Market News and Charts for May 14, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

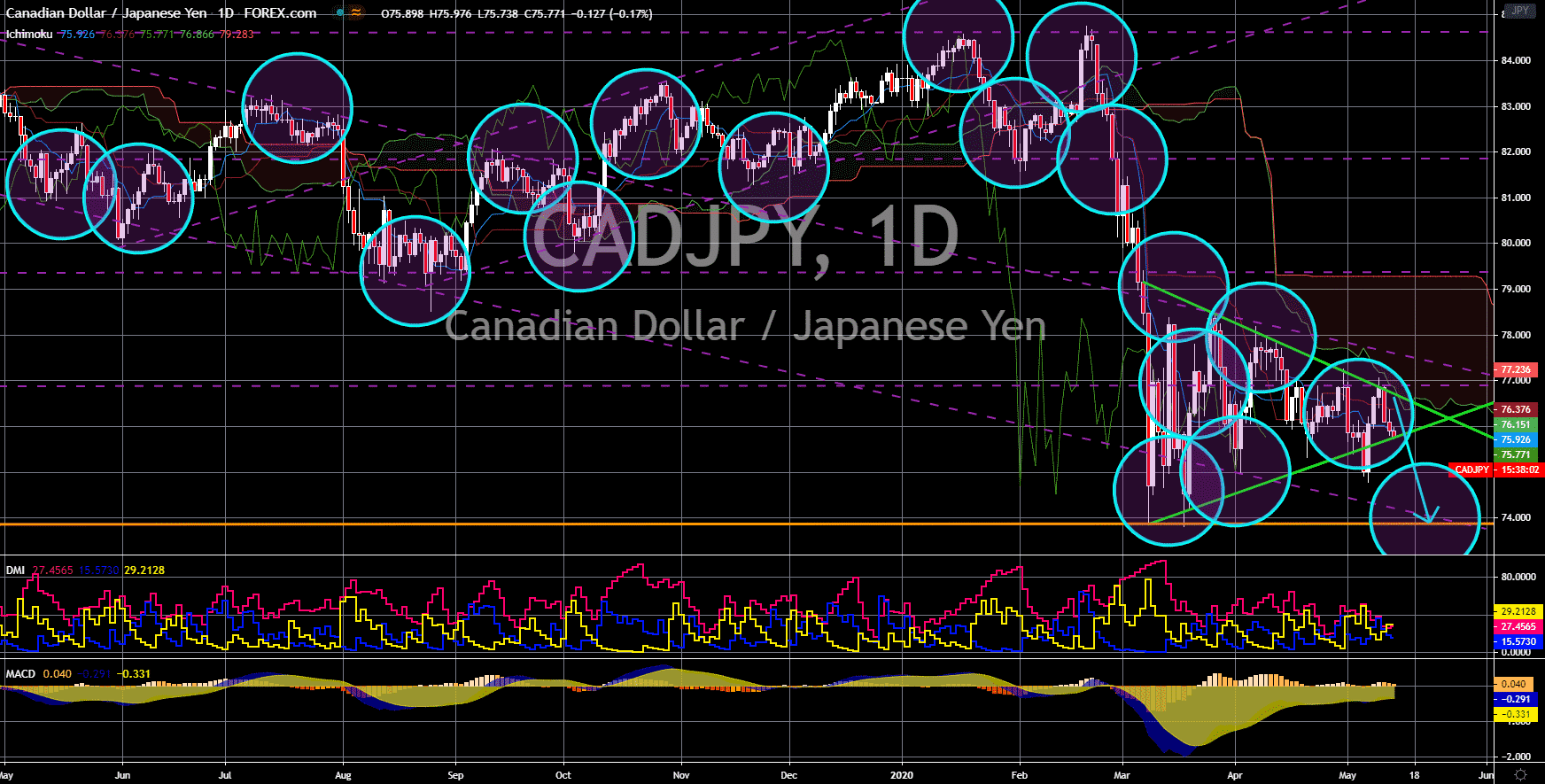

CAD/JPY

The pair will break down from the “Triangle” formation, sending the pair lower towards its previous low. Canada and Japan were seen recovering from the recent slump in their economic data. Canada’s Manufacturing Sales report went up by 0.5% from five (5) consecutive negative figures in the previous months. Meanwhile, Japan’s foreign bond and stock buying were up from last month’s record. Investment in stocks by foreign investors went down by another -$86.6 billion from the recorded -$271.9 billion in April. Meanwhile, bonds were already in the positive territory after foreign investors increased their holdings of the fixed-income investment. The investment in the asset was at $239.1 billion from the staggering -$1,107.6 billion last month. One factor that drove Japanese stocks and bonds was the report of Japan’s current account. The figure went down from $3 trillion to $1 trillion, highlighting the government’s effort to save its economy.

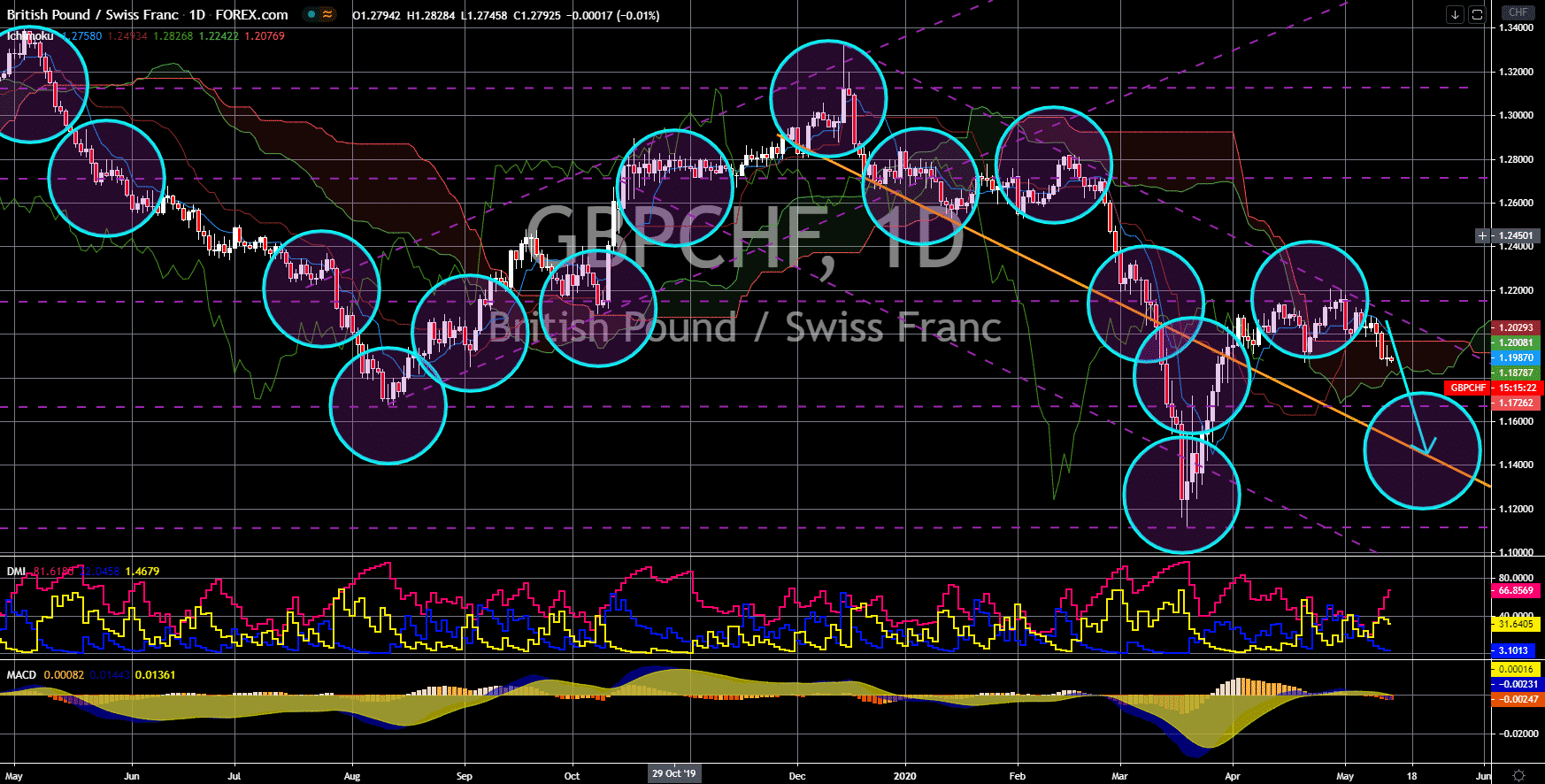

GBP/CHF

The pair failed to break out from a downtrend channel’s resistance line, sending the pair lower toward the channel’s middle support line. The United Kingdom is on the verge of recession after its posted -2.0% growth for the first quarter of 2020. In the fourth quarter of 2019, Britain recorded zero (0) growth. Two (2) negative quarterly GDP growth is needed for a country to enter a recession. Q1 only covers half a month of the coronavirus lockdown but it already recorded a negative growth. Analysts are expecting a steeper decline in the country’s economic growth in the second quarter as the full-blown economic effect of the coronavirus will materialize. Meanwhile, the safe-haven appeal of the Swiss franc will shine against a basket of major currencies. As Switzerland lifts several restrictions, businesses are expected to recover their losses. This, in turn, will be beneficial for the Swiss currency in coming sessions.

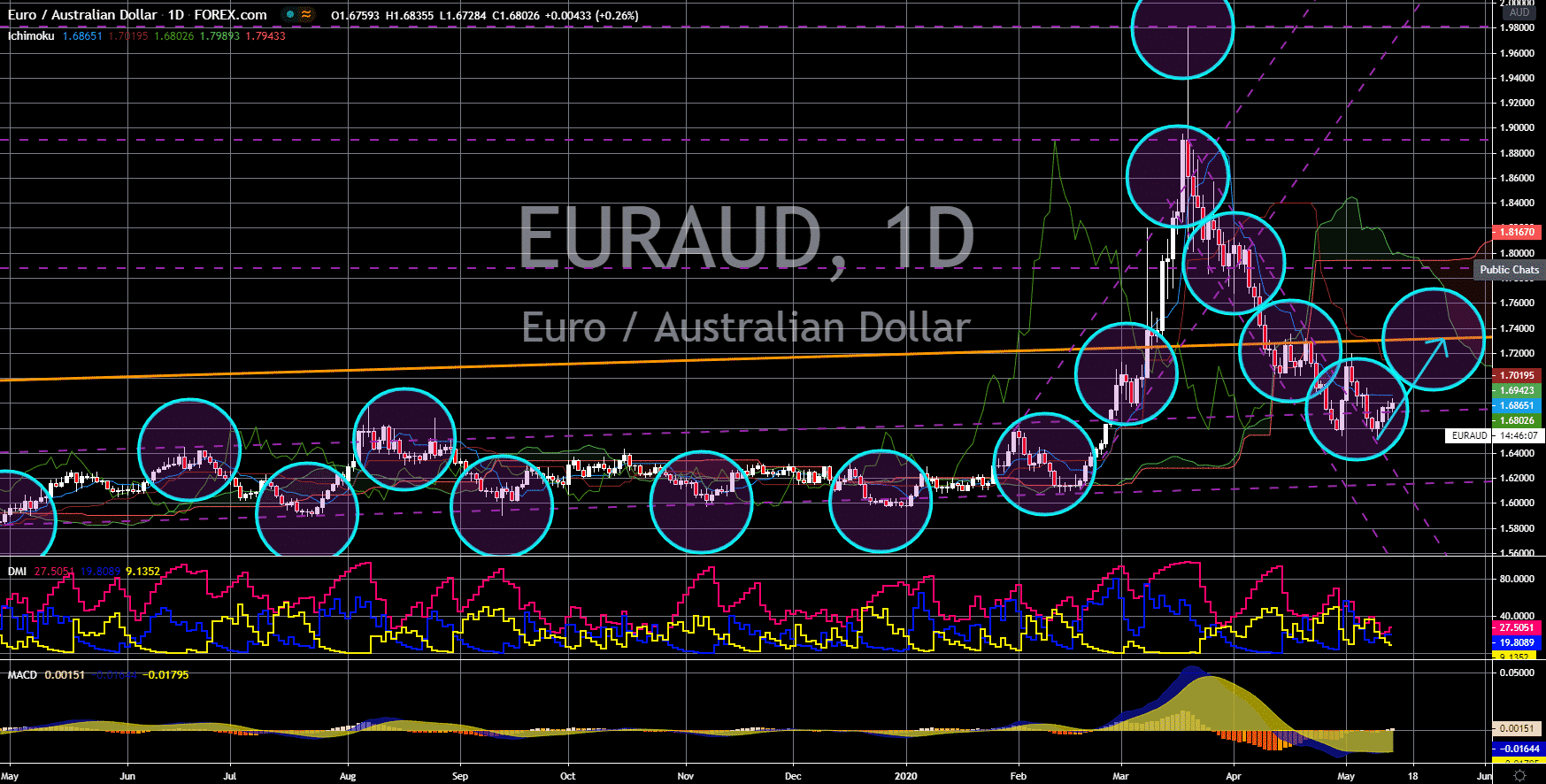

EUR/AUD

The pair will bounce back from its current support line, sending the pair higher towards the nearest resistance line. Australia posted a staggering unemployment report yesterday. Canberra recorded a -594.3K unemployment for the month of April, which is expected to have a negative impact in the Australian dollar. The country has been experiencing sluggishness in growth in the previous quarter as the trade war between the United States and China disrupted its economy. As tension between Washington and Beijing reignited, a grimmer outlook in the Australian economy is expected. Meanwhile in France, unemployment rate dropped by 0.3%, from 8.1% in the fourth quarter of 2019 to 7.9% in the first quarter of 2020. This was despite the country being in a lockdown since March. This increased the prospect of robust recovery in the European Union. Consumer Price Index (CPI) in Germany and Spain were also positive.

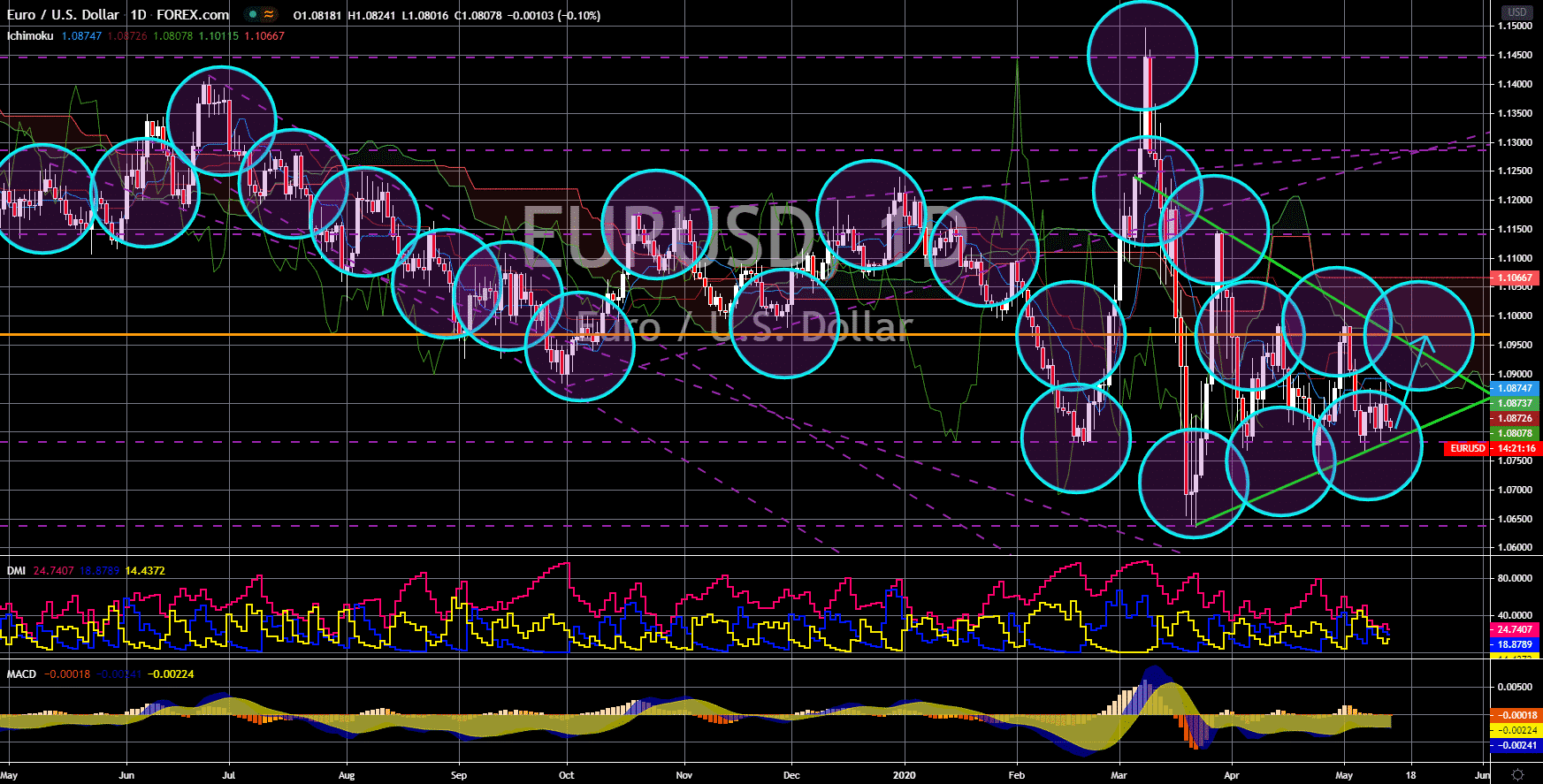

EUR/USD

The pair will bounce back from the “Triangle” formation’s support line, sending the pair higher towards a key resistance line. The US crude oil inventories report was in a negative territory this week, the first time since the third week of January 2020. This signals a future rally in the lack gold commodity in the coming sessions. Unfortunately, its comeback is not a great time for the American economy as unemployment in the country is expected to continue rising on this week’s jobless claims report. The high crude oil prices will not match the wages and salary of employees in the US. The US government and the Federal Reserves is currently reviewing the fourth phase of their fiscal stimulus as the continued lockdown in the country makes the third phase insufficient to support the economy. As America struggles to keep its economy afloat, the European Union is back on its feet and is expecting a recovery in the coming months.