Market News and Charts for March 18, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

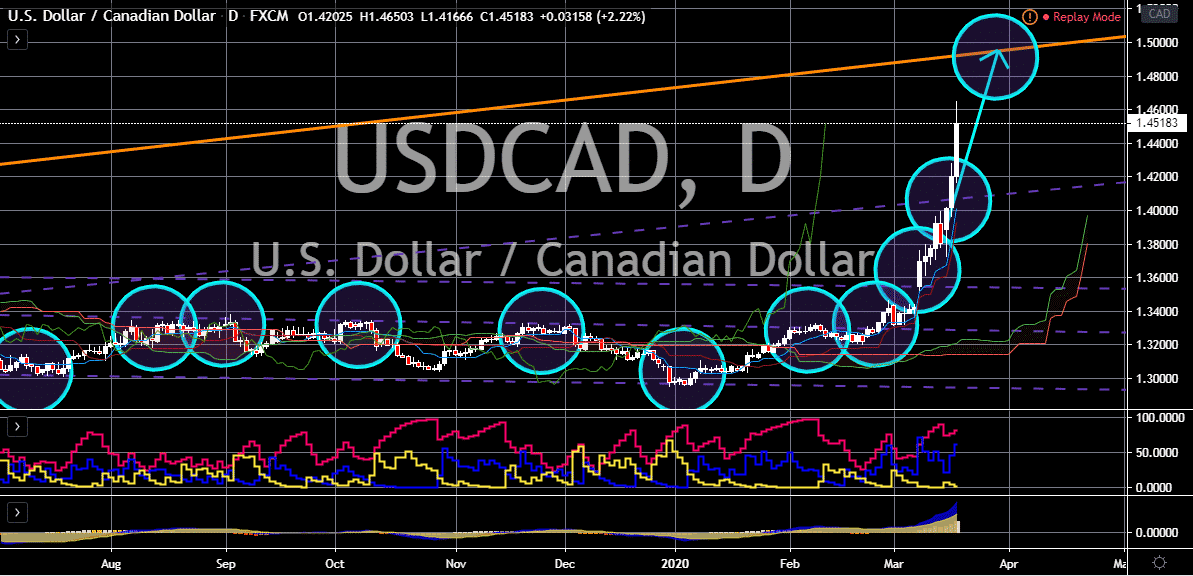

USD/CAD

The Canadian dollar continued to weaken against the buck today, while the US dollar kept its gains intact and added to them. Oil prices drove the Canadian dollar’s performance. Saudi Arabia and Russia kept up their fight for market share, while US crude futures lost 0.3% at $28.62 per barrel. The Bank of Canada said it was ready to take further action after it cut its policy rate by 50 basis points to 0.75% in an emergency move last Friday. The Canadian dollar further weakened on the results of economic data. The data showed the Canadian manufacturing sales plummeted for the fifth consecutive monthly decline in January. This result would support the argument for further easing. This would also mean the bank needs to cut rates even if there was no threat from the coronavirus pandemic, and the action should be taken as soon as possible. Additionally, Canadian bond yields rose across a flatter yield curve, with the two-year yield up 5.9 basis points at 0.526%.

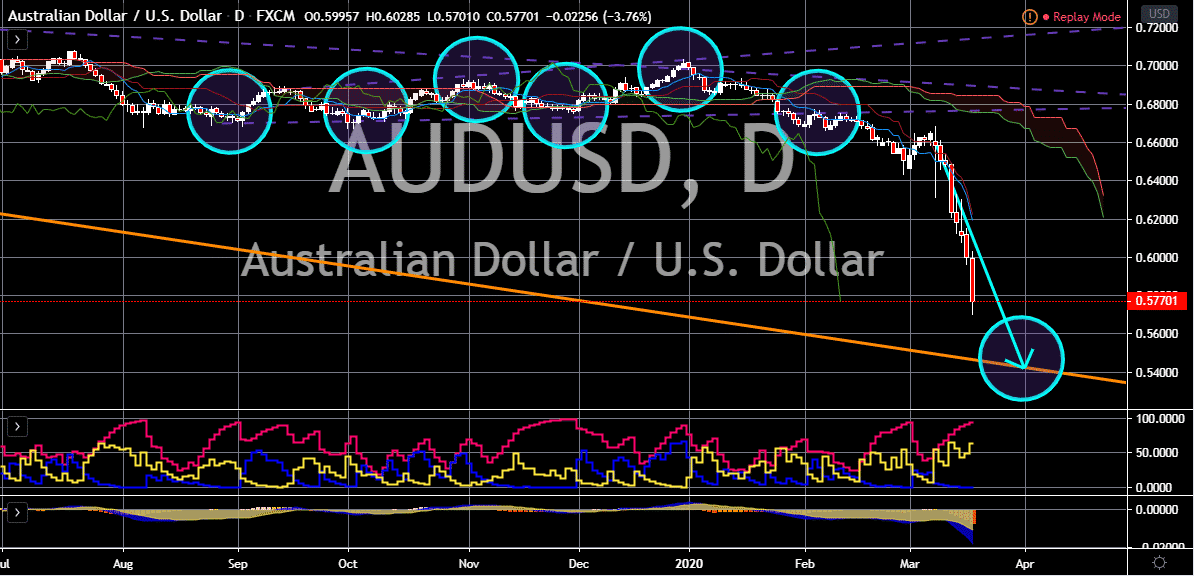

AUD/USD

The daily chart for the AUDUSD chart is showing a dramatic fall in exchange rate in recent days, with the Australian dollar continuously weakening against the US dollar in sessions. The Australian central bank is under pressure from the Fed and the Trump administration. Treasury Secretary Mnuchin is negotiating with Congress about sending checks to Americans over the short term, while the US government recently announced further relief measures. Over in Australia, the Reserve Bank of America released the minutes of its latest meeting. However, the contents appear to be old news. There was no discussion of the possibility of quantitative easing. This suggests the bank doesn’t expect to resort to unconventional methods anytime soon. And because of the rapidity of market developments, there isn’t a lot of new information from today’s release with last week’s RBA announcement on government bond purchases.

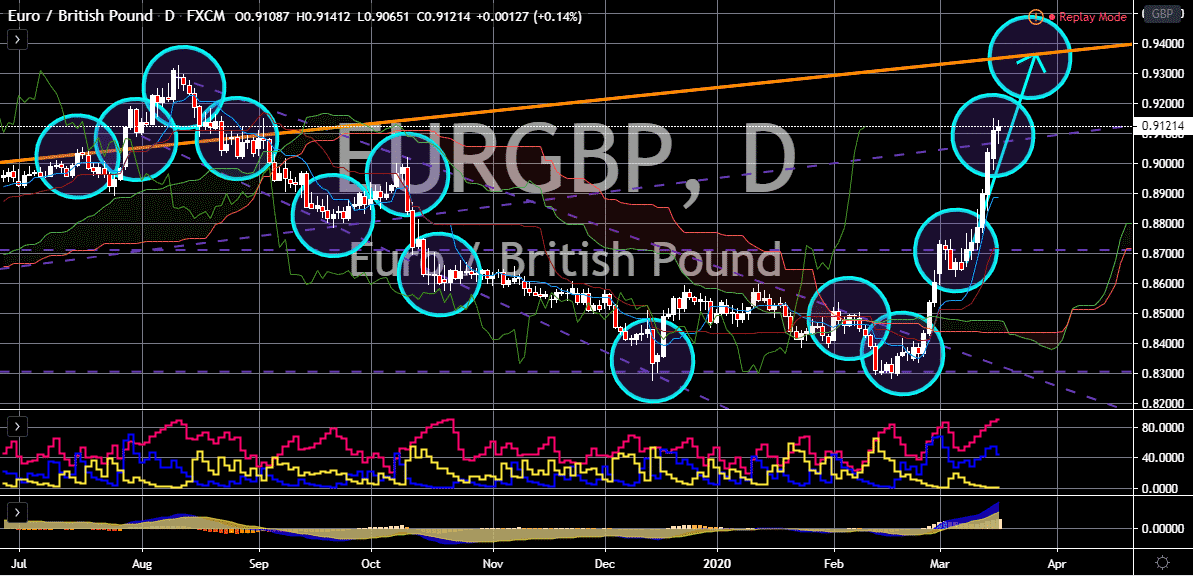

EUR/GBP

The euro continues its uptrend against the British pound, although the sterling managed a slight pullback in today’s session after nearing a key resistance area. The euro has had the upper hand as GBP traders have become increasingly frustrated with the sterling’s performance. Coronavirus concerns have been driving the exchange rate of the pair, with the euro benefitting from the carry-trade trend while the British pound sinks on worries over lack of foreign investment. Still, the euro’s rally might come to an end soon as eurozone confidence plunges, based on data from the ZEW’s March economic sentiment index for both Germany and the entire eurozone. Both of the figures for the regions saw a huge amount of contractions, coming well below expectations. German and eurozone economic sentiment came in at -49.5. This is partly the reason the British pound managed a comeback even though the euro has been surging.

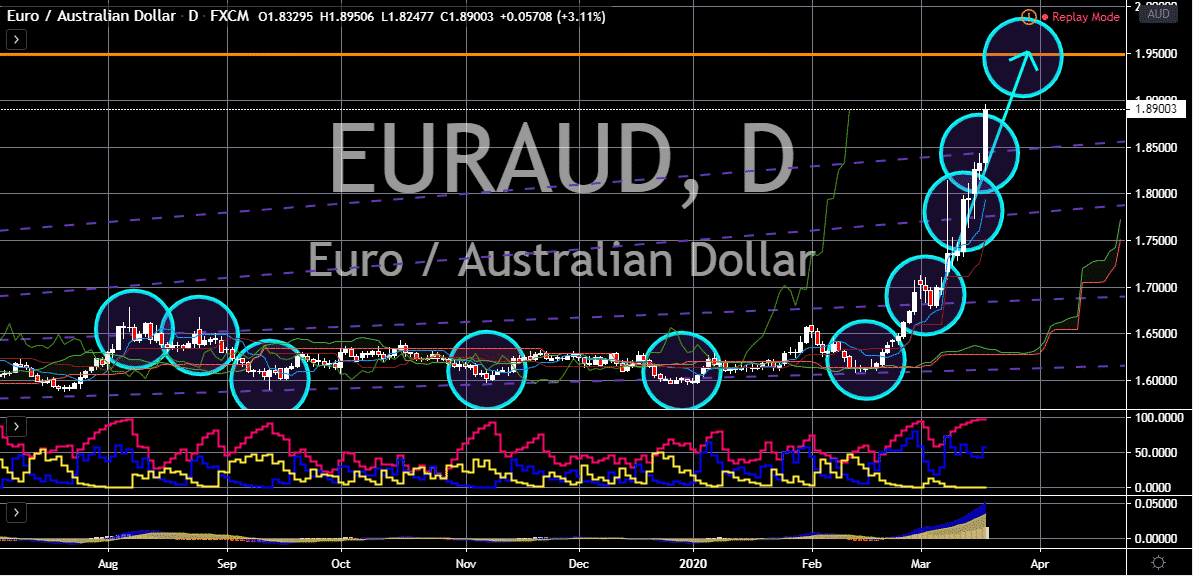

EUR/AUD

Against the Australian dollar, however, the uptrend doesn’t show any signs of letting up. Exchange rates continue to tread the higher portions of the daily chart. In what can be best described as a nosedive, the Australian dollar continued to fall to reach 17-year lows as fears of a coronavirus-driven global recession sent investors dumping risky assets and commodities, with the panic spilling into sovereign bonds. The RBA has previously flooded the banking system with cash to ease the strain in bond markets, injecting A$10.7 billion into the market on Wednesday. At the same time, the Aussie government flagged another round of stimulus to try to avoid the scenario of recession. And the Australian dollar has continued to be weak, but the lackluster performance of the currency isn’t likely to boost the domestic economy as demand for service exports such as tourism and education is drastically crippled by the coronavirus pandemic.