Market News and Charts for May 04, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

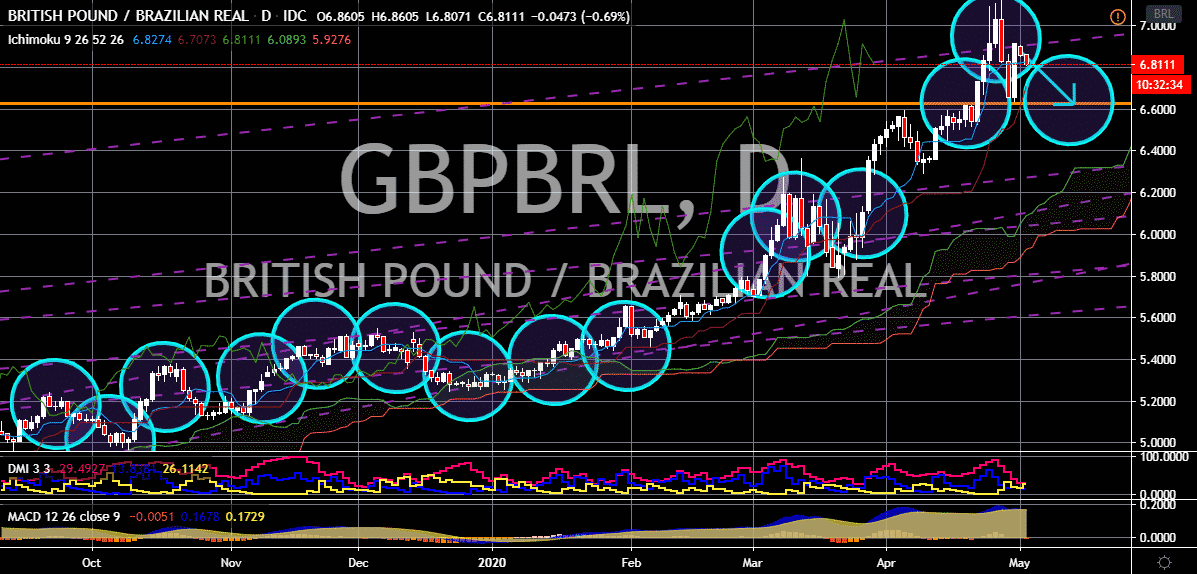

EUR/NZD

The New Zealand dollar struggles to regain its footing thanks to the renewed trade tension between the two biggest economies. This gives bullish investors of the EURNZD pair to take over and propel the pair towards its resistance area. The New Zealand dollar fell to its knees following the recent threat of the United States President against China. Aside from that, New Zealand dollar traders were saddened by the comments of Prime Minister Jacinda Ardern about the possibility of allowing travel between Australia and New Zealand. Ardern said that the nation shouldn’t expect anything like that for the next coming weeks. Meanwhile, investors of the euro are thrilled that countries in the block are starting to gradually reopen their economy amidst the pandemic. However, experts still ask the question of how long the recovery will take as it’s very evident that the economic slump is rather deep compared to any other.

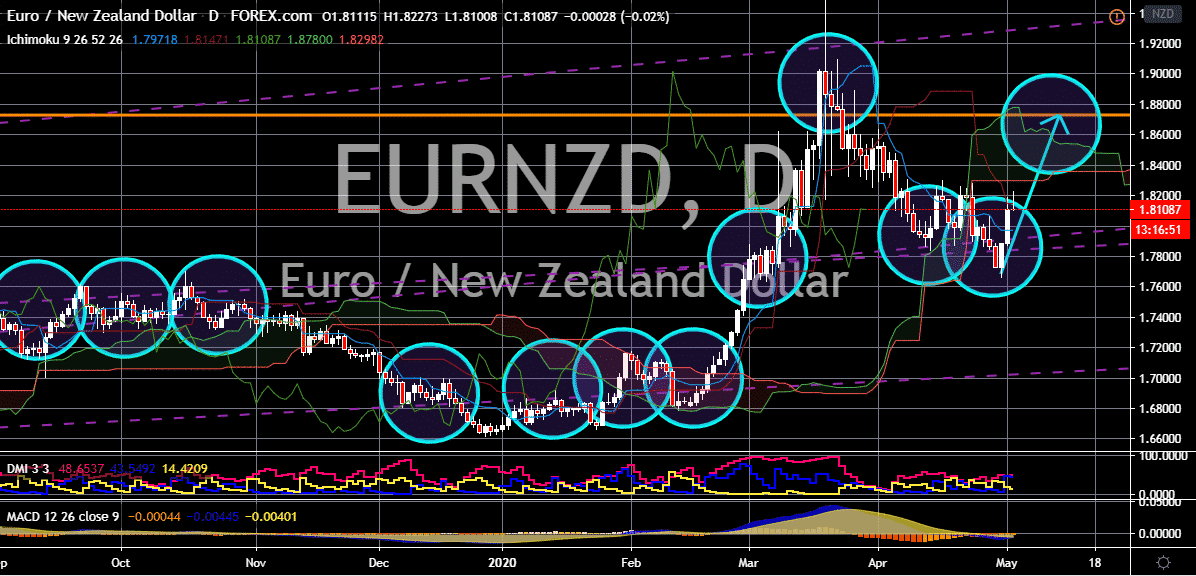

AUD/NZD

The Australian dollar regains its footing this Monday against the New Zealand dollar. However, the pair is still expected to decline to its support level in the coming sessions. Looking at it, both currencies are heavily affected by the renewed trade and geopolitical tensions between Beijing and Washington. The US President and State Secretary Mike Pompeo accused the Chinese government of allowing the coronavirus to escape from a controversial laboratory in the city of Wuhan. Washington is now pushing the initiative to remove global industrial supply chains from mainland China, weighing a new round of sanctions to punish Beijing. This, of course, would hurt the Australian dollar as the antipodean currency is highly susceptible to threats towards China, its largest trading partner. Today, the kiwi dropped thanks to the comment of the country’s Prime Minister regarding the possibility of allowing travel between Australia and New Zealand.

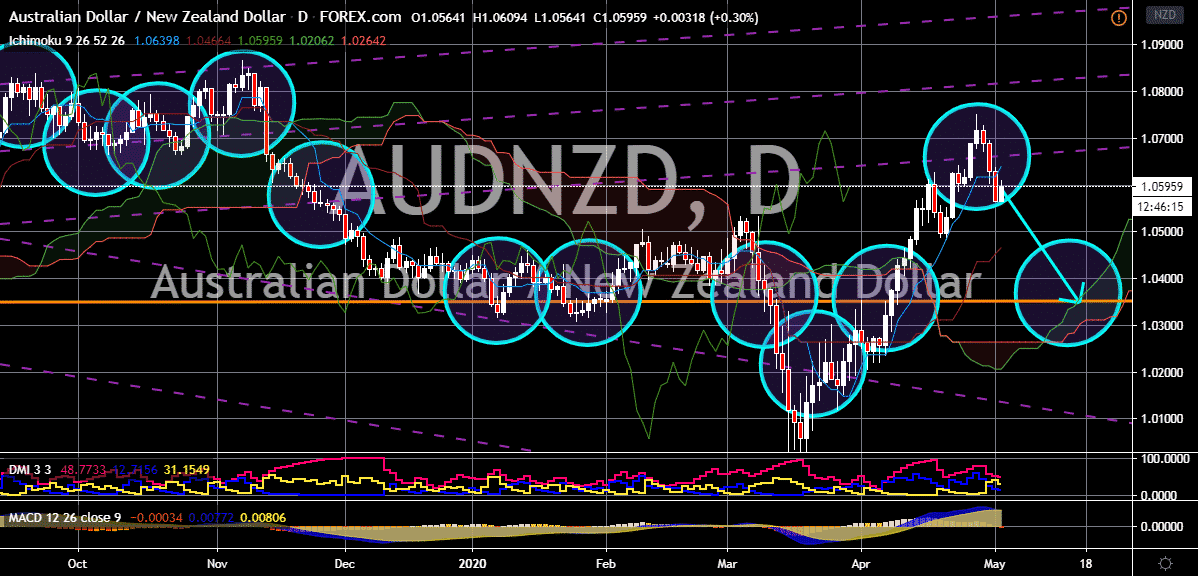

EUR/BRL

The euro temporarily hits a roadblock against the Brazilian following the news about the eurozone’s manufacturing activity collapsing. Despite the news, the euro to Brazilian real trading pair is widely expected to climb to its resistance by mid-May. Just recently, it was reported that the manufacturing activity of the block plunged last month as government-enforced lockdowns forced factories to halt production. Thanks to the lockdowns, major supply chains in the eurozone have been disrupted, resulting in the HIS Markit’s manufacturing purchasing managers’ index to plunge from 44.5% in March to just 33.4% in April. The reading is reportedly the lowest in the record since the survey began back in 1997. Meanwhile, the controversial president of Brazil once again makes headlines as anti-lockdown rallies in the country continue despite the rising death toll. Yesterday, President Bolsonaro rallied along with thousands of demonstrators in Brasilia.

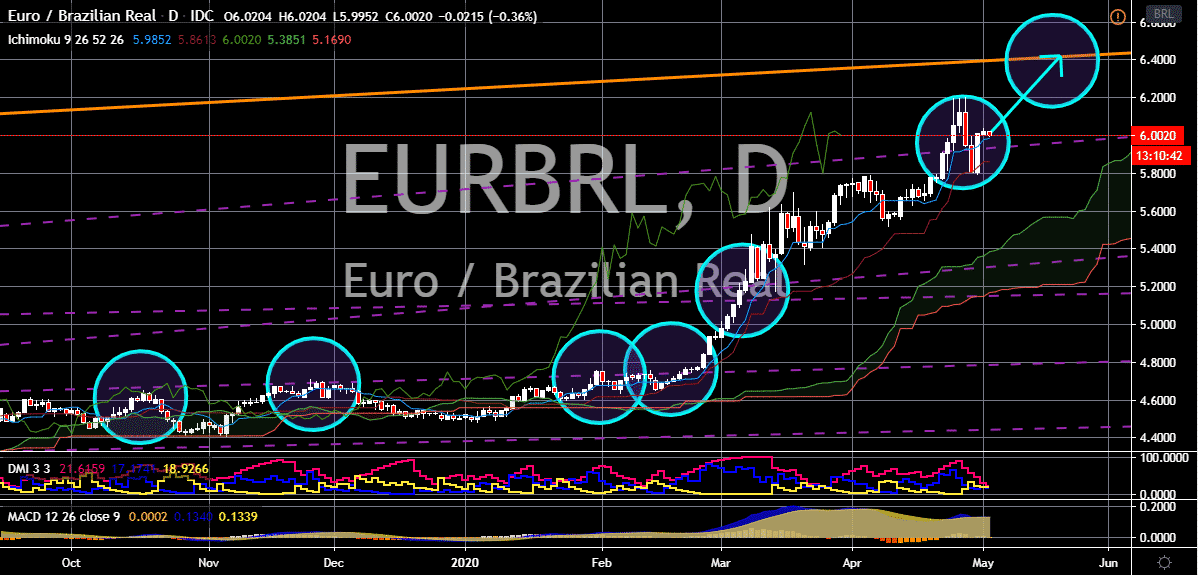

GBP/BRL

The British pound is back on the defensive against the Brazilian real despite the controversies bombarding the real. Bearish investors are looking to force the pair towards its support area in the coming sessions. It appears that in this matchup, the Brazilian real has brushed off the controversies regarding its president from yesterday’s anti-lockdown protests. Yesterday, the far-right Brazilian president gave a speech during the anti-lockdown protests in front of the palace in Brasilia. Bolsonaro blamed state governments about the lockdown and his move made headlines as the number of coronavirus deaths in Brazil continues to jump. Technically, the pair has a huge potential to make a sharp U-turn once it hits its support as Boris Johnson projects that the United Kingdom will bounce back once the lockdown is lifted. The British PM recently unveiled the timescale for things to revert back to normal and assured that each step will be taken carefully.