Market News and Charts for May 18, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

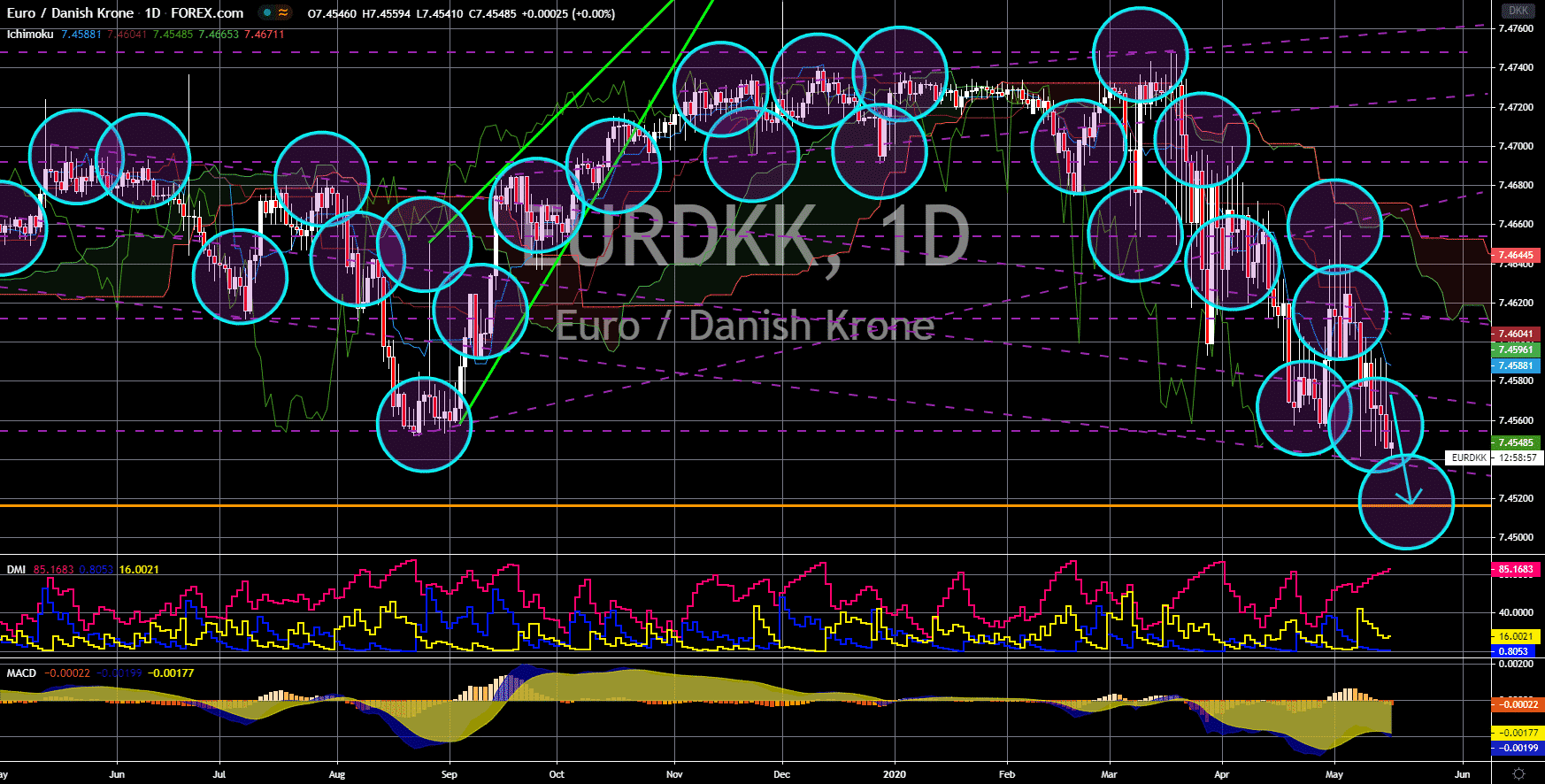

NZD/JPY

The pair will bounce back from its current support line, sending the pair higher towards a major resistance line. The Japanese economy officially entered recession today, May 18. The country’s first quarter GDP growth for fiscal 2020 fell by 0.9%, which followed the negative growth from Q4 2019 at -1.9%. This was despite the monetary measures undertaken by its government and central bank to contain the economic effect of the coronavirus. Analysts further warned that this is just the start of a gloomier outlook for the third-largest economy. Although Japan rejected the lockdown and lifted its state of emergency, its economy is still at risk. Japan signed an agreement with the Olympics Committee to host the Olympic event this 2020 as tourism in the country continues to decline. The postponement of the event will take a toll in the Japanese economy throughout 2020. On the other hand, New Zealand began reopening its economy.

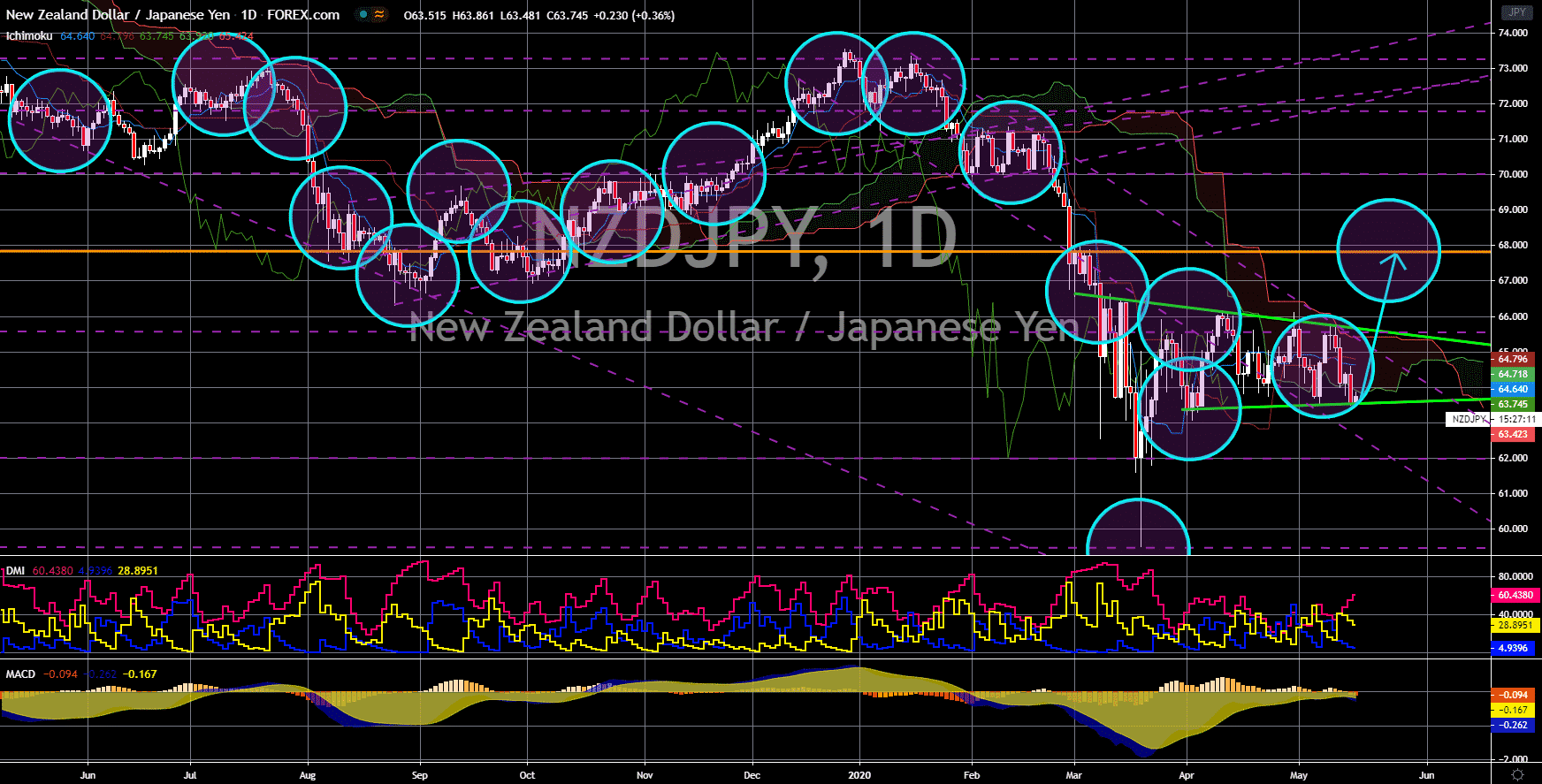

USD/HKD

The pair will breakout from a downtrend channel middle resistance line and move towards the channel’s primary resistance line. Hong Kong just posted its fourth consecutive quarter of GDP growth decline. However, analysts warned that a double whammy of events could further drag the economy of the special administrative region (SAR). The average decline for the first three (3) consecutive quarterly GDP growth was only 1.27%. However, the figure for the first quarter GDP growth for fiscal 2020 plummeted by 5.3%. The reason for the three (3) consecutive decline in GDP in 2019 was the trade war between the United States and China. On the other hand, the Q1 2020 GDP was brought by the coronavirus pandemic. However, as the US threatens to impose another round of tariffs to China, the trade war might escalate again. This, in turn, will directly hit the Hong Kong economy which will further drag its Q2 GDP report.

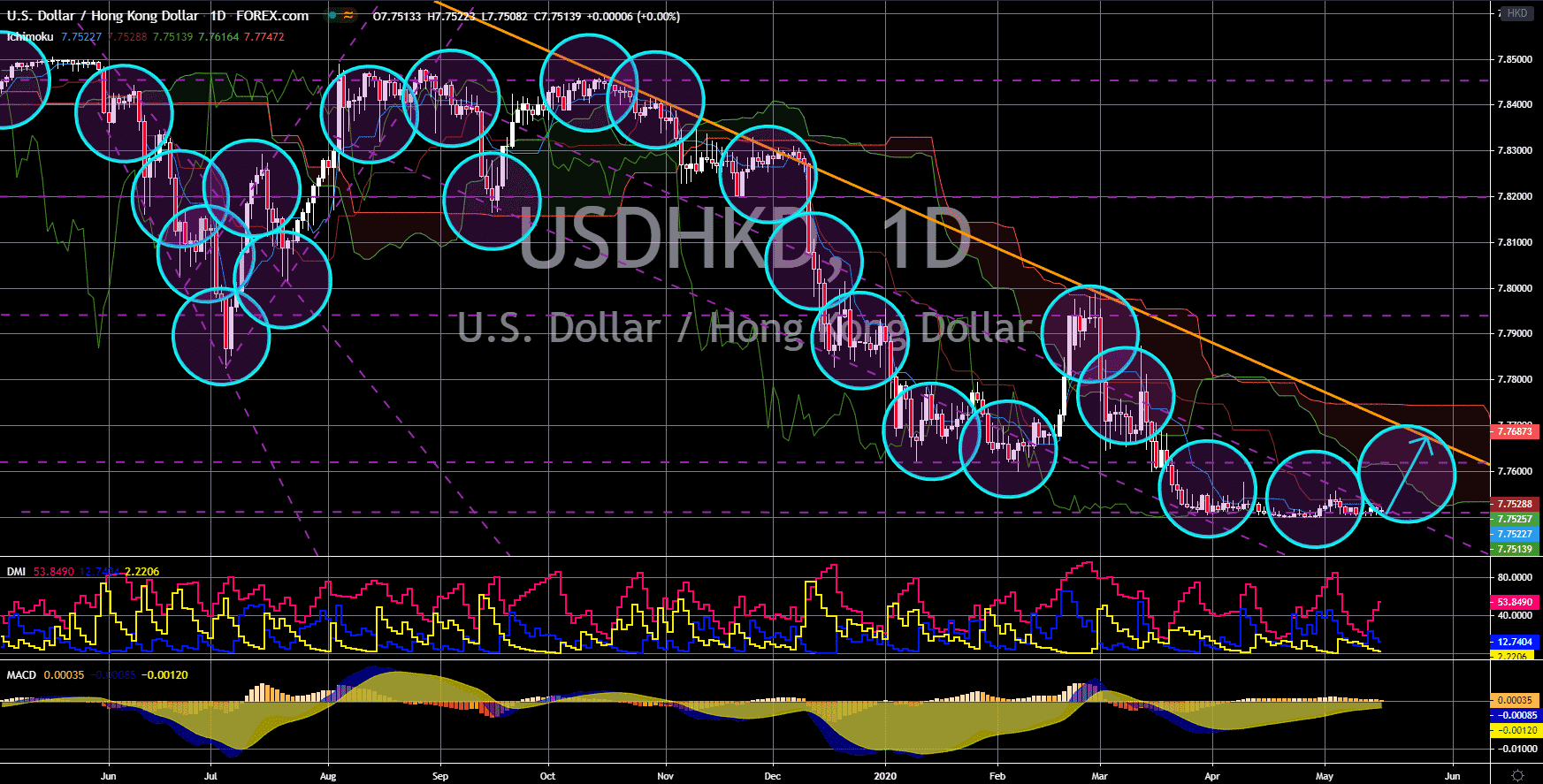

USD/SGD

The pair will bounce back from the “Rising Widening Wedge” pattern support line. Singapore is taking a toll from the coronavirus pandemic. As the largest investment hub in Asia and the fourth in the world, Singapore suffers from the lack of foreign direct investments (FDI) especially from the United States. In Asia, Singapore and China took the most hit from COVID-19. US investors are choosing the US dollar as their safe-haven investment during this pandemic. The greenback is particularly attractive due to the notion that America will always find a way to keep its economy afloat. Among the fiscal measures taken by the US government and the Federal Reserve was increasing liquidity in the market. In total, the stimulus by these institutions amounted to $5 trillion. The government and its central bank are also looking to distribute the fourth phase of stimulus to the public to prevent its economy from collapsing.

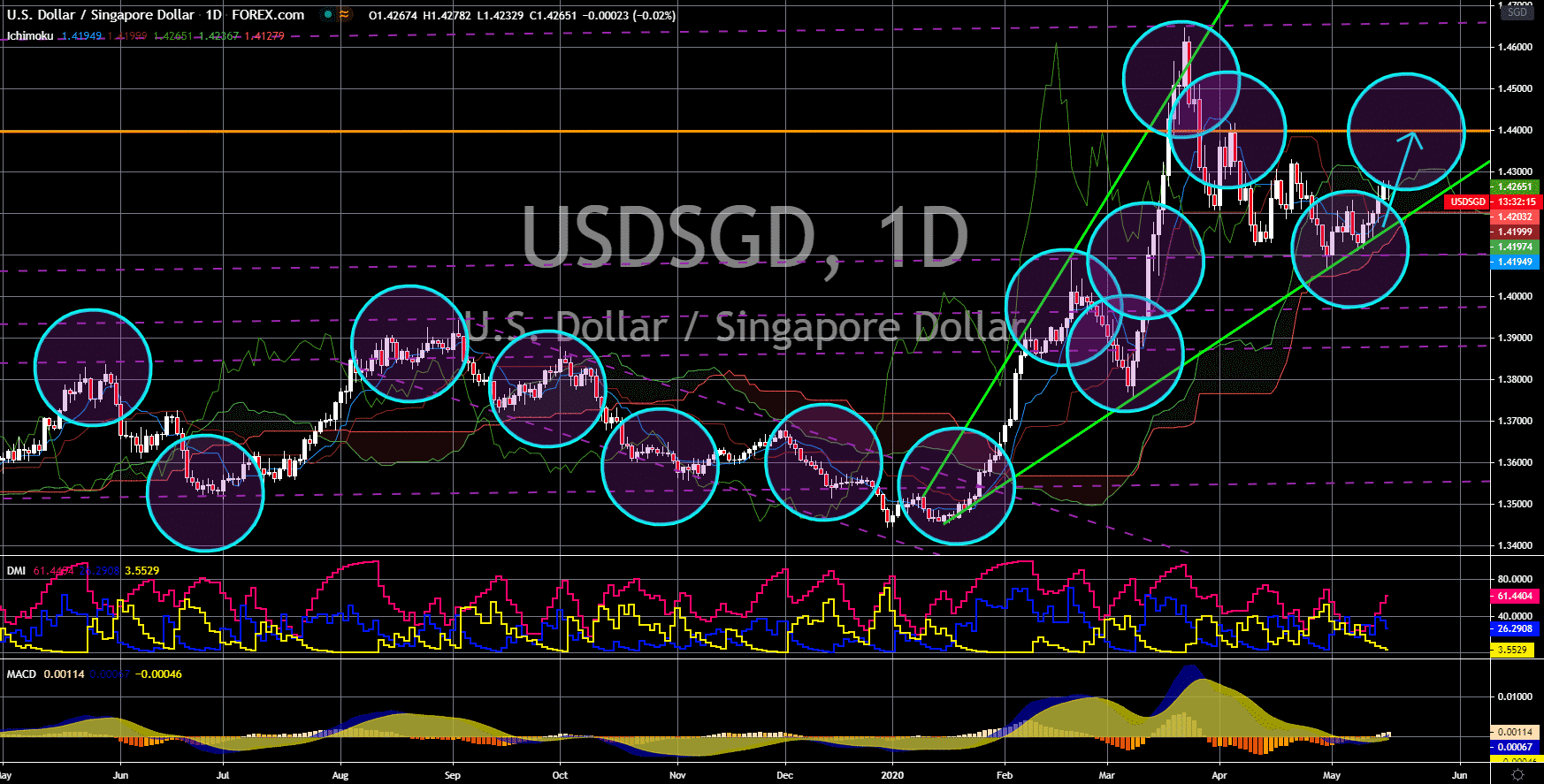

EUR/DKK

The pair will continue to move lower in the following days toward its August 2018 low. The members of the eurozone were hit the hardest compared to other EU member states that are not using the single currency. First quarter GDP growth by the eurozone was recorded at -3.8% compared to the EU’s -3.5%. Germany and France, the EU’s de facto leaders, were among the members who are now experiencing recession. Denmark, on the other hand, posted only -1.9% decline in its GDP. Denmark has a smaller case of coronavirus compared to other EU member states. This is the primary reason why the country didn’t suffer the same fate with Germany and France. Aside from that, the Germano-Franco alliance was already suffering prior to the pandemic. Germany’s economy began slowing down in 2019 due to the US-China trade war and the threats by President Donald Trump that he will wage a trade war with the EU.