Market News and Charts for May 08, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

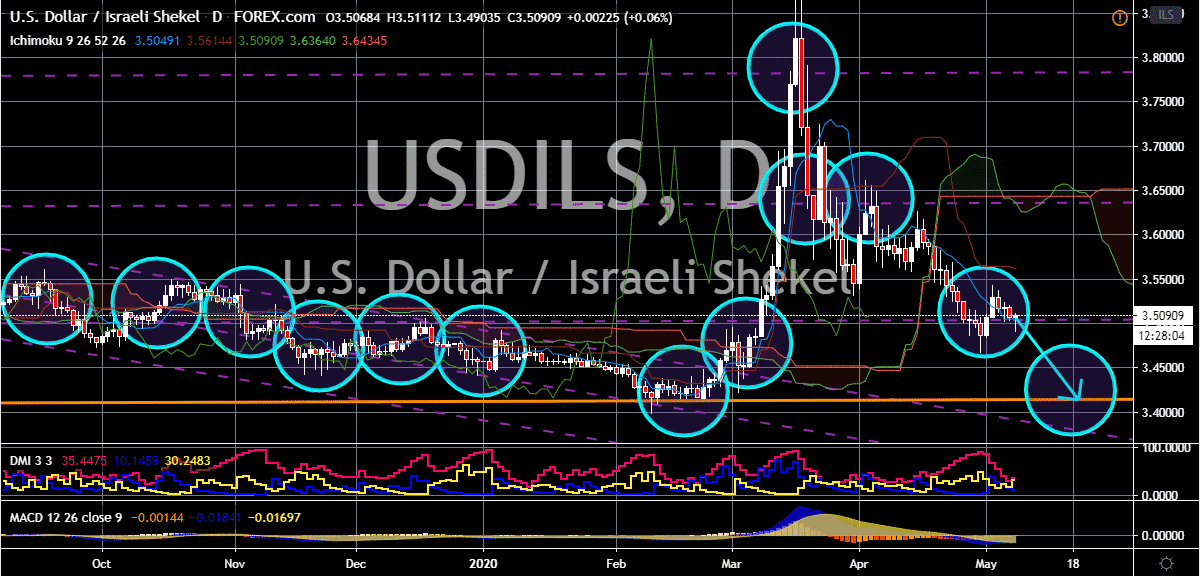

USD/ILS

As Israel’s stock market continues to close higher, the odds will continue to favor bearish investors. The USDILS trading pair is mainly driven by the positivity in the Israeli market and the negativity in the United States economy. The Israeli shekel is bound to recover its major losses against the US dollar from earlier this year, maintaining its commendable performance. However, it’s also feared that further appreciation from the Israeli shekel might prompt the country’s central bank to interfere. But despite those concerns, the pair remains on track to crash back to its support area. Moreover, experts from Israel warns that the outlook of the country and the economy is still vague thanks to the ongoing pandemic, with some experts saying that this dilemma is truly unique in history. However, bearish investors are hoping that the Israeli government has finally learned from previous economic hurdles like the 2008-2009 economic crisis.

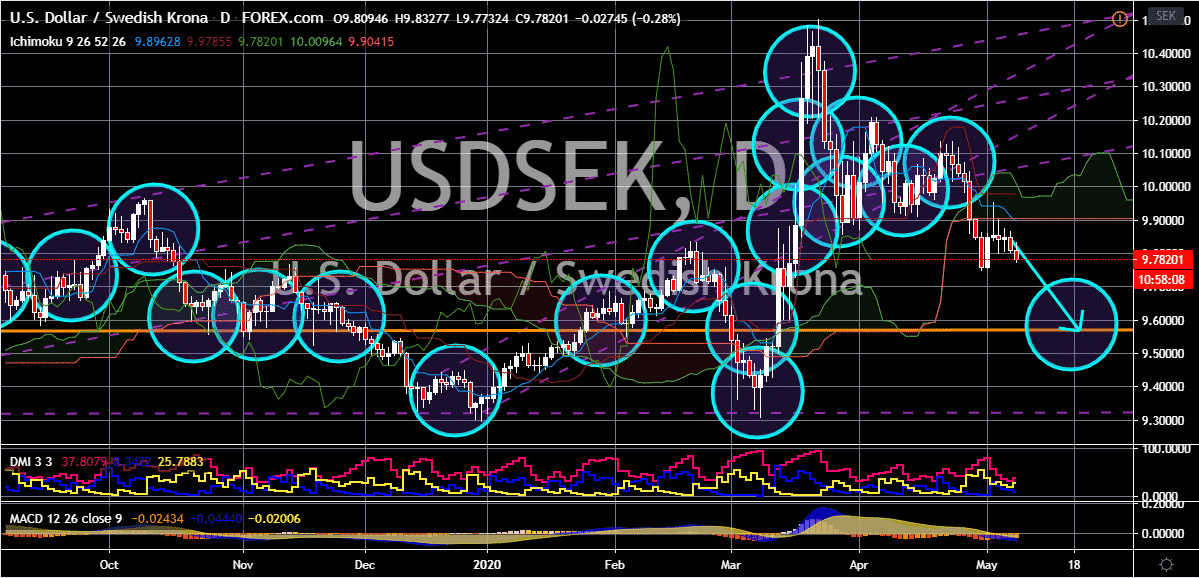

USD/SEK

Thanks to its maverick-like approach against the coronavirus pandemic, the Swedish krona gains support from the country’s economy. That approach, coupled with the relationship of the crown currency to the commodity market, the pair is on track to its resistance. The Swedish krona is looking to bounce back against the US dollar and its timing is better than ever as the safe-haven See, Sweden is noted as one of the countries with commendable protective instincts, but in the current pandemic, the government has decided to take a hands-off approach on the crisis. Sweden has refused to follow in the steps of other countries and did not enforce strict lockdown measures. The government banned gatherings of more than 50 people but allowed businesses to continue to operate. In short, it placed the fate of the country to its people’s discipline. And its decision has lessened the impact of the virus on the economy compared to other countries.

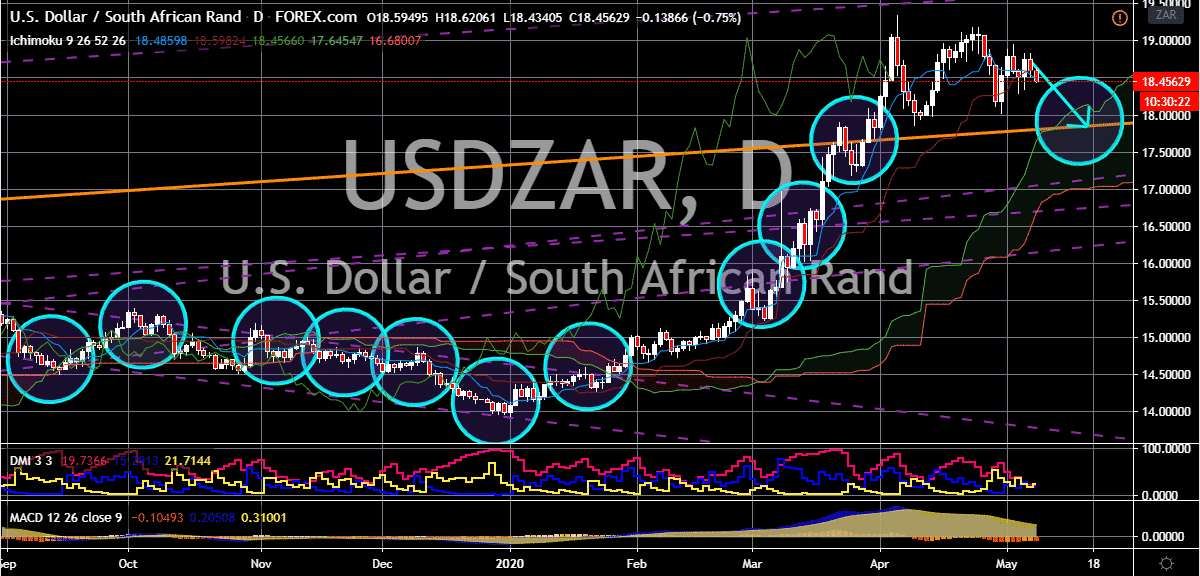

USD/ZAR

The US dollar to South African rand exchange rate is closing its week on a rough note as bearish investors take advantage of the renewed risk sentiment and attraction for emerging market currencies. The South African rand strengthens this Friday thanks to the easing concerns about the US-China trade war. The USDZAR pair is expected to hold on to its bearish momentums as the rand looks to regain some of its losses against the greenback. Apparently, the positive news about US and Chinese trade negotiators holding a phone call gave off a risk-on mood for investors. According to reports, the top trade officials of Washington and Beijing agreed to fortify their economies and prioritize public health cooperation. The news further undermined the safe-haven appeal of the US dollar. And considering that news about the South African economy gradually reopening once again has also boosted the confidence of the bearish investors.

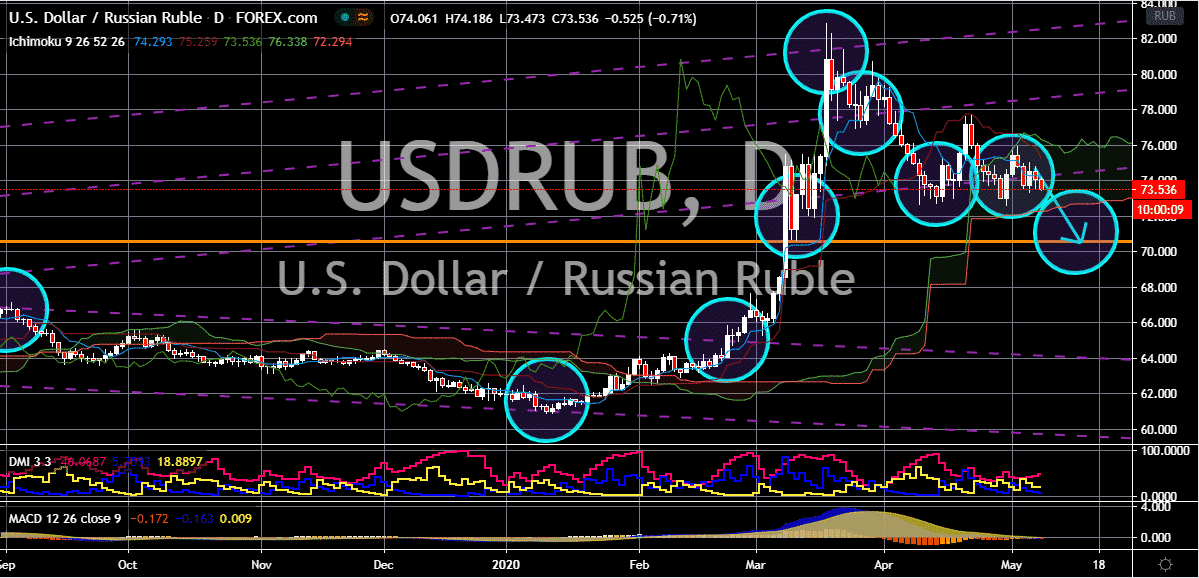

USD/RUB

The Russian ruble is on track to force the pair downwards towards its support levels. The US dollar is on the defensive thanks to the heightening concerns of negative rates from the United States Federal Reserve. The US dollar to Russian ruble exchange rate is predicted to drop to its support by the halfway point of the month. Investors of the safe-haven currency are getting more and more anxious for the outlook of the currency as speculations as to whether the Fed will cut its rates again is once again in the air thanks to the disappointing news about the American labor force. Just this week, the ADP nonfarm payroll report, the American private sector, has recorded a whopping 20.2 million job loss last month thanks to the pandemic. The novel coronavirus has greatly done damage in the US economy and has raised questions about the possibility of another stimulus package that will add up to the already massive spending package of the US government.