Market News and Charts for March 08, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

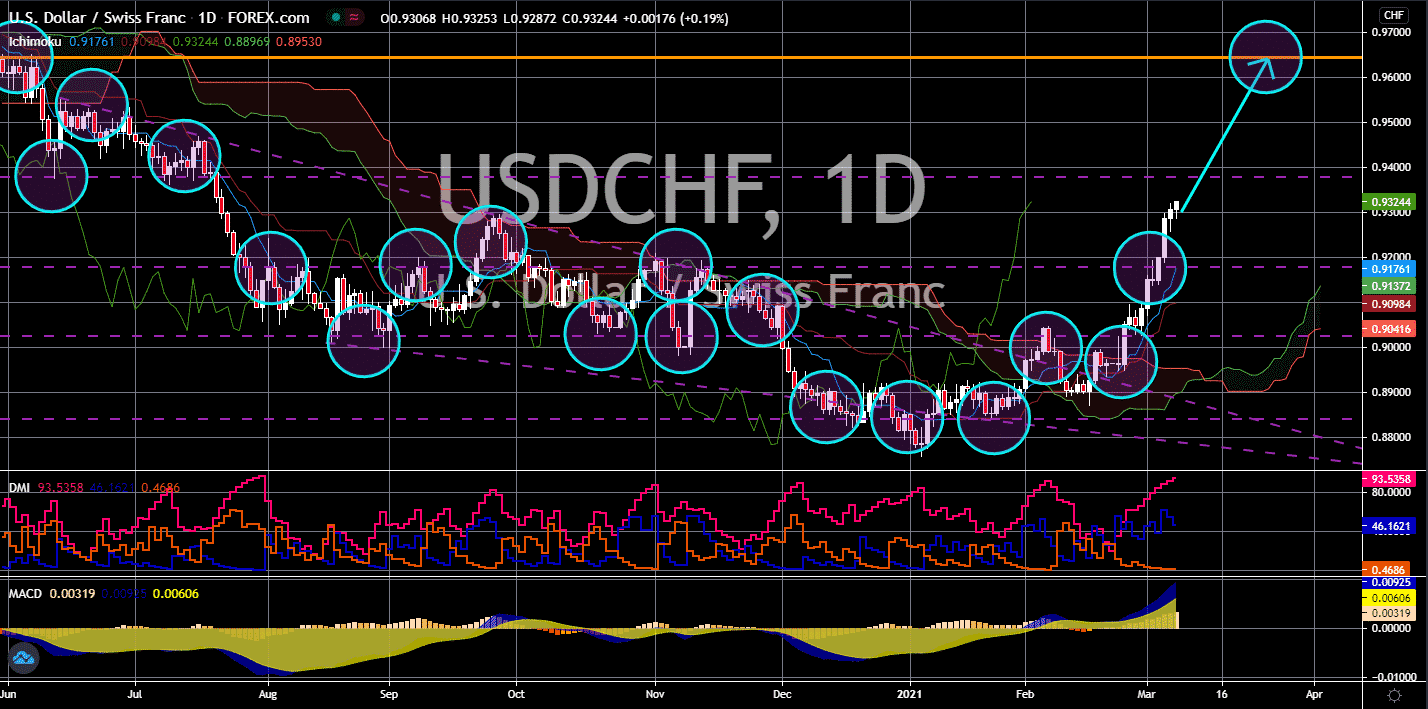

USD/SEK

The pair will continue to move higher in the coming days to reach its previous high at 9.16272. Investors are expected to shrug off the passing by the US Senate of the proposed 1.9 trillion economic aid on Saturday, March 06. Since the win in the November 2020 election by President Joe Biden, the US dollar had already reflected the second-largest stimulus package in the country’s history. Hence, investors are now just looking for any changes with the original proposal. Analysts expected the rising US yield as the main driver for the USDSEK pair. As of writing, the 10-year treasury bond is up by 0.018% to 1.586%. This figure is the highest reported data since January 19, 2020 at 1.688%. Treasury Secretary Janet Yellen’s comment on the yield further added to the expected recovery in the greenback. Yellen said that the rising yield curve reflects the continued growth in the US economy. Thus, investors should expect the US dollar to outperform its peers.

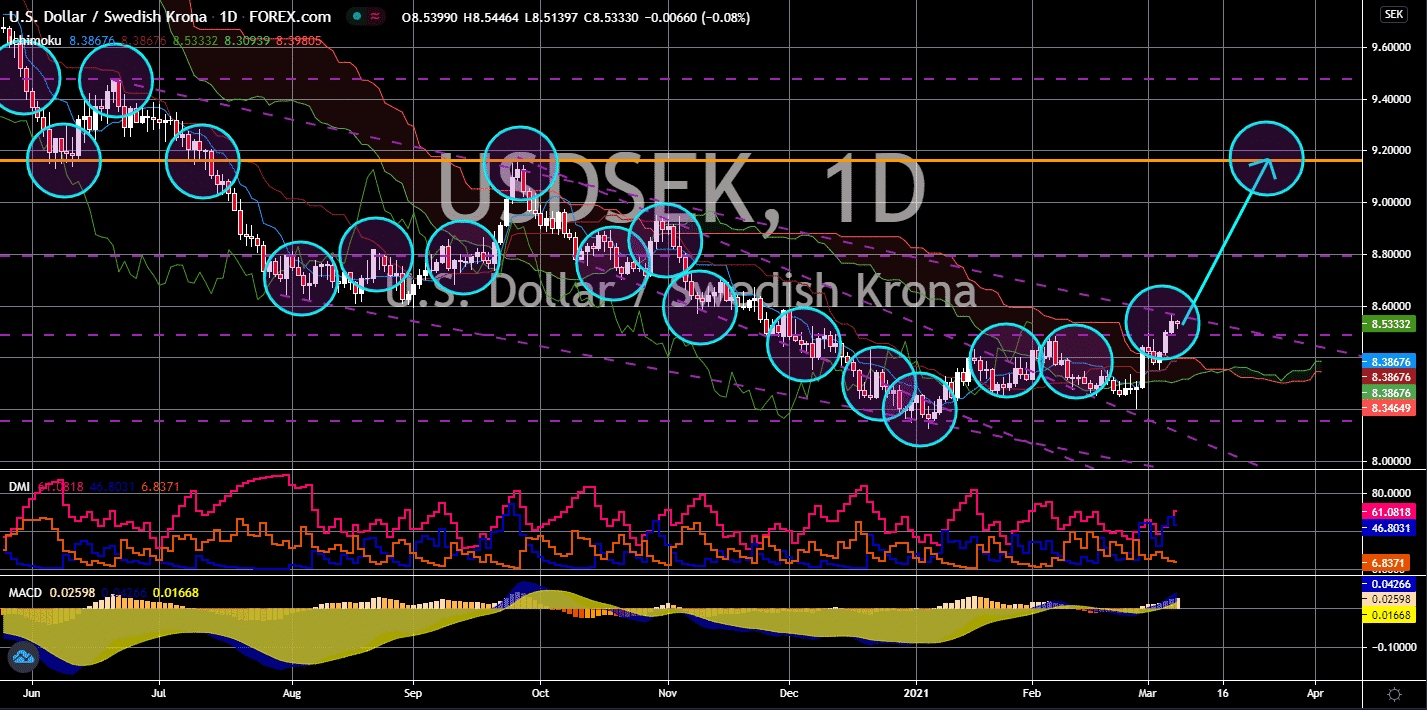

USD/ZAR

The pair will break out of the downtrend channel resistance line to retest a major resistance area at 16.59818. Tax collection in South Africa is expected to severely decline by 213 billion rand for fiscal 2021 compared to the previous year. This was due to several businesses completely shutting down their operations amid the continued rise in coronavirus cases. Despite this, FirstRand expects a substantial recovery in South Africa’s economy amid the COVID-19 vaccine rollout. SA just received new vaccines from COVAX group in addition to the country’s orders of one-jab vaccine shot from Johnson & Johnson. The Janssen vaccine is proven to be effective against the UK and South Africa’s variants. In addition to this, Finance Minister Tito Mboweni gave a bearish tone for wealthy individuals. Analysts are expecting the government to increase income tax on the higher brackets to compensate for the budget deficit. This will send ZAR lower in sessions.

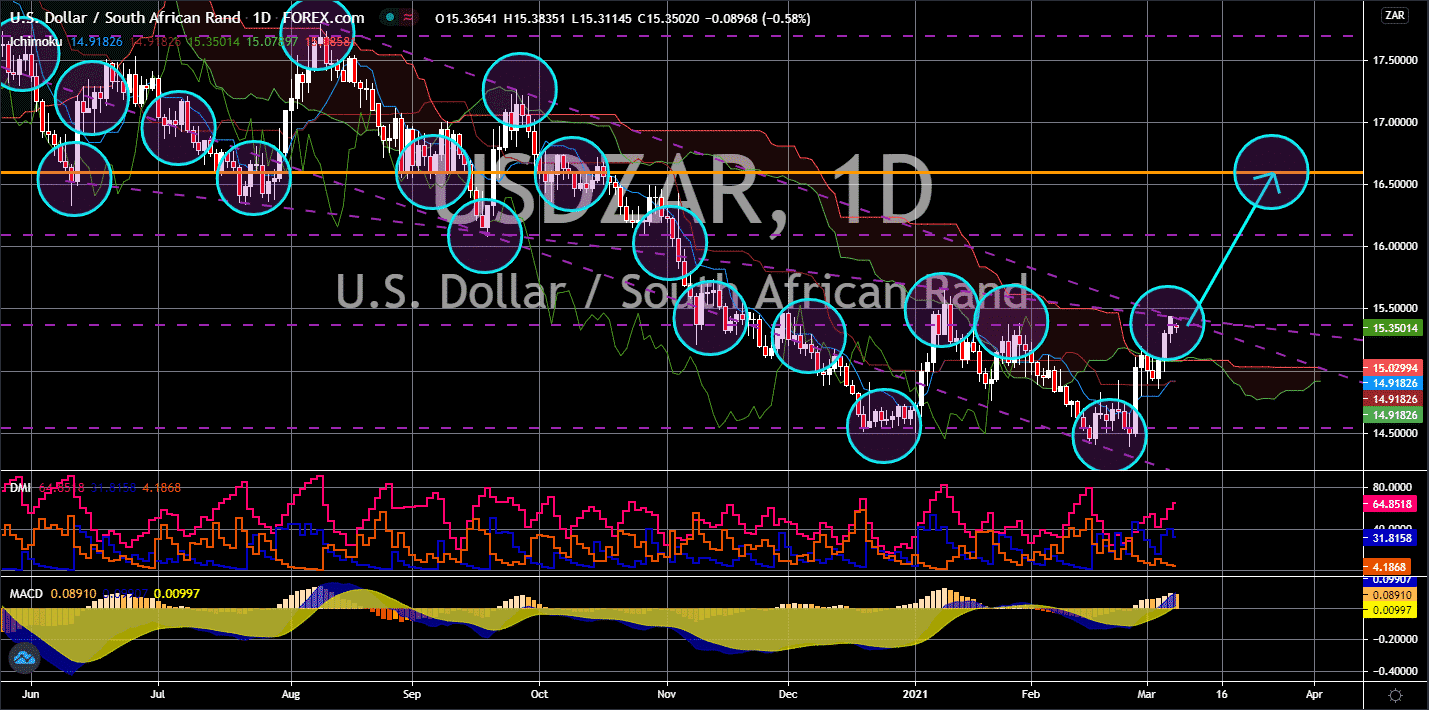

USD/RUB

The pair will decline towards its July 2020 low at 70.261. Russia’s consumer price index (CPI) report on Friday, March 05, showed a continued increase in prices of basic goods. Figure came in at 0.8% for the month of February, beating the 0.6% forecast and 0.7% previous result. On an annual basis, the number was up by 5.7%, the highest since December 2016’s 5.8% result. While inflation drives growth, a drastic increase in prices hurt the economy in the long run. As for the Russian government, the target is 4.0% with a range of +-1.0%. The economy ministry is anticipating a further increase in the YoY data for CPI until March when it will hit its peak. Investors should expect the ruble to outperform the US dollar in coming sessions. In other news, the US and the EU have imposed new economic sanctions against Russia. This was following attempts by the government to silence Alexei Navalny, an anti-Putin critic from Russia.

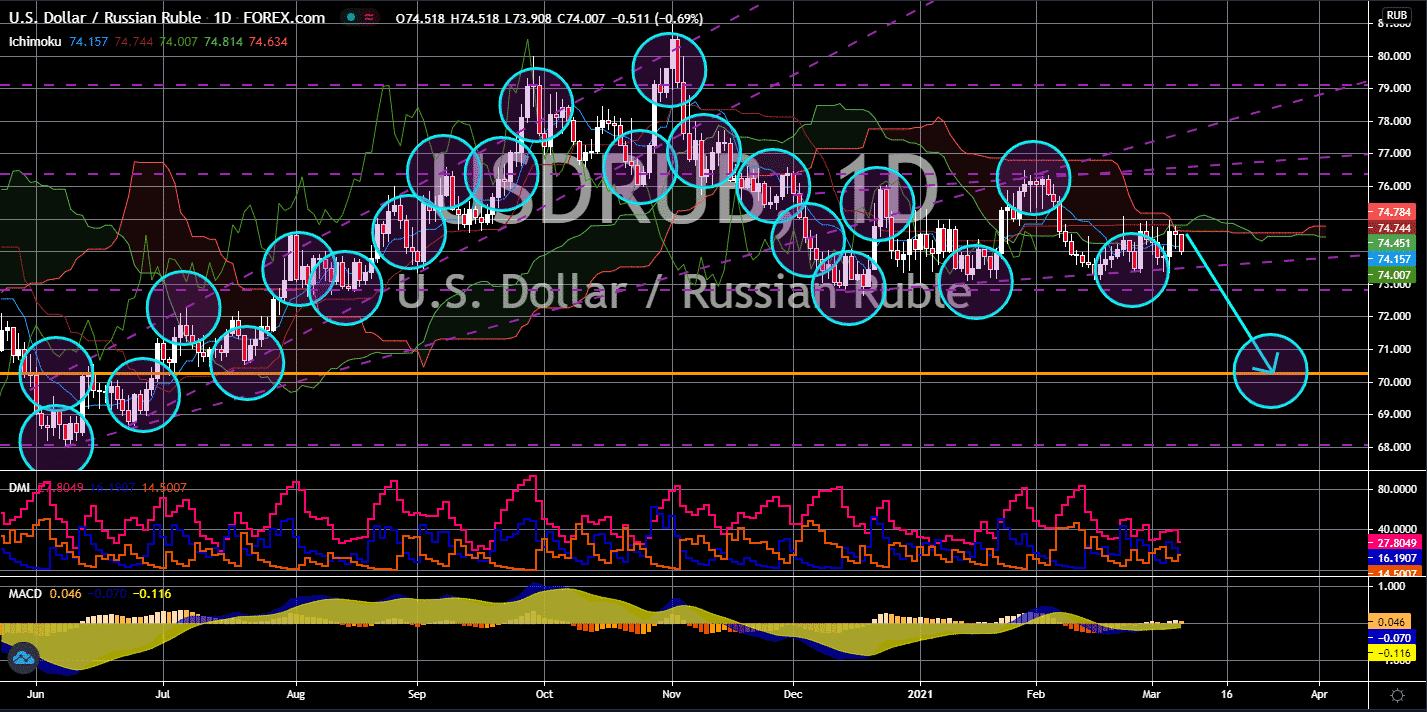

USD/CHF

The USDCHF pair will continue its two (2) week rally and revisit its July 2020 high of 0.96452. The Swiss franc is trading nearly to its 8-month low as investors ditch the safe-haven currency amid the continued vaccine roll out around the globe. As of writing, around 300 million individuals have already received at least one (1) shot of COVID-19. In the US, the government has a 2.1 million vaccine shots target daily. Since the rollout began on December 14, 17.3% of the entire US population has received partial or full shots of vaccines. In Switzerland, the figure is lower. As of March 03, there were 582,436 Swiss who received at least one (1) shot of the vaccine, representing 6.82% of the entire population. Meanwhile, 3.51% of Switzerland were fully vaccinated. Another data that is weighing down on the Swiss franc was the unemployment rate. The figure stood at 3.6% for February result, which is higher than 3.5% in the prior month.