Market News and Charts for May 31, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

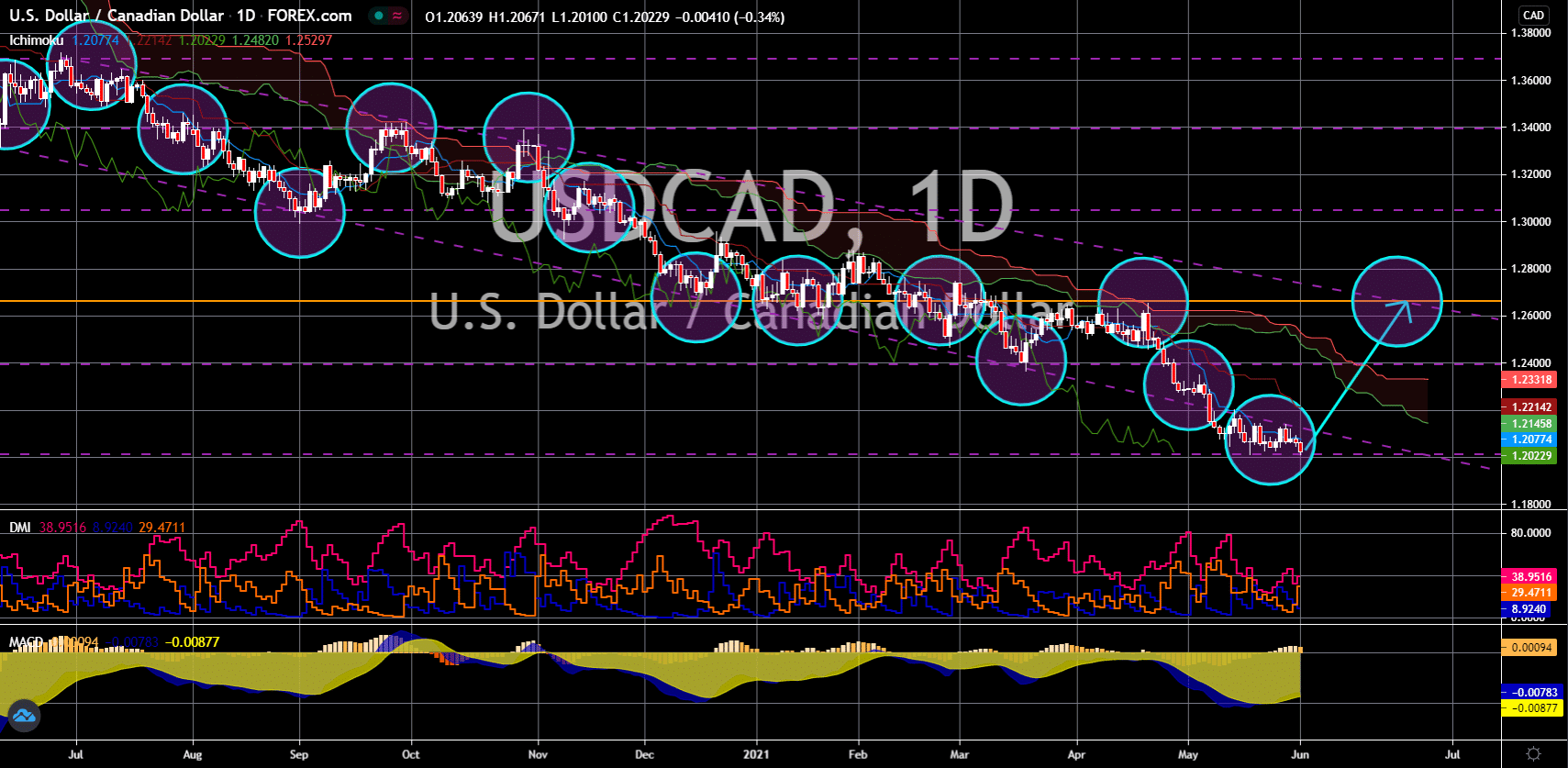

EUR/CHF

The pair will bounce from its current support area to retest March 05’s intraday high of 1.11519. A combination of positive data and negative numbers will drive the euro higher. Italy’s GDP expanded by 0.1% in the first three (3) months of fiscal 2021. This was in contrast to Germany and France’s GDP results which contracted by -1.8% and -0.1%, respectively. However, the EU’s third-largest economy is still -0.8% below its pre-pandemic level. Meanwhile, the bloc’s preliminary CPI data for May shows promising results. The initial result for the consumer price index is an increase of 2.0% year-over-year (YoY), which was in line with the ECB’s annual inflation target. This could prompt the European Central Bank to tighten its monetary policy. Also, for the 27-member state bloc, the average unemployment rate is 8.0% for the month of April. This was the lowest recorded figure in the past eight months or since September 2020.

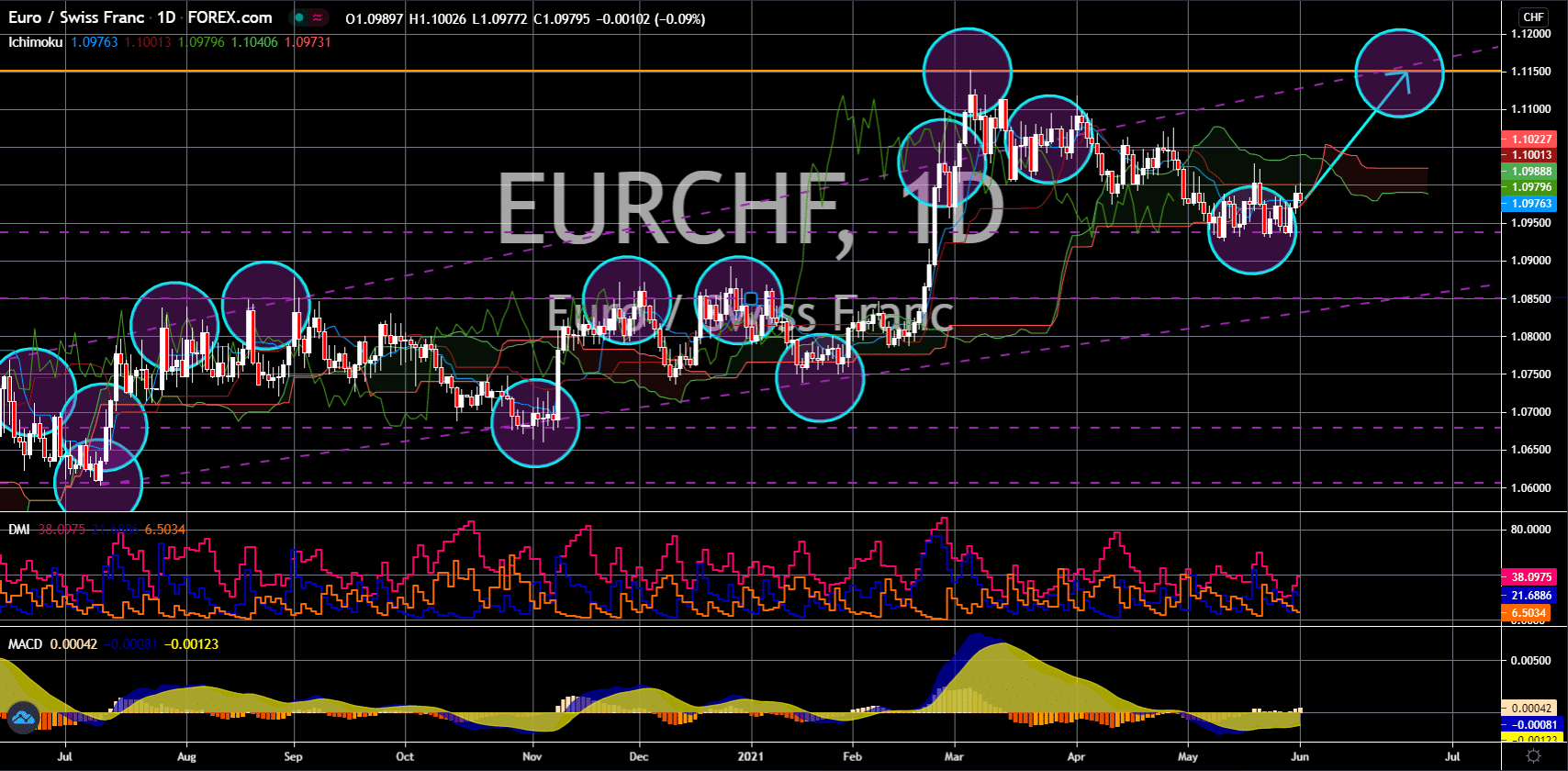

EUR/GBP

The pair will break out from the downtrend channel resistance line to retest a major resistance area around 0.89000. Demand for the British pound will start to fade as the UK economy plans to lift COVID-19 restrictions in England by June 21. This will cause a surge in FTSE 100 while the British pound will shrink against the euro currency. The UK’s housing market continued to advance in May as the gradual lifting of restrictions in mid-March provided home buyers with down payment. The figure came in at 1.8% in May and a year-over-year (YoY) growth of 10.9%. The OECD revised the UK’s 2021 GDP forecast to 7.2% after the contraction of -9.8% last year. The growth is expected to continue in 2022 with a 5.5% consensus estimate. The current year’s forecast is well above the global average growth of 5.8%. The UK’s fully vaccinated individuals represent 42% of the entire population against America’s 1.2%.

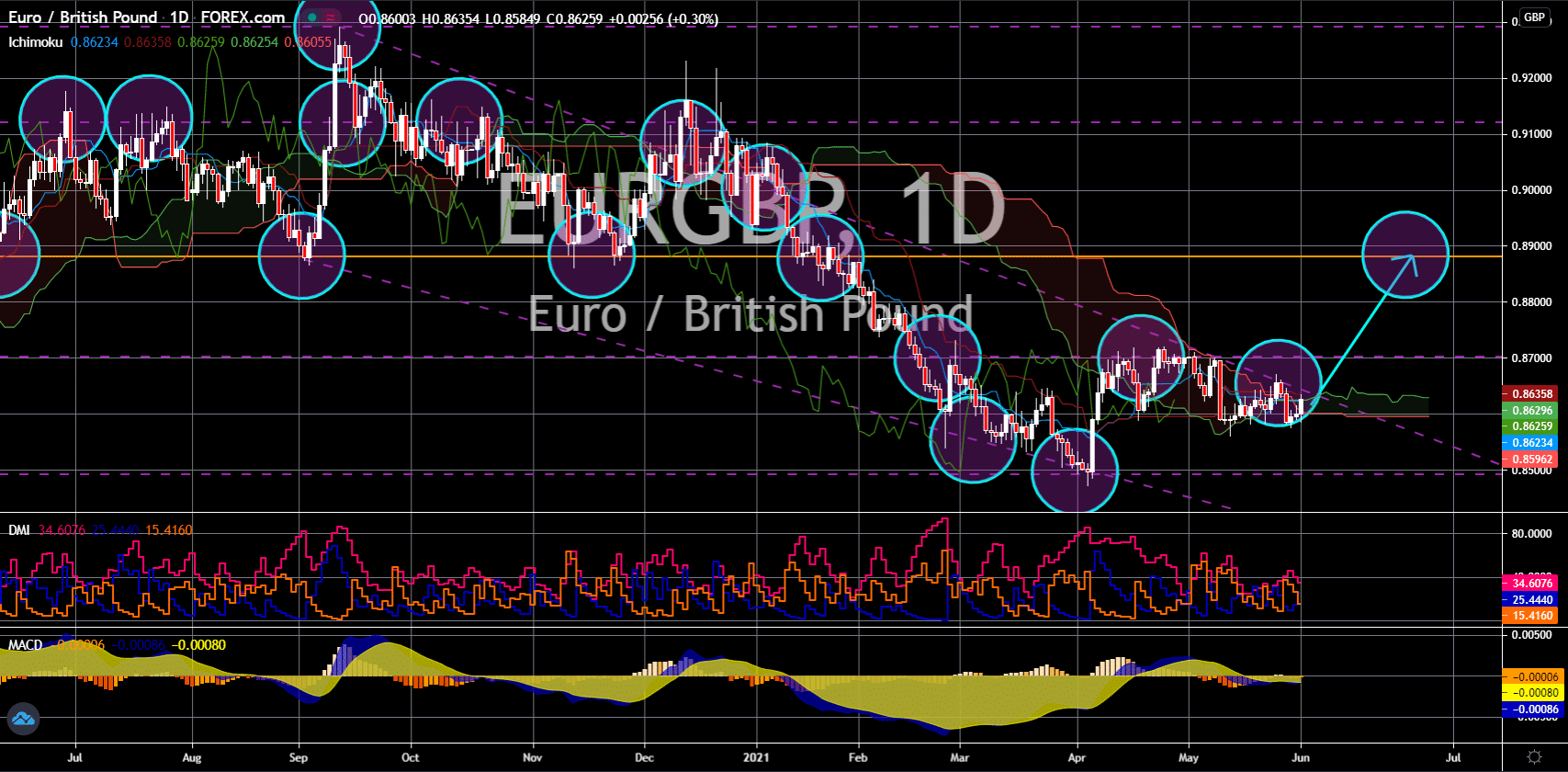

EUR/JPY

The euro will continue to advance against the Japanese yen towards 140.000. Businesses in Tokyo are refusing to expand their business operations amidst uncertainty due to COVID-19. Capital spending was down -7.8% in the first quarter of 2021, which ended two (2) consecutive quarters of improving results. The figure justifies the 3.3% growth in construction orders, which was much slower than March’s 12.5% increase. The Household Confidence Index was also down to 34.1 points in May from 34.7 points in the prior month. While industrial production and retail sales reports from Sunday, May 30, show advances by 2.5% and 12.0%, respectively, the numbers are still below the estimates of 4.1% and 15.3%. In other news, the Tokyo Olympics will proceed in July despite warnings from health experts. A new wave of COVID-19 cases will continue to prevent Japan from reaching its pre-pandemic level.

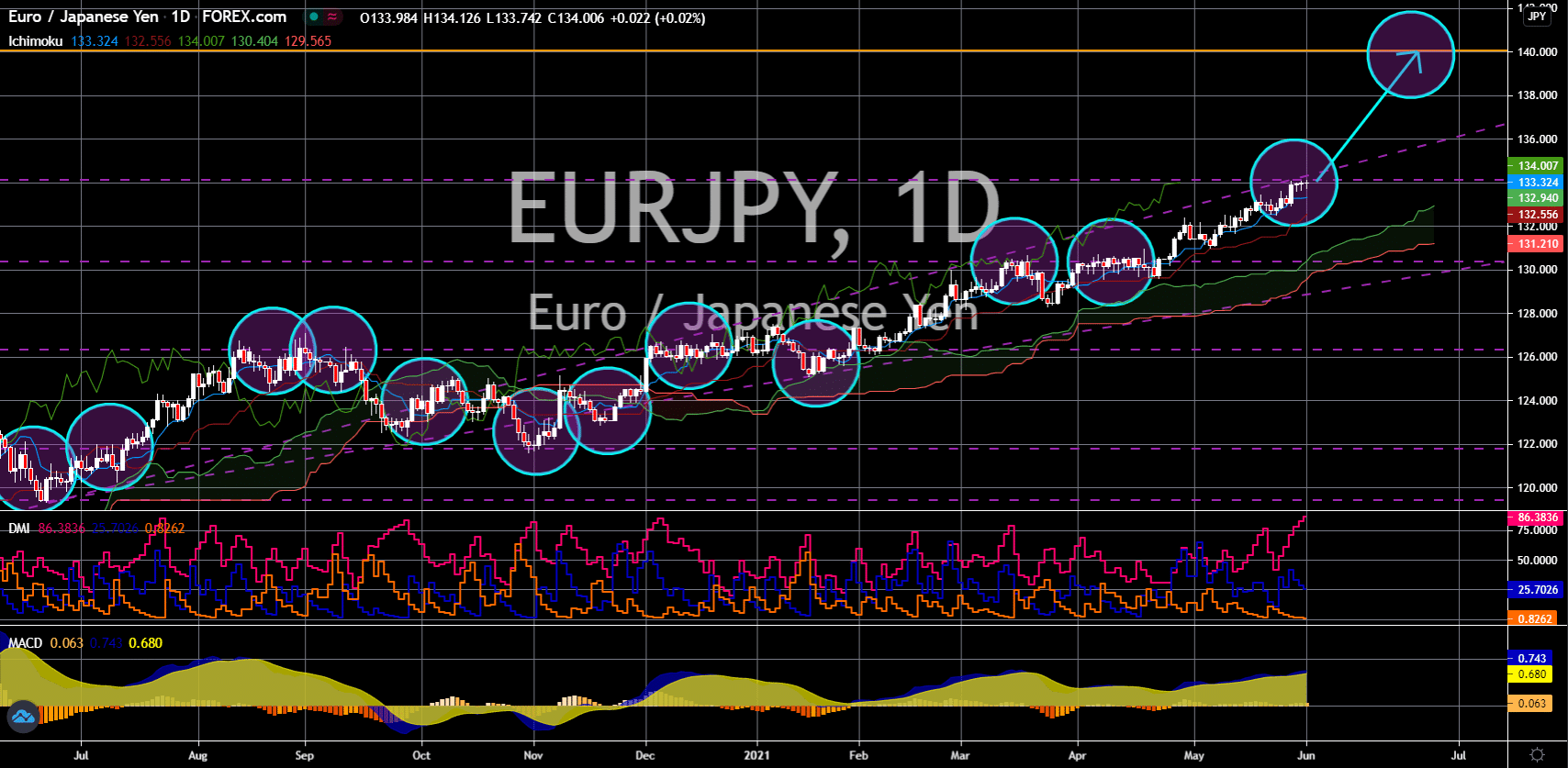

USD/CAD

The pair is expected to recover from the recent sell-off to retest a key resistance area around 1.26609. Demand for the US dollar will increase ahead of the US labor market report. The forecasted number of individuals filing for unemployment benefits is 390,000. If the actual results on Thursday came near the estimate, it will be new milestones for the lowest claimants during the pandemic and the first time it fell below the 400,000 since April 2020. Last week, the result was a record low of 406,000. The jobless claims will be followed by the monthly non-farm payrolls (NFP) report on Friday, June 04. Analysts were expecting the US economy to create 664,000 jobs for the month of May. This was following the disastrous April result of 266,000 which was only 25% of the consensus estimate. As for the unemployment rate, the projection is a decline to a 12-month low of 5.9% for May from 6.1% in the prior month.