Market News and Charts for May 15, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

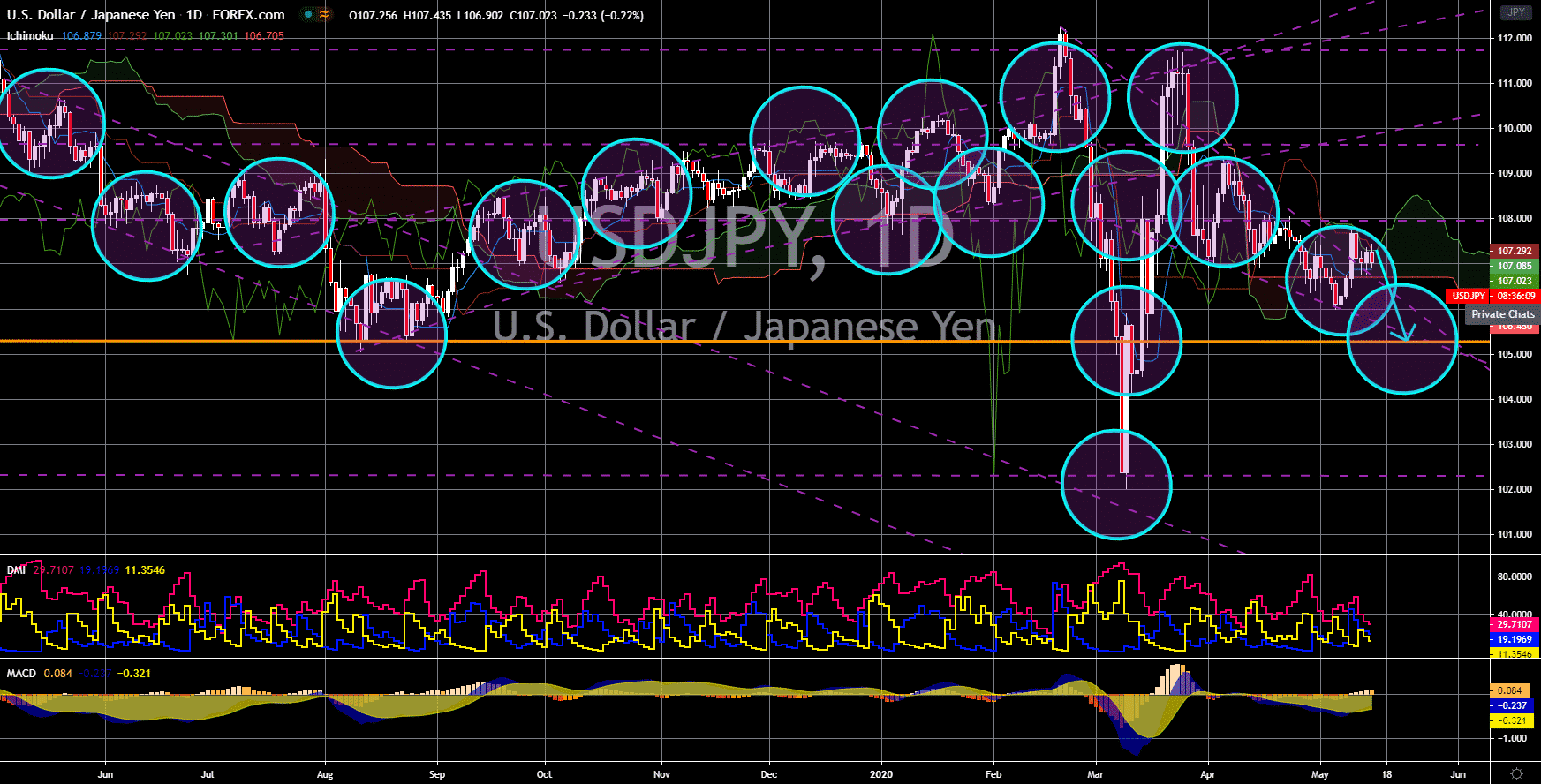

USD/JPY

The pair will continue to move lower in the following days towards a major support line. Japan stepped up its game after it introduced the “Corona Bonds”. The rising pressure from Japanese politicians forced PM Shinzo Abe to create a new investment vehicle to help local businesses cope from the pandemic. The government-backed bonds will help Japan raise almost $1 trillion in cash. In total, Japan had already injected a $1.1 trillion stimulus to the economy. Meanwhile, the US is securing the fourth phase of fiscal stimulus as COVID-19 continues to hit sales and income of businesses. During the third phase, the US government unleashed a $2 trillion stimulus. The Federal Reserve, on the other hand, unveiled a $2.3 trillion package. Unlike Japan, however, the US was still uncertain as to when it will reopen the country’s economy. Some US states already lifted several lockdown restrictions, but the majority were still in a lockdown.

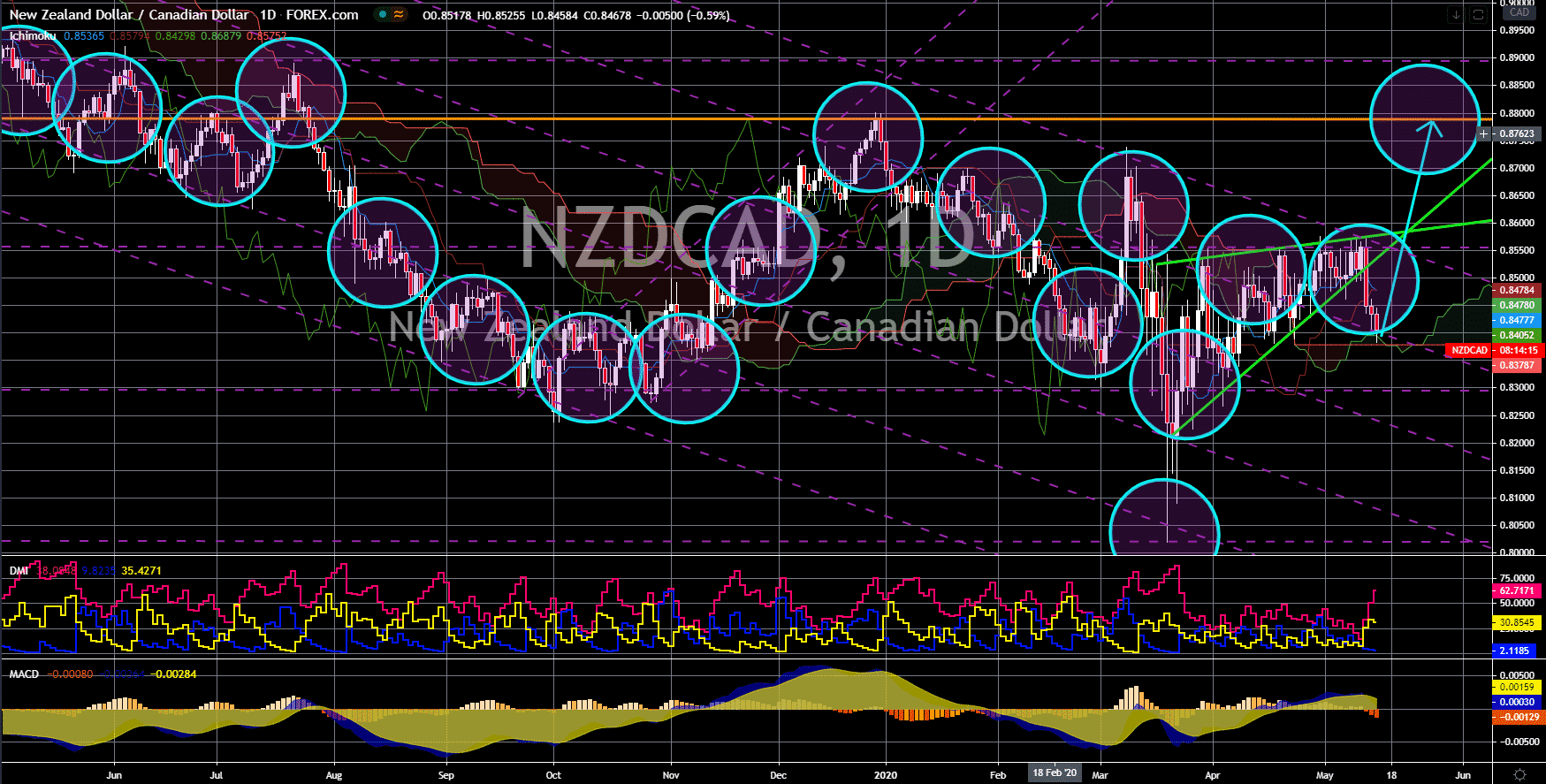

NZD/CAD

The pair will bounce back from its current support line, sending the pair higher towards a major resistance line. New Zealand lifted its national state of emergency this week following the country’s successful combat against the deadly coronavirus. NZ Prime Minister Jacinda Ardern won praise abroad once again as his central left approach to dealing with the coronavirus ended positively. Ardern was among the few central left leaders around the world but was the most popular on the international stage. She first came into the spotlight after being the first sitting prime minister to give birth. Her popularity grew at a high pace following her peaceful approach to the Christchurch bombing. She also passed a “Well-being” budget aimed at improving the lives of NZ people instead of improving the economy. Meanwhile in Canada, COVID-19 cases continue to surge, and investors are worried of more cases once the US lifts its lockdown.

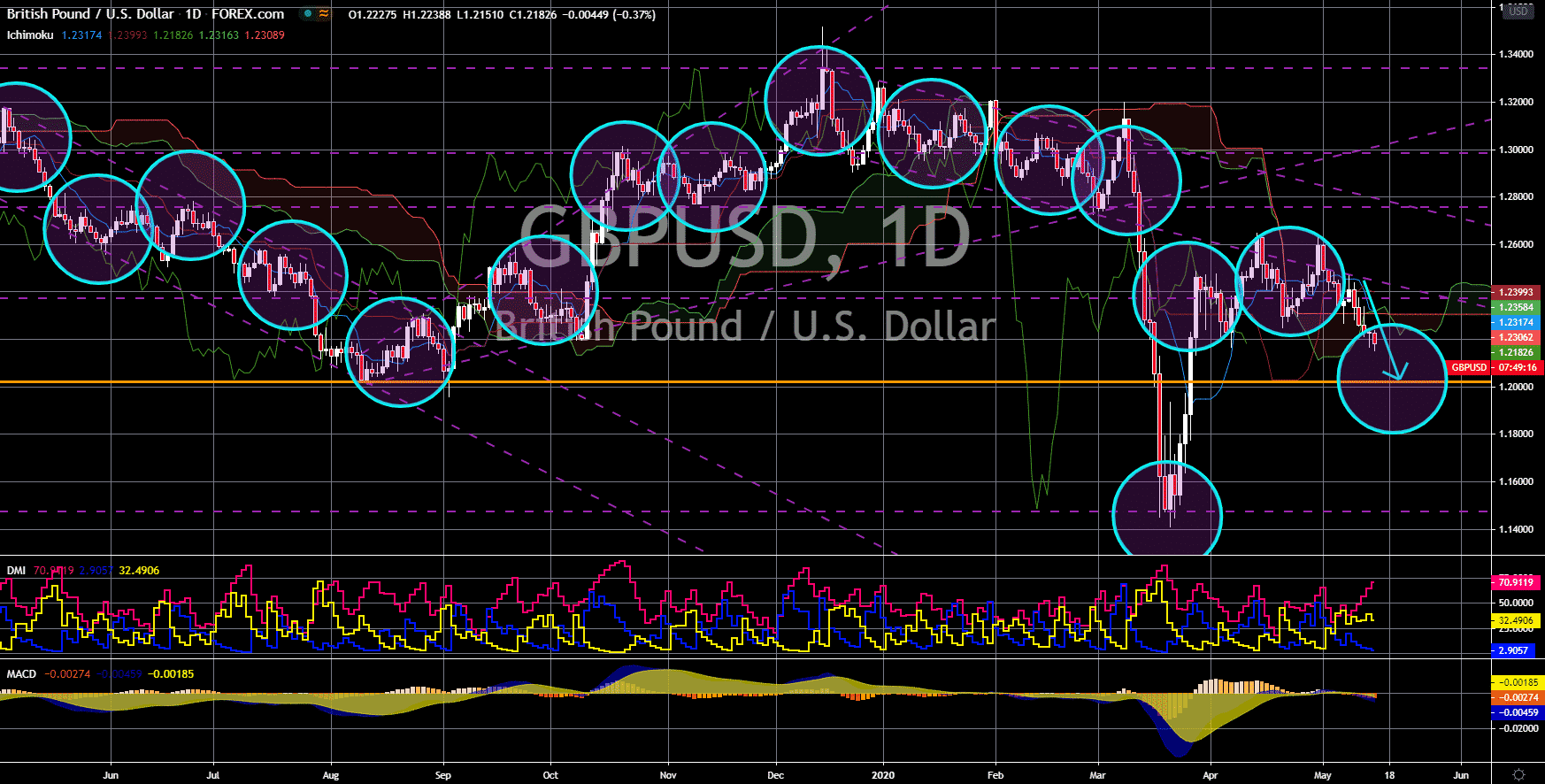

GBP/USD

The pair broke down from a key support line, sending the pair lower towards a major support line. Former Chancellor Darling warned that the British economy is already in a very deep recession. However, he gave a gloomier outlook on the future of Britain’s economy. Darling said the UK is heading a path much more painful than the 2008 recession. Many analysts already warned the same outlook for the UK economy as it faces a double whammy of events. First, the UK officially leaves the EU on January 31. Many analysts were optimistic of an independent United Kingdom. However, reports show that the UK economy is slowing down instead. And second, the coronavirus is taking a toll in the global economy. Unfortunately for the UK, its withdrawal from the EU is making it harder for the country to increase its economic activity. The US, on the other hand, has been relying on the high demand for the US dollar to keep its economy afloat.

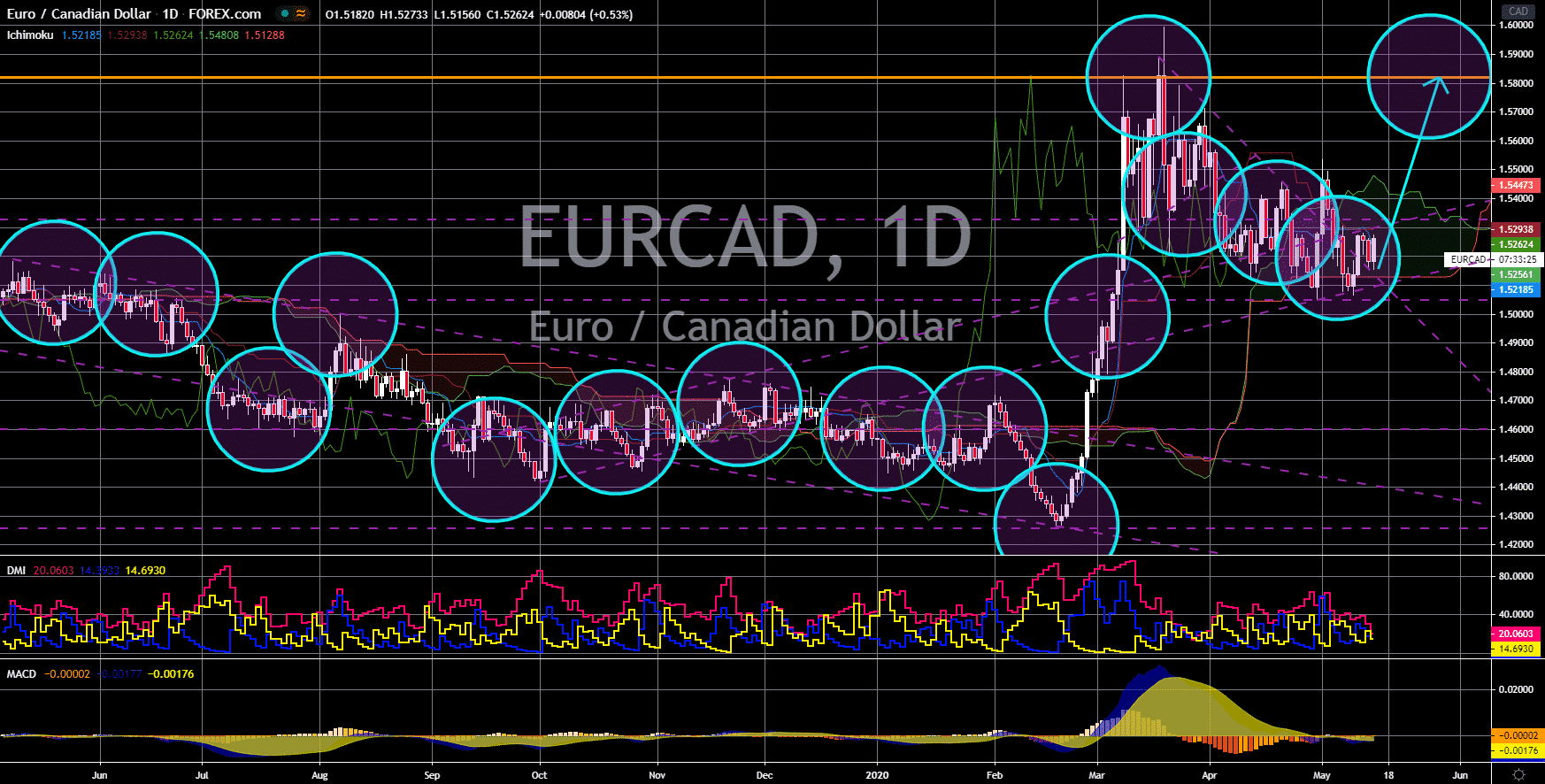

EUR/CAD

The pair will bounce back from a major support line, sending the pair higher towards its previous high. The single currency is expected to recover in the coming days as most EU member states start to ease restrictions. The US is also planning to lift several restrictions this month as businesses start to starve of revenues. However, analysts warned that the premature lifting of lockdown could further result in more COVID-19 cases in the US. As of writing, the US has 1.45 million positive cases while deaths were at 88.6 thousand and counting. This plan by US President Donald Trump could negatively affect its neighbor Canada. As a country relying on migrants, Canada could see its productivity swelling in the coming months. Bank of Canada had already made bold steps, including a 150 basis points cut, to propel economic activity. Analysts are worried that the BOC might run out of monetary tools if COVID-19 continues to hit its economy.