Market News and Charts for March 04, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

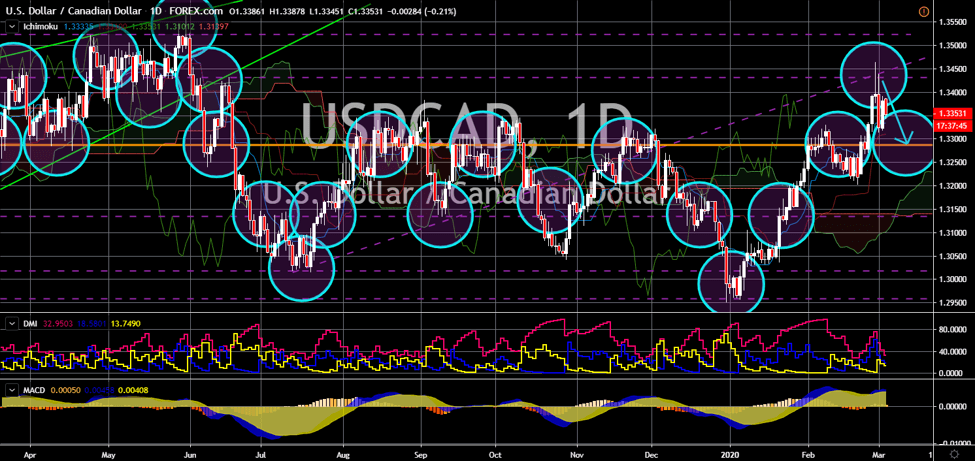

USD/CAD

The pair reversed back towards its previous resistance line after it failed to breakout from a key resistance line. The Federal Reserve made an emergency cut on its interest rate yesterday, March 03. The decision by Fed Chair Jerome Powell came amid the growing fears of the deadly coronavirus. Analysts expect China to grow slower compared to its initial target as economic implications of COVID-19 hunts its economy. In the US, major indices already went tumbling down. Dow Jones Industrial Average had its worst day since August 2011. Meanwhile, the S&P 500 suffers the biggest lost since the 2008 Global Financial Crisis. China is the second largest economy in the world and is the biggest trading partner of the United States. Thus, it is only logical for Fed to cut its rate. On the other hand, the BOC is set to release its own interest rate decision today, March 04. Bank of Canada last cut its rate in 2015.

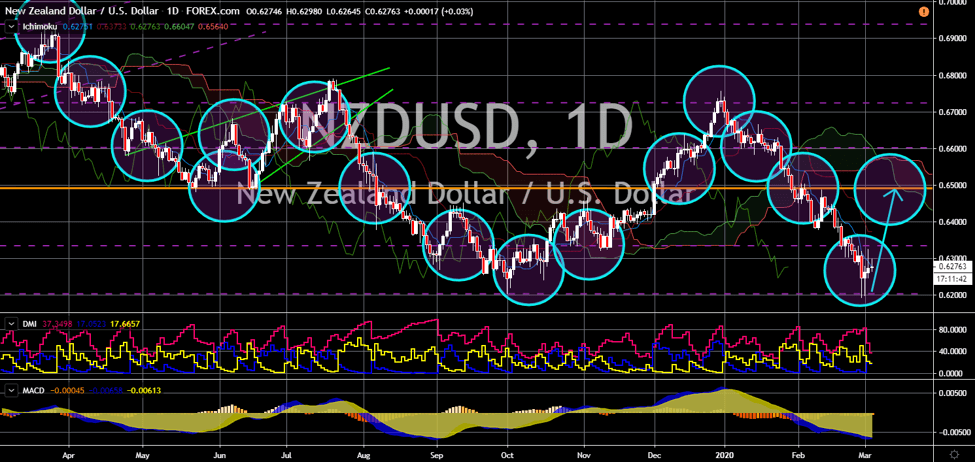

NZD/USD

The pair will bounce back from a major support line, sending the pair higher towards a key resistance line. New Zealand Global Dairy Trade Price Index posted better figure from its previous record. The report highlights the changes in the country’s biggest export, which is dairy products. The reported made investors optimistic of the country’s economy as the global economy faces challenges posed by the coronavirus. Analysts further expect the country to report much better figures in the coming months amid the Brexit. New Zealand maintains a good trading relation with the EU despite being the first to sign the post-Brexit trade agreement. On the other hand, the United States just cut its benchmark interest rate yesterday, March 03. This was the country’s fourth interest rate cut for the past 12-months. The Federal Reserve previously cut 75-basis points to counter the economic effect of then escalating US-China trade war.

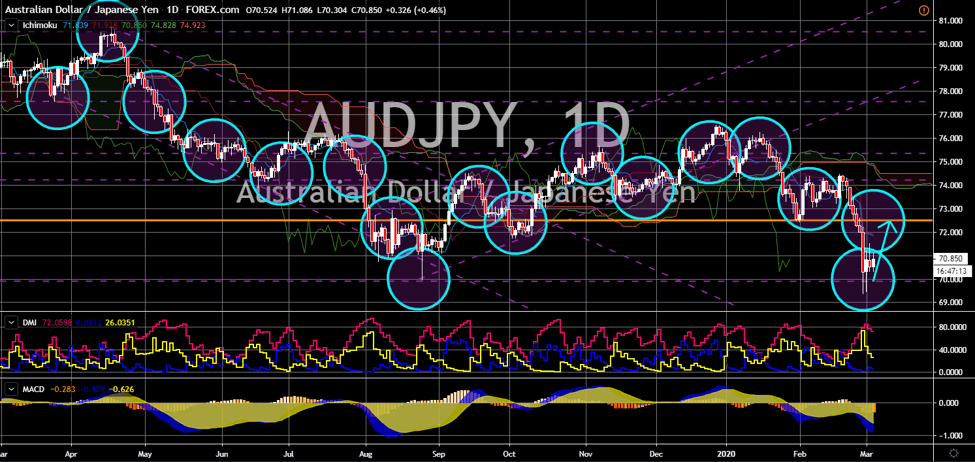

AUD/JPY

The pair will recover from the recent sell-off, sending the pair higher towards a key resistance line. The Australian dollar and the Japanese yen are in a tug-of-war. Australia had a technical recession in 2019 and fears are growing that the same fate will happen this 2020. This was after the European Union hit back at the country for signing post-Brexit trade agreement with the United Kingdom. On the other hand, Japan is on the brink of recession. This was after the country posted a negative GDP growth rate of 1.6% for the fourth quarter of 2019. In line with this, the yen is losing its luster as a safe-haven currency. This was after it became the worst performing currency among the G10 currencies. The plummet of the Japanese yen was partly due to the weak performance of the Japanese economy. For the Services Purchasing Managers Index (PMI) report yesterday, the two (2) countries posted figures below 50 points, indicating an economic contraction.

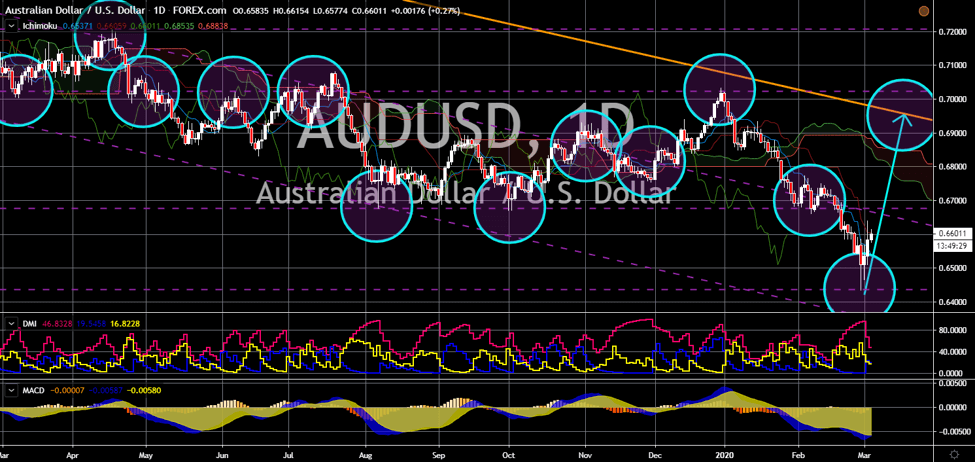

AUD/USD

The pair will bounce back from its 11-year low, sending the pair higher towards the downtrend channel resistance line. The interest rate cut of 50 basis points by the Federal Reserves will make the US dollar to tumble in coming sessions. Fed Chair Jerome Powell argued that the cut will mitigate the economic impact posed by the deadly coronavirus. Over the last 12 months, the US central bank has cut its benchmark interest rate by 75 basis points. Analysts further warned that the Fed might cut additional points in coming meetings if fears over coronavirus will not subside. On the other hand, Australia is also facing economic problems with the decrease in the number of Chinese tourists in the country. Moreover, Canberra is currently at odds with the EU after it signed a post-Brexit trade agreement with the UK. Brussels banned several Australian exports using names relating to any EU locations to prevent competition with its domestic business.