Market News and Charts for November 01, 2019

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

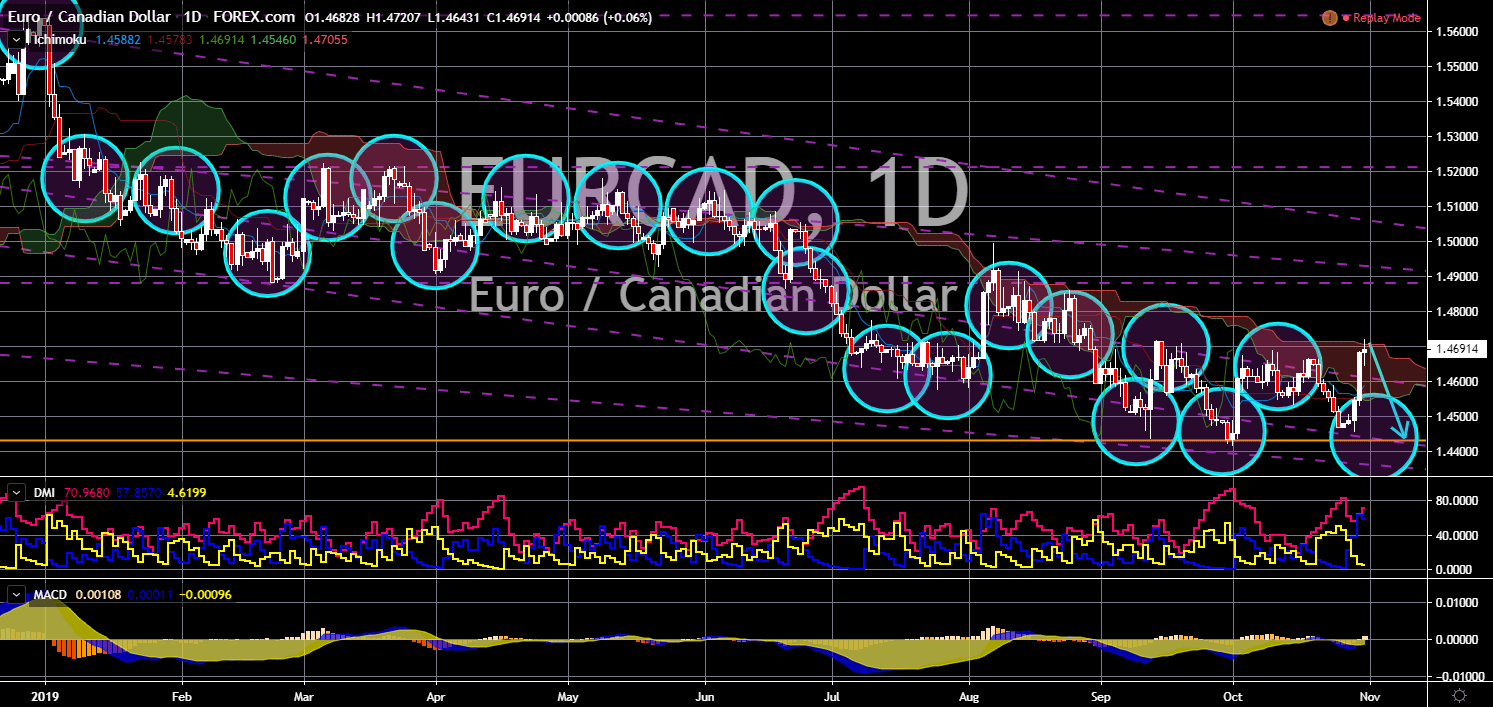

EUR/CAD

The pair is expected to move lower in the following days after its rally. The European Union is under pressure from the Brexit party leader Nigel Farage. This was after his statement that he will form a “leave alliance” ahead of the December 12 general election. The UK Parliament approved British PM Boris Johnson to conduct a general election. This was after they forced the prime minister to send a Brexit extension letter to the European Council President Donald Tusk. Farage accused Johnson of a “sell-out” Brexit deal during his meeting with the European Commission President Jean-Claude Junker. Nigel Farage got backing from President Trump as the Brexit delays the potential U.S.-UK bilateral trade agreement. Canada, on the other hand, has been weighing whether to sign a trading deal with Britain or the European Union. A np-deal Brexit is favorable for Canada as tariff restrictions will be limited.

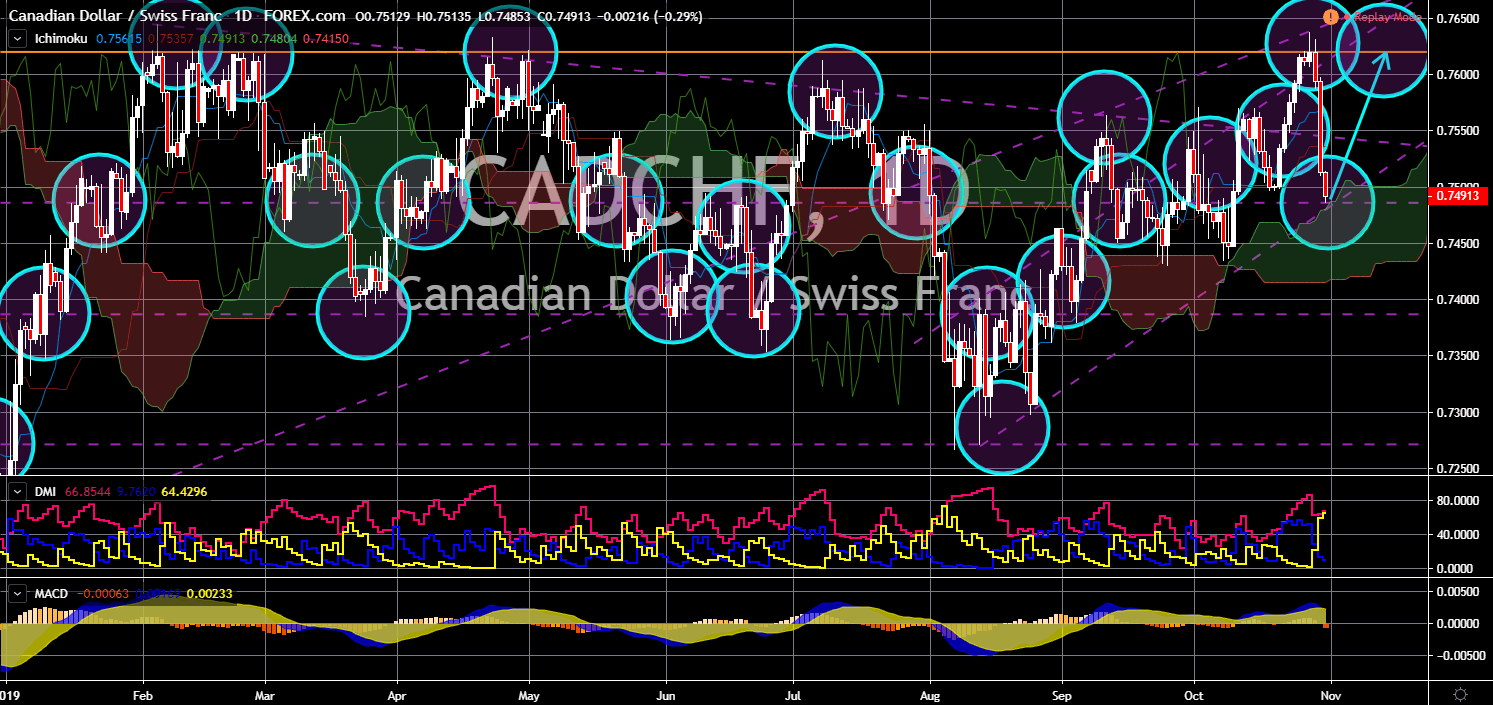

CAD/CHF

CAD/CHF

The pair will bounce back from an uptrend channel support line, sending the pair higher towards its previous high. The Brexit extension is causing havoc on post-Brexit trade agreement signatories. This is particularly evident with Switzerland who refused to sign a framework deal with the European Union. Canada, on the other hand, is weighing the pros and cons of signing to either of the parties. The country already received a greenlight from the European Parliament but is still waiting for the temporary tariff rates by the United Kingdom. Canada is also not in a rush as the country is also a member of a large trading pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Switzerland, on the other hand, was heavily exposed to European countries for its imports and exports. A delayed Brexit withdrawal and being at odds with EU-member states can affect Switzerland’s economy.

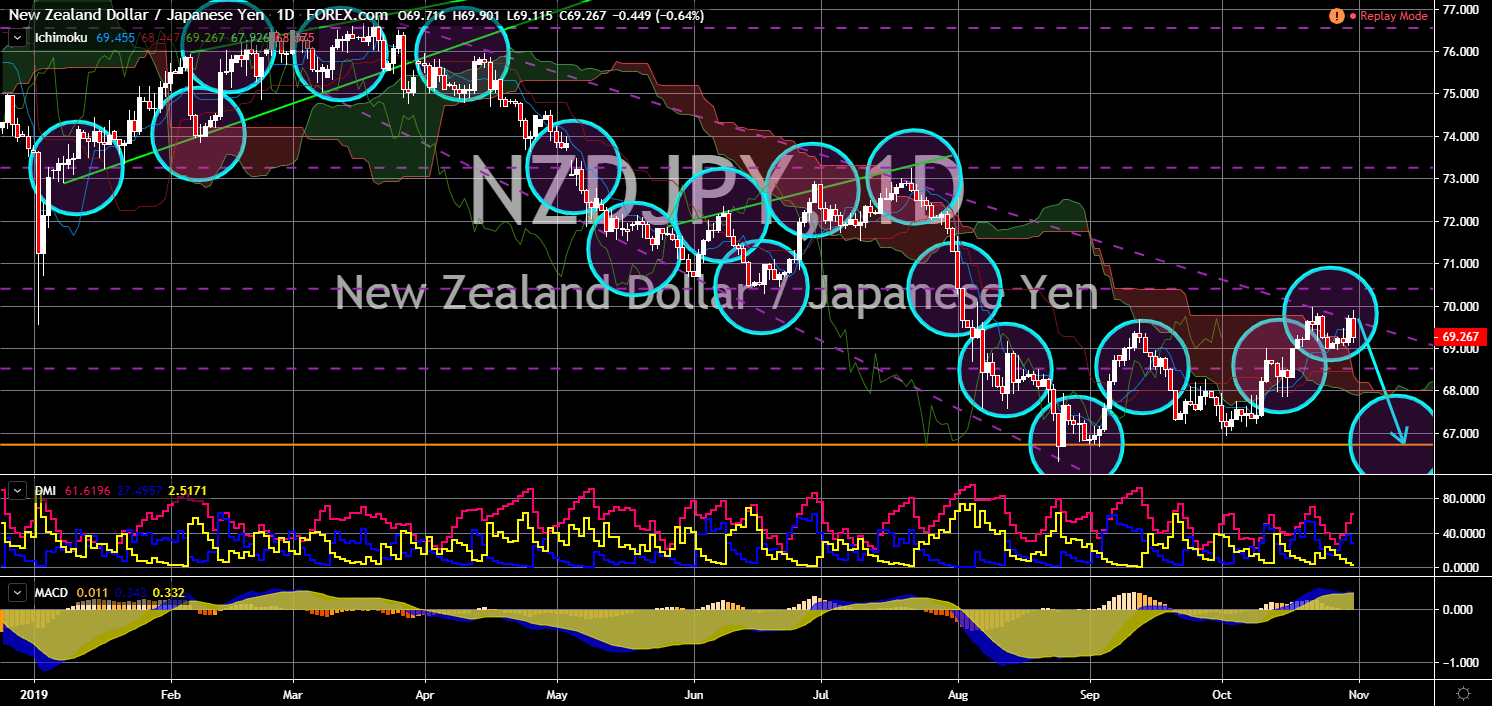

NZD/JPY

The pair is expected to fail to breakout from a downtrend channel resistance line, sending the pair lower. Asian leaders will meet today, November 01, for the 35th ASEAN Summit. The Association of Southeast Asian Nation is composed of 10 Asian nations that aims to promote intergovernmental cooperation and facilitate economic, political, security, military, educational and sociocultural integration among its members. The ASEAN Plus Six includes Japan, South Korea, China, Australia, New Zealand, and India. The trade agreement between the ASEAN Plus Six is known as the Regional Comprehensive Economic Partnership (RCEP). This is expected to further boost Japan’s influence as an economic power. The country heads the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), ratified the EU-Japan Free Trade Deal, and signed a bilateral trade agreement with the United States.

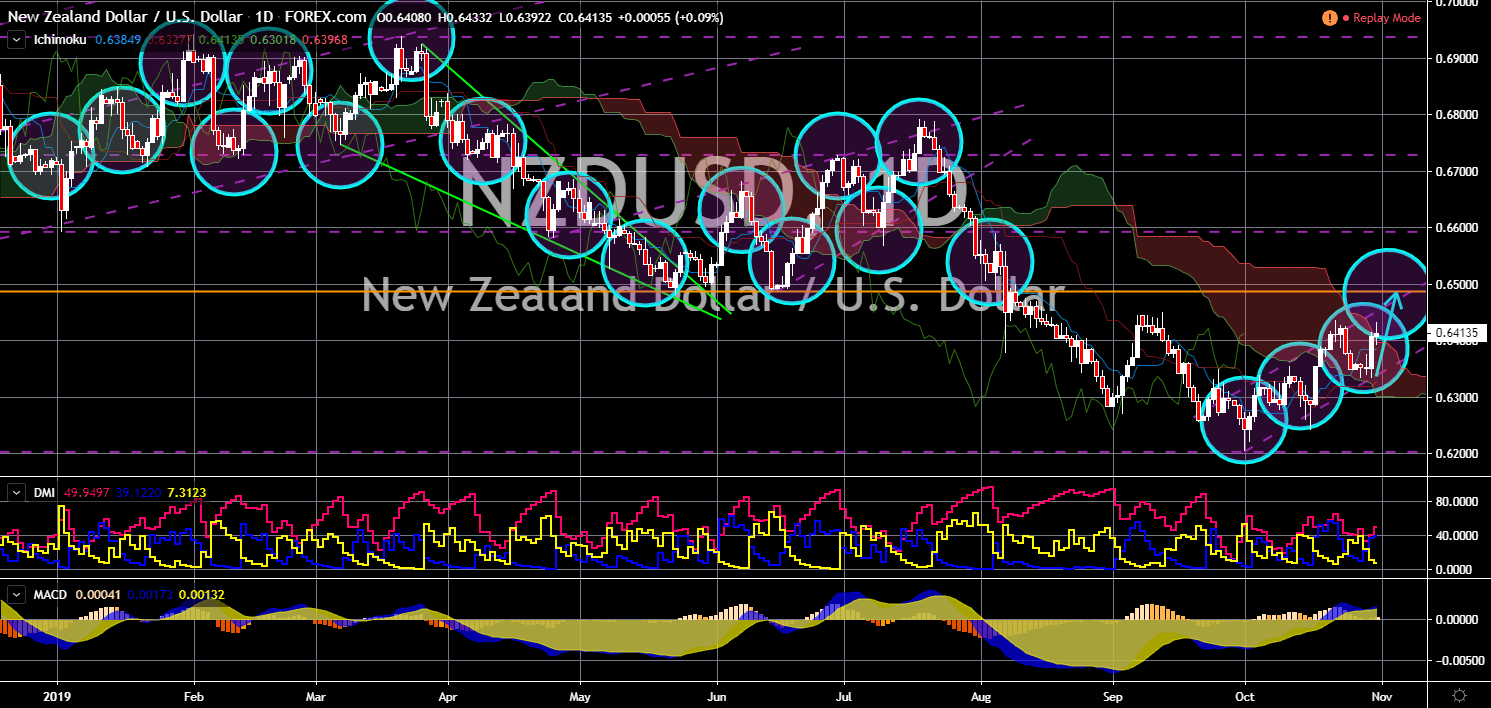

NZD/USD

The pair is seen to continue moving higher with its short-term uptrend channel to retest a major resistance line. While the United States is building a tariff wall, Asian countries are betting on free trade agreements. The ratification of the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), without the U.S. is a slap to President Donald Trump who withdraw from the pact in 2017. In addition, the Association of Southeast Asian Nation is teaming up together with advanced economies to promote globalism. The ASEAN Plus Six (Japan, South Korea, China, Australia, New Zealand, India) is planning to lay the foundation of the RCEP (Regional Comprehensive Economic Partnership). Analysts were anticipating the rise of the East with China and India leading the growth. Meanwhile, most of the emerging economies are coming from Southeast Asia.