Market News and Charts for June 30, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

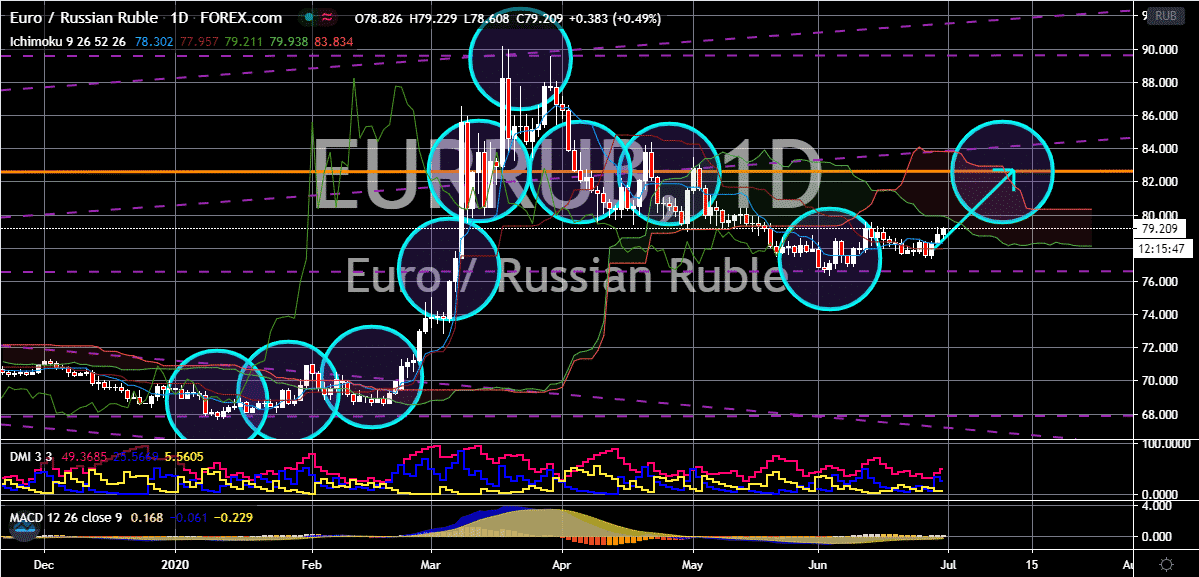

EUR/RUB

The euro is starting to gradually gain momentum against the Russian ruble despite the conditions in the oil market. However, looking at it, it appears that the bearish traders are on the defensive and are most likely to remain there because of the rising number of new coronavirus infections across the globe. This is because the Russian ruble is a commodity-linked currency, its direction affected by the status of oil prices. And considering that the number of cases is rising once again, it could slow down the recovery of the crude demand and prices. Earlier this month, the Russian ruble was dubbed as the underdog in the currency market, and it is proven that it has resilience as it continues to prevent the euro from snatching massive gains in the previous weeks. The pair is widely projected to head upwards in the coming days, but it will be a gradual journey. As of writing, the ruble is pressured by the decline in Moscow’s stock market.

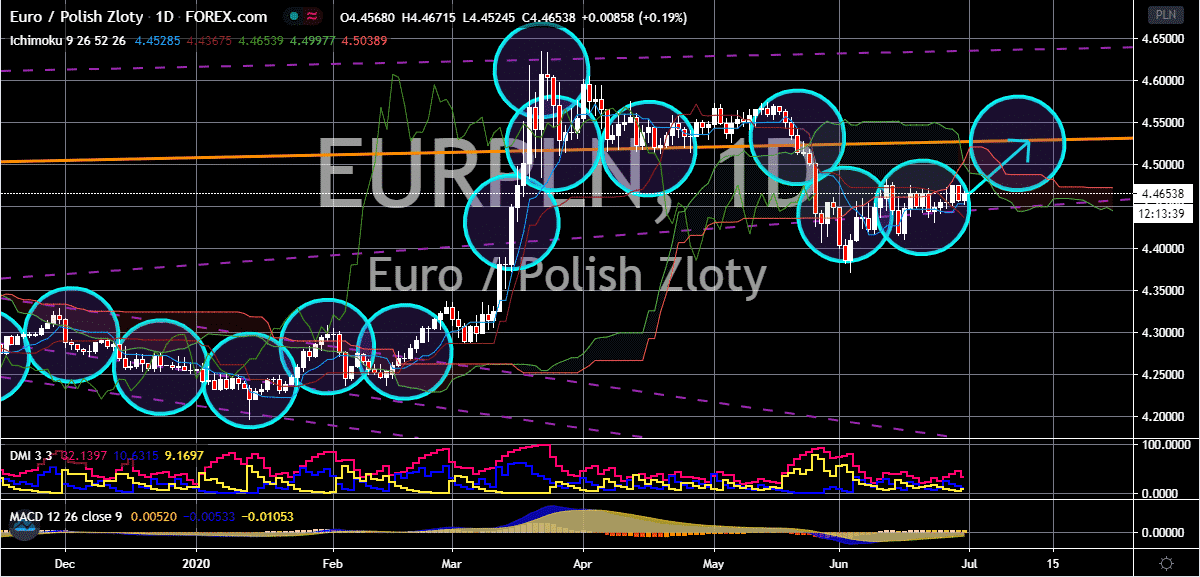

EUR/PLN

Earlier this month, the Polish central bank signaled that it’s highly concerned about the strength of the Polish zloty. According to the central bank, it prefers the zloty to be weaker to help the economy recover much more efficiently amid the coronavirus pandemic. This paved the way for the euro bulls to force the pair higher towards its resistance level in the sessions. Looking at it, both the zloty and the euro are relatively weak, but the tides are still in favor of bulls. Moreover, investors of the exchange rate are focusing their attention on the presidential elections in Poland. Conservative President Andrzej Duda is facing the current mayor of Warsaw and Liberal party candidate Rafal Trzaskowski in the upcoming second round of voting in the country due in two weeks’ time. The results would have a significant impact on the direction of the Polish zloty as it would determine the approach of the government’s coronavirus rescue and recovery plan.

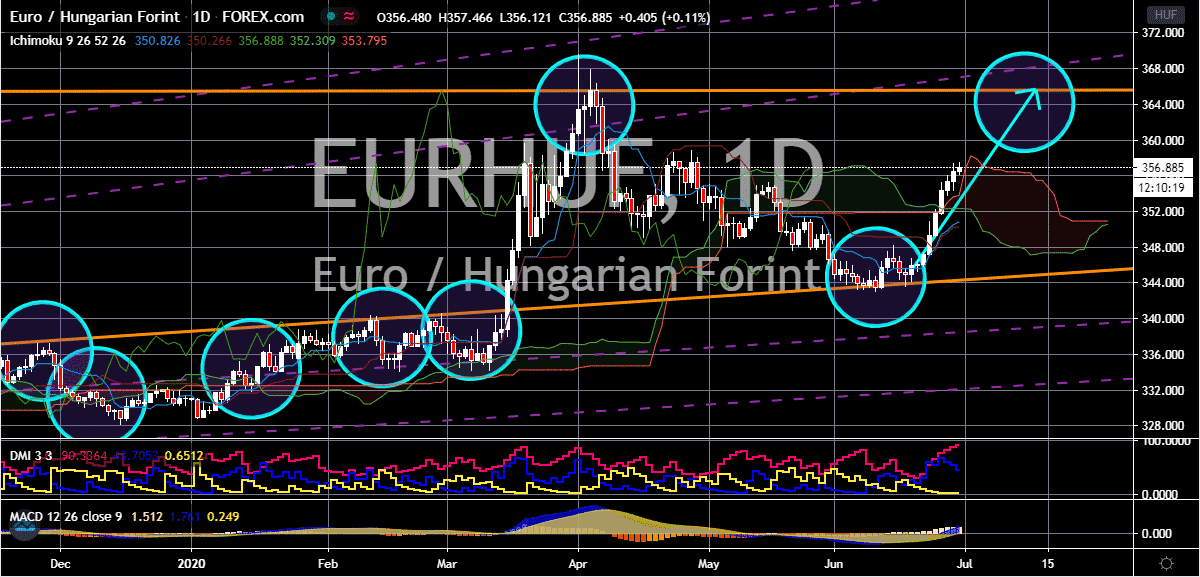

EUR/HUF

The expected interest rate cut from the Hungarian central bank this July is slowing down the Hungarian forint. In fact, it caused to weakened significantly against the euro in the trading sessions. The pair is widely projected to climb to its resistance and hit levels last seen in early April 2020 during the hype of the euro’s bullishness. Just last week, the National Bank of Hungary’s governor Barnabas Virag said in a radio interview that the bank may once again cut its key interest rates by 15 basis points next month. Virag added that it would be the lowest that the rates will go for the foreseeable future. The news helped bullish investors to floor their gas pedals against bears and propel the pair. The unexpected interest rate cut from the National Bank of Hungary just recently was the first cut in four years from the bank and was clarified as not the beginning of an easing cycle which was previously speculated.

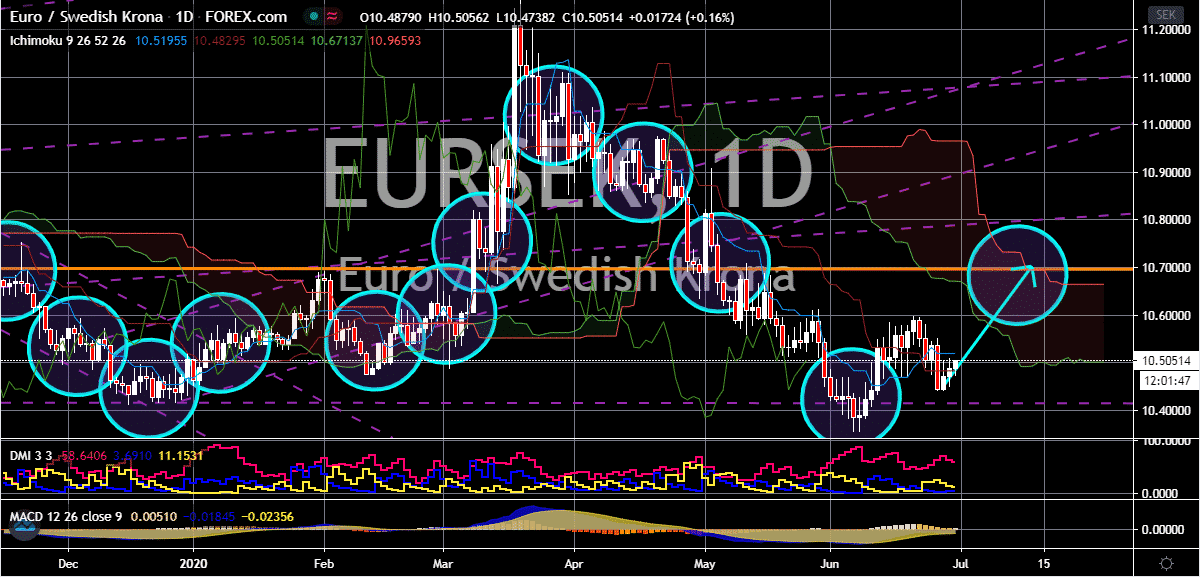

EUR/SEK

The second wave of new coronavirus infections in Sweden has prevented the Swedish krona from fully recovering against the euro. The exchange rate is widely on track to climb towards its resistance level as the euro feels the pressure from the pandemic. As for the euro, it’s starting to regain its footing against the Swedish krona as more and more businesses finally reopen their doors as countries in the eurozone ease their lockdown restrictions. In fact, the currency appreciated even faster than what economists and forex analysts previously expected. On the other hand, the euro is also pressured by political tensions between the European Union and the United States. Visitors from America are still banned from entering in the region due to the alarming number of active coronavirus cases in the country. The bloc is now accepting travelers from countries with relatively low number of active cases. The bloc determined 15 countries that were deemed “safe” to travel.

What direction if Poland's Duda wins?

You’re saying “The results would have a significant impact on the direction of the Polish zloty as it would determine the approach of the government’s coronavirus rescue and recovery plan.”, but what direction would the PLN take if Duda wins?

Did you find this review helpful? Yes No