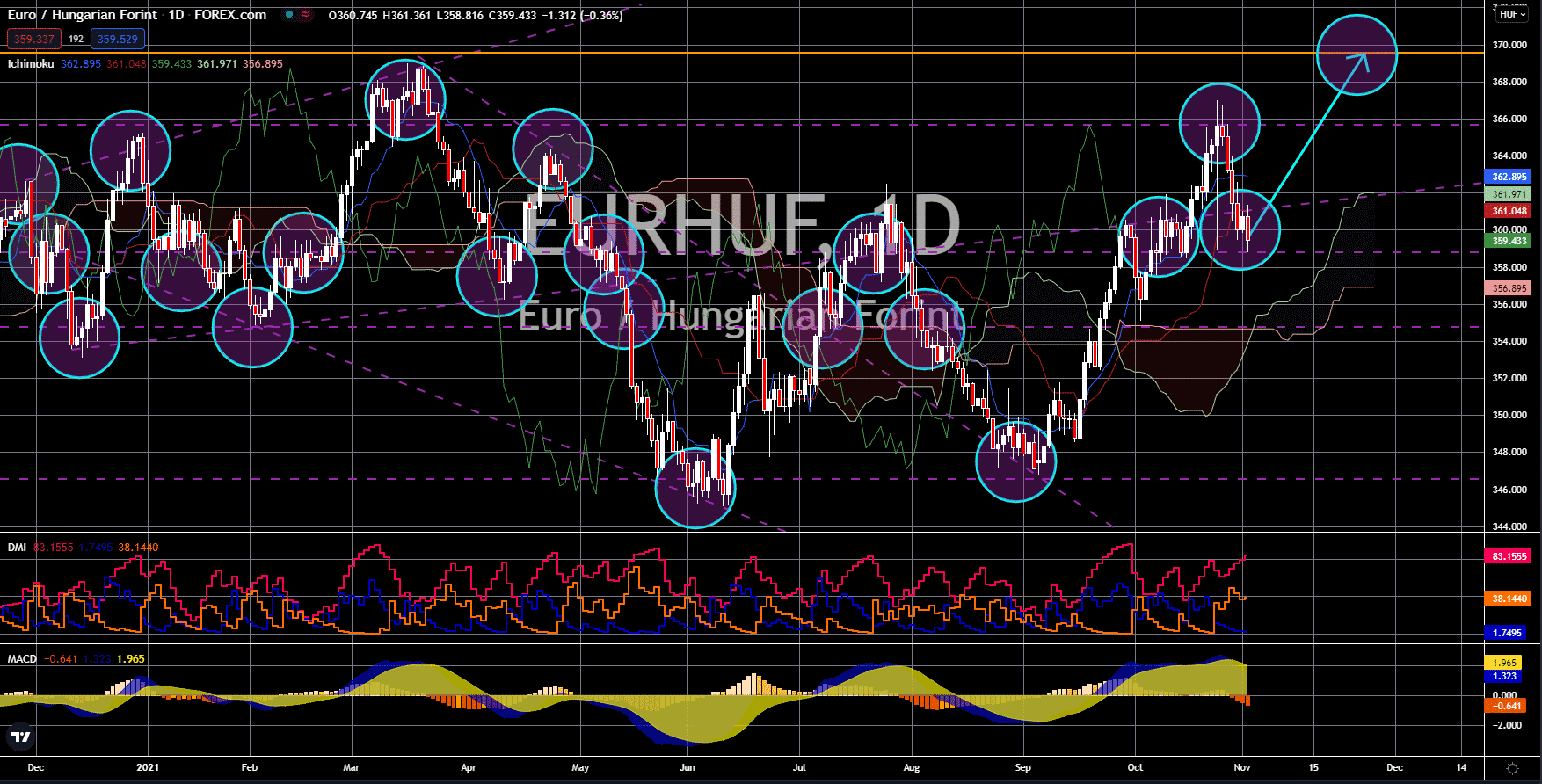

EUR/RUB

Russia’s September Gross Domestic Product slows to a 3.4% YoY growth. This is the lowest data reported so far since April this year. After failing to jump above August’s 3.7% hike, analysts are worried that this might be the start of a sustained downtrend for the indicator. In defense, the economy ministry said that the country’s recovery is faring better than expected. Year-to-date, Russia’s GDP recovery has so far recorded a 4.6% pace. This is better than last year’s 4.0% result over the same period. Moreover, the unemployment rate rested on the green side after reporting 4.3% in September. The result is lower than analysts’ expected 4.5% notch and August’s 4.4% result. Adding to the overall optimism among economists is the retail sales jump during the same month. The indicator showed a 5.6% recovery which is far higher than the 3.8% forecast. This shows that Russia’s economy is performing better all across the board despite ongoing challenges.