Market News and Charts for May 10, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

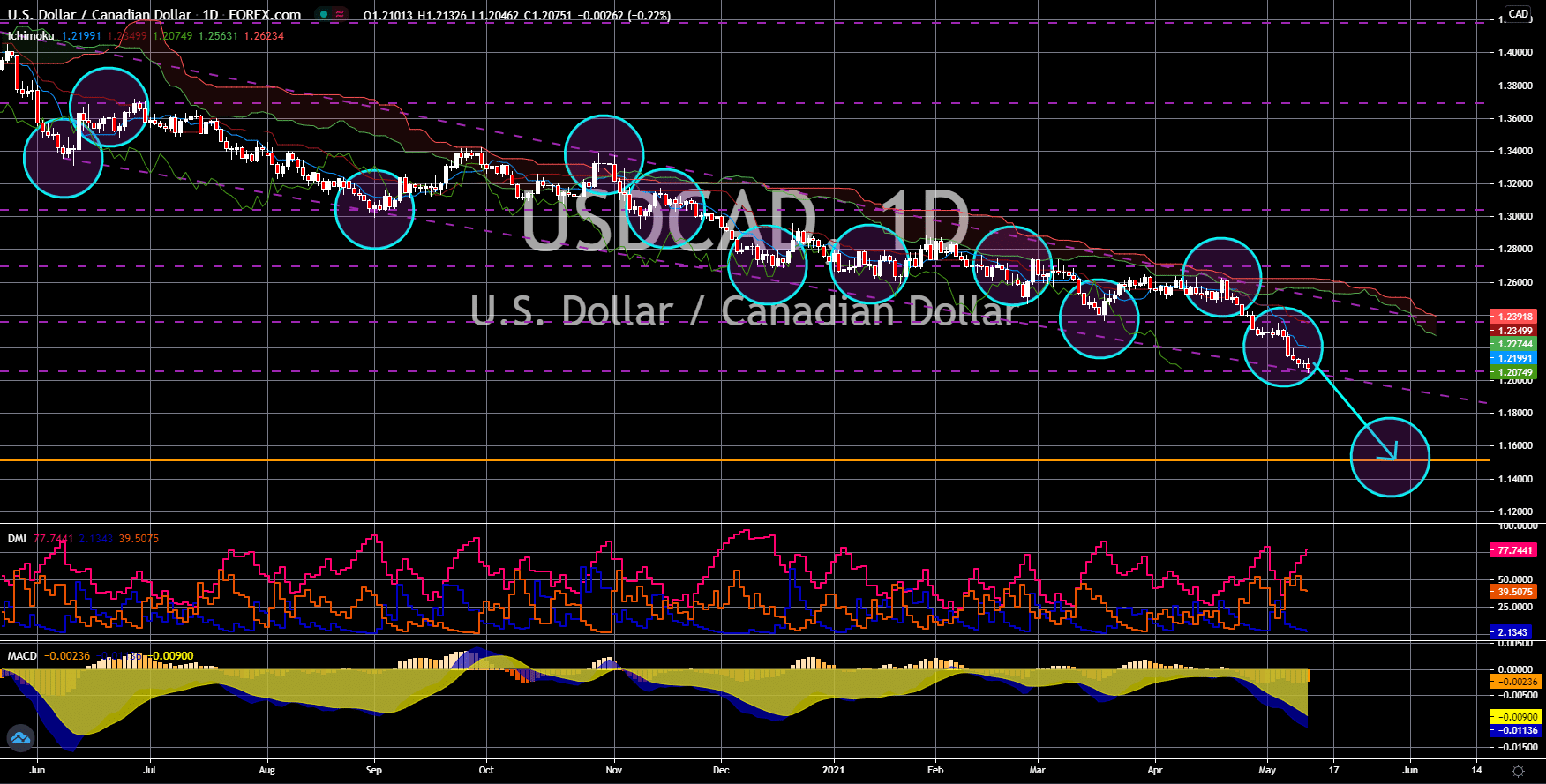

USD/CAD

The pair will continue to decline in coming sessions towards the 1.15000 key support area. Both Canada and the United States posted disappointing employment data on Friday, May 07. As for Ottawa, unemployment increased to 8.1% in April, a 0.6 percentage points change compared to the prior month. Meanwhile, Washington recorded 6.1% for the same result, which was the opposite of what analysts anticipated with a decline to 5.8% from 6.0% in March. Another bleak data from the US is the non-farm payrolls report, which added only 266,000 jobs. The projection for the NFP data is 978,000 additions. On the other hand, Canada lost 207,000 jobs in April against 175,000 estimates. As a result, investors are flocking in on the Canadian dollar as they dump the equities market. Another challenge for Canada’s economy was a possible shut down of a 645-mile oil pipeline from the state of Michigan, which is a key energy source for Canada’s economy.

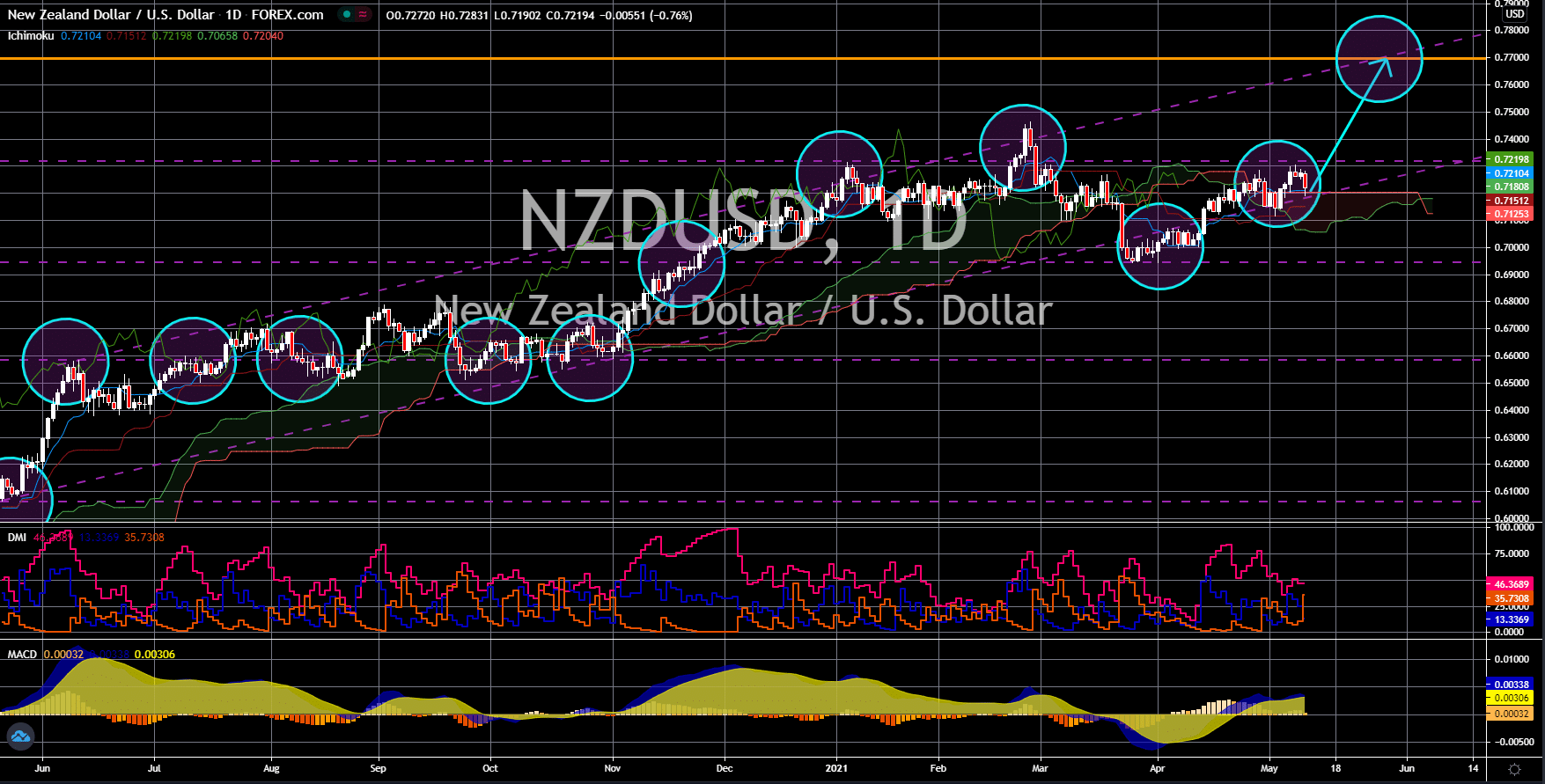

NZD/USD

The pair will bounce back from its current support area to reach the 0.77000 price level. All eyes are now with the United States following the surprise NFP missed on Friday, May 07. Two (2) key upcoming reports from the United States were the consumer price index report on Wednesday and initial jobless claims on Thursday. As for the CPI, the US is expected to post an annualized figure of 3.6%. This is a concern for investors as soaring inflation data cripples high-growth stocks, which fueled the rally in the US indices. As for the month of April, the anticipated number is 0.2%. The Federal Reserves has an inflation target of 2.0% with a range of +-1.0%, or from 1.0% to 3.0%. Meanwhile, the number of unemployment benefit claimants last week dropped to 498,000, which was the lowest recorded figure since March 2020. The disappointing data from the non-farm payrolls report are putting pessimism on investors despite lower estimates of 490,000 this week.

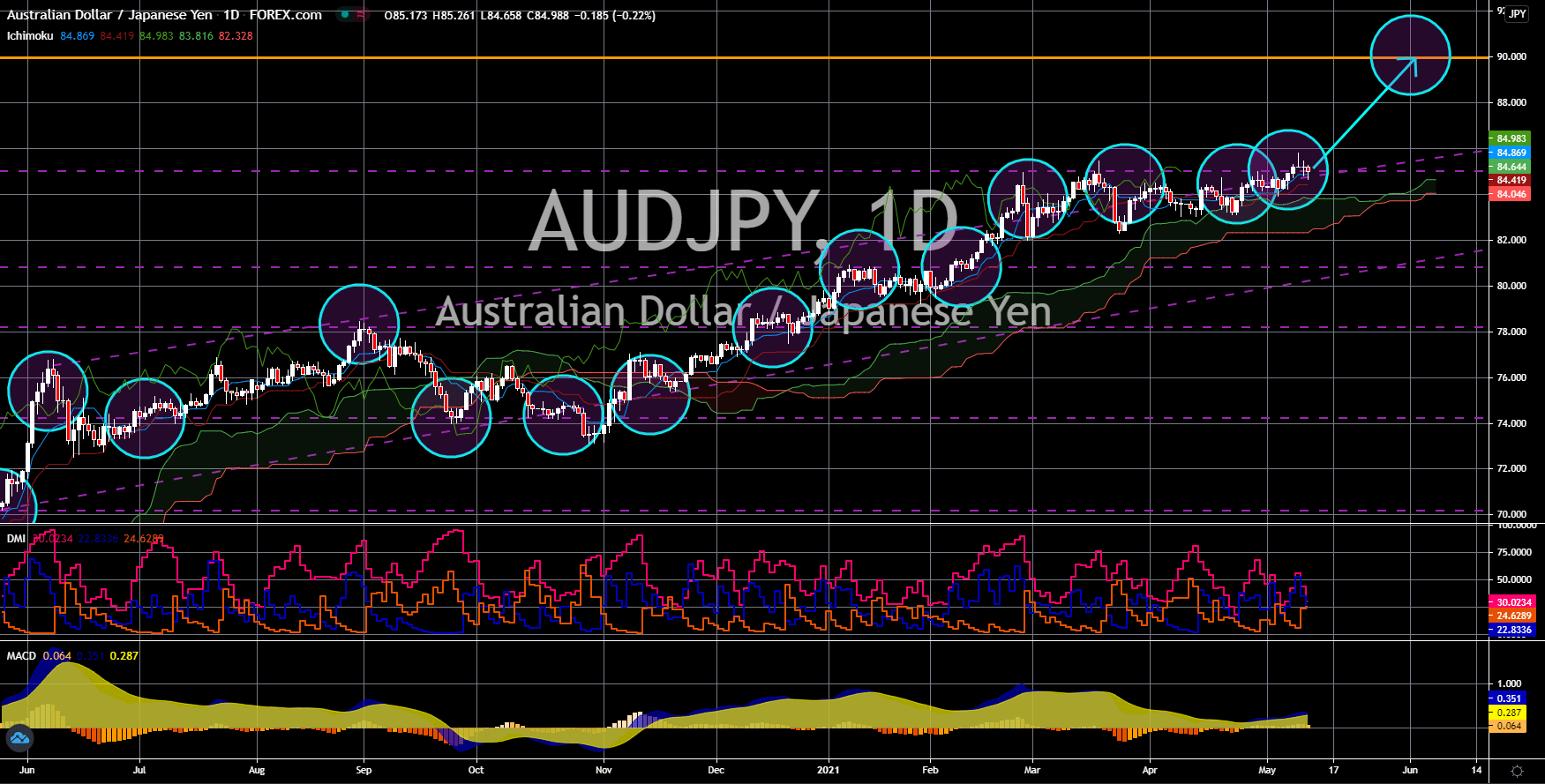

AUD/JPY

The pair will continue to make new highs in coming sessions with a price target of 90.000. The catalyst for the weak performance of the Japanese yen is the bettering economic data from the world’s third-largest economy. On May 10, Japan posted household spending year-over-year (YoY) of 6.2%, a major advancement when compared to -6.6% in February. The reported number also dwarfed analysts’ estimate of 1.5%. As for the MoM figure, the result was 7.2%. This was in the opposite direction to the expected slowdown in March of 2.1% from 2.4% prior. The Coincident Indicator and Leading Index were also up on Wednesday’s report. Figures came in at 3.2% and 4.3%, respectively. Both reports were higher from their previous data. Investors should expect continued upbeat data as the Japanese government keeps businesses open despite the rising cases of COVID-19. The Tokyo Olympics is scheduled to start from July 23 until August 08.

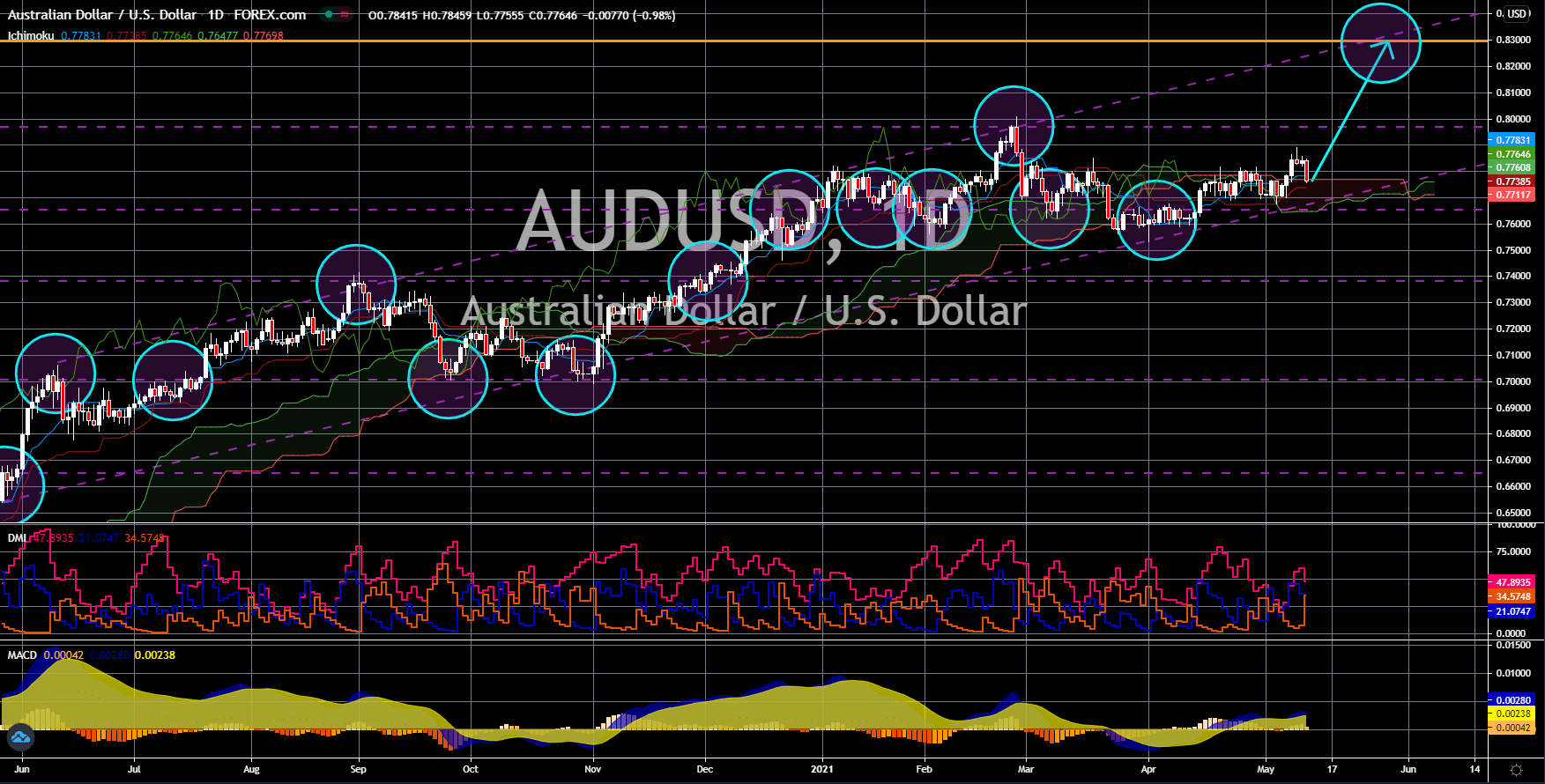

AUD/USD

The Australian dollar will continue to advance in the coming days against its US counterpart. The Morrison government plans to spend 311 billion to reverse the economic impact of the coronavirus pandemic. This puts an initial budget deficit of 161 billion. Majority of the budget, or around 290 billion, will go directly to rehabilitating businesses and building new infrastructures to create more jobs for the Aussies. Meanwhile, 1.9 billion has been allotted to COVID-19 vaccines procurement. While the country has succeeded in containing the deadly virus, growth has been slow as border restrictions remain intact except for New Zealand. This keeps foreign skilled workers from entering Australia. As for the economic ties with China, analysts believe that Beijing will not be able to afford to keep Australia’s metal exports from reaching the mainland despite rising tension. China is a major importer of industrial metals particularly with Australia’s iron ore and gold.