Market News and Charts for June 17, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

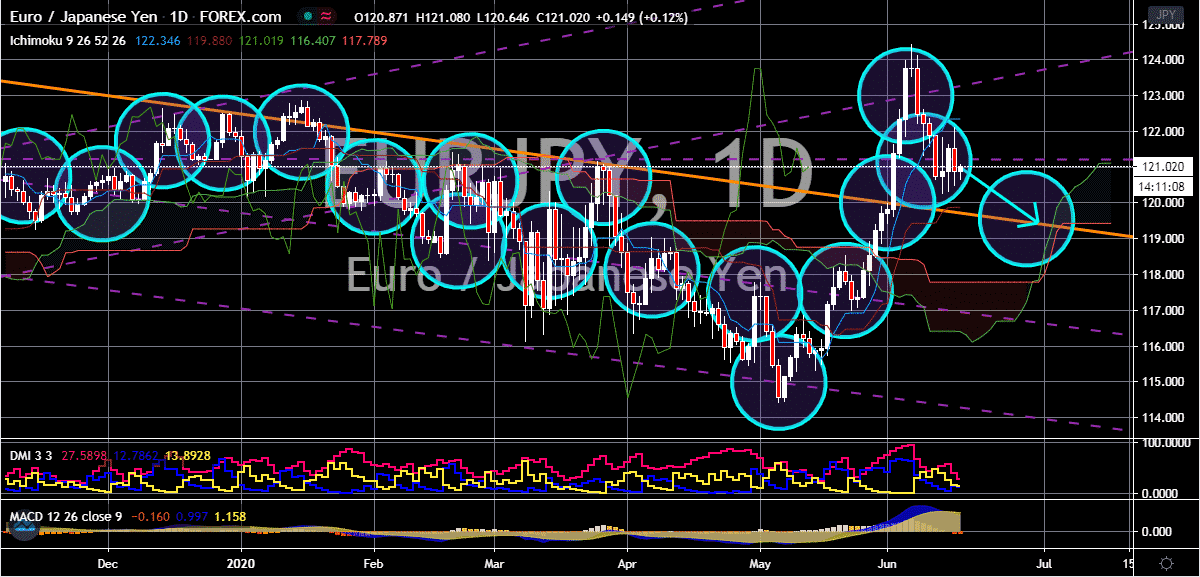

USD/CAD

The US dollar to Canadian dollar is meant to go up to its resistance level as the safe-haven demand is predicted to strengthen. Looking at the loonie, experts believe that the oil-linked currency is expected to slow down as it’s finally starting to show signs of exhaustion. The pair will soon climb to positive territories, eventually reaching its resistance level by the end of the month or if not, by the first week of July. The Canadian dollar is weighed by the global stock market. And considering the heightening concerns for a second wave of coronavirus infections, the stock market is looking pretty gloomy. Just recently, Beijing reported new confirmed cases for the coronavirus, raising concerns for another possible outbreak in the second-largest economy of the globe. Aside from that, New Zealand is also no longer coronavirus free. The country just saw two new cases after a 24-day run without any new infections. The news should push the pair higher and higher.

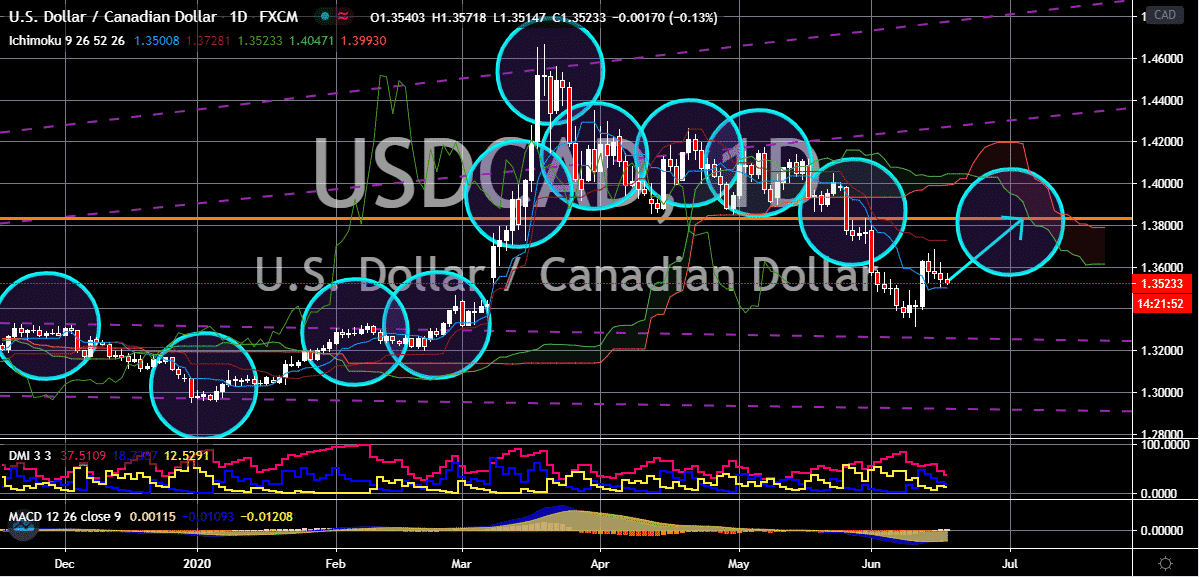

EUR/CHF

The demand for safe-haven currencies should pick up in the coming sessions. However, considering the strength of both currencies, it appears that the Swiss franc’s safe-haven charms are not going to work. This means that the EURCHF trading pair would most likely return to positive grounds in the sessions. The main factor that will help the pair to climb to its resistance is the expectations for the Swiss National Bank to maintain its famous negative rates. It’s widely expected that the SNB will leave its official interest rates unmoved at -0.75% until the very end of 2020. However, it appears that there is still a chance that the Swiss franc eventually appreciate despite the billions of cash spent by the Swiss National Bank to prevent the currency from climbing. Traders are still forcing the pair towards parity in with the beloved single currency. And the Swiss National Bank fears that it could eventually come to reality.

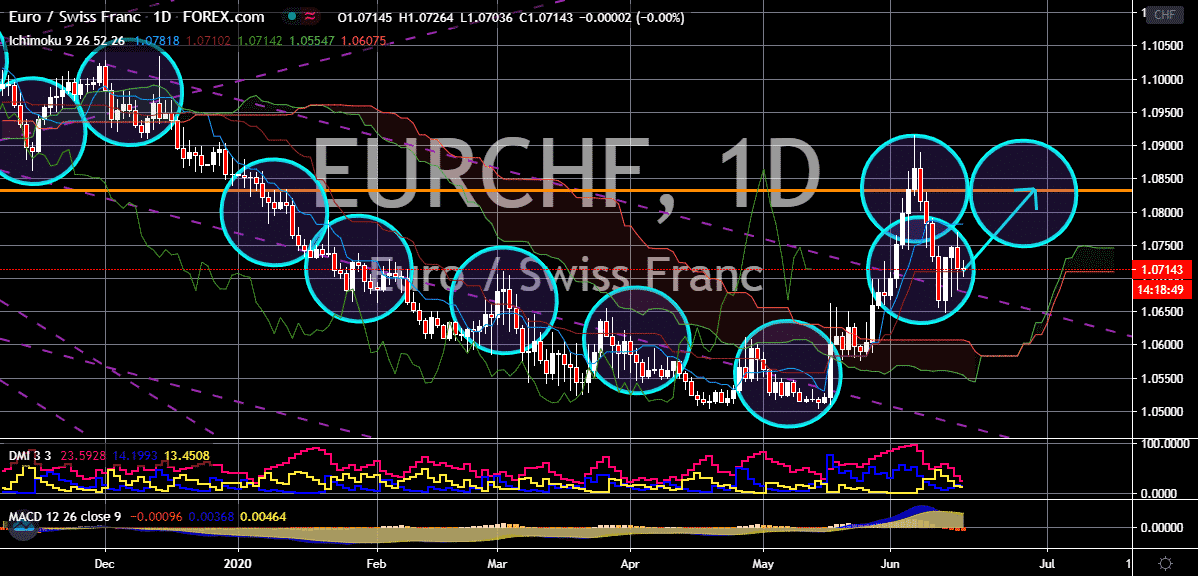

EUR/GBP

The exchange rate is stuck in a horizontal trend. However, it appears that the euro has the upper hand against the British pound and the pair is mostly seen in positive territories. The pressure from the failed Brexit negotiations allowing the trading pair to climb higher in the trading sessions. Investors are growing more anxious as a hard Brexit would not only affect the financial market of the United Kingdom. In fact, Britain will be left vulnerable if its leaders fail to snatch a deal with it. The country is at risk of losing its access to key information such as real-time access to the infamous watchlist for suspected terrorists. And as the trade talks between the European Union and the United Kingdom reach a stalemate, Boris Johnson’s government is opening new trade negotiations with other countries, mainly New Zealand. However, the results from this aren’t expected immediately, thus the impact isn’t really felt by the British pound now.

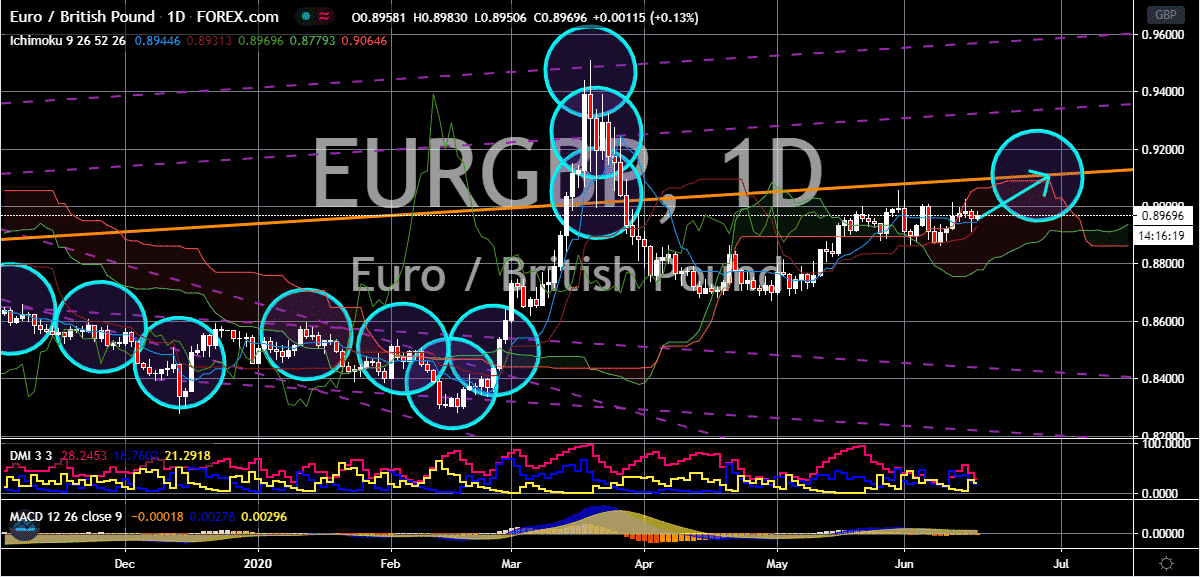

EUR/JPY

The Japanese yen slightly losses its balance after the Bank of Japan unveiled its interest rate decision for the month. Although fortunately, bearish investors averted a strong surge from the exchange rate. Perhaps the fact that the decision of the BOJ was already widely expected by the market. Despite the current weakness faced by the Japanese yen, the pair is still projected to head down as the safe-haven appeal of the currency drives it in the trading sessions. Earlier this week, it was reported that the BOJ’s verdict is to leave its rates at -0.10%. Aside from that, the bank also opted to leave its yield curve control program intact as it pushes forward with its aggressive quantitative easing program. Investors are closely watching the euro as it struggles thanks to the mixed signals shown in the global stock market. The euro is already seen giving up some of its gains in the previous sessions, leading to speculations as to whether it still has fuel to push forward.