Market News and Charts for March 02, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

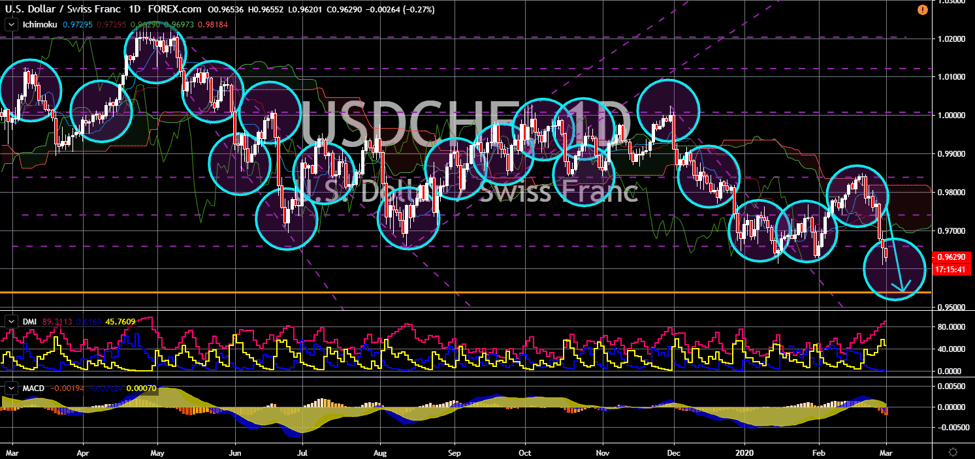

USD/CHF

The pair broke down from a steep uptrend channel, sending the pair lower towards another major uptrend channel support line. The appeal of safe-haven assets is back following the three (3) consecutive days of stock sell-off in the United States. The pessimistic view of investors in the global economy, particularly in America, was due to the deadly coronavirus. On February 27, the Dow Jones Industrial Average (DJIA) fell 1,191 points, the biggest since August 18, 2011.Cummulatively, the DJIA lost 3,500 last week. Meanwhile, the S&P 500 recorded its worst day since the 2008 Global Finance Crisis. On the following day, February 28, the US announced its first death case relating to the coronavirus. President Donald Trump tried to calm the market by telling Americans not to panic. However, the stock market is saying otherwise. Safe-haven currencies like the Swiss franc and Japanese yen will benefit from weak US economy.

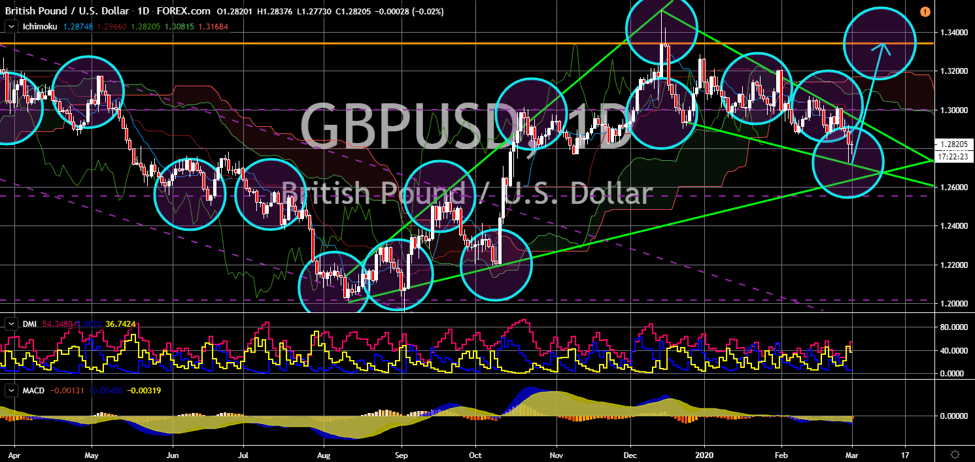

GBP/USD

The pair will bounce back from a “Falling Wedge” pattern support line, sending the pair higher towards its previous high. The United Kingdom is showing other member states that there is life outside the European Union. For the month of February, the UK’s M4 money supply grew 0.1%, slower than the previous record of 0.8%. The M4 consists of coins and notes, cash-convertible assets, short-term and long-term bank deposits, and Treasury bills. The lower the money in circulation, the stronger the British pound will be. Aside from M4, Britain will also release its Manufacturing Purchasing Managers Index (PMI) report today, March 02. Last week, the PMI level rose to 51.9 from 50.0 in the second week of February. This is also higher from the 49.7 expectations. Analysts anticipate the United Kingdom to be in an economic contraction following the Brexit, but it proved otherwise. Meanwhile, the US PMI dropped to 50.8 from 51.9 prior.

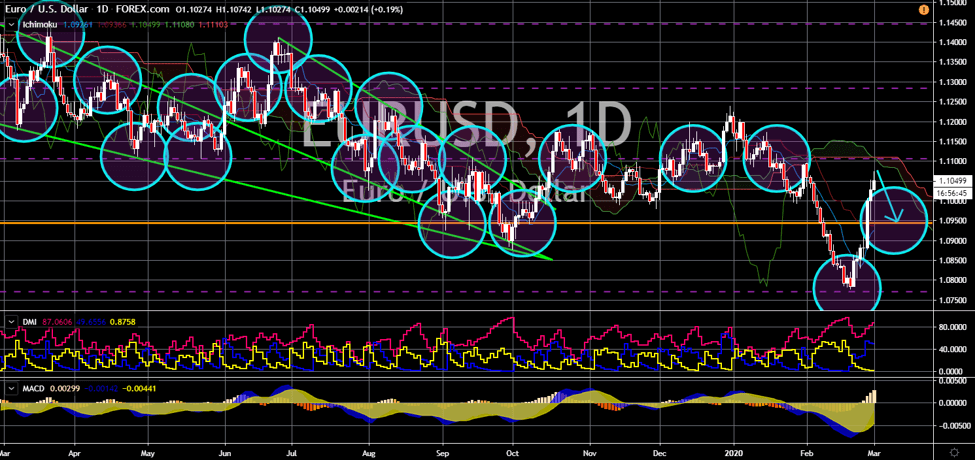

EUR/USD

The pair will fall back in coming sessions after its seven (7) days rally. The single currency benefited from the recent slump in the US indices. American companies also announced that they will miss their earnings target for the upcoming quarterly earnings report. This will further drag the already weak US indices like S&P 500, DJIA, and NASDAQ. The culprit for the sell-off was the deadly coronavirus. Analysts further warned that the COVID-19 might end the longest economic expansion in the US economy and triggers a recession. On the short-term, investors and traders will minimize their exposure to euro. The reason for this was due to the ailing EU economy. Germany’s growth for Q4 was zero (0) while France and Italy ended up in the negative territory. The three (3) largest EU economies are also in contraction with their PMI reports. The Purchasing Managers Index were at 47.8 (Germany), 49.7 (France), and 48.9 (Italy). This indicates that the European Union is in an economic contraction.

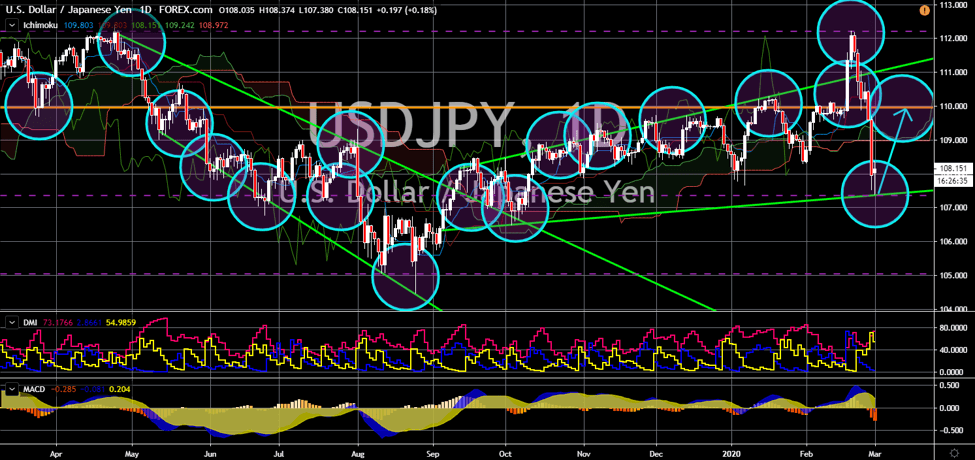

USD/JPY

The pair will bounce back from a “Rising Widening Wedge” pattern support line. The US dollar plunged against the Japanese yen last weak amid the growing fears of the deadly coronavirus in the US. However, as the market took some rest over the weekend, analysts were looking at the Japanese yen for its ability to become a safe-haven currency. Among the G10 currencies, the yen was the worst-performing currency. This was amid fears over the country entering recession in the coming months. In the first month of 2020, Japan’s GDP growth rate plunged to -1.6%. If the negative figure continues for the month of February, the country will be on a technical recession. Some analysts said that Japan entering a recession in imminent. The country experienced a negative growth rate despite minimizing its monetary base to prop up the yen. Meanwhile, the US have strong figures for major reports last month.