Market News and Charts for March 24, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

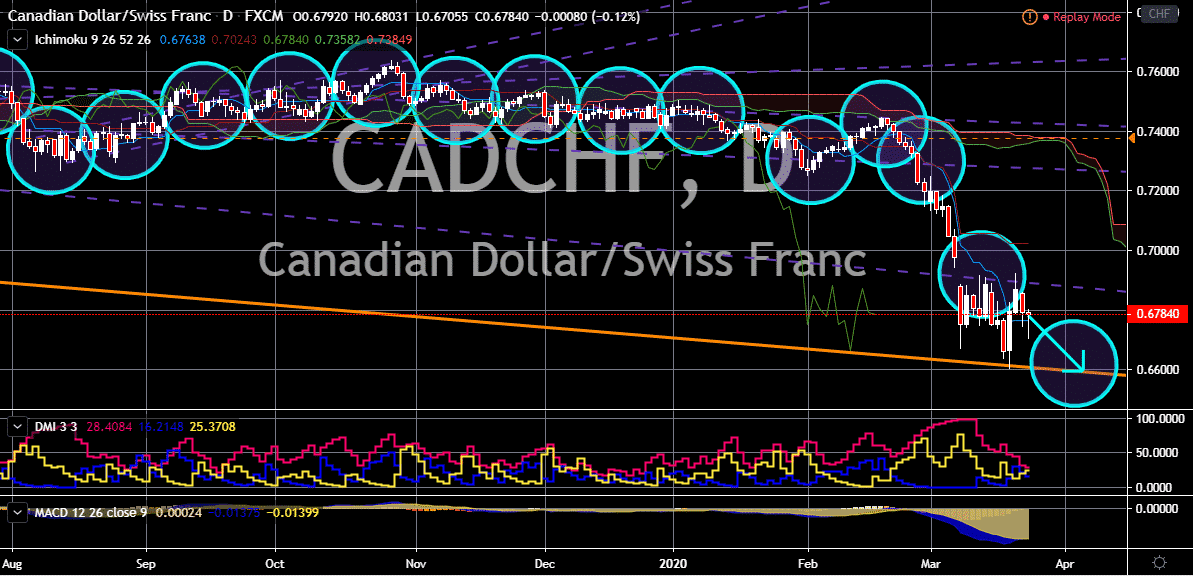

CAD/CHF

The pair is still within record lows after recording a plummet on March 20, recorded in history as the 2020 Black Monday. More recently, the exchange rate has been stuck within a range, with the Canadian dollar largely considered to be the underdog as the Swiss franc gets boosted by its safe-haven appeal. Still, a tremendous gain in the Swiss franc’s value doesn’t really help the Swiss economy that much. So, the Swiss National Bank is adopting some measures (read: interventions) to hinder the continuous ballooning of the franc’s value. According to recent data, the Swiss National Bank hiked its foreign currency interventions to the highest level since the 2016 Brexit referendum. This shows the Swiss central bank’s commitment to reigning on the value of the currency. Therefore, if such efforts are effective, we may see the loonie rise in the short-term. However, if the downward pressure to the Canadian currency is stronger, it will stay low.

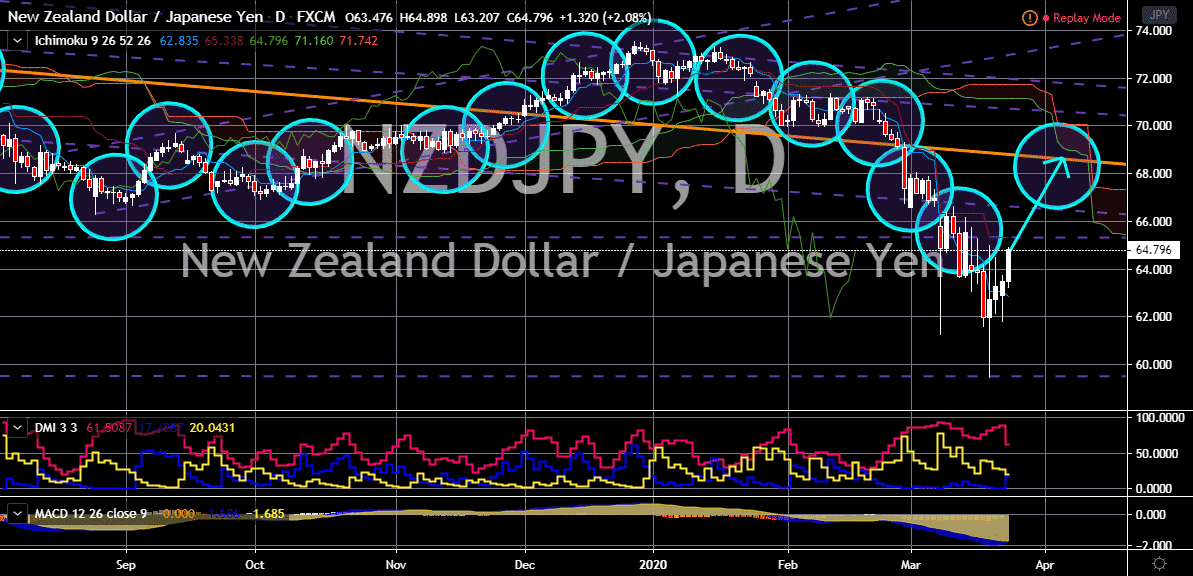

NZD/JPY

The NZDJPY pair is driven by news from both of the countries’ central banks, although news from the Reserve Bank of New Zealand prevailed in strength. Over in Japan, Japanese banks have borrowed a record $89.3 billion from the Bank of Japan’s funding operations. This suggests strong demand for the US dollar from the country’s financial institutions. The borrowing amount in the BOJ operations exceeded the record from the 2008 financial crisis, which amounted to $50.2 billion. The demand for liquidity is especially tight ahead of March 31, which happened to be the end of the financial year for many Japanese companies. In the stock markets, Japanese stocks perked up as authorities bolstered stimulus measures to fight the economic impact of the global coronavirus outbreak. The country’s Nikkei 225 was among the region’s major markets that recorded the largest increase, climbing by 7.13%.

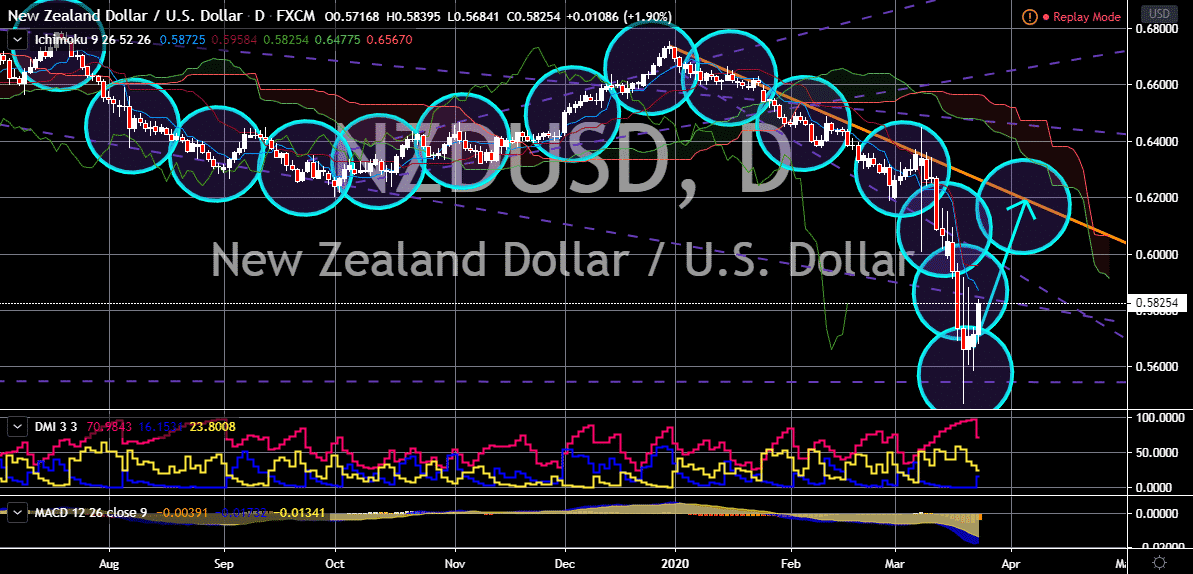

NZD/USD

The NZDUSD pair’s movements looks very similar to that of the NZDJPY, although the reasons are pretty different. The exchange rate is current trading in the green as the NZD reclaims ground against the highly in-demand greenback. The strength today can be connected to the country’s government’s comments about a $16.3 billion support package, which they said was “only the beginning.” New Zealand Finance Minister Grant Robertson warned, however, against expectations that things will go back to normal anytime soon. He also warned about the country’s unemployment levels, which he claimed could reach 7% soon. Meanwhile, New Zealand Prime Minister Jacinda Ardern offered some reassurance to mortgage holders. The government also announced retail banks will offer a six-month principal and interest payment holiday for mortgage holders and small businesses whose incomes have been impact by the COVID-19 pandemic.

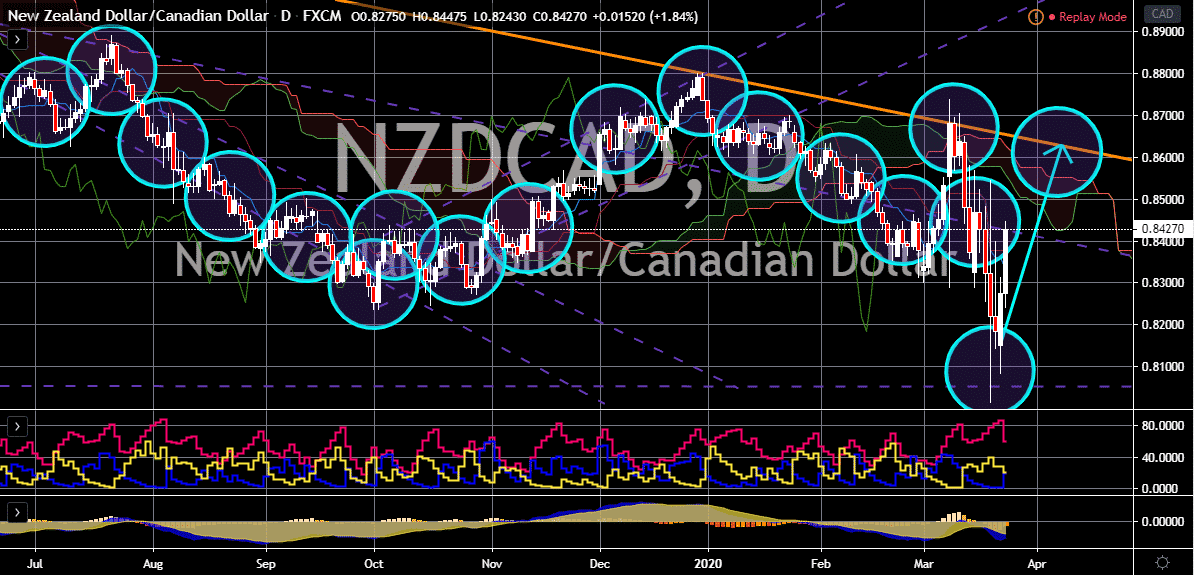

NZD/CAD

The performance of the NZD against the USD today is consistent with its performance against CAD. Circling back to the loonie, we see the commodity-heavy currency weakening against the kiwi amid the latest round of support to businesses from the NZ government. In the Great White North, meanwhile, the Bank of Canada recently restated its authority to purchase corporate and municipal bonds. BOC Governor Stephen Poloz issued a restatement of the bank’s policy in the Canada Gazette on March 13. He said the rights to purchase securities include the right to buy the debt of companies and municipalities when it’s addressing a situation of financial system stress that could have “material macroeconomic consequences.” According to some, the bank might start a quantitative easing program for the first time in history. The country is currently combating what may be described as a drastic rise in unemployment.