Market News and Charts for May 17, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

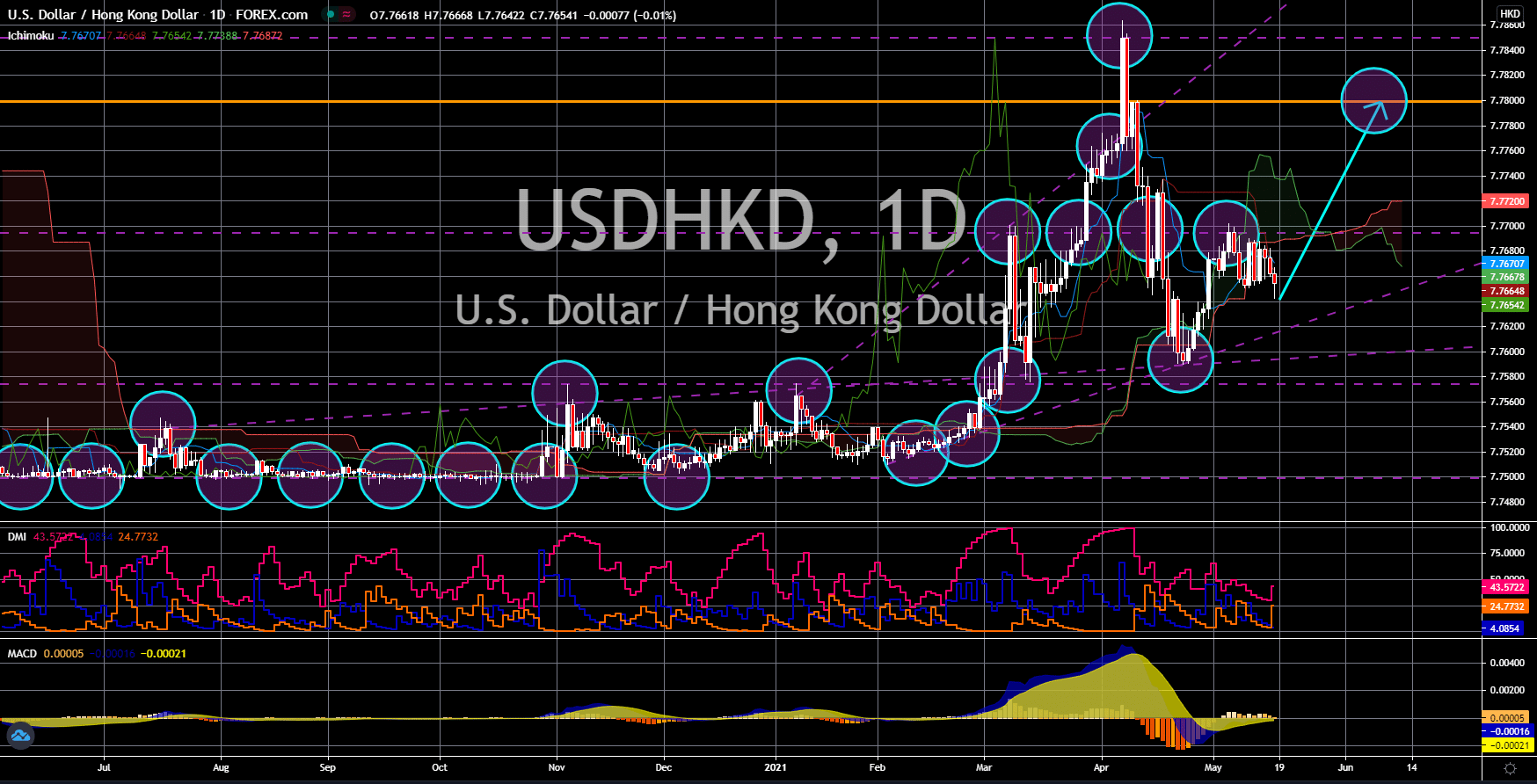

USD/HKD

The pair will continue to move higher in the following days towards 7.78000. Hong Kong’s economy grew by 5.3% in the first quarter of fiscal 2021 from Q4 2020. Meanwhile, the economic expansion on an annualized basis was at 7.8%. This was the first positive result in the past six (6) quarters, or since Beijing tightens its grip on the special administrative region (SAR). The reported YoY data easily beats estimates of 3.7%. Analysts believe that the city’s exposure to mainland China was one of the reasons for the upbeat performance. With closer integration to China, the economic performance of the world’s second-largest economy will spill towards Hong Kong. Also, with less media exposure on the current political situation in HK, businesses are confident that operations will run smoothly. In other news, Hong Kong cut its tie with Taiwan. This was after Taipei opened its borders to any Hong Kong citizens wishing to leave China’s SAR.

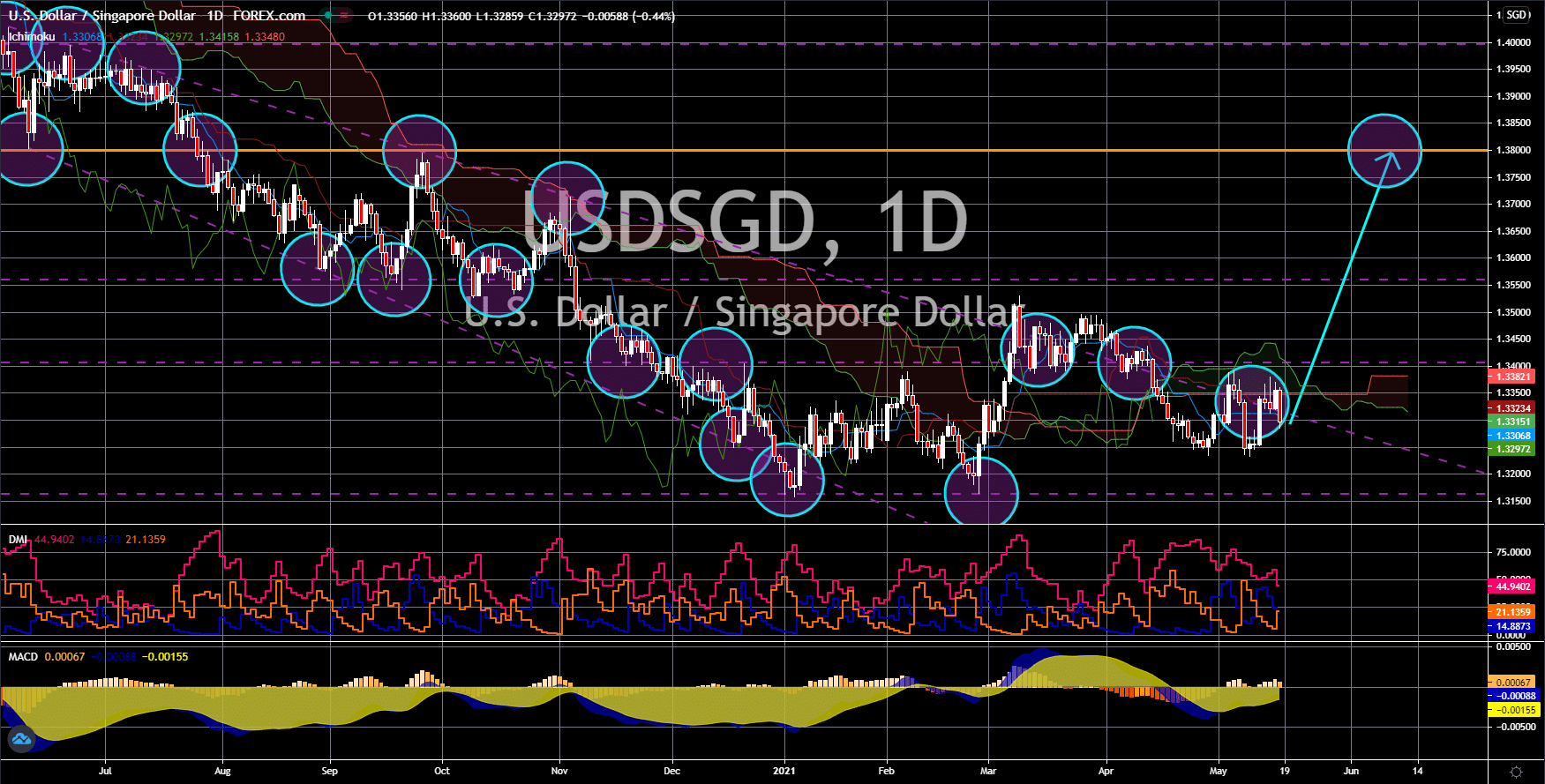

The pair will break out from its current resistance and retest September 2020’s high around the 1.38000 level. Uncertainty is now surrounding the US economy. The country’s labor market is experiencing massive growth with lower unemployment benefit claimants last week at 473,000. This has been the lowest reported figure over the course of the pandemic. However, America ended the week on negative data. Retail Sales is flat in April at zero percent from 10.7% in March. Meanwhile, Core Retail Sales dipped in the negative territory at -0.8%. Meanwhile, the imports and exports price index has slowed down by 0.8% and 0.7%, respectively. The same case happens with the industrial and manufacturing production at 0.7% and 0.4% growths. On Tuesday, May 18, the result for Housing Starts report is a decline of -9.5% from 19.5% advancement prior. The disappointing data from the US will send the safe-haven greenback higher against the SGD.

USD/SGD

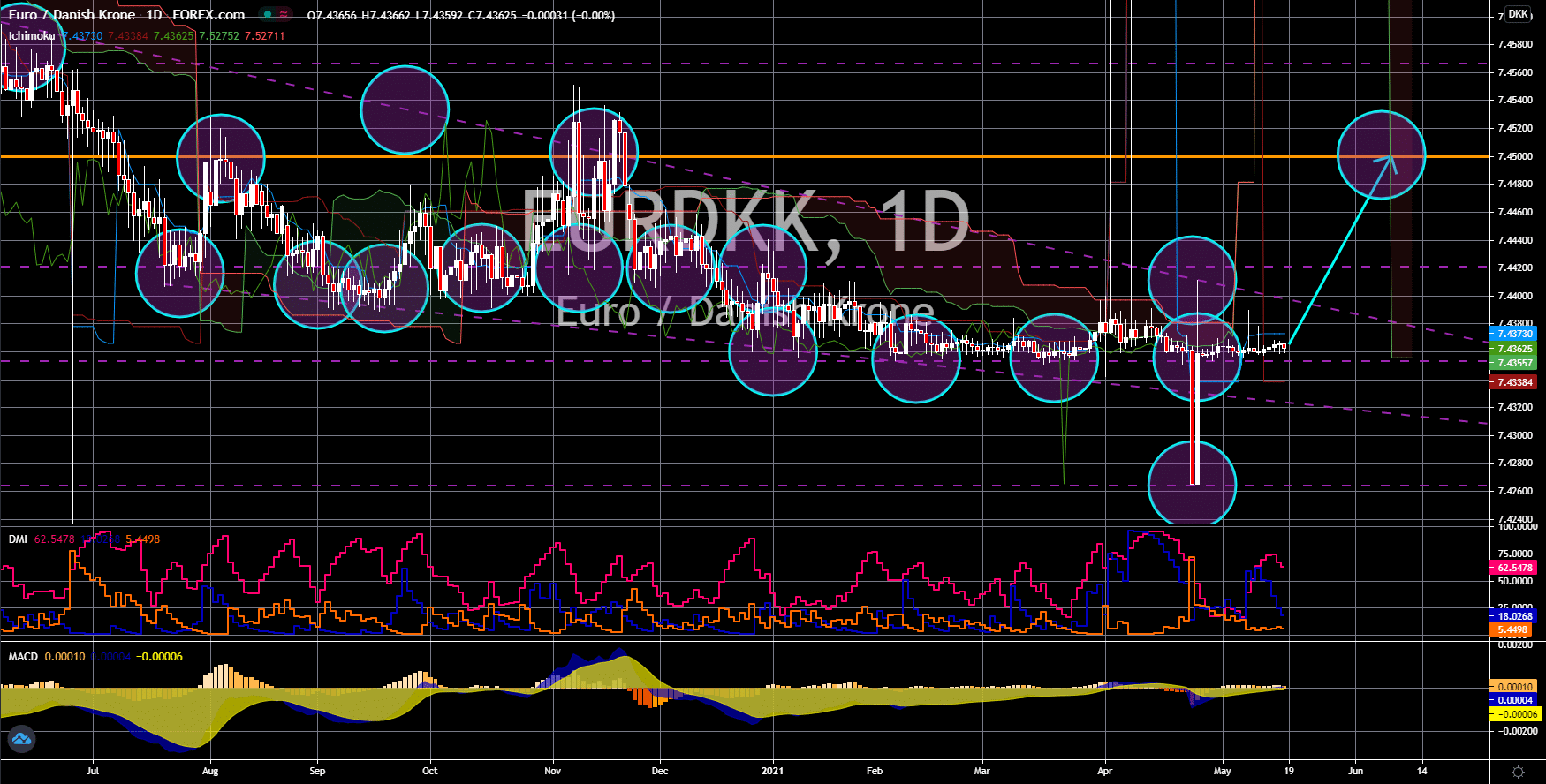

EUR/DKK

The pair is expected to retest a key resistance area around the 7.45000 level this week. The European Union published its Q1 GDP performance on Tuesday, May 18. During the first three (3) months of fiscal 2021, the 27-member state bloc extended last quarter’s decline by another 0.6%. Meanwhile, the figure came at -1.8% compared to the year ago result. Both numbers were in line with analysts’ estimates. However, unemployment data showed a slowdown in the labor market. The trading bloc created 157,441K jobs in the first quarter, which was lower when compared to Q4 2020’s 157,792K. Meanwhile, preliminary employment change was down -0.3%. Analysts are also expecting lower figures for the upcoming consumer price index (CPI) report on Wednesday, May 19. April’s CPI is anticipated at 0.6%. This is lower from the March data of 0.9%. And on Friday, the Purchasing Managers Index (PMI) report will be the news headlines.

EUR/TRY

The pair will continue its upward movement in coming sessions towards 11.00000. The Turkish lira has traded to its lowest level this last week amid concerns on the declining foreign reserves. At the start of May 2021, Ankara had 46.92 billion US dollar in foreign reserves. This was almost twice lower when compared at the start of fiscal 2020, which was around the 80.00 billion mark. The shrinking reserve is a policy of President Recep Tayyip Erdogan, who sacked the country’s central bank governor and his deputy for cutting the benchmark interest rate. With the weaker lira along with the economic impact of the coronavirus pandemic, poverty in Turkey has increased to 12.2%. This was the second consecutive increase in the report. Meanwhile, unemployment in fiscal 2020 was at 13.2%, which represents 4.61 million Turkish individuals. Also, the country’s inflation data in April reached record high after the report surged by 17.14% year-over-year (YoY).