Market News and Charts for March 15, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

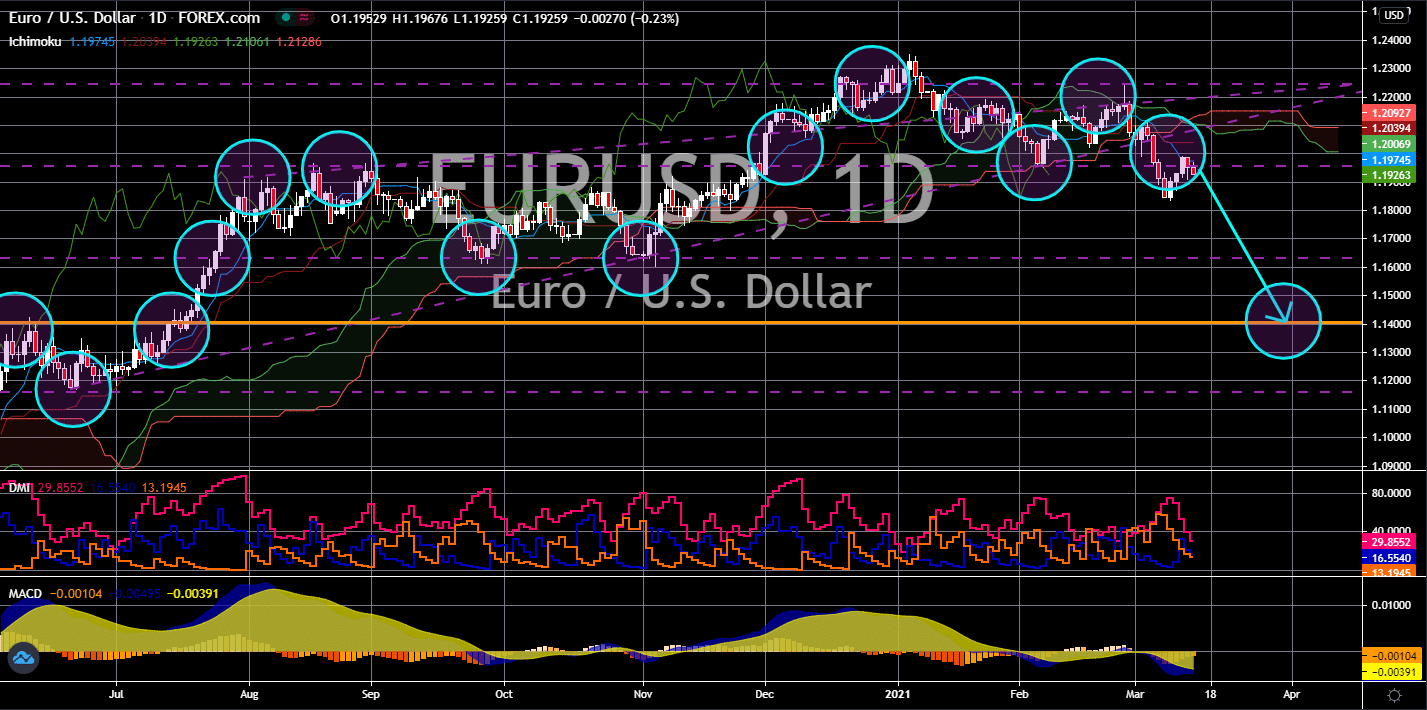

EUR/USD

The pair will continue to move lower towards the 1.14000 price level in coming sessions. The US treasury yield reached its 2021 high on Friday’s trading, March 12. The 10-year maturity note is up by 10 basis points to 1.626% while the 30-year coupon price is at 2.388%. The upbeat performance of the fixed income assets was due to the signing of the 1.9 trillion economic aid by President Joe Biden on the same day. The passing of the stimulus package into law increased fears of surging inflation. And the rise in inflation data could further add pressure to the Federal Reserve to raise the interest rate. Also, the number of unemployment benefit claimants on Thursday, March 11, slowed down by 712,000. Meanwhile in Europe, the European Central Bank retained its benchmark interest rate. However, ECB President Christine Lagarde said that the central bank will continue its bond purchase to support the Eurozone, adding pessimism to the single currency.

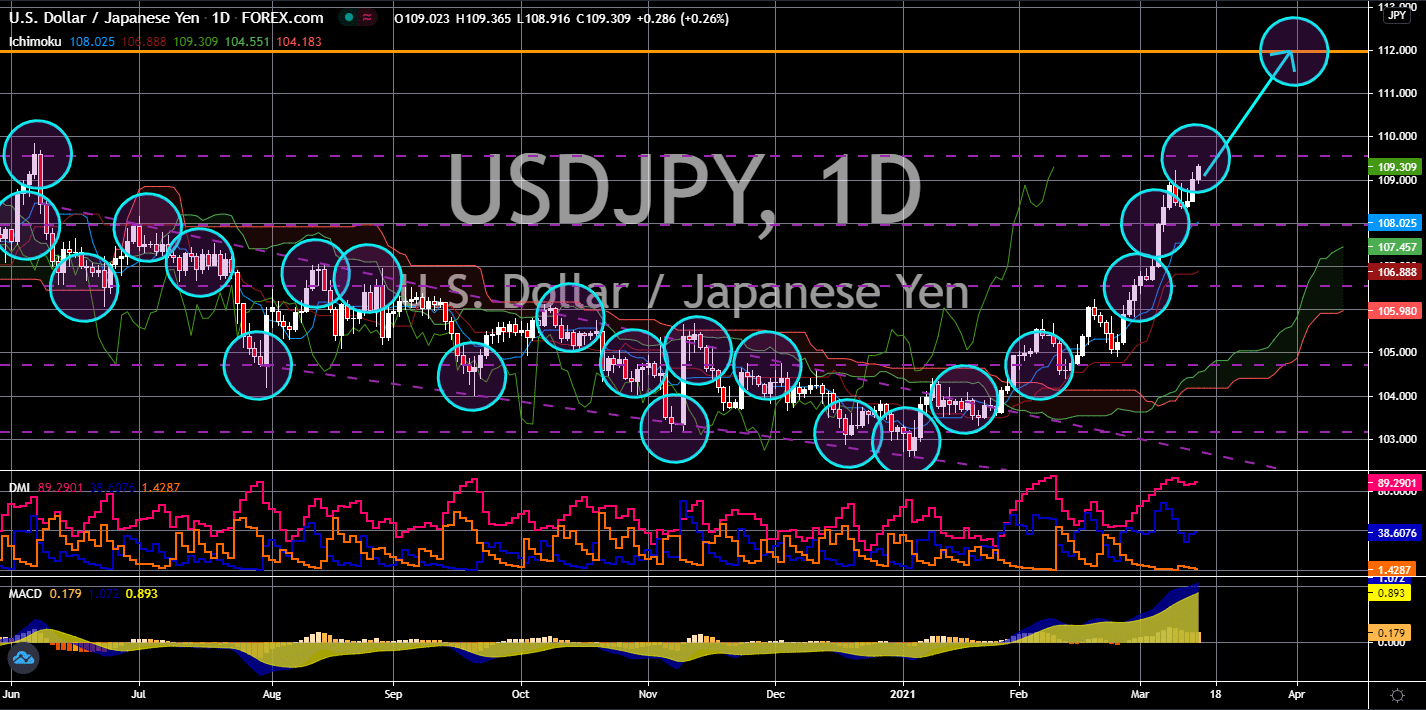

USD/JPY

The USDJPY pair will continue its rally this week up to the 112.00 key resistance area. Japanese manufacturer’s spending in January had dramatically slowed down. Core machine orders plunged by -4.5% in the first month of fiscal 2021 as businesses were worried with the possibility of extending the national state of emergency. This was due to the surge of coronavirus cases in Europe and the gradual increase in daily infections in Japan. The recorded fresh cases on March 07 were 1,722. This was the highest reported number since February 06 at 2,270. As a result, the Liberal Democratic (LDP) party calls for new stimulus from the Japanese government. In December. The world’s third-largest economy passed 700 billion in economic aid. Lawmakers are suggesting to double this amount after President Joe Biden signed the second-largest relief package in US history on Friday, March 12. Analysts are anticipating the USDJPY pair to reach its 2-year high.

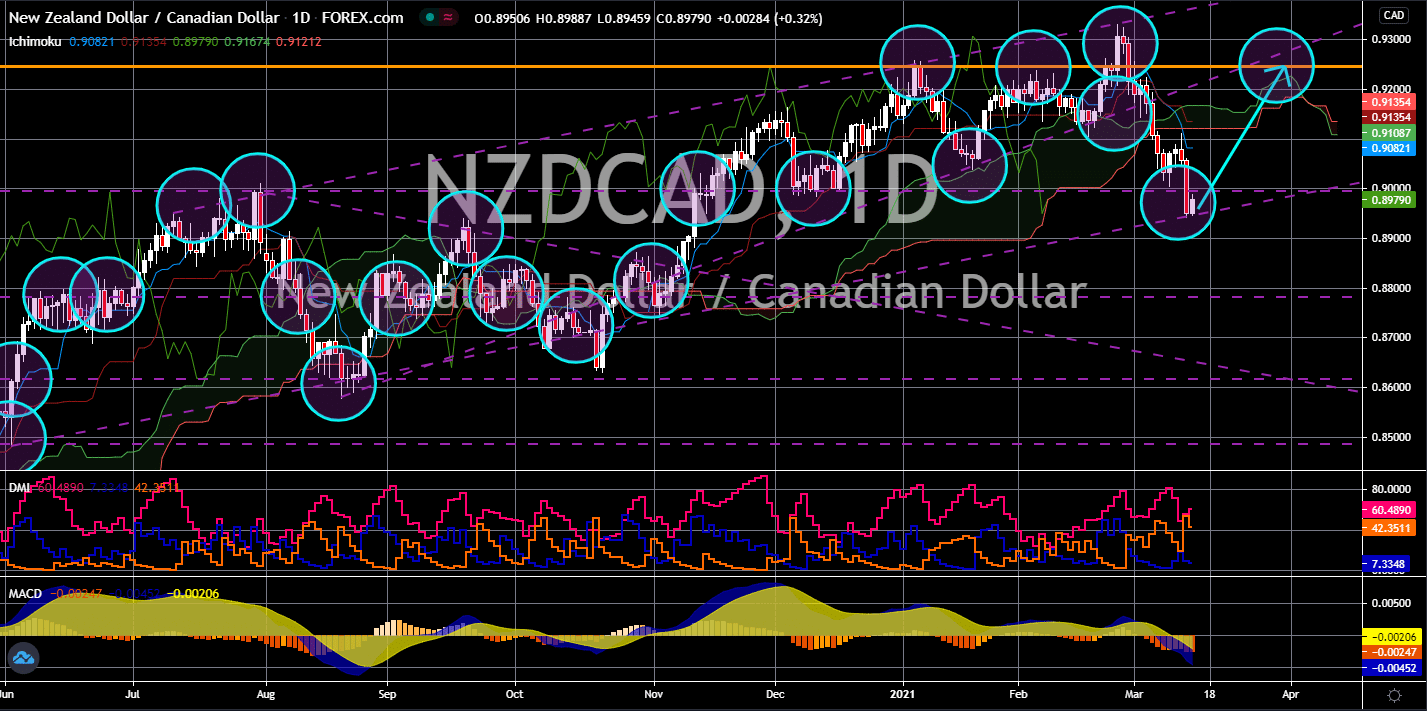

NZD/CAD

The pair will bounce back from an uptrend channel support line to retest the 0.92460 resistance area. Canada posted better-than-expected results on Friday’s reports. Unemployment was down to 8.2% in February against 9.2% expectations. In the first month of fiscal 2021, the figure was 9.4%. The number of new jobs added in the same month was 88,200 compared to January’s 12,600 additions. These figures will send the Canadian equities market higher while investors will lessen their exposure to the local currency. While investors will see a decline in the Canadian dollar in the short-term, a possible interest rate hike will drive the NZDCAD pair lower in the medium to long-term. The Bank of Canada retained its 0.25% rate amid concerns over the labor market. But the upbeat unemployment data could pressure the central bank in the next meeting. On the other hand, New Zealand’s Business PMI slowed down to 53.4 points, which disappointed investors.

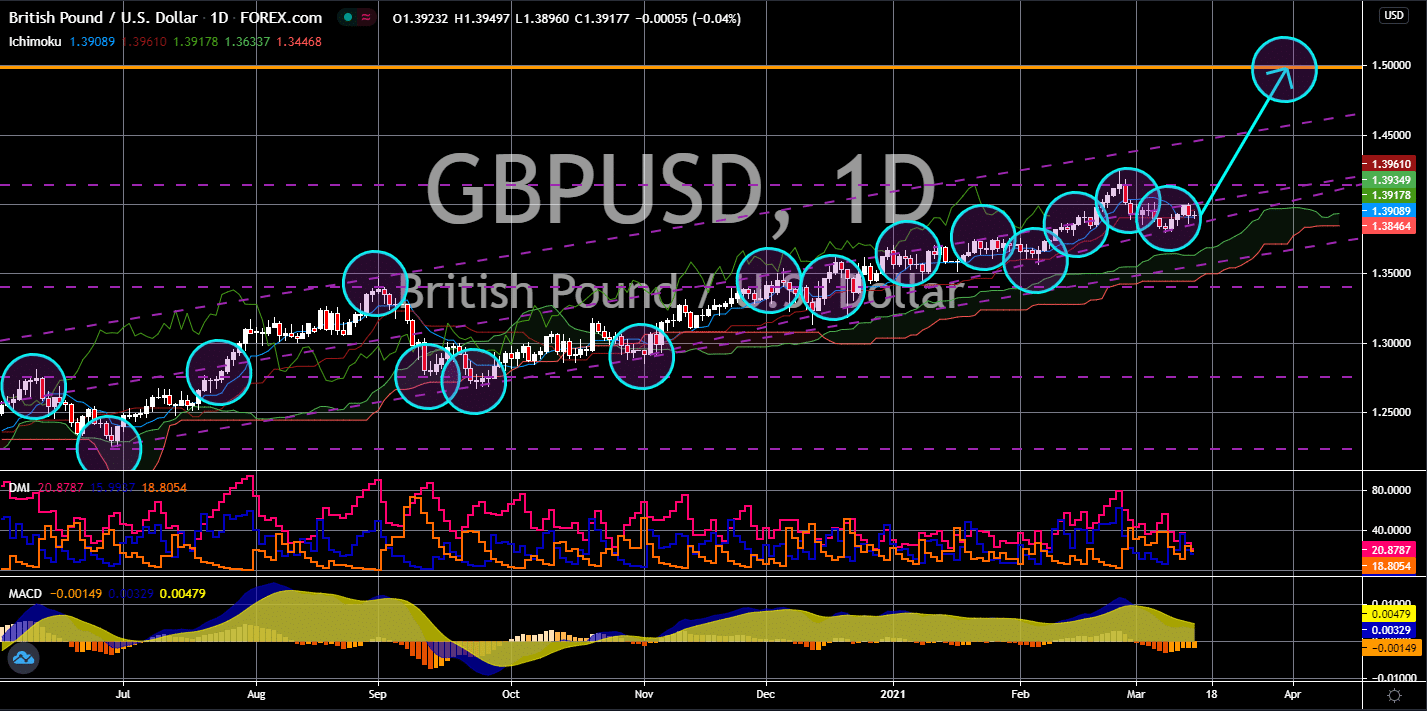

GBP/USD

The pair will rally in coming sessions to reach the 1.50000 resistance level. The UK economy shrank by -2.9% in January as the third lockdown in Britain put a dent of the country’s economic recovery. On a year-over-year basis, the United Kingdom’s economy was smaller by -9.2%. Other key reports also showed the current status of Europe’s second-largest economy. Industrial production and manufacturing production posted disappointing data at -1.5% and -2.3%. On an annual basis, these reports were down by -4.9% and -5.2%, respectively. Aside from the threats of the UK variant, Britain’s withdrawal from the European Union is also weighing down on the country’s recovery. The UK’s economic output was down by -2.9% in January after exports to the European Union fell by -40.7% while imports were also hit by Brexit with a -28.8% plunge. Investors will continue to seek haven in the British pound in the short to medium-term.