Market News and Charts for May 03, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

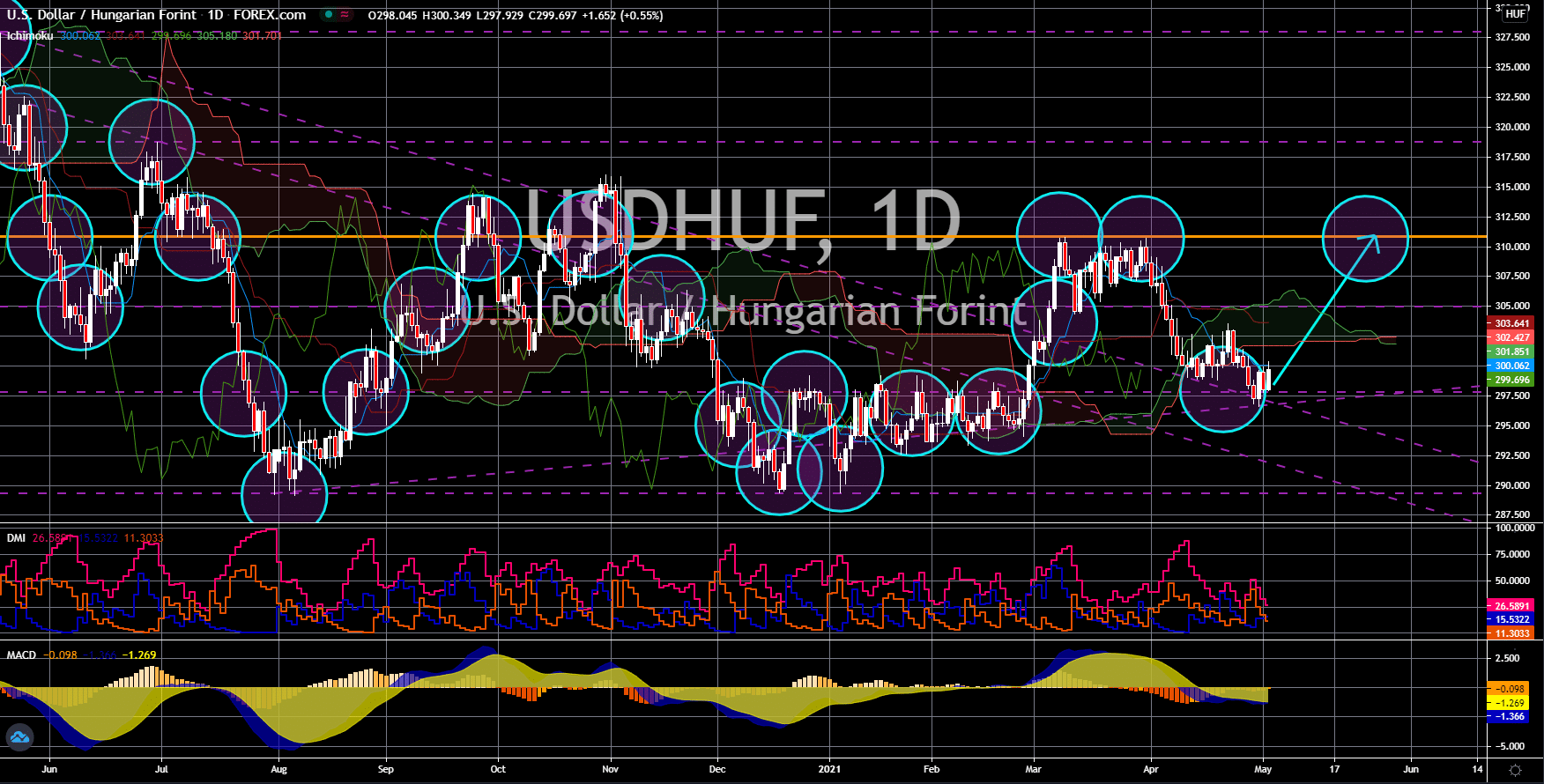

EUR/PLN

The pair will break down from an uptrend support line to retest December 09’s intraday low of 4.41723. Poland approved a mining operation until 2044 in defiance of the EU’s shift towards clean energy. The issuance of a license to operate for the same energy firm until 2026 is currently under investigation with the Court of Justice. The decision by Polish lawmakers to continue the mining business is critical as the Eastern European country is the biggest recipient of the 17.5 billion euros transition fund. This amount is part of the bigger 7-year budget of the bloc amounting to 2.2 trillion, which distribution had Poland protests earlier resulting in the final approval in December 2020. The EU Commission warned that only regions complying with the EU standard of carbon neutrality before 2050 will be able to benefit from the allocated amount. If unused, the fund will create excess liquidity of euro in the market resulting in a decline of the single currency.

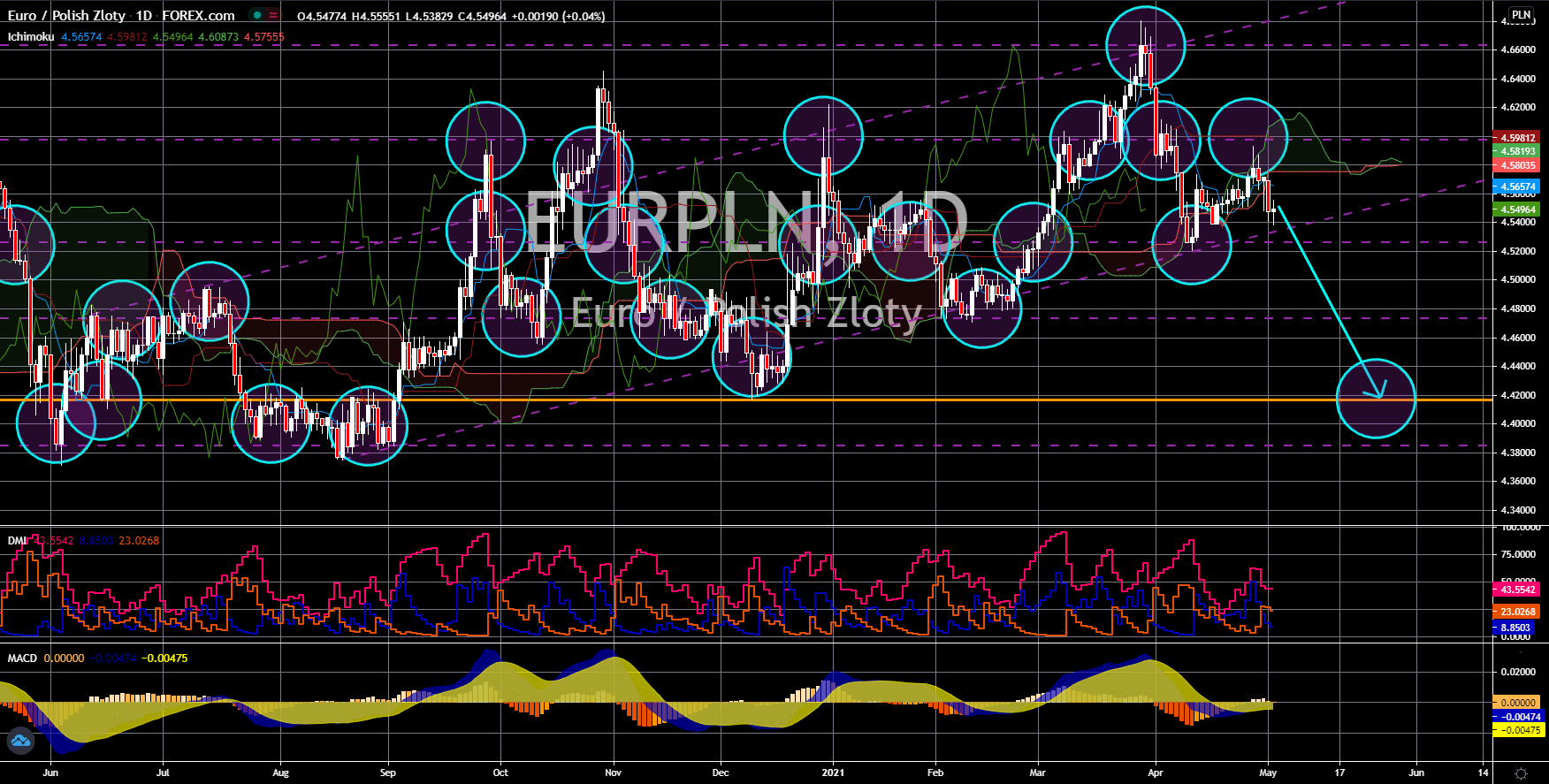

EUR/SEK

The pair will continue to move higher in the following days after it bounced back from a key support line. Sweden will continue its plan to open the economy despite extending its vaccination target for adult citizens by another three (3) weeks. Stockholm rejected giving 65 and above individuals the option to be vaccinated by the US pharmaceutical company Johnson & Johnson after reports of a rare blood cloth. Sweden currently has a statistic of 32 vaccinated individuals for every 100 citizens. Meanwhile, one of the EU’s economic powerhouses, France, is one notch higher from Sweden at the 16th spot. By May 17, Swedish officials will allow cultural and sporting events to take place with a capacity of 500 people in hopes of reviving economic activity from the pandemic induced slowdown. With regards to the economic data, the country’s manufacturing sector remains as the key driver of the economy with 69.1 points against estimates of 62.5 points.

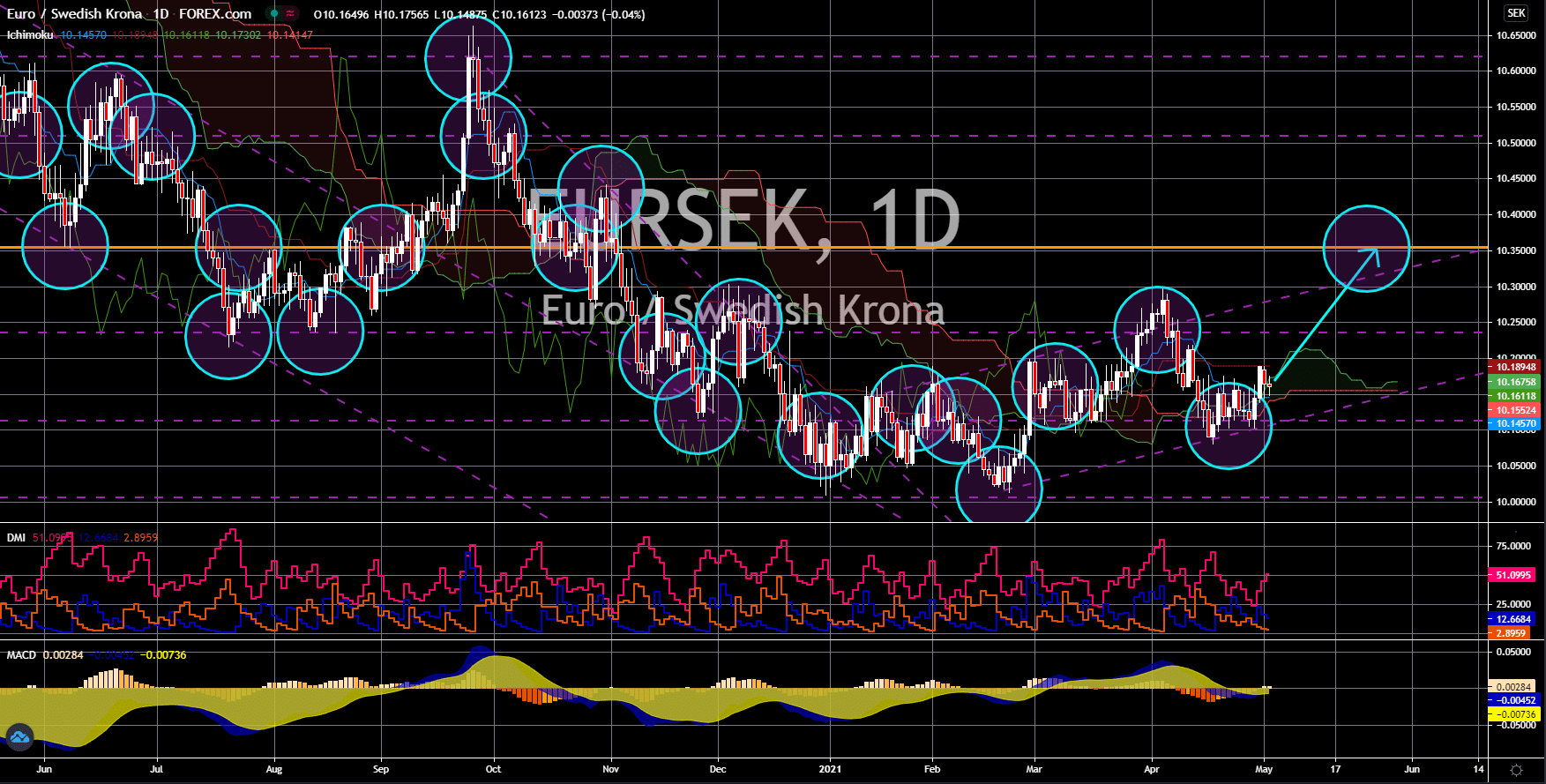

EUR/CZK

The pair will break down from the psychological support area at 25.70000 to reach the key support level of 25.00000. The optimistic outlook for the Czech koruna was due to the decline in its GDP figures for the first quarter of fiscal 2021. The economy contracted by -0.3% in the first three (3) months of the year after an expansion of 0.6% in Q4 2020. On a year-over-year (YoY) basis, this translates to a -2.1% dipped, which is much better than the previous quarter’s -4.8%. Last year, Prague contracted with a -5.6% record. Adding to investors’ concern over Czechia’s economy was the rising government deficit of 192.0 billion in April. Also, the Markit PMI data failed to beat the 59.0 points projection with the 58.9 points result. Other concerns include the souring relationship between Moscow and Prague over the Czechia’s expulsion of Kremlin diplomats, which it accused were spies who were also responsible for the assassination of a double agent in United Kingdom.

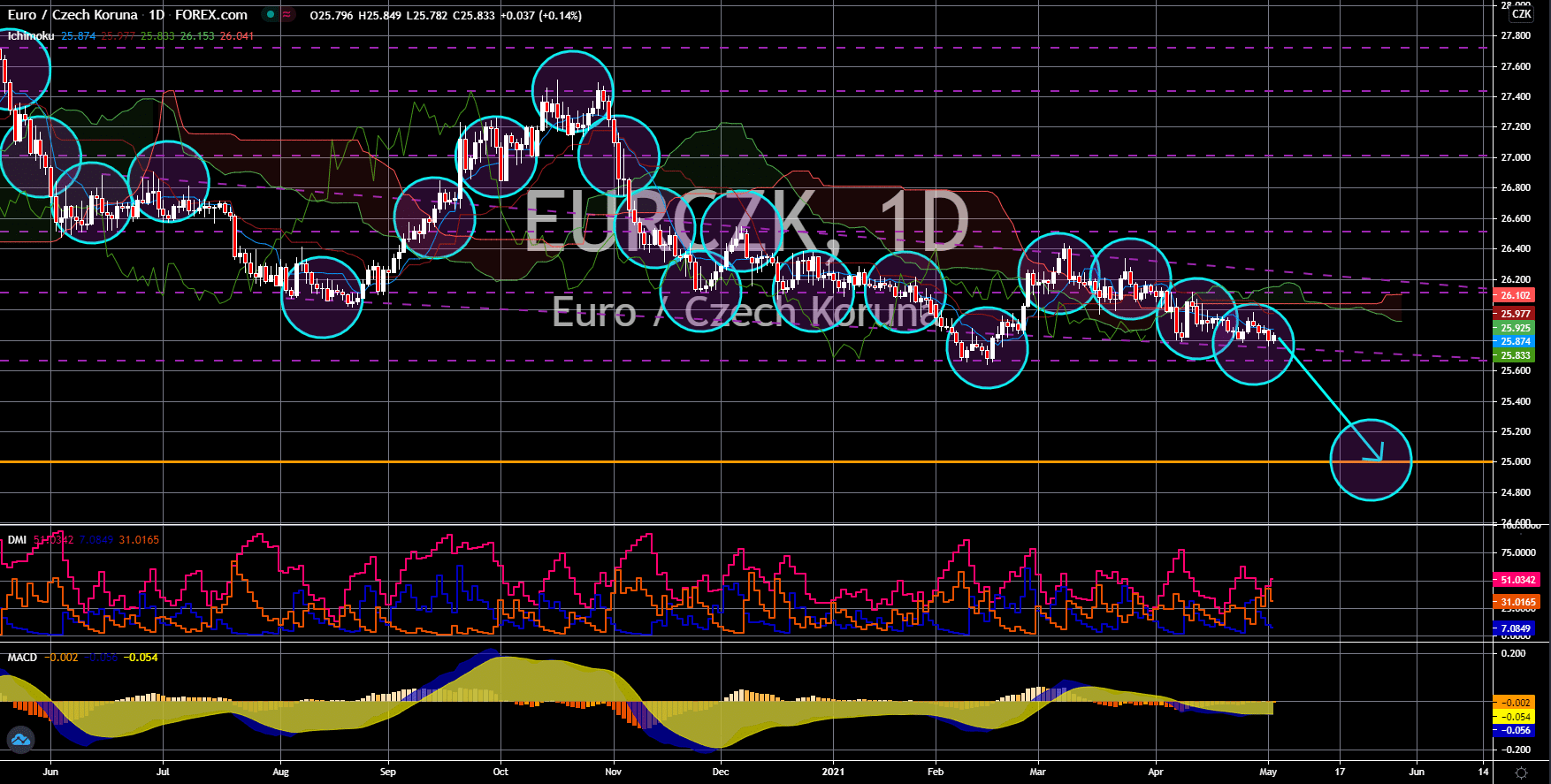

USD/HUF

The pair will bounce back from the support lines to retest its previous high at 310.691. Hungary is nearing to fully reopen the economy as non-essential businesses and activities such as gyms, spas, and zoos were allowed to operate and cater individuals that can show proof of vaccination. Around 40% of the population has received either a partial or full jab of COVID-19 vaccine. Meanwhile, the government targets 5 million vaccinated individuals before big gatherings like weddings and reunions will be considered. As for the economy, 2021 GDP is projected to increase by 4.3% with better forecast for 2022 at 5.2%. However, the renewed economic activity in the world’s largest economy will drive the greenback higher against the forint. In Q1, the US economy advanced by 6.4% and a full-year guidance shows 2021 GDP jumping by 7.1% from the -3.5% contraction in 2020. Also, unemployment data were at their records amid the success of the vaccination program.