Market News and Charts for May 13, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

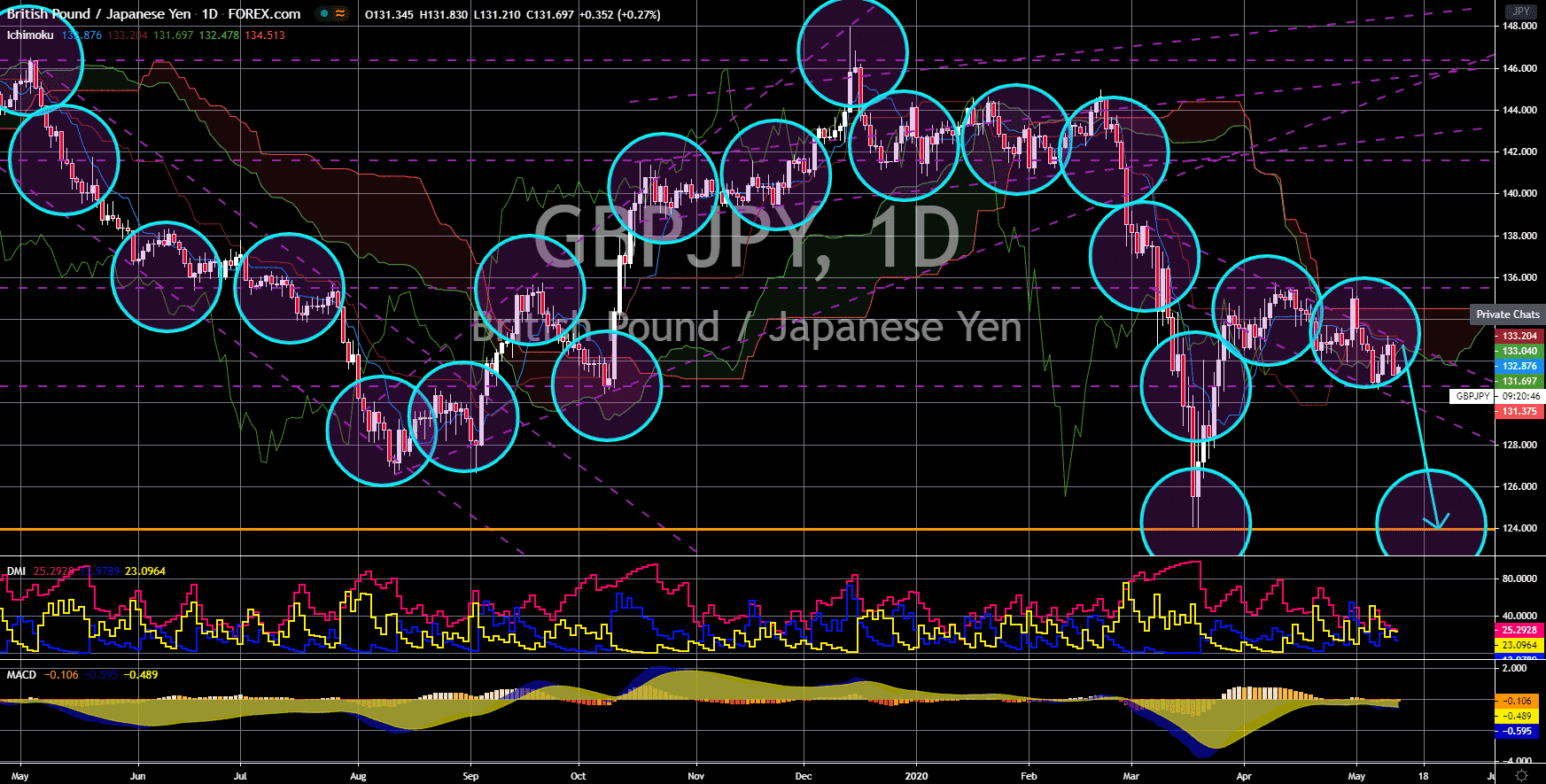

AUD/USD

The pair will continue to move higher in the following days towards a key resistance line. The United States is recovering from the recent slump in crude oil prices and build up in inventories. Oil experts believe that today’s crude oil inventories report will record lower figures for this week amid the lifting of several restrictions of countries around the world. However, the US still faces several problems which could influence the value of the US dollar. As the lockdown hampered the growth of the US economy, President Donald Trump promised to reopen the country’s economy this month. Although this decision was celebrated by investors, economists are worried about the long-term effect of this decision. The US is currently leading the countries with the highest number of coronavirus cases and deaths. Meanwhile in Australia, its government began lifting several restrictions as the country achieved to flatten the curve of COVID-19 cases.

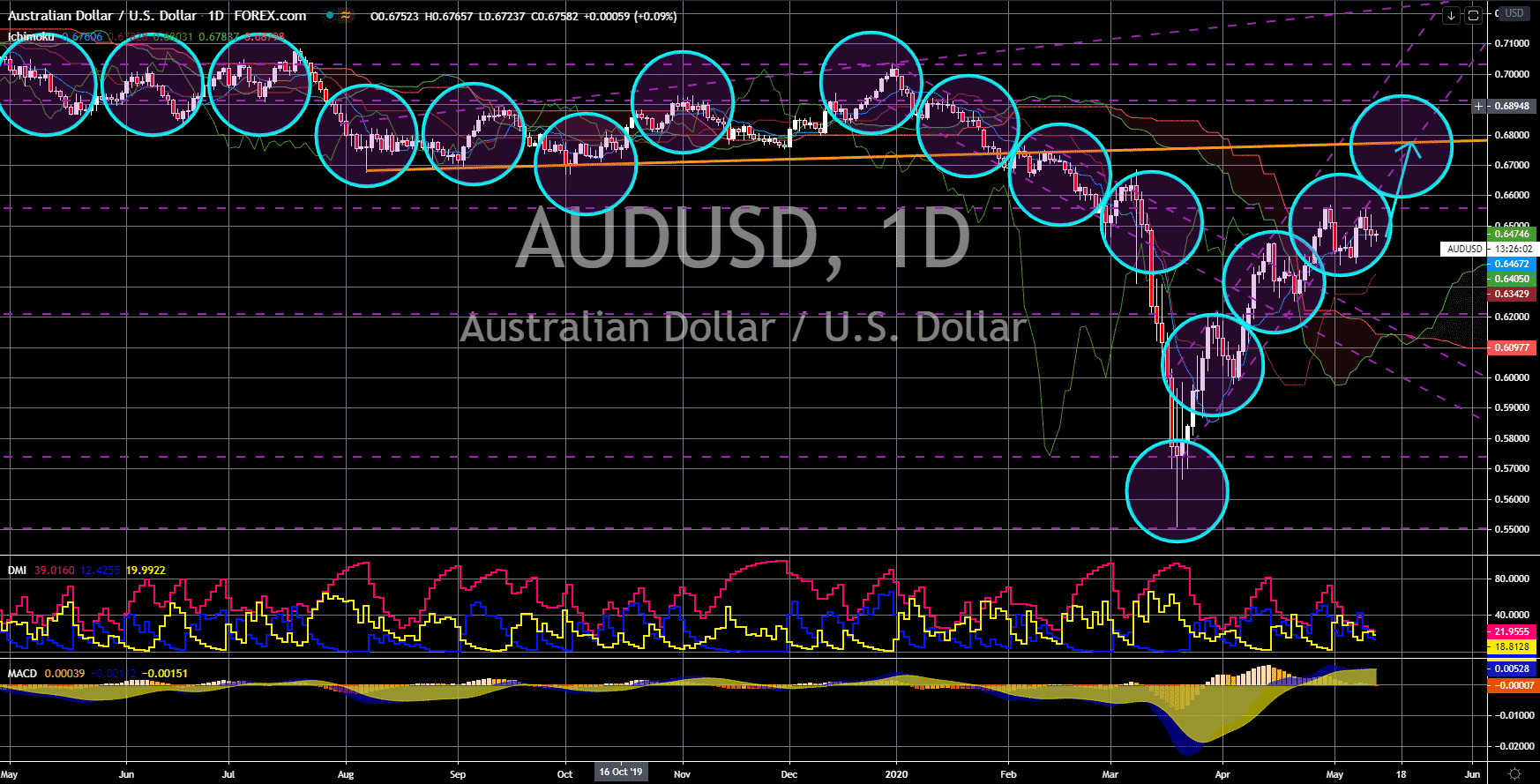

AUD/CAD

The pair failed to breakout from a major resistance line, sending the pair lower towards a key support line. The Australian dollar might finally see an end to its upward momentum. The recent weakness in the Canadian dollar was due to the interest rate cut of 150 basis points by the BOC in April. However, as the information fully reflects in the value of CAD, investors should expect stability in the pair. This means that the Australian economy’s weakness will be visible in coming sessions. Australia began lifting several restrictions in the country as the coronavirus took a toll on its economy. Unemployment in Australia defied analysts’ expectation of a negative growth. But analysts remain firm on their forecast of high unemployment in Australia in the coming employment report. Moreover, efforts by the Australian government are being overshadowed by the accomplishments by New Zealand Prime Minister Jacinda Ardern.

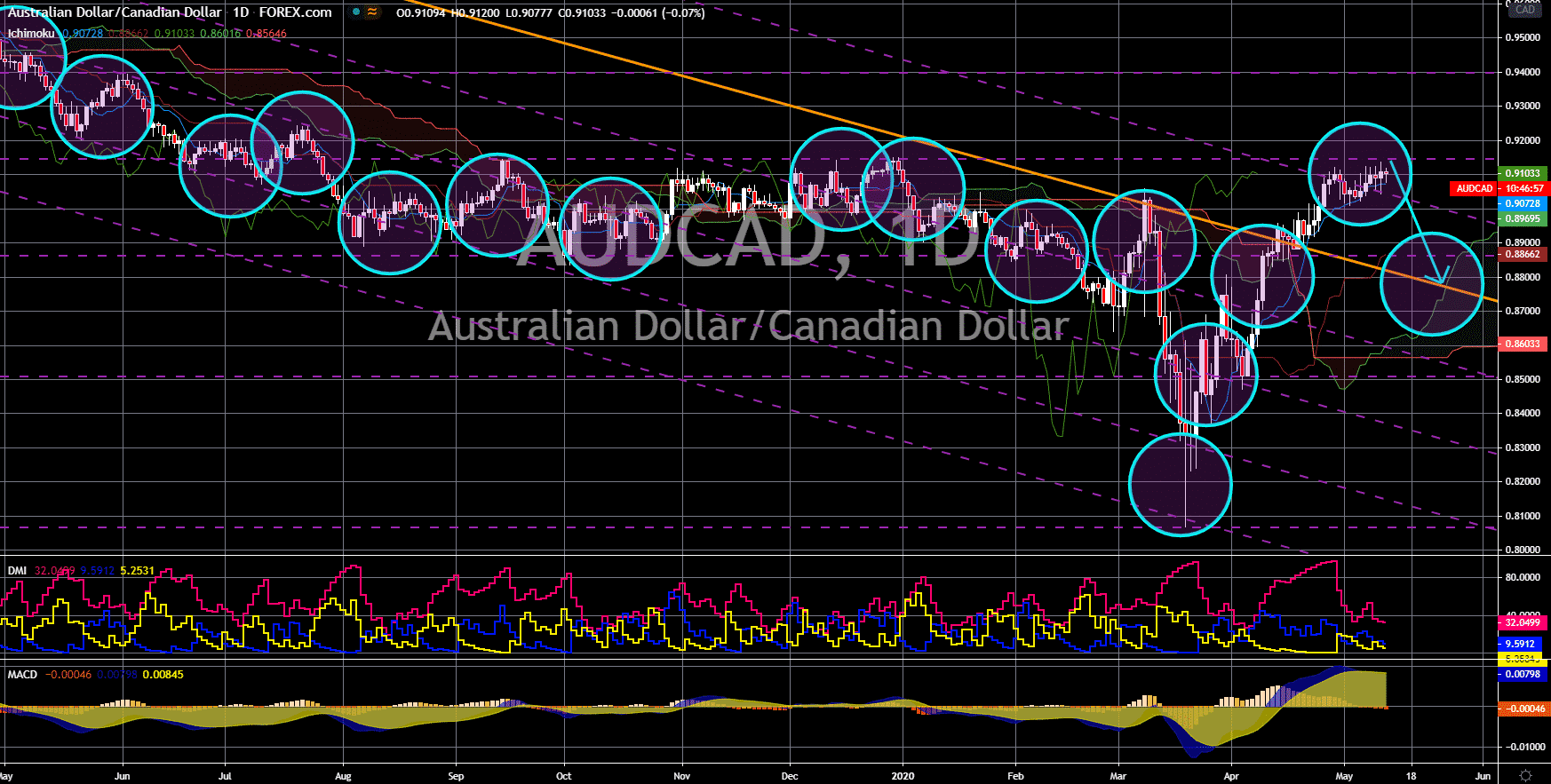

AUD/CHF

The pair broke down from a steep uptrend channel support line. With Switzerland lifting several lockdown restrictions, analysts anticipate the return of the Swiss franc as a safe-haven currency. The Swiss currency loses its safe-haven appeal after Europe became the center of the pandemic. During that time, a hard lockdown was implemented among several European countries. This hurt not only the countries hardly hit by the virus but also the countries dealing with this country. Switzerland borders Italy, which currently has the second most infected citizens in Europe at 221,000 and deaths at 30,900. During the weakness of the Swiss franc, currencies paired with it took the advantage and their value to increase just like the Australian dollar. However, as cases in Europe continue to go down, the economic pitfalls of Australia due to COVID-19 are becoming visible. Analysts forecast a sharp rise in the unemployed people in Australia in this month’s report.

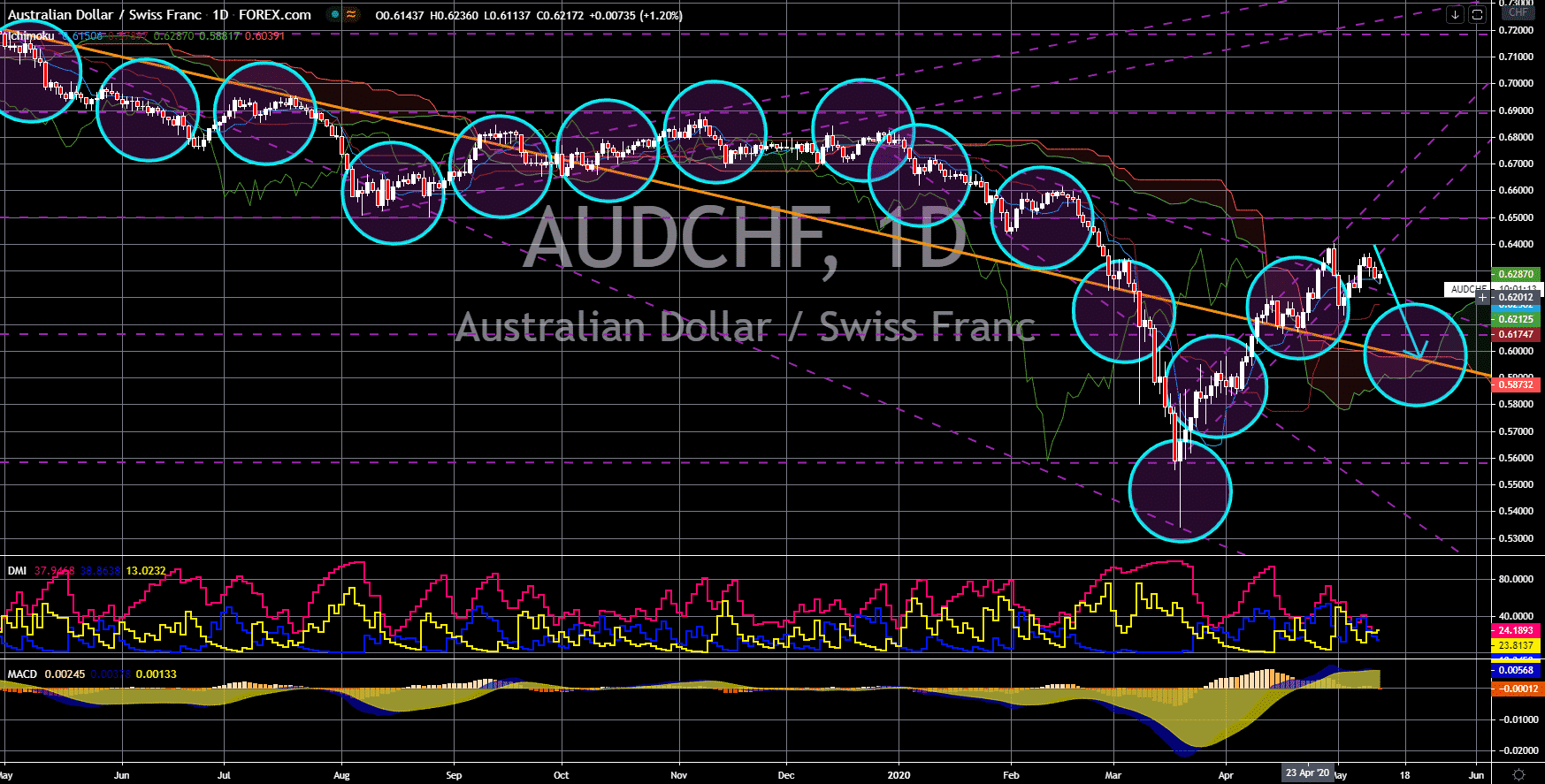

GBP/JPY

The pair will break down from a key support line, sending the pair lower toward its previous low. In April, Japan introduces its largest fiscal stimulus in history at $555 billion. Currently, the current account was at $1.9 trillion compared to the $3.1 trillion last month. This means that $1 trillion was infused to the Japanese economy to help individuals and businesses to cope up with the pandemic. On the other hand, the United Kingdom just saw its biggest contraction since 2009. The country’s quarterly GDP report fell by 2.0%, which is better than the expected 2.5% slump. Despite this, the data increases the likelihood of a recession in the second quarter of the fiscal year. The UK is already suffering from its withdrawal from the European Union. However, the coronavirus pandemic just gave Britain a major blow. Aside from GDP, the UK’s manufacturing report also fell today to -4.6% from 0.3% in the previous report.