Market News and Charts for June 24, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

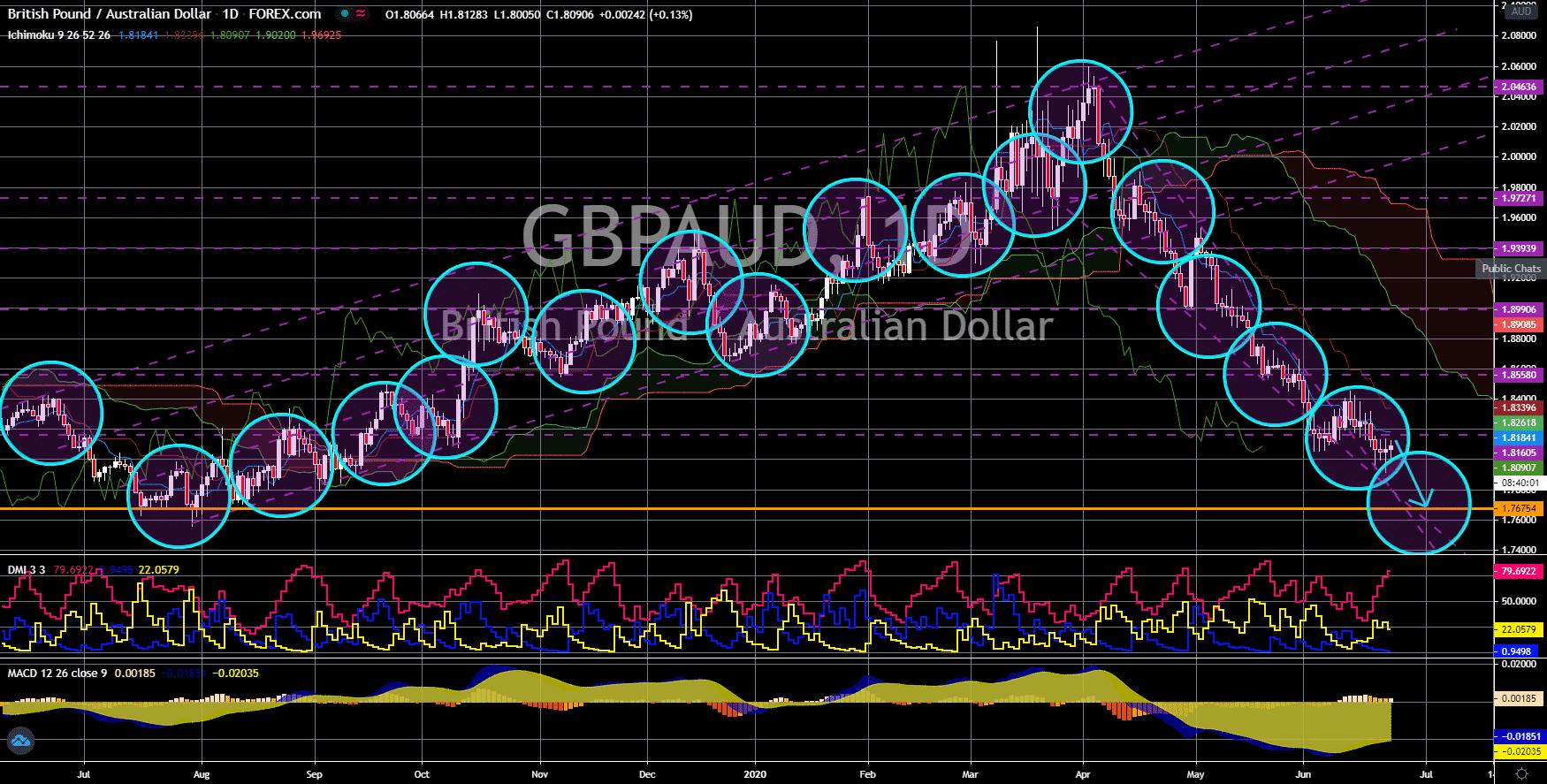

USD/SGD

The pair will bounce back from a major support line, sending the pair higher towards an uptrend channel resistance line. Singapore is moving forward on the post-pandemic world with its new guidelines for businesses. Enterprise Singapore (ESG) and Singapore Standards Council (SSC) laid out its benchmark policies that businesses must adhere to if it wants to operate. Investors welcomed this move as it spells out the reopening of Singapore’s economy. A report from Morgan Stanley further added optimism among investors. The investment bank said Singapore should expect a sustained rebound as it began to reopen its economy. On the other hand, recovery in the US might be delayed following the recent move by US President Donald Trump. The administration issued an executive order on Monday to suspend visas and help Americans fill the job vacancies. However, heads of Google, Apple, Amazon, and Tesla slammed this idea.

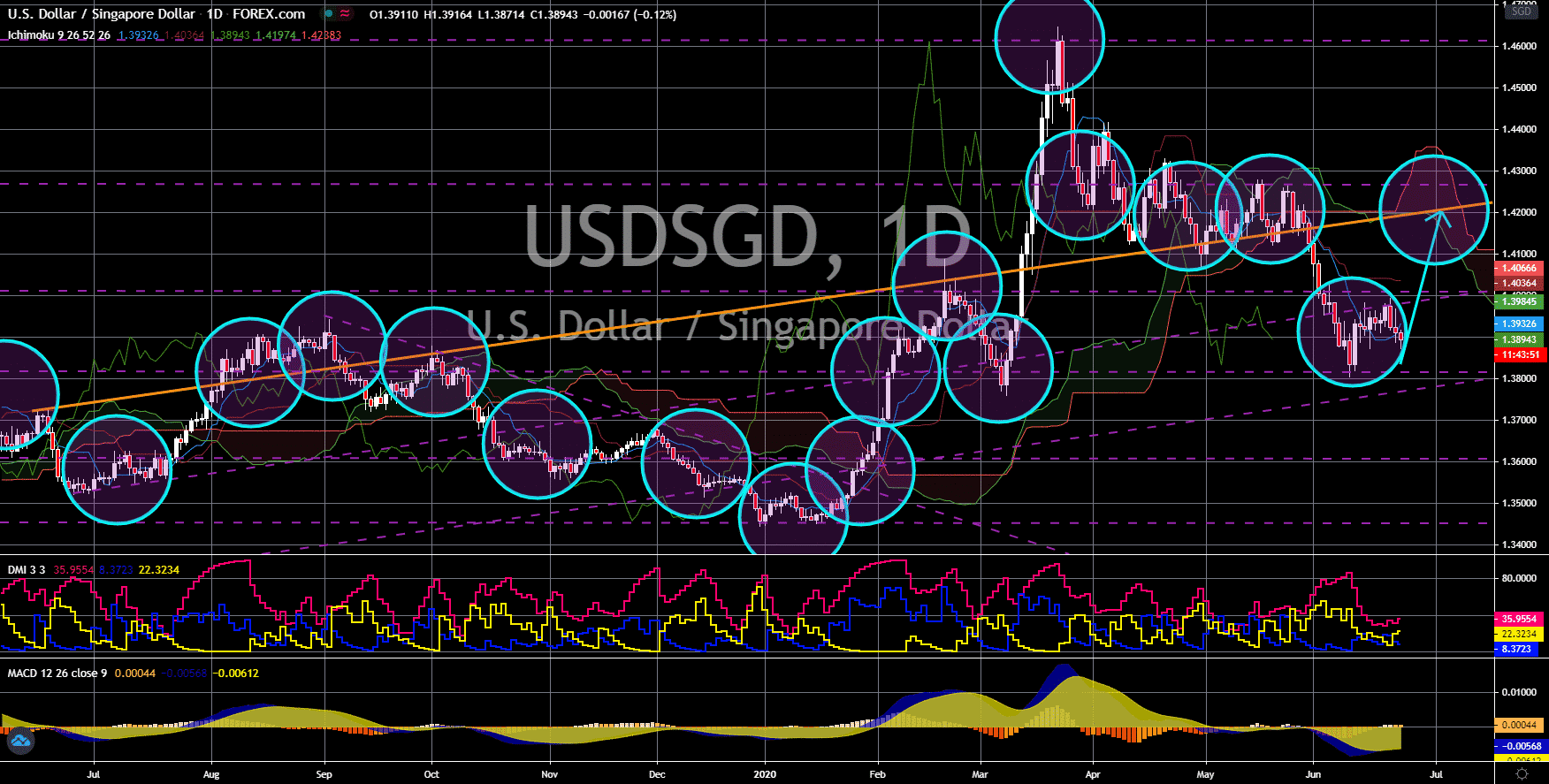

EUR/DKK

The pair bounced back from a major support line, sending the pair higher towards its previous high. Denmark’s government is encouraging Danes to spend more as the economy reopens. A major part of the government’s income comes from its high taxation system. With most countries entering a lockdown period during the heights of the pandemic, people have tightened their spending habit as uncertainty creeps on the economy. The Danish government is also nearing to max out its options with banks as emergency buffer were cut to zero. On the other hand, some countries were able to convince investors that their economy will go back to their previous levels. Germany’s business expectations for the second half of 2020 rose above 90 points, a level last seen prior to the coronavirus pandemic. Aside from this, the business climate was at its best this month with 86.2 points. The same thing is true for German current assessment reports.

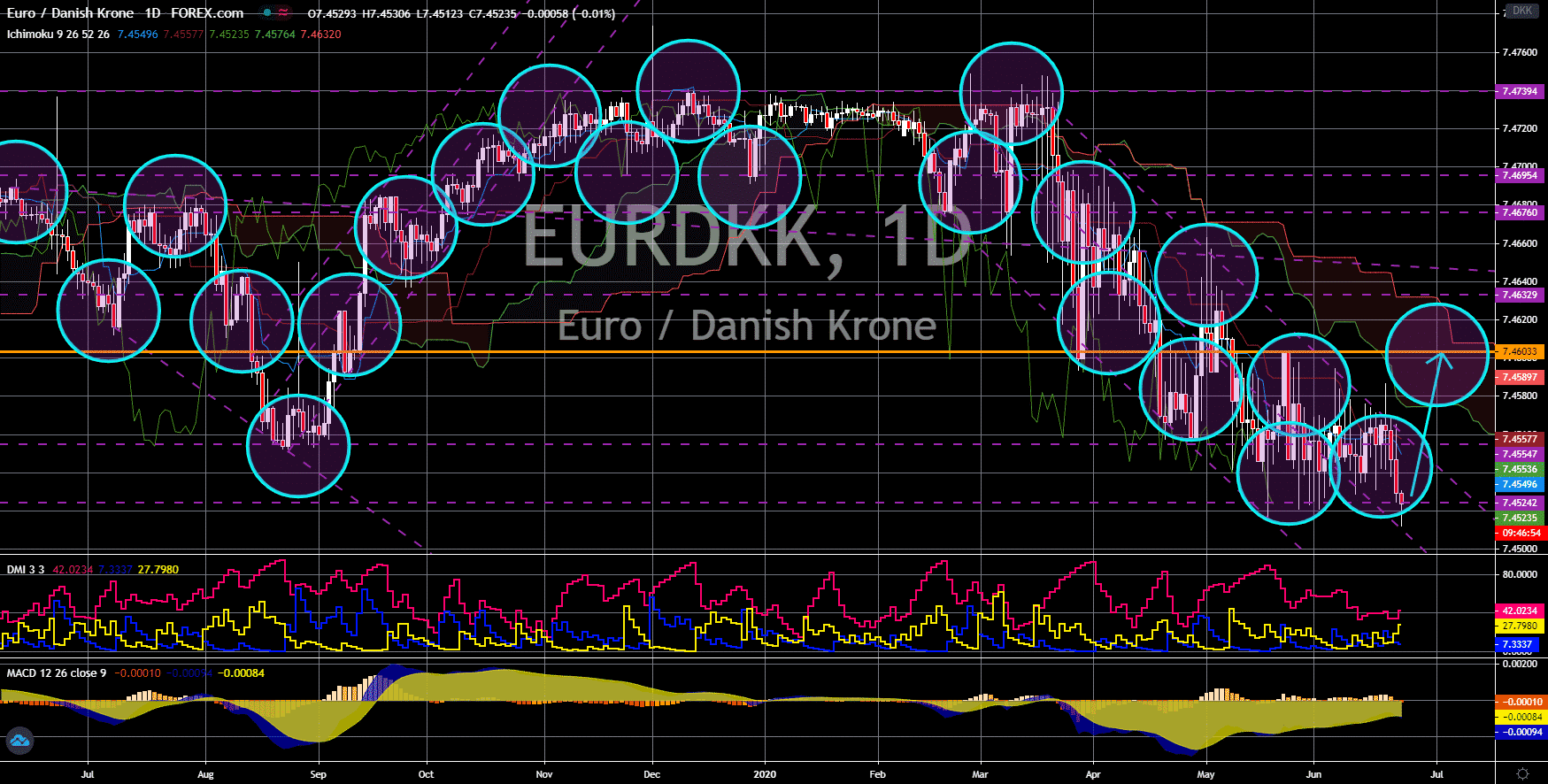

EUR/TRY

The pair will break out from a major resistance line, sending the pair higher to its all-time high. Turkey’s central bank is expected to cut a quarter or a half percentage point on Thursday, June 25. This will send the benchmark interest rate between 7.5% to 8.0%. JPMorgan Chase said the cut was necessary to support the robust recovery of the Turkish economy. This, in turn, will drag the lira to its lowest level in history against the single currency. The lira began shrinking against a basket of major currencies last year during the Turkish lira flash crash. Since then, the interest rate fell from 24% to just 8.25%. On the other hand, despite the slow recovery in the European Union, analysts expect the euro to thrive against the lira in the short to medium term. Germany is leading the pact with a bright six (6) month outlook. Aside from this, the current tension between the United States and China might force investors to consider an alternative market.

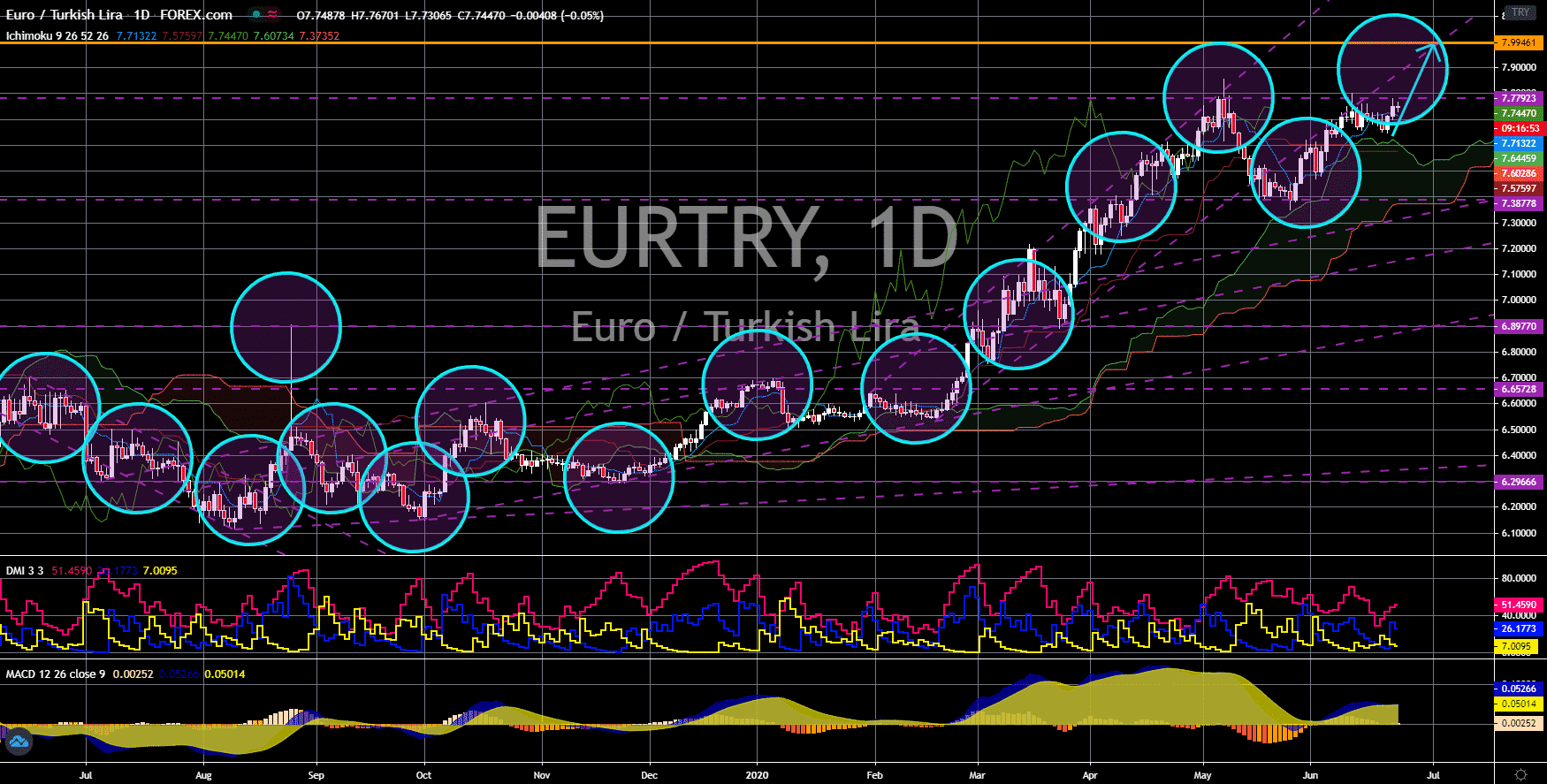

GBP/AUD

The pair will continue to move lower in the following days towards its July 2019 low. The table has turned, and the British pound is sinking to a level last seen at the start of the second half of 2019. The coronavirus pandemic has shattered the British economy. The Bank of England has released several measures to stop the economy from bleeding, but the wounds are deep. A major part of this was the recent historical move by Britain to leave the European Union. Australia is also facing its own problem, mainly an external one. Australia is reliant on imports and is vulnerable to any uncertainty in the global market. The recent tension between the United States and China has been causing the Australian stock to plunge. However, the AUD will thrive against the pound as it was able to solve its problem with the coronavirus. Meanwhile, medics in Britain warned of a second wave of the virus which could further derail the UK economy.