Market News and Charts for June 09, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

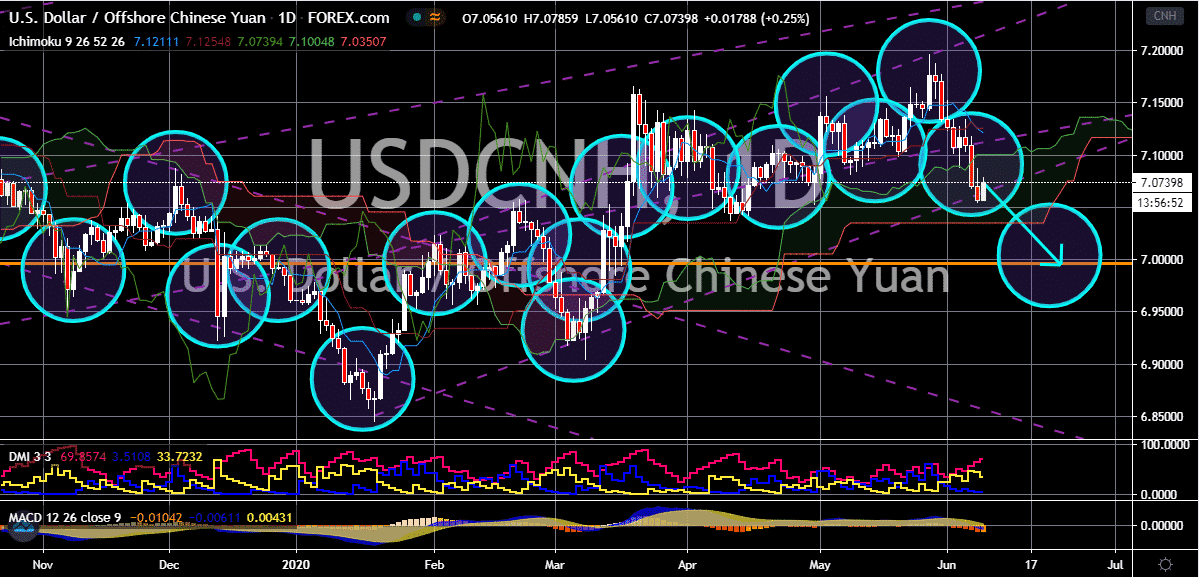

USD/CNH

The Chinese yuan slips slightly today against the US dollar thanks to the threat of fresh tariffs from Washington. However, geopolitical tensions won’t stop the pair from reaching its support area in the coming sessions. The USDCNH trading pair is widely projected to continue its fall as the US dollar loses steam. The trade war tension between the two of the globe’s biggest economies continues to rise. Just recently, the United States President Donald Trump was reported planning to sign a legislation that will enforce crippling sanctions on Chinese officials involved in the oppression of other religious minorities in China, mainly Uighur Muslims. A source familiar with the matter told reporters about the news but has not yet given any details about the target date for the signing of the legislation. If this gets signed, the trade war between Beijing and Washington will escalate into the next level, potentially disrupting the USDCNH exchange rate.

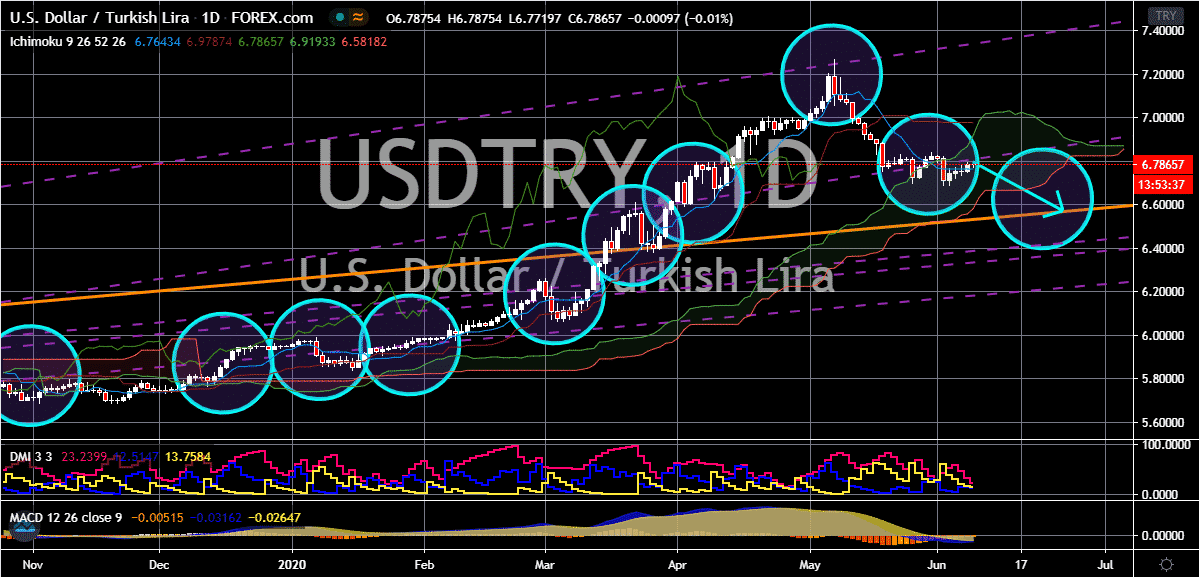

USD/TRY

The Turkish lira eases against the US dollar in the recent sessions following its persistent attempt to recovery. The USDTRY exchange rate is currently seen gradually moving up today but it’s widely expected to turn bearish once again in the coming sessions as the buck buckles. It was recently reported that Turkey will now continue to back investments in the country that will reduce the number of imports and increase exports. This was according to Turkish Treasury and Finance Minister Berat Albayrak, citing the latest announcement of the Turkish Central Bank to start reallocating its Turkish lira rediscount credits for local firms. According to Albayrak, around 400 million Turkish liras or 59 million US dollars would be given to businesses with a maximum maturity of about 10 years. Meanwhile, the US dollar’s strength continues to deteriorate as the risk sentiment continues to prosper, raising talks about how long its dominance will last.

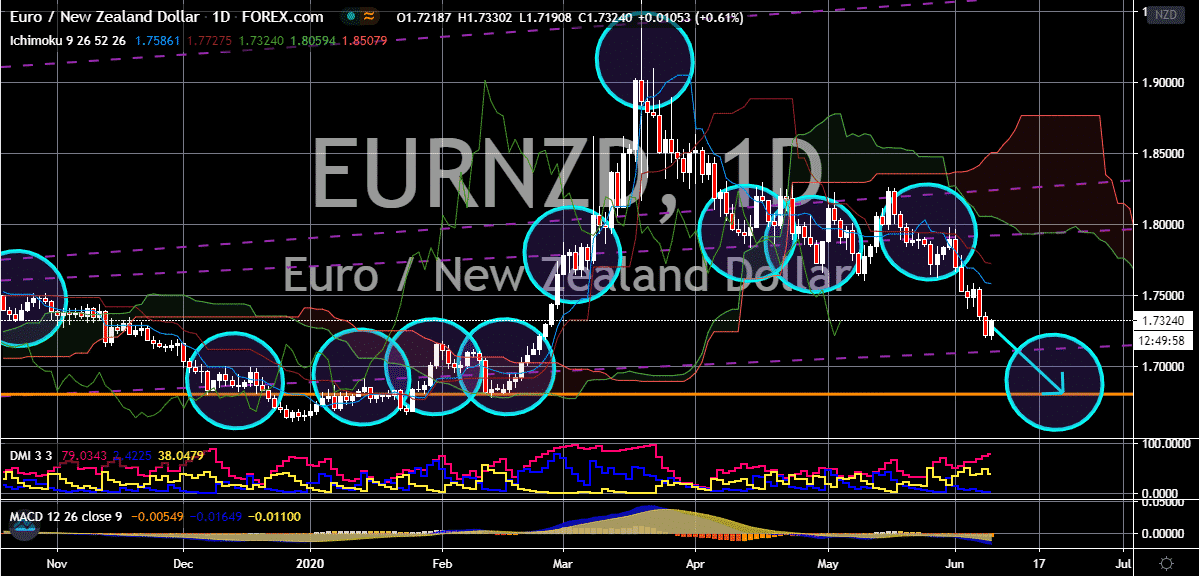

EUR/NZD

As of writing, the euro to New Zealand dollar trading pair is recovering. However, the euro is still on the defensive against the New Zealand dollar. The pair remains on track to hit its support level later this month. The euro is said to be overbought and its strength is seen fluctuating in the recent sessions, showing signs of exhaustion from bullish investors. This also suggests that there will be a pullback in the coming sessions. On Monday, during the quarterly monetary dialogue with the European Central Bank Head Christine Lagarde, investors tuned in for the latest bout the measures taken and being planned by the bank to counter the negative impact of the pandemic. The decision of a high court in Germany about the ECB’s public sector purchasing program was also discussed, giving hope to investors this Tuesday. Meanwhile, the New Zealand dollar is also supported by the recent lift of the country’s lockdown following the recovery of the last kiwi COVID-19 patient.

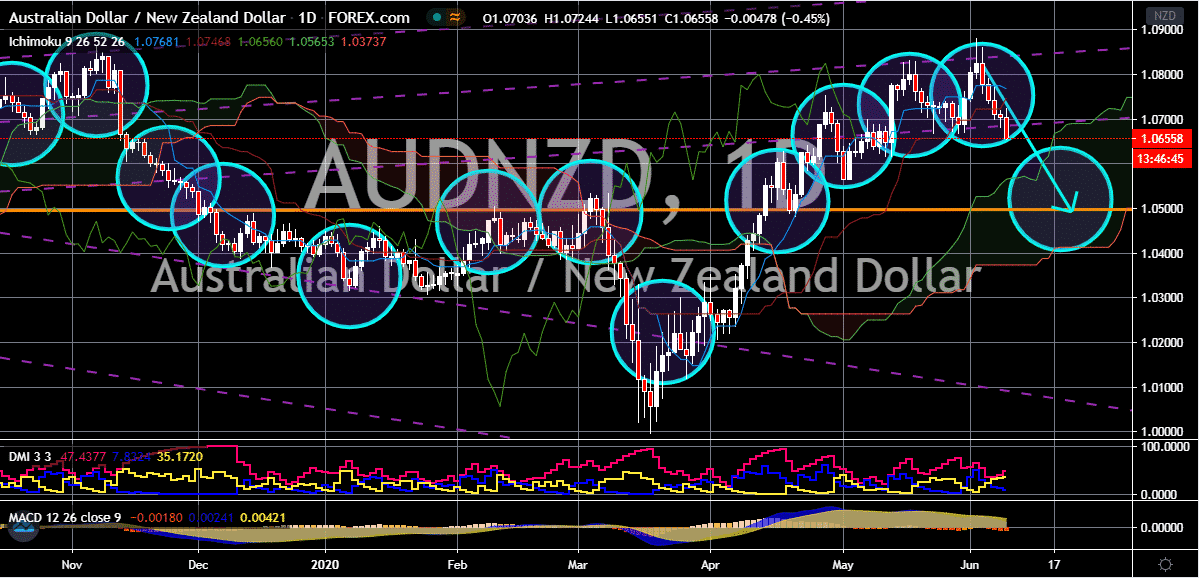

AUD/NZD

In the matchup of the two antipodean currencies, the New Zealand dollar ultimately comes out dominant. The kiwi is determined to take the Aussie to its resistance as bearish investors of the pair seek to recover their losses late last month. Looking at both currencies, it appears that the two are seen strongly dominating the forex market. However, the main supporting factor that’s helping the kiwi to thrive is the recovery of the last coronavirus patient in New Zealand. This is also followed by the much-awaited lifting of its lockdown this week. The New Zealand Health Ministry recently released a statement saying that the country has gone for almost three weeks without any new cases. As of yesterday, there are no more coronavirus patients in the country. Aside from that, the country has recorded only 22 deaths from the deadly virus, significantly smaller compared to other countries around the world, even to its neighbor Australia.