Market News and Charts for May 01, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

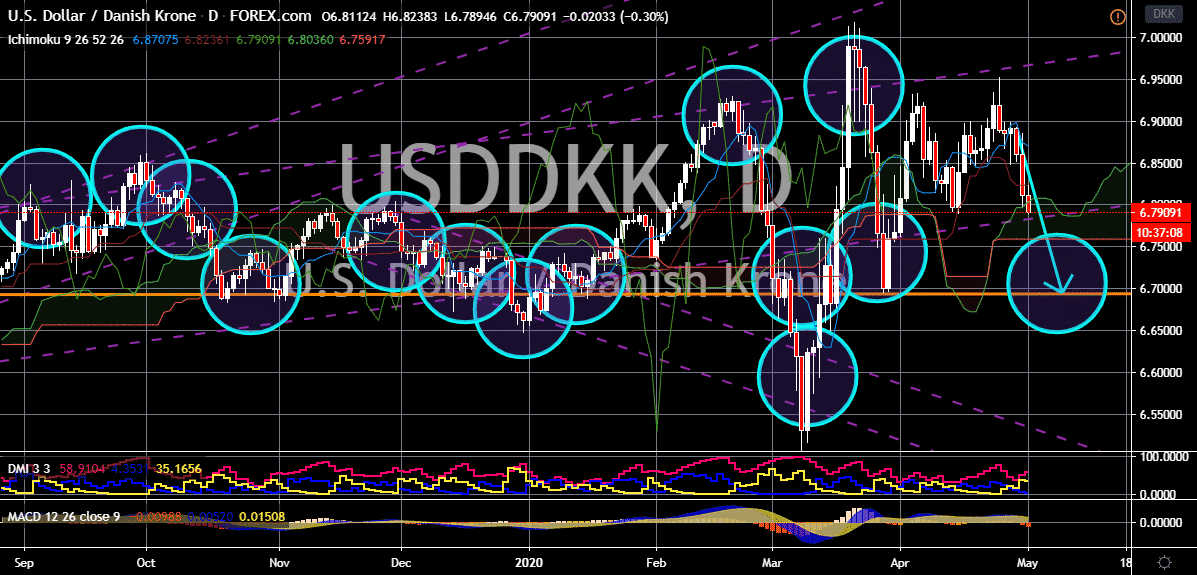

USD/DKK

The Danish krone takes advantage of the broader weakness of the US dollar and bags gains against it. The USDDKK pair is widely expected to drop to its resistance level, hitting levels last seen in March this year. Just recently, the United States Federal Reserve decided to leave its official rates unmoved for the month and will opt to patiently wait for the effect of the previous rate cuts to gradually take effect. Fed Chair Jerome Powell added that the reserve bank isn’t in a rush to heighten the interest rates because it had just slashed it near to zero. Moreover, it appears that the safe-haven appeal of the US dollar isn’t working on investors of the Danish krone despite the Danish economy entering one of its worst recession in history thanks to the pandemic. It appears that bearish investors are smoothly brushing off the downbeat results from the country such as the Danish retail sales which recently declined by 3.7% on a year-over-year basis.

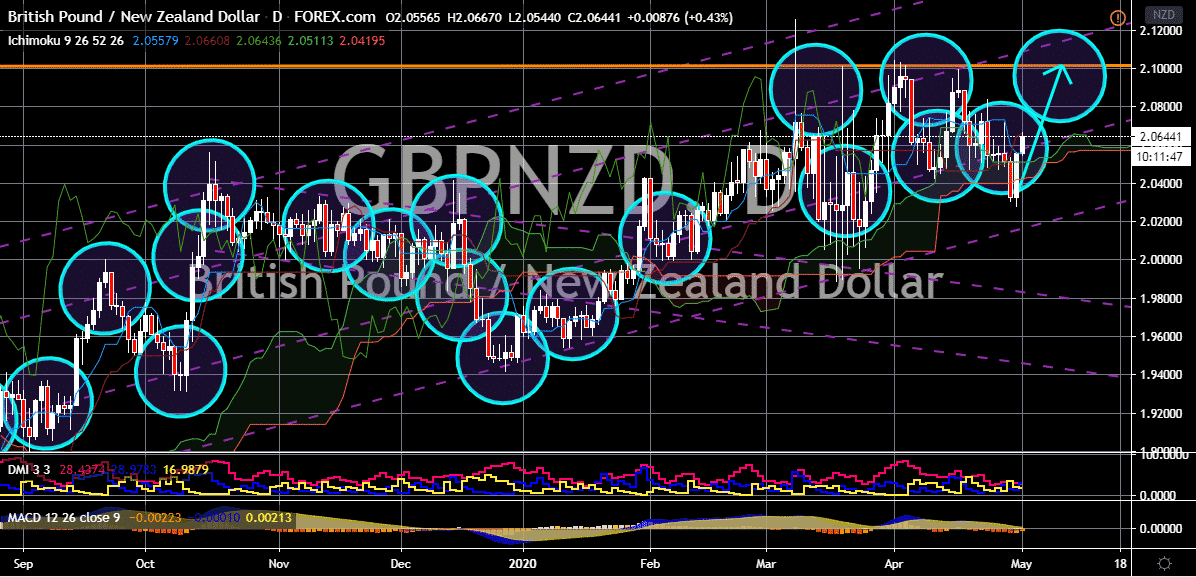

GBP/NZD

The British pound to New Zealand dollar exchange rate is heading to its resistance in the next coming sessions. Bullish investors hold a firm grip on the direction of the pair, propelling it higher despite the broader strength of the kiwi in the foreign exchange market. Looking at it, New Zealand has done a successful and commendable job in containing the coronavirus as it implemented one of the most severe and strict lockdown measures in the globe. The country only has 19 counts in its death toll and new cases only come in single digits. However, this took a great toll on the country’s economy and it appears that the British pound is taking the opening to control the pair. However, the pair has the potential to make a sharp bearish reversal as New Zealand could bounce back from its economic slump faster than Great Britain. Considering the number of cases in the United Kingdom, it looks like it will take time before it could fully recover.

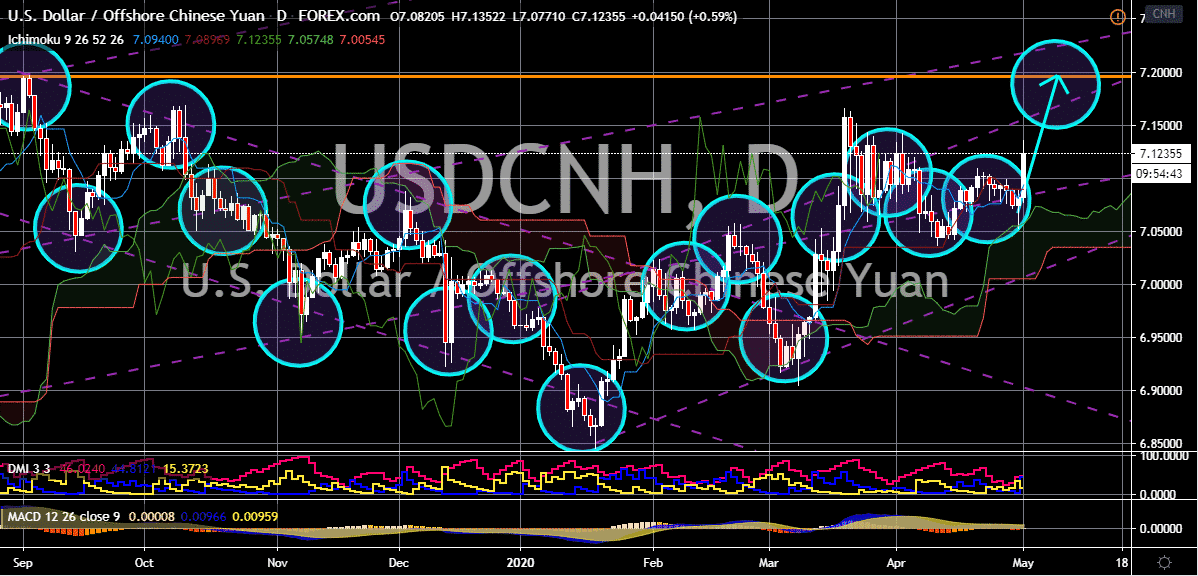

USD/CNH

The US dollar continues to advance against the Chinese yuan despite the massive hurdles faced by the US economy. The US dollar to Chinese yuan trading pair is widely expected to rally and reach its resistance area by the first few days of the month. The beloved greenback is feeling the pressure from the negative results produced by the American economy, and the most recent initial jobless claims report. Adding salt to the buck’s wounds is the negativity in the US stock market today which saw major indices fall thanks to the discouraging results from the earnings call of tech companies. The fall of the US stock market this Friday is led by Apple and Amazon whose stocks plunged during the after-hours of the trading market. Perhaps the poor economic data and corporate earnings are attracting more investors towards the safe-haven appeal of the greenback.

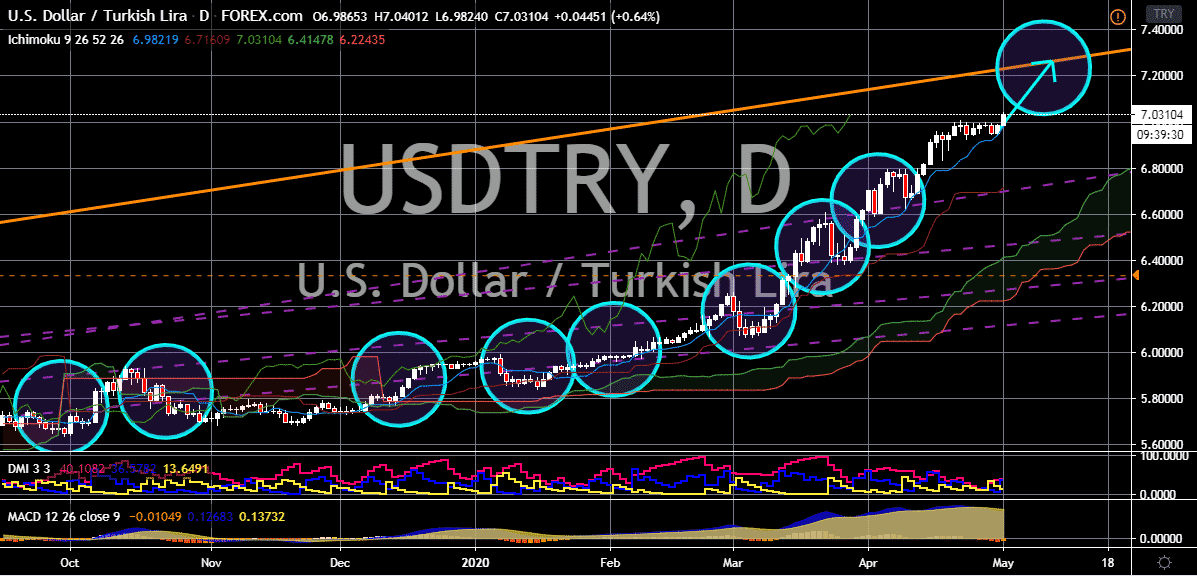

USD/TRY

The Turkish lira continues to buckle against the US dollar. The USDTRY pair is heading towards its resistance, climbing to ranges last seen in August 2018. Fortunately for bullish investors, the pair is expected to break past its resistance and continue climbing gradually as the Turkish economy feels the intense burn of the pandemic. The Turkish economy is bound to fall to its first recession in a decade because of the pandemic and as drastic measures, the country’s government is working on ways to gradually reopen the economy despite the underlying threat. This, however, is also backfiring against the Turkish lira as investors grow even more concerned for the possibility of a second wave of coronavirus cases. This then prompts investors to seek safety and head towards the safe-haven US dollar. Although the US dollar is also pressured by the negative results from its inflation, initial jobless claims, and other more reports regarding its economy’s status.