Market News and Charts for June 21, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

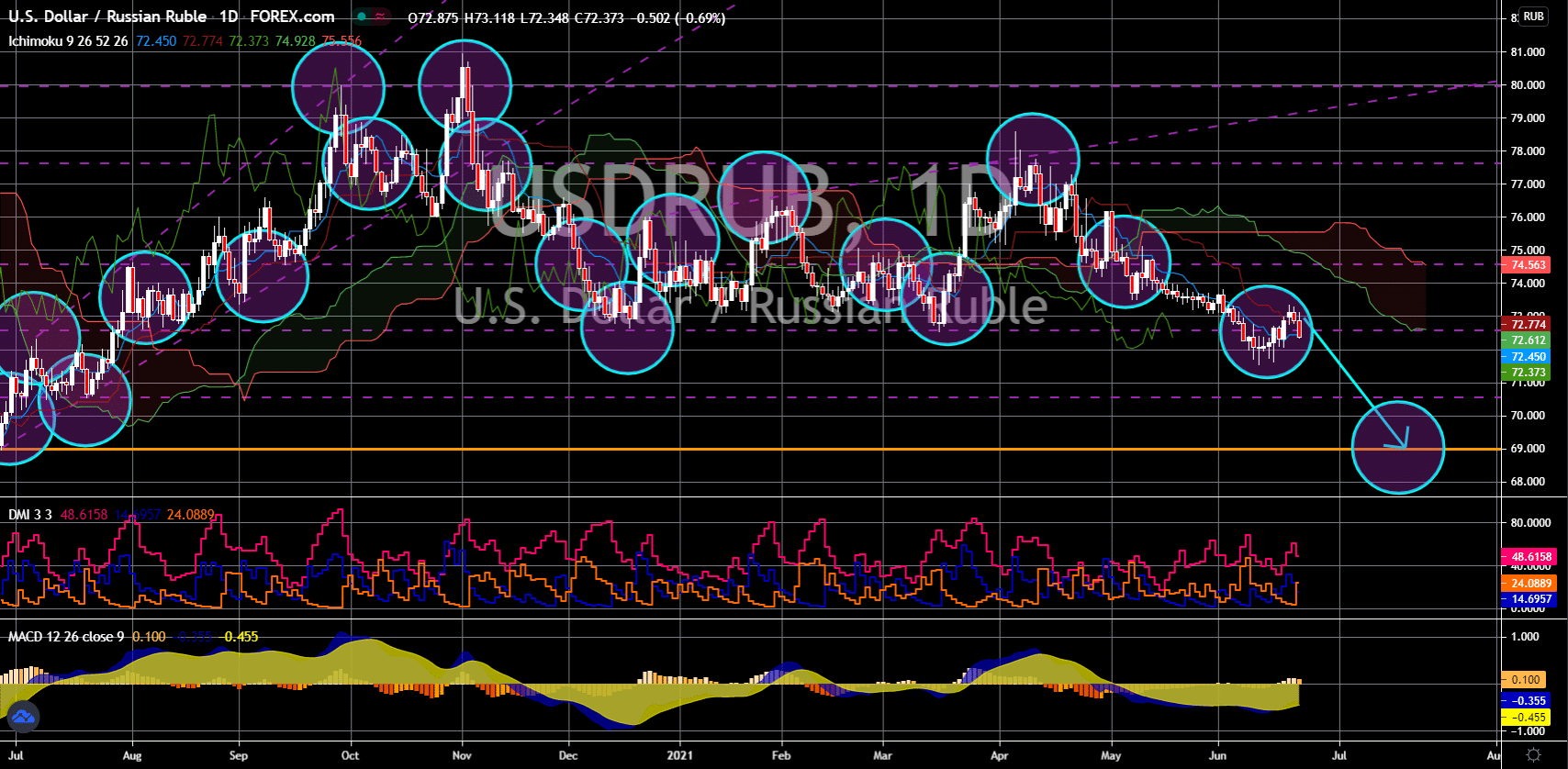

USD/RUB

The pair will continue with its downward movement towards a 12-month low of 69.000. The strength of the Russian ruble roots from three (3) consecutive interest rate hikes this year. In March, the central bank kickstarted the tightening of the monetary policy amid increasing fears among investors of surging inflation. The first increase was 25-basis points to 4.50%. This was followed in the succeeding month by 50-basis points and another 0.50% increase on June 11 to 5.50%. Analysts expected further rate hikes this year as the number is still below the 6.00% pre-pandemic record. The increase in the benchmark interest proves to be effective as the Producers Price Index (PPI) report continues to decline. The recent result on Thursday, June 17, for May, was an increase of 2.3%. Meanwhile, the year-over-year figure is anticipated to cool down after publishing a 35.5% jump from the same month last year. The net change is 7.7 percentage points from April’s data.

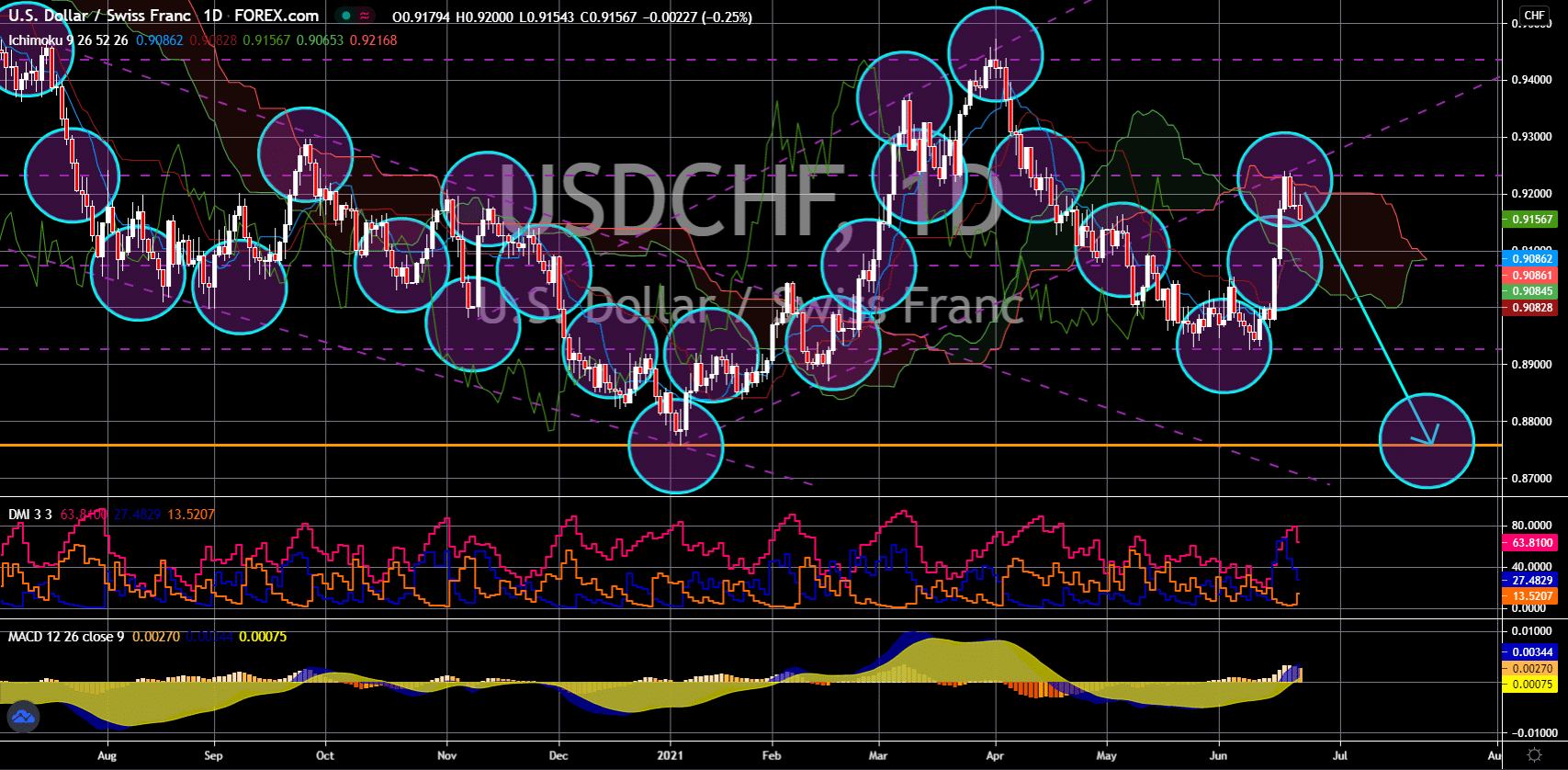

USD/CHF

The pair will retreat from its recent rally to form a price action of lower low. Switzerland continues to lead the recovery in Europe from the pandemic-induced economic slowdown. The ultra-loose monetary policy by the Swiss National Bank (SNB) has allowed the country to ease the financial impact of coronavirus. On Thursday, June 17, the central bank kept its benchmark interest rate at -0.75%. This will allow businesses and individuals to ensure their stability once the SNB and the government pull out their support to the economy. Adding to the optimism in the Swiss economy was the narrowing trade surplus. In May, the figure was up by 1.175 billion to 4.948 billion based on Thursday’s report. The International Monetary Fund (IMF) expects these improvements to the country’s 2021 GDP data to 3.5% for fiscal 2021 from a contraction of 3.0% last year. Meanwhile, unemployment will increase to 3.5% as the government starts to withdraw its economic support.

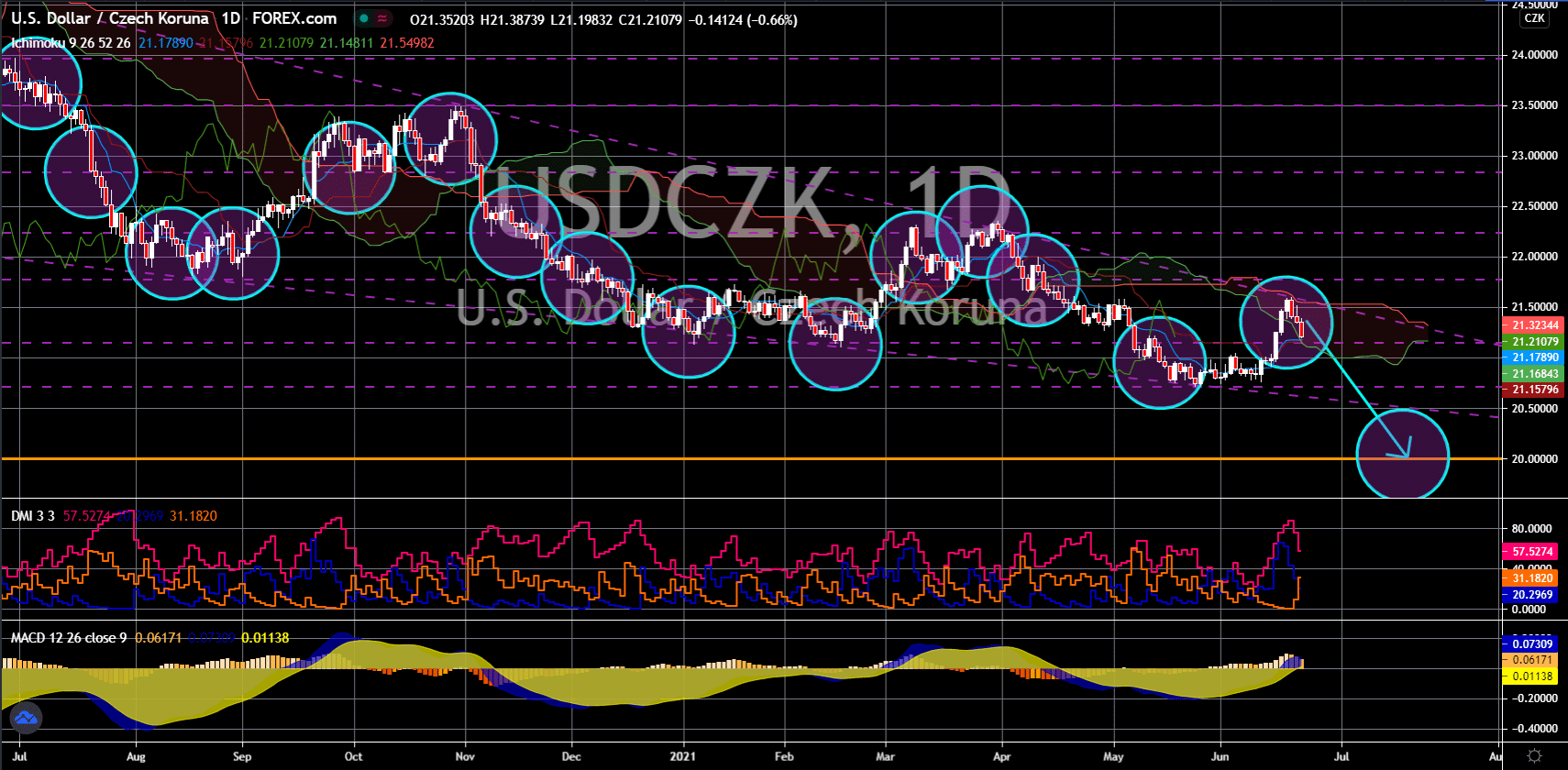

USD/CZK

The pair failed to break out from a downtrend resistance line, sending USDCZK lower towards the 20.00000 price level. The jobless claims report on Thursday, June 17, recorded an increase in the number of individuals filing for unemployment benefits. The figure came in at 412,000 which broke six (6) consecutive declines in the report, from 553,000 on April 29 to 376,000 in the previous report. The bleak figure added bearish sentiment among investors following the interest rate decision by the Federal Open Market Committee. The group headed by central bank chief Jerome Powell retained the US interest rate at a record low of 0.25%. But Powell sees the need for an interest rate hike by fiscal 2023 twice. This was an improvement from the previous meeting where the FOMC announced 1 hike in 2023. While the short term continues to be unfavorable for the American dollar, analysts believe that the greenback will regain its strength in the long run.

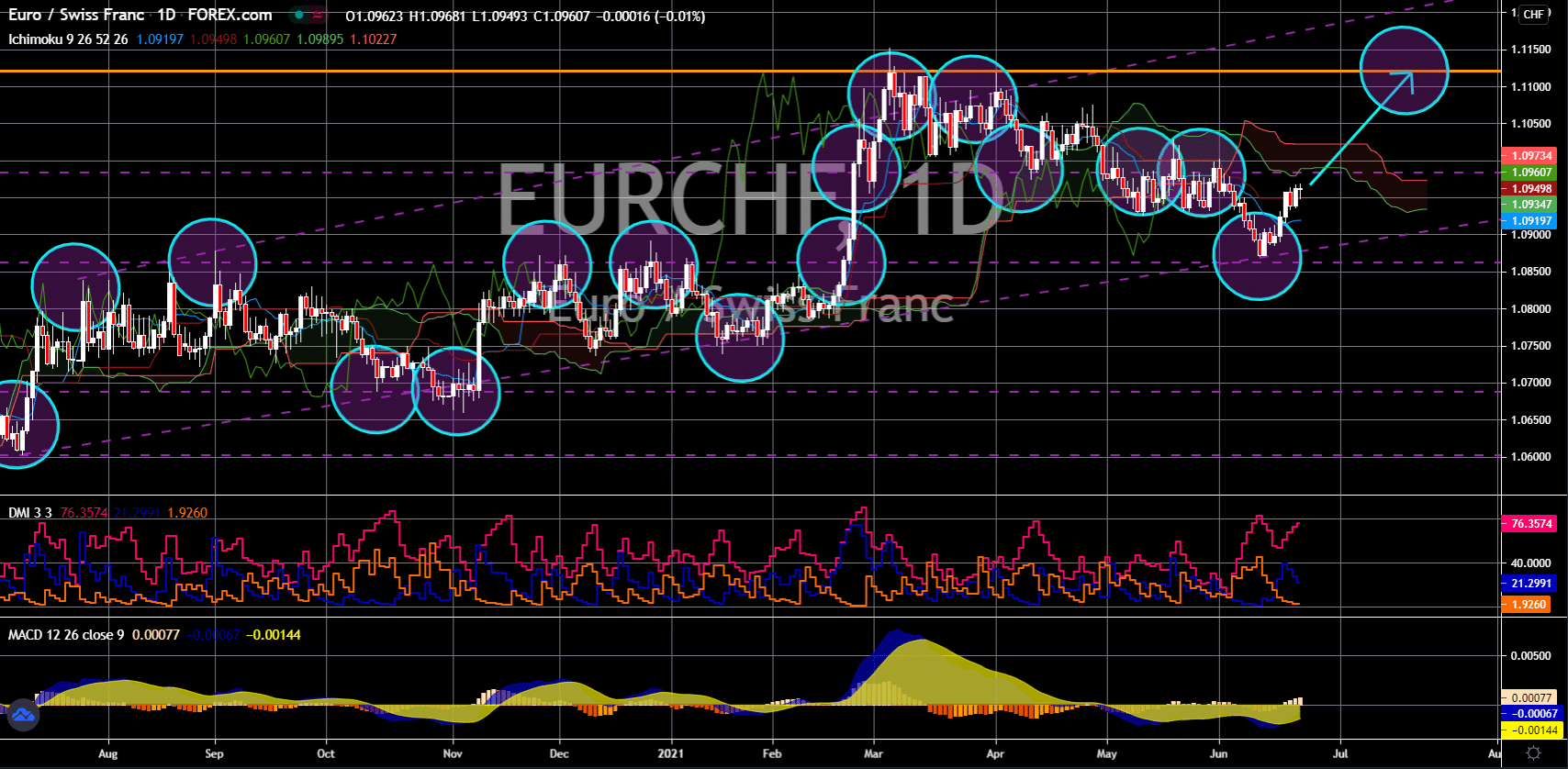

EUR/CHF

The pair will continue to trade higher in the coming days after it bounced back from the uptrend support line. The Eurozone has finally achieved an inflation data of 2.0%, which was in line with the European Central Banks’ (ECB) annual inflation target. This was the first time that the report has reached the figure in almost three (3) years. Meanwhile, the slowdown in May’s consumer price index (CPI) report of 0.3% against 0.6% prior ensures that inflation will not overshoot the target. On Friday, June 18, the EU also posted a net export of 22.8 billion on a seasonally adjusted basis. The narrowing trade gap will allow the bloc to recover even if the central bank has stopped the 2.2 trillion PEPP (Pandemic emergency purchase programme). Meanwhile, in the EU’s largest economy, the Producers Price Index was up 1.5% for May against a 0.7% consensus estimate. On a year-on-year figure, the PPI report advanced by 7.2% compared to 5.2% in the month prior.