Market News and Charts for March 01, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

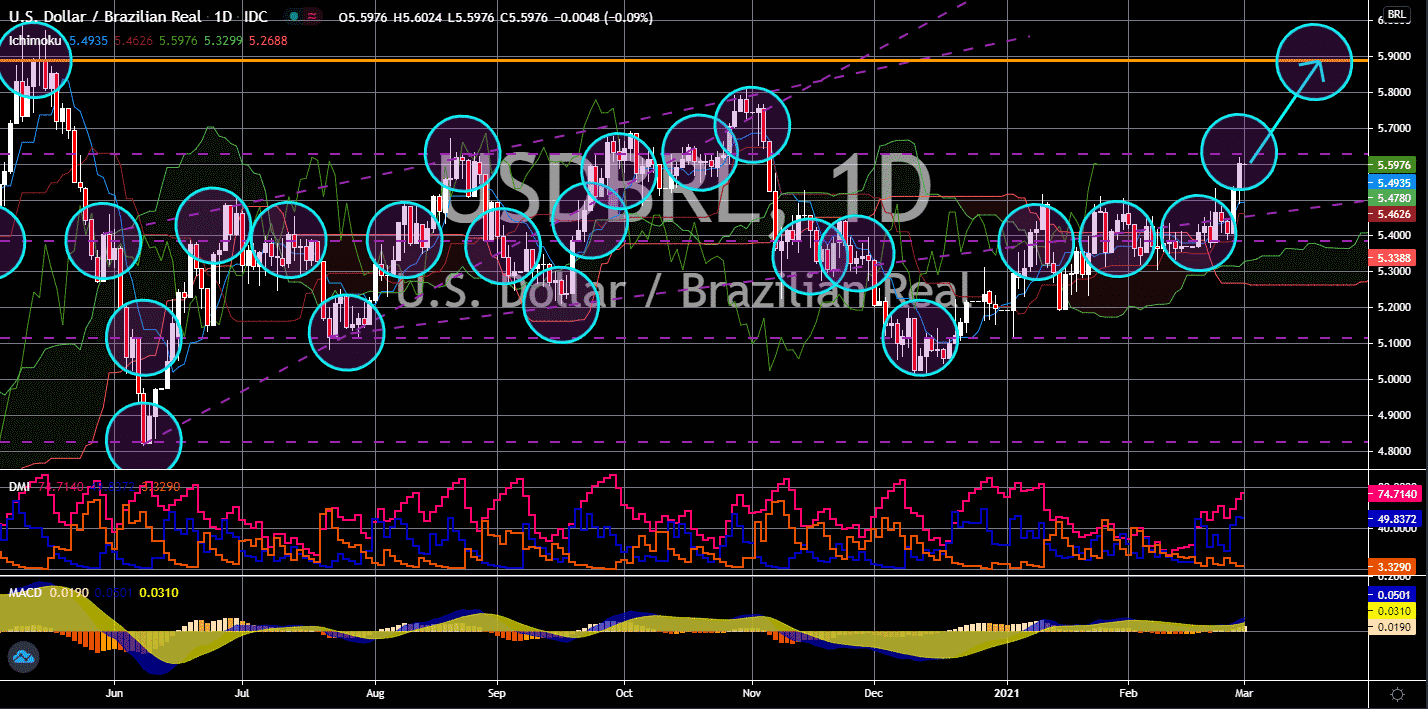

AUD/NZD

The pair will bounce back from an uptrend support line, sending the pair higher towards a major resistance line. Last week, New Zealand’s trade reports resulted in the weakness of the kiwi currency. Both imports and exports in January slowed down. The figures came in at 4.82 billion and 4.19 billion, respectively. The report showing the biggest decline was imports. This has caused New Zealand to incur a trade deficit in the first month of fiscal 2021. On the other hand, Australian exports in the fourth quarter is expected to shrink by -0.3% against the -1.9% data in the prior quarter. This projection has made analysts anticipate an increase in the current account for the same quarter by 13.1 billion. In Q3, the figure was 10.0 billion. In other news, the Reserve Bank of Australia (RBA) is expected to hold its current interest rate of 0.10% on Monday’s report, March 01. This was due to the strong AIG Manufacturing Index on Sunday, February 28, of 58.8 points.

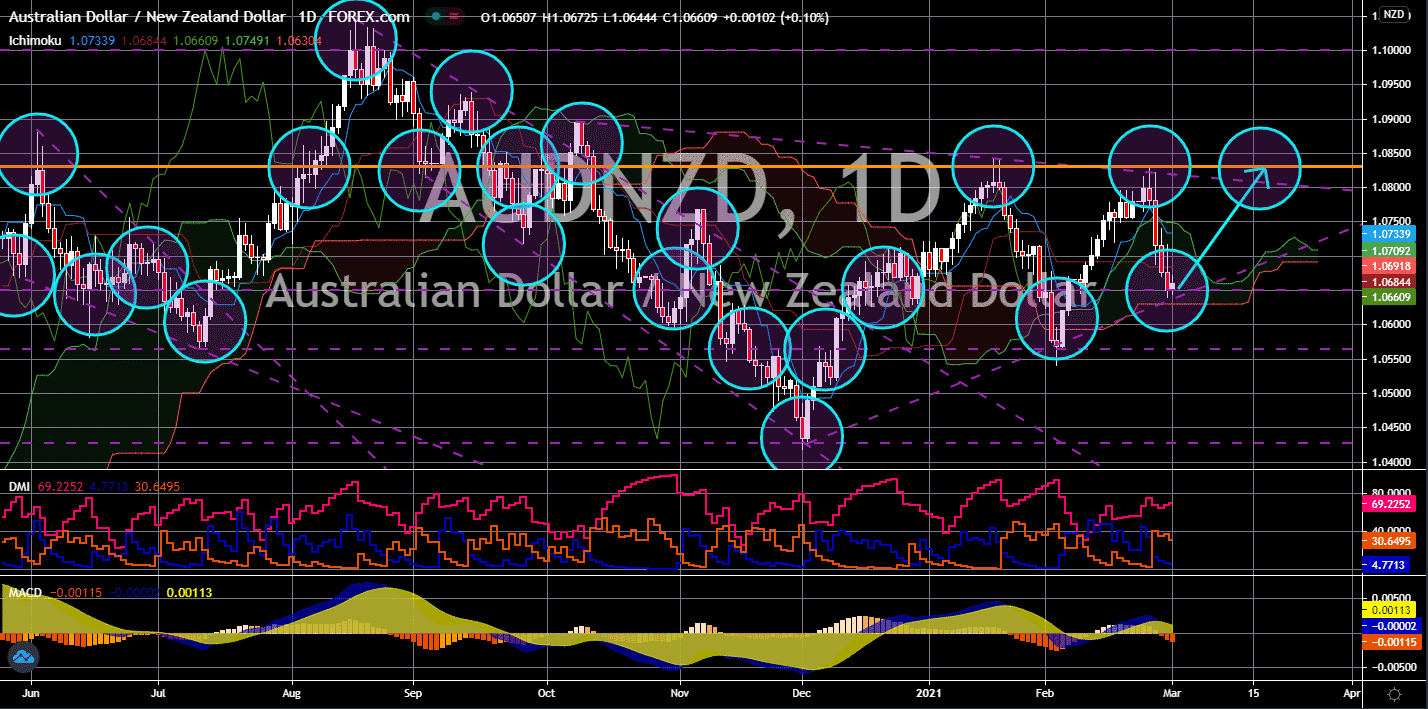

EUR/BRL

The pair is expected to break out from a major resistance line and move towards the 7.5000 area. Investors are expected to shrug off Germany’s 0.3% economic expansion in the fourth and final quarter of fiscal 2020. This was due to the weak readings for this week’s reports. The preliminary data of the EU’s largest economy’s CPI report is projected to slow down by 0.5% in February following the 0.8% result in the first month of the year. Meanwhile, Italy pulled out its projection for the same report, but on a year-over-year basis, the forecast is a decline of -0.1%. As for the Manufacturing PMI, the EU’s big four (4) is expected to have an upbeat data with the exception of France, which has a similar projection with January’s 55.0 points figure. However, investors are expecting a worse-than-expected result after French Consumer Price Index shrank by -0.1%, the first time in four (4) months. Also, its GDP declined anew by -1.4% quarter-over-quarter.

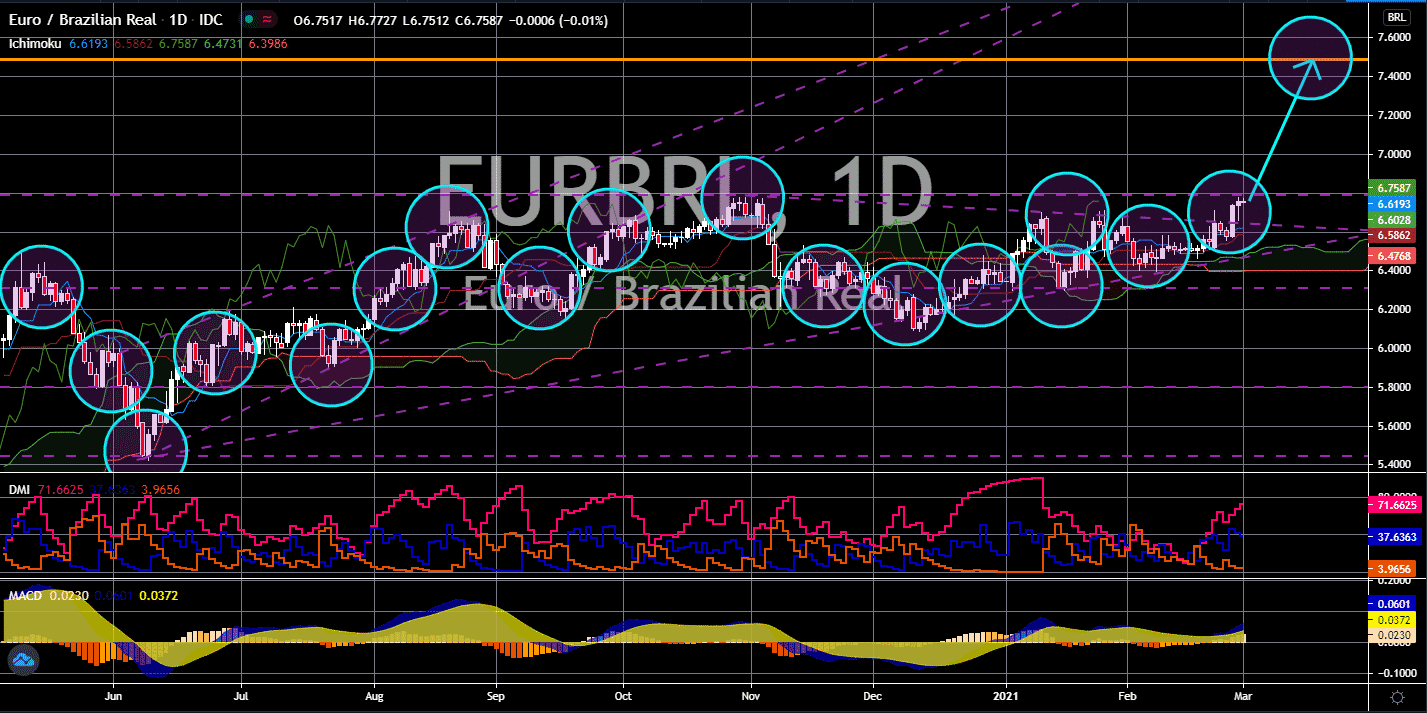

GBP/BRL

The pair will continue its rally in the coming days towards the 8.5000 resistance level. Public and private finances in the United Kingdom was severely affected by the new lockdown based on the projection for Monday’s reports, March 01. The consumer credit of the Bank of England (BoE) is expected to decline by another -1.900 billion. This number represents the biggest contraction in the report since May 2020. As a result, banks tightened their lending activities. Mortgage approvals are anticipated to slow down by 96,000 against 103,380 in December. Meanwhile, the total amount lent to individuals is stagnant at 5.59 billion. On Wednesday, March 03, FM Rishi Sunak will unveil the government’s new budget. However, Sunak already warned that the government deficit will be huge as it allotted a bigger amount to support business and retrenched employees. Britain is now exploring the possibility of a “vaccine passport” to revive the economy this year.

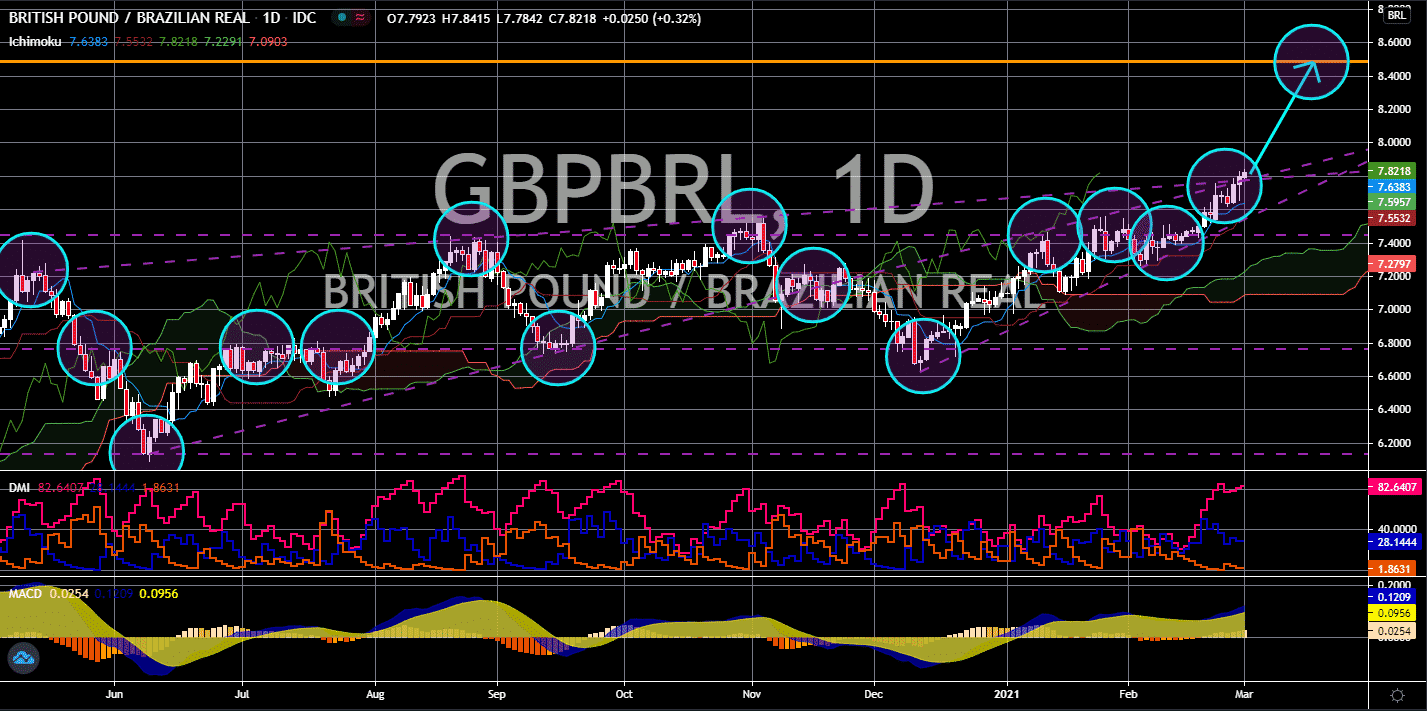

USD/BRL

The pair is expected to break out from a major resistance line to reach the 5.9000 price area. Analysts warned of higher inflation after the House of Representatives gave a nod to President Joe Biden’s $1.9 trillion economic aid on Friday, February 26. This led to concerns of an overheating economy. Despite not fully recovering from the COVID-19 induced economic slowdown, the US markets kept soaring. The continued support by the US government could push prices of equities higher but may lead to a steep decline in the near-term. In addition to this, the International Monetary Fund and Bank of America upgraded their GDP growth for 2021. The global financial institution sees a 3.8% rebound this year while the investment firm gave a more bullish outlook at 6.5% expansion. This has led some investors to seek haven from the US dollar in the short-term. In other news, China’s nominal GDP now represents 70% compared to the United States.